Malaysian Stocks: How to Interpret Malaysia Airports's Q1 Earnings?

Performance Overview

The Group’s revenue for the current quarter increased by 30.6% over the corresponding quarter in the prior year to RM1,351.3 million. This growth was driven by higher passenger volumes resulting from the new airlines operations, school holiday break, Chinese New Year festive season and the implementation of 30-day visa-free waiver for China and India travellers to Malaysia.

The Group achieved a notable year-over-year increase in profitability, with a pre-tax profit of RM214.6 million and a net profit of RM190.0 million recorded.

Good Performance Across Business Segments

1.Airport Operations

Revenue from airport operations experienced a significant increase of 31.7%, rising from RM960.7 million to RM1,265.7 million.

The aeronautical segment saw its revenue grow from RM553.8 million to RM733.9 million compared to the corresponding quarter from the previous year. This surge was primarily driven by a rise in traffic, with the total number of passengers for the Group reaching 31.3 million, up from 26.8 million in the same quarter last year.

In Malaysia, passenger traffic surged to 21.8 million passengers, compared to 18.7 million in the corresponding quarter of the prior year. Similarly, operations in Türkiye showed continuous growth in passenger traffic, increasing from 8.1 million to 9.5 million passengers during the same period.

The non-aeronautical segment also saw an increase in revenue, rising from RM406.9 million to RM531.8 million yoy. This growth was largely attributed to better commercial revenue contributions from both Malaysia and Türkiye operations.

2.Non-airport Operations

Revenue from non-airport operations increased by 16.1%, or RM11.9 million, from RM73.7 million to RM85.6 million. This was due to higher revenues from the hotel, agriculture, project, and repair maintenance businesses.

Overall, Malaysia and Türkiye operations recorded a combined revenue increase of 35.0%, from RM632.2 million to RM853.2 million, and 25.0%, from RM377.4 million to RM471.8 million, respectively. Meanwhile, Qatar operations saw a marginal revenue increase from RM24.8 million to RM26.3 million.

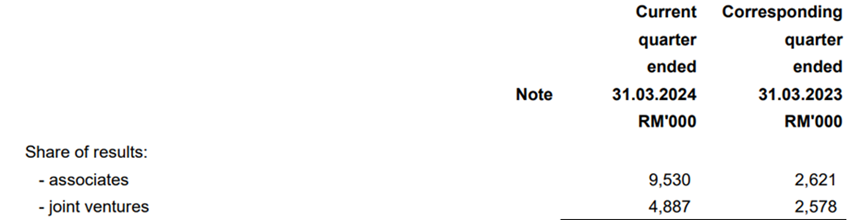

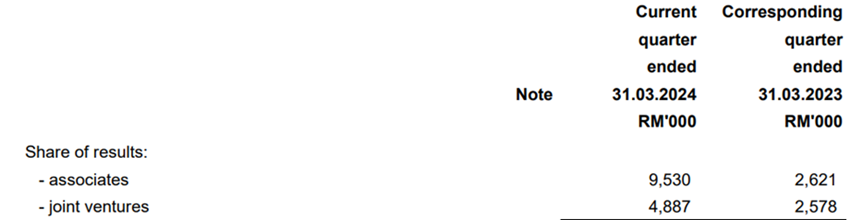

Share of results of Associates and Joint Ventures (JV)

1.Associates: In the current quarter, the share of results from associates recorded profits of RM9.5 million, down from RM15.4 million in the previous quarter. This decline was mainly due to a lower contribution from MFMA, which fell from RM12.3 million to RM1.7 million due to a revaluation of investment properties at the financial year-end. However, higher contributions from KAF (RM3.8 million), Alibaba KLIA Aeropolis (RM1.5 million), and CES (RM2.5 million) offset some of this decline.

2.Joint Ventures: The share of results from joint ventures recorded profits of RM4.9 million, slightly less than RM5.4 million in the previous quarter. This reduction was primarily due to lower contributions from SASB (RM2.2 million) and ACES (RM2.7 million).

Rising Revenues Drive Up Expenses

The Group’s cost moderately increased in tandem with the increase in passenger traffic and corresponding operational requirements. Nevertheless, its core cost per passenger improved to RM15.59 per passenger compared to RM16.48 per passenger in 1Q23, testament to the Group’s relentless pursuit of managing its costs and increasing its efficiency and productivity.

Profit before tax and zakat rises

The Group registered a PBT of RM214.6 million in the current quarter, a significant increase compared to RM63.3 million in the same quarter last year.

However, it's slightly lower than the RM221.8 million recorded in the previous quarter. This reduction was primarily due to a one-off gain of RM102.4 million from the fair value of investment in GHIAL recorded in the previous quarter, as well as lower operational costs and depreciation in the current quarter.

Excluding the one-off gain from the fair value of investment in GHIAL, PBT actually increased by 79.7%, or RM95.2 million, compared to the preceding quarter.

In the current quarter, Malaysia operations recorded a PBT of RM160.8 million, higher than the RM157.1 million recorded in the previous quarter. In contrast, Türkiye operations recorded a lower PBT of RM51.3 million, down from RM65.8 million in the previous quarter. Qatar operations saw an improvement, recording a PBT of RM2.5 million, compared to a loss before tax (LBT) of RM1.1 million in the previous quarter.

Dividend Recovery on Track

No dividend proposal for the current quarter. The company resumed dividend payments in 2023 after halting them in 2020. The current dividend yield is 1.48%, and the latest dividend proposal was announced in the 2023 annual report and has been implemented:

A single-tier final dividend of 10.80 sen per ordinary share amounting to RM180.2 million in respect of the financial year ending 31 December 2023 was approved by the Board of Directors on 29 February 2024 and was paid on 8 April 2024.

Commentary on Prospects

The Group did not publish any profit forecasts.

MAHB has been profitable with positive cash flows for five consecutive quarters, reflecting traffic recovery. For FY2024, passenger traffic is expected to approach pre-pandemic levels. IATA and ACI forecast global passenger growth of 9% and 6% above 2019 levels, respectively, with Asia Pacific numbers expected to grow by 10% (IATA) and 3% (ACI). Locally, relaxed visa requirements and extending e-Gate usage to China and India passengers have boosted arrivals.

In response, MAHB is investing in modernizing airports and replacing aging assets. New Operating Agreements (OAs) with the Government extend MAHB's tenure to 2069, enabling viable airport developments. The expansion of Penang International Airport will be the first project under the new OAs, with a pre-agreed rate of return.

MAVCOM has introduced new Aviation Service Charges for June 2024 to December 2026, including a supplemental Loss Capitalisation Mechanism, transitioning to cost-based regulations from 2027 onwards, ensuring better cost recovery.

Challenges include aircraft availability, global inflation, potential fuel price increases, and geopolitical risks. MAHB remains focused on cost optimization and monitoring the West Asia conflict's impact on operations and costs.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment