Big Tech's AI Investment Payoffs Are Facing an Earnings Test

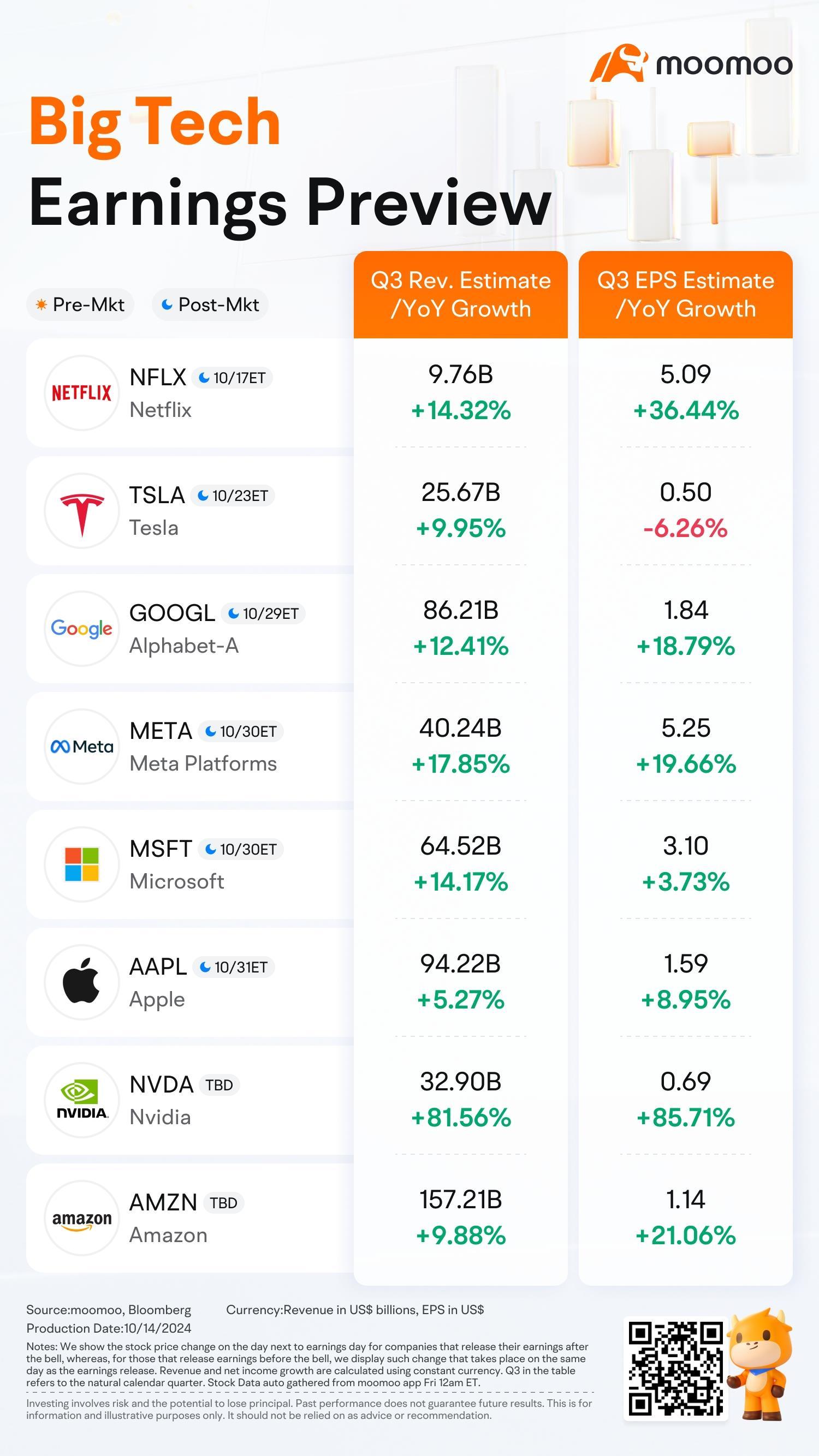

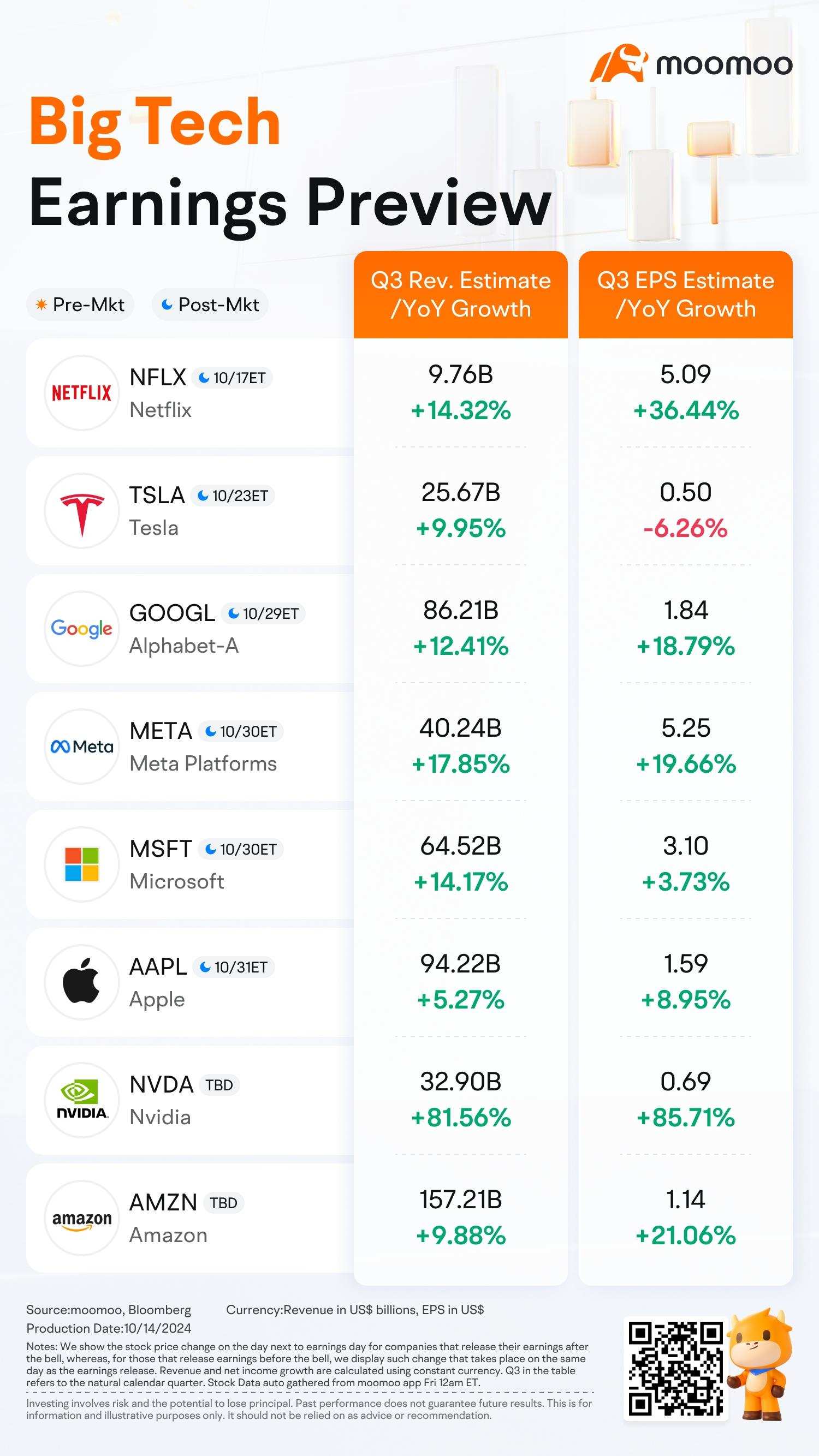

The tech stocks are bracing for the onset of third-quarter earnings reports, with $Netflix (NFLX.US)$ set to release its quarterly results this Thursday and $Tesla (TSLA.US)$scheduled to follow on the following Wednesday.

The AI Investment Payoff Question Looms Large

The 'Magnificent 7'—a group of tech giants have been pivotal in driving the stock market's gains this year due to their hefty investments in artificial intelligence. Yet this season, analysts caution that merely exceeding quarterly expectations might not suffice to spark Wall Street's enthusiasm. Investors are seeking strong future performance guidance, the lack of which could potentially depress stock values.

Mark Malek, Siebert's chief investment officer, emphasized the heightened expectations, stating, "Investors are particularly eager to see how these firms are leveraging AI for profit and whether the substantial capital deployed is yielding worthwhile returns. Simply exceeding estimates may not suffice; the market is anticipating exceptional outcomes from this sector."

Sequoia Capital has voiced concerns about whether Big Tech can generate adequate returns on their massive AI investments to justify the spending, calling this dilemma 'AI's $600B Question'. Their analysis, building on their September 2023 study, points to a daunting revenue target of $600B needed from Nvidia's $150B annual data center run rate by the fourth quarter, assuming a 50% software margin for CSPs and a 50% operating cost from GPUs.

Concerns about the extensive funds directed toward AI projects have begun to give investors pause. This apprehension spurred some investors to secure profits from mega-tech stocks and shift their capital to smaller-cap companies, seen as having more growth potential especially as the Federal Reserve eases interest rates. As a result, tech stocks have lost some momentum.

This skepticism has led analysts to scrutinize Big Tech management about monetization strategies and potential overinvestment during earnings calls. Meanwhile, companies like $Alphabet-C (GOOG.US)$ have faced additional pressures such as regulatory scrutiny and competitive challenges in search sectors, impacting their stock prices post-earnings release over the summer.

$Apple (AAPL.US)$ also saw its valuation dip beneath its 2024 peak, even though the stock had rallied in anticipation of the iPhone 16's release. The absence of anticipated AI enhancements in the new smartphones has since fostered concerns over demand, prompting a correction in its stock price.

John Belton of Gabelli Funds noted, "There's a growing weariness with the AI narrative, as evidenced by the underperformance of semiconductors and many AI-related stocks this quarter."

Some Mega-Tech Stocks' Valuation Appeals as They Enter Q3

Despite the risks this earnings season presents, the current lower valuations of some mega tech stocks could entice investors. According to Dow Jones Market Data, each of the 'Magnificent 7' is trading below its peak price-to-earnings ratios of the year, with Netflix, $NVIDIA (NVDA.US)$, and Alphabet below their five-year averages.

Furthermore, within all industry sectors, tech stocks are the focus of the highest growth expectations for the third quarter, with the projection of a 14.9% year-over-year increase, according to Factset.

Solita Marcelli, Chief Investment Officer for the Americas at UBS Global Wealth Management, mentioned in a recent note that third-quarter outcomes could act as a catalyst for advances, as investors zero in on the fundamentals of technology and the potential of AI.

"We continue to favor the semiconductor space and megacaps for AI exposure," she wrote, noting that she expects tech and AI companies to beat results for the September quarter and raise their outlooks.

Source: Barron's, Factset, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103238951 : okla

Leila Yang : Awesome

Talented Mr Ripley : I see more Tesla's on the freeways, and at the charging stations. Q3 revenue and eps will exceed estimates.

101550592 :

101775147 AL alfijai :

joemamaa :