Maybank: A Company with Both Dividend and Fundamental Strength

Malayan Banking Bhd engages in banking and financial services, Islamic banking, investment banking including stockbroking, general and life insurance underwriting, general and family takaful, trustee and nominee services, and asset management.

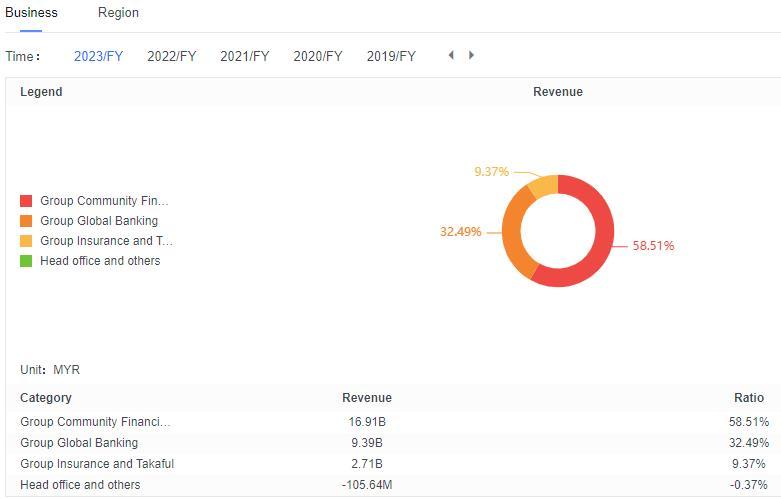

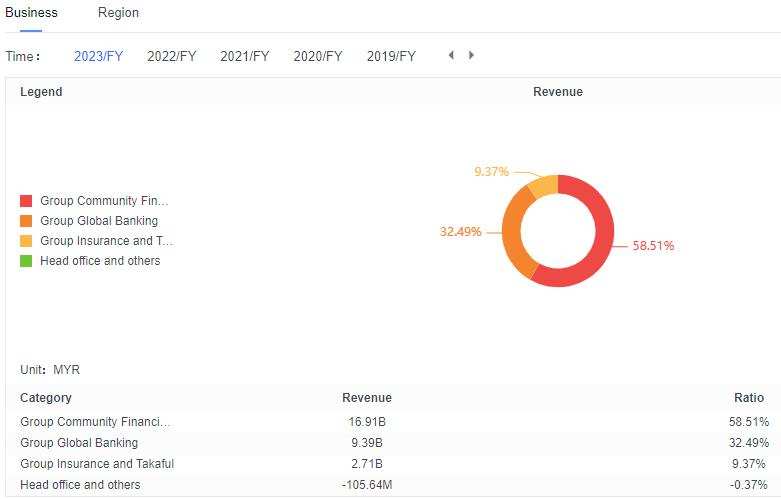

The company's segments include Group Community Financial Services; Group Corporate Banking and Global Markets; Group Investment Banking; Group Asset Management; Group Insurance and Takaful; and Head Office. The Group Community Financial Services segment generates the largest portion of the company's revenue.

1.Revenue Overview

The company's net operating income reached RM7.58 billion, representing a year-on-year growth of 19.2%. Breaking it down:

Net Interest Income:Net interest income was RM4.84 billion, showing a slight increase from RM4.80 billion in Q1 2023.For Q1 FY2024, the net interest margin (NIM) compressed by 19 basis points year-on-year due to higher funding costs. Quarter-on-quarter, the annualized NIM compressed by 6 basis points as the increase in customer deposit expenses slowed.

Non-InterestIncome:

Non-interest income saw a significant increase, reaching RM2.7 billion, a 79.2% year-on-year growth. This was primarily driven by doubled gains in financial markets business and the turnaround in the insurance segment from loss to profit.

2.Cost Increase on Higher Personnel, IT Expenses and Revenue-related fees

Operating costs increased by 19.8% year-on-year, reaching RM3.66 billion. This was mainly due to higher personnel costs, administrative and general expenses, IT expenses, and marketing expenditures.Despite the rise in costs, the strong revenue growth allowed the cost-to-income ratio (CIR) to remain stable at 48.3%, the same as last year.

3. Net profit

Net profit for Q1 FY2024 increased by 9.8% year-on-year, reaching RM2.49 billion. Considering the revenue and cost situation mentioned above, this was mainly due to a 19.8% increase in net operating income, particularly the significant growth in non-interest income. Although operating costs rose, effective cost management maintained a stable cost-to-income ratio.

4.Healthy Liquidity Levels

Group loans grew 11.2% year-on-year, led by 13.6% in Indonesia; 12.2% in Singapore; 8.2% in Malaysia.

Segments across markets, including auto loans, non-retail, corporate banking, and mortgages (in Malaysia), contributed to this growth.Group CASA (Current Account Savings Account) increased by 4.3%, and time deposits grew by 8.1%. However, the CASA ratio declined from 39.1% a year ago to 37.3%, indicating that the growth rate of time deposits outpaced that of CASA.

5.Asset Quality Management

EPS

In Q1 2024, the company's EPS reached 0.206 MYR, the highest level in the past two years.

Looking ahead, net interest income is expected to remain stable in 2024. MAY's loan growth is projected to continue at a mid-single-digit rate, while the compression of the net interest margin is expected to moderate to around 10 basis points (guidance range: up to 5 basis points). This is due to easing deposit competition in Malaysia and Singapore, as well as interest rate hikes in Indonesia.

Simultaneously, MAY will leverage its Islamic banking business and take advantage of improving capital market outlooks to increase fee-based income and enhance investment returns.

These factors will support our forecast of stronger revenue growth in 2024, approximately 10%, which is a significant improvement compared to the three-year compound annual growth rate of 3.4% up to 2023.

Valuation

The company's current TTM P/E ratio is 12.57x. Since the beginning of 2024, the company's stock has risen by 15.5%, outperforming the Malaysian index's gain of 11.05%. Despite the stock's strong performance, the current valuation remains reasonable, and the company's excellent business performance continues to support its fundamentals.

The company's current TTM P/E ratio is 12.57x. Since the beginning of 2024, the company's stock has risen by 15.5%, outperforming the Malaysian index's gain of 11.05%. Despite the stock's strong performance, the current valuation remains reasonable, and the company's excellent business performance continues to support its fundamentals.

Shareholder Returns

The company's current TTM dividend yield is 6.01%, which is relatively high. Historically, the company has maintained a stable dividend payout, demonstrating a commitment to rewarding shareholders.

In 2024, Malaysia's economy is expected to benefit from stronger external demand, manufacturing activities, and resilient domestic demand driven by increased consumer and investment spending. However, risks such as prolonged high interest rates in advanced economies and geopolitical conflicts remain. Investors need to pay close attention to interest rate changes and the overall economic environment.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

101550592 : Awesome

103530241 :

smoke maria : bank in Malaysia all giving moderate to high dividend with strong growth as well. but sadly fall under non-shariah compliance

I Am 102927471 :