Market sentiment turns mixed as traders cautious ahead of FOMC minutes and 10 year auction

US Market Key Charts (S&P, US Dollar, Gold)

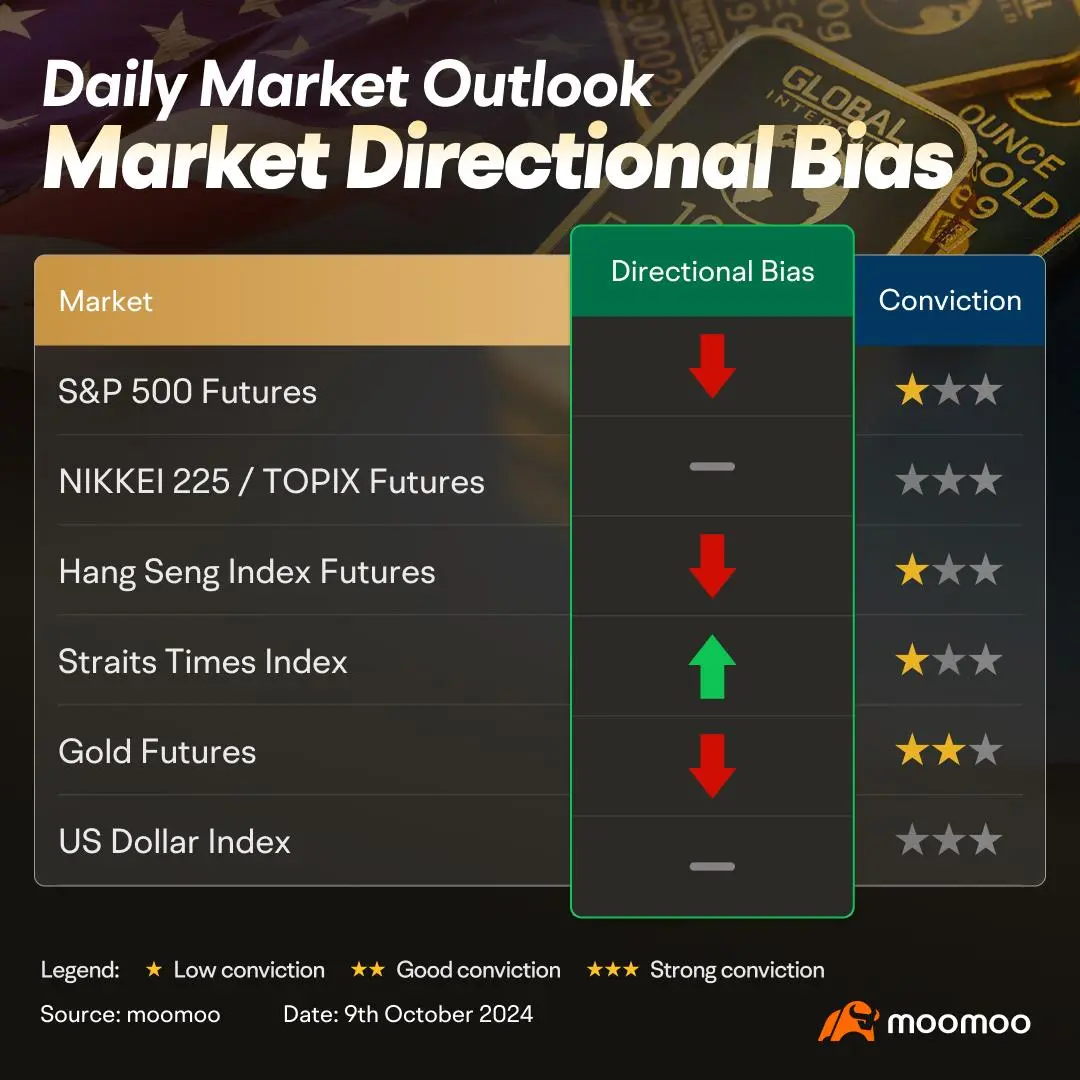

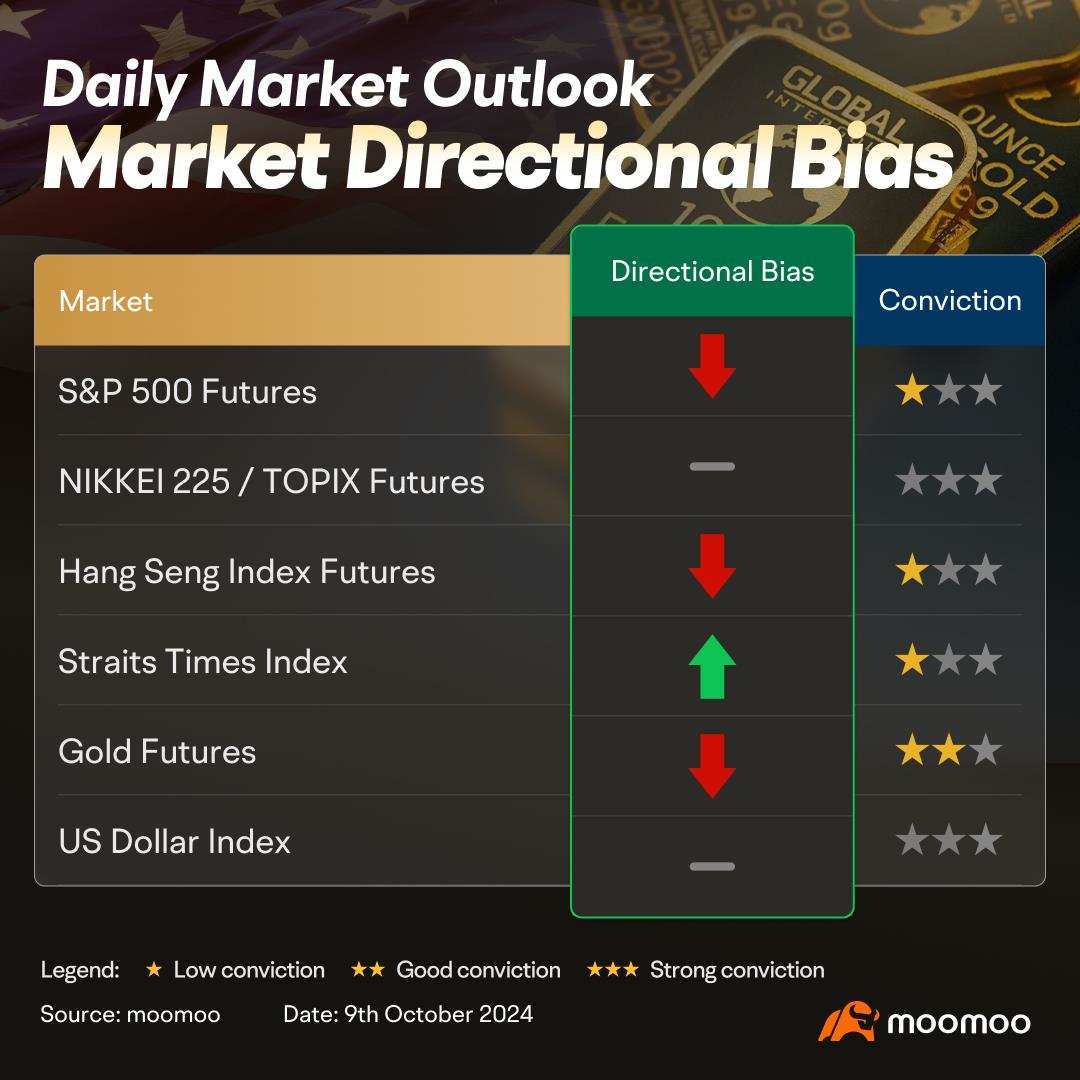

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We maintain our bearish directional bias as price is holding below descending trendline resistance. As long as price holds below 5810 resistance level, we expect price to drop lower towards 5740 support level. Technical indicators have yet to display a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5740 support level couldopennext drop towards 5690 support level.

$USD (USDindex.FX)$ (4 Hour Chart) -[NEUTRAL]We stay neutral with a slight bullish bias as price is hovering between 102.293 support level and 102.639 resistance level. A 4 hour candlestick closing above 102.639 resistance level could see a push towards 102.749 resistance level. Technical indicators are displaying a bullish momentum.

Alternatively: A 4 hour candlestick closing below 102.293 support level will open next drop towards 102.176 support level.

$Gold Futures(DEC4) (GCmain.US)$ (4 Hour Chart) -[BEARISH ↘ **]We stay bearish as long as price holds below 2645.30 resistance level. We expect price to drop to support level at 2616.50. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour candlestick closing above 2645.30 resistance level would push for next resistance at 2658.30.

NIKKEI 225 / TOPIX IndexFutures

$Nikkei 225 (.N225.JP)$ (4 Hour Chart) -[NEUTRAL]View unchanged as prices are forming within the ascending channel. We expect price to hold between 38860 support level and 39850 resistance level. Technical indicators are leaning towards a bullish momentum.

Alternatively: A 4 hour candlestick closing below 38860 support level couldopennext drop towards support level at 38330.

HSI IndexFutures

$HSI Futures(NOV4) (HSImain.HK)$ (4 Hour Chart) -[BEARISH ↘ *]We maintain bearish directional bias as we expect price to hold below 21550 resistance level. We expect price to drift towards 20400 support level. Technical indicators are displaying a bearish momentum as well.

Alternatively: A 4 hour candlestick closing above 21550 resistance level willopennext push towards 22600 resistance level.

SG Market - STI

$FTSE Singapore Straits Time Index (.STI.SG)$ (4 Hour Chart) -[BULLISH↗ *]As price is holding above 3570 support level, we turn bullish as we expect price to drift towards 3620 resistance level. Technical indicators are mixed for now, with MACD displaying a bullish momentum.

Alternatively: A 4 hour candlestick closing below 3590 support level will open a drop towards 3530 support level.

Summary - What Is Happening In The Markets

US markets closed higher last night, with $E-mini S&P 500 Futures(DEC4) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ edging higher by 0.97% and 1.53% respectively. Tech sector advanced the most last night, with the megacap tech making notable performances. There is risk-on sentiment among traders after US Fed Governor Adriana Kugler commented on providing additional cuts to interest rates if inflation cools as projected. However, traders should be careful of Hurricane Milton, which is expected to make landfall in the US tonight. Traders should look out for FOMC meeting minutes and 10-year note auction tonight as well.

Asian markets opened mixed today. $Nikkei 225 (.N225.JP)$ drifted the most by 0.51%, due to the weakening of JPY and the advancements of the tech sector. Traders should keep an eye out for PPI data released tomorrow morning. $HSI Futures(NOV4) (HSImain.HK)$ dipped marginally lower by 0.10% today. Markets are taking a breather as the details of the latest stimulus package failed to excite the market. Traders should look out for stimlus announcement package sometime this month. $FTSE Singapore Straits Time Index (.STI.SG)$ edged higher by 0.61%. There is risk-on sentiment among traders after news of Singapore's collaboration and strategic partnerships with different countries (China, South Korea and Indonesia).

Prepared by:

Moomoo Singapore

Isaac Lim CMT, CFTe

Chief Market Strategist

Chief Market Strategist

This report is provided for informational and general circulation purposes only and should not be construed as an offer, solicitation, or recommendation for the purchase or sale of securities, futures, or other investment products. It does not take into consideration any particular needs of any person. This advertisement has not been reviewed by the Monetary Authority of Singapore.

For full disclaimers, please visit https://www.moomoo.com/sg/support/topic5_935.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Cui Nyonya Kueh :

Warren Buffed : Still bullish..lol