Meta Sees $293M Block Trades of Bearish Calls as Technicals Signal Overbought Conditions

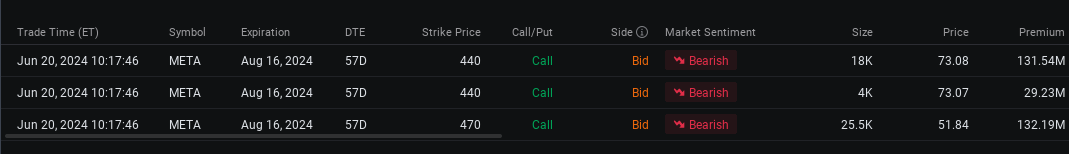

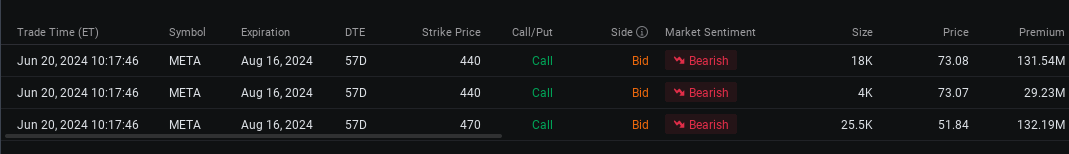

$Meta Platforms(META.US$ saw a combined $293 million in block trades of short call options expiring in 57 days at a time when the social media giant's stock is enjoying a 42% rally this year.

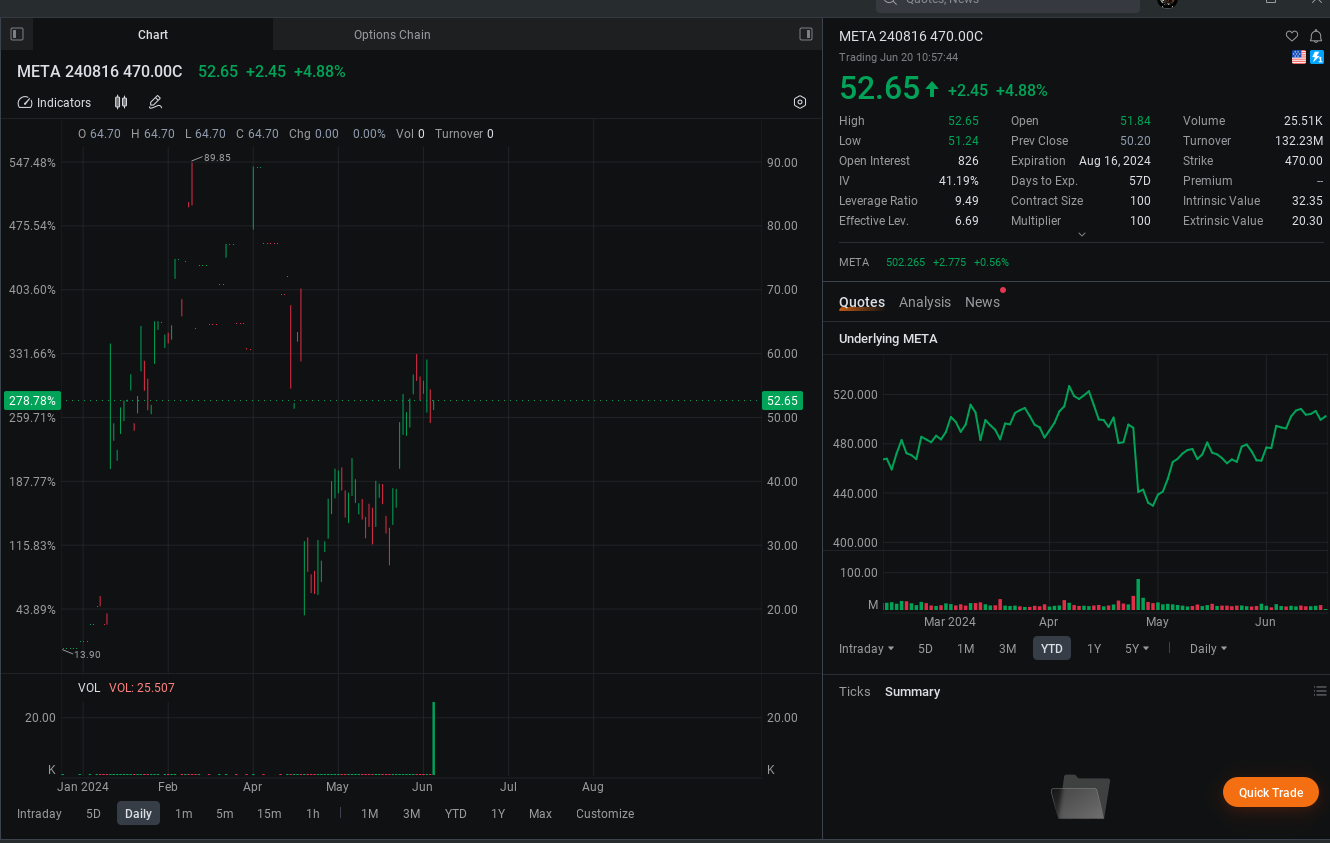

The biggest of the three block trades posted at exactly 10:17:46 a.m. in New York Thursday was for call options giving the holder the right to buy 2.55 million Meta shares at $470 each by Aug. 16. The seller stands to collect a premium of $132.2 million for writing 25,500 options for that trade, data compiled by moomoo showed.

That block trade sent the contract's volume soaring to 25,510 call options Monday, from just 40 on Friday. The latest volume is almost 31 times its open interest. To see Meta's options chain, click here .

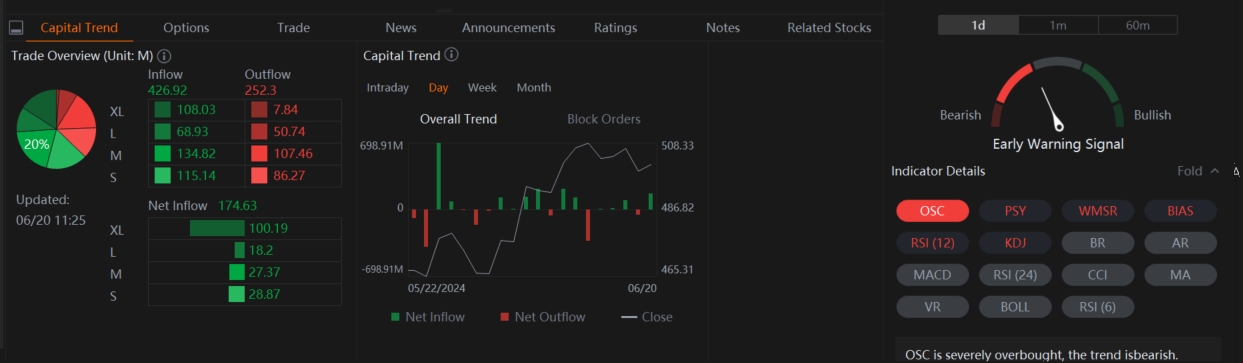

The bearish block trades came just as six of the 15 technical indicators tracked by moomoo are showing early warning signals that the stock is overbought and could turn lower. Still, Meta attracted net inflows of $178 million so far, with the bulk of the funds coming from extra-large orders, data tracked by moomoo showed.

KeyBanc analyst Justin Patterson is among those positive on Meta's outlook. He raised his price target on the stock to $540 from $475 and kept its overweight rating, Barron's reported, citing the analyst's research note on Thursday. Meta's investment in artificial intelligence is paying off, citing an uptick in the social media giant's ad prices which "reflects progress with AI across engagement, ad relevance and advertiser returns," the report quoted Patterson as saying.

Let me know your thoughts below. And if you want to see more of my options column, click here.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See this link for more information.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

romeo guard : How can investors best use block trades to inform there decisions?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) luzi

luzi

White_Shadow : I was bullish until the surgeon general started talking shit about warning labels

White_Shadow :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)