Meta Sees Strong Advertising Growth but Warns of 'Significant' Spending Expansion in 2025

$Meta Platforms (META.US)$ beat market expectations for second-quarter revenue on Wednesday and issued a rosy sales forecast for the third quarter, signaling that robust digital-ad spending on its social media platforms can cover the cost of its artificial-intelligence investments.

Meta shares rose 7% in extended trading following the report.

Financial Highlights

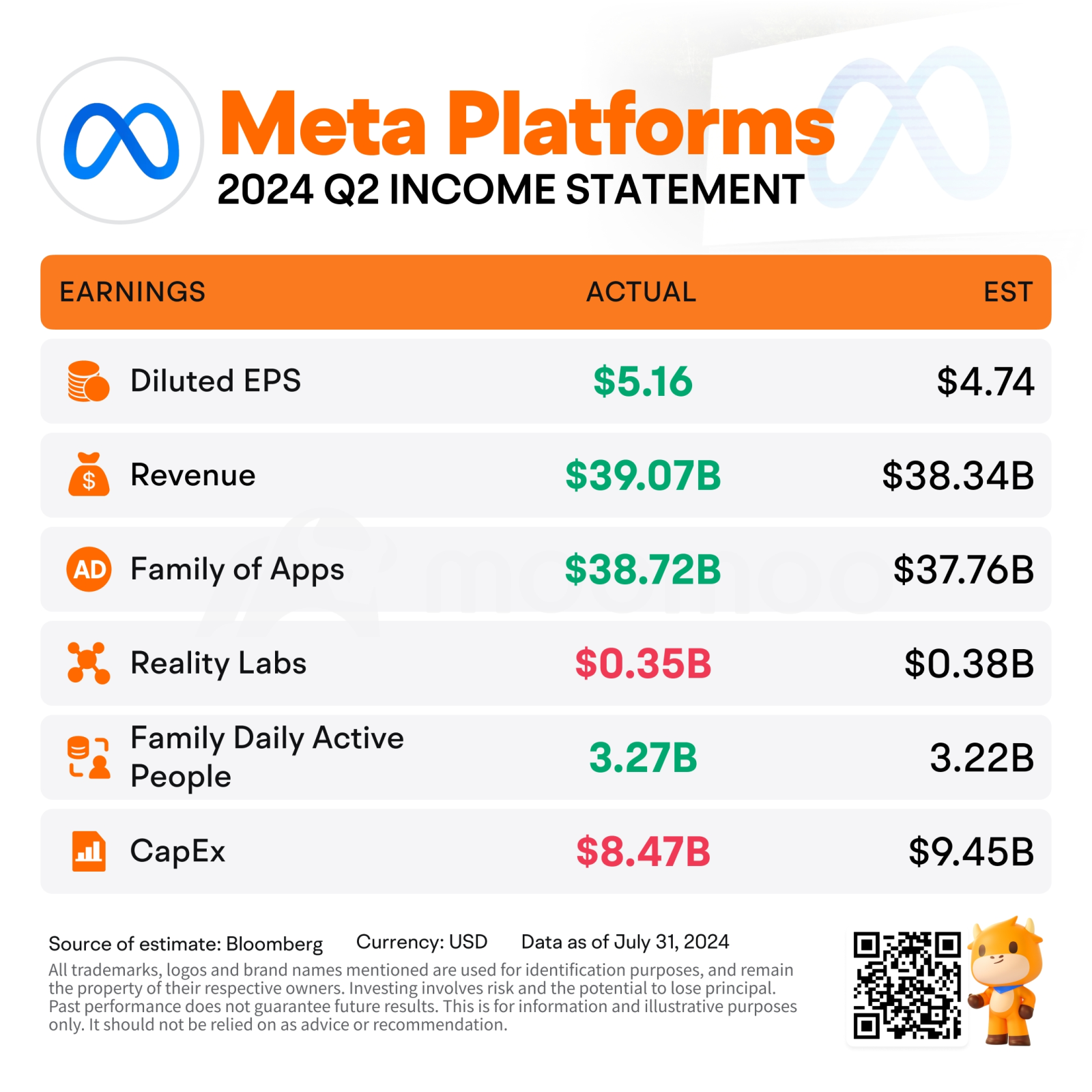

● For the second quarter, Meta saw earnings per share (EPS) of $5.16 on revenue of $39.07 billion. Analysts were expecting EPS of $4.74 on revenue of $38.3 billion, according to estimates compiled by Bloomberg. Meta recorded EPS of $2.98 on revenue of $31.9 billion during the same period last year.

● The company’s Family of Apps revenue clocked in at $38.72 billion, higher than estimates of $37.7 billion.

● Family daily active people (DAP) was 3.27 billion on average for June 2024, an increase of 7% year-over-year.

● The capital expenditures were $8.47 billion, lower than estimates of $9.45 billion. The company announced that it is raising its forecast for its minimum 2024 capital expenditures from $35 billion to at least $37 billion, but it maintained its maximum forecast for expenditures at $40 billion.

Breaking it down by segment

Meta sees strong advertising growth

Meta's advertising reported Q2 revenue of $38.33 billion, up 21.7% year-over-year, exceeding market expectations of $37.57 billion. This marks a slight deceleration from the 27% growth rate in the first quarter, maintaining its contribution to about 98% of total revenue.

Zuckerberg and finance chief Susan Li rattled off all the ways that AI has helped the company grow faster than the competition in the digital advertising market.

“The ways that it’s improving recommendations and helping people find better content, as well as making the advertising experiences more effective, I think there’s a lot of upside there,” Zuckerberg said on the earnings call. “Those are already products that are at scale. The AI work that we’re doing is going to improve that.”

Meanwhile, Meta also reports that total ad impressions delivered across its apps increased by 10% year-over-year, while the average price per ad also rose by 10%.

So more ads, a higher prices, reflecting ongoing demand, which suggests that Meta’s going to be in good shape for some time yet. Which will also enable it to keep investing in AI and VR, where it’s still sinking billions of dollars.

Source: Bloomberg

AI investment

“We had a strong quarter, and Meta AI is on track to be the most used AI assistant in the world by the end of the year,” Zuckerberg said in a statement. “We’ve released the first frontier-level open source AI model, we continue to see good traction with our Ray-Ban Meta AI glasses, and we’re driving good growth across our apps.”

As part of Meta’s AI push, the company debuted last week the latest version of its Llama AI model. One version of the Llama 3.1 technology contains a whopping 405 billion parameters, which are metrics that indicate the size and capabilities of the AI model, underscoring Meta’s efforts to ensure that its technology is on par with rivals like OpenAI and Google.

However, Meta’s capital expenditures in AI have raised concerns among investors. Meta is maintaining its full-year projections for capital expenditure ceiling at $40 billion unchanged, while raising the lower limit by $2 billion to $37 billion.

“While we continue to refine our plans for next year, we currently expect significant capital expenditures growth in 2025 as we invest to support our artificial intelligence research and product development efforts,” Meta said.

Reality Labs' losses have widened

Meta’s Reality Labs segment, which includes its mixed reality hardware and software, saw revenue of $353 million in the quarter versus expectations of $376 million. That's better than the company reported in the same quarter last year, but the segment continues to hemorrhage cash.

In Q2, Meta reported that the segment lost some $4.49 billion, slightly below expectations of $4.53 billion. It lost $3.8 billion in Q1. The division has also been plagued by turnover and a lack of clear vision, adding to Reality Labs’ troubles.

eMarketer principal analyst Max Willens said any apprehensions about Meta's spending on AI and the metaverse are likely to be allayed by this quarter's results.

“While impression growth has slowed a bit, Meta's careful introduction of ads on Reels has led to a perfect storm of rising impressions and rising ad prices,” he said.

“With its margins as healthy as they are, Meta's investors should feel comfortable with the company's vigorous investments in its plans for the future."

Source: CNBC, Bloomberg, Yahoo Finance

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

10baggerbamm : who's going to get that money?? I'll give you a hint it starts with an N and ends in an A. and that's because I'll give you another hint it starts with a B and ends in an L is going to be their latest and greatest in Q4 through mid 25. and everybody is lining up to buy them now they're going to be 100% sold out on allocation yet again

Laine Ford : I will buy it stock for my future hold meta platform

Reggie123 : Great job.!!!!!!!! I'm, let's do this

104327919 : good

Derpy Trades 10baggerbamm : The news is that Blackwell is being delayed.