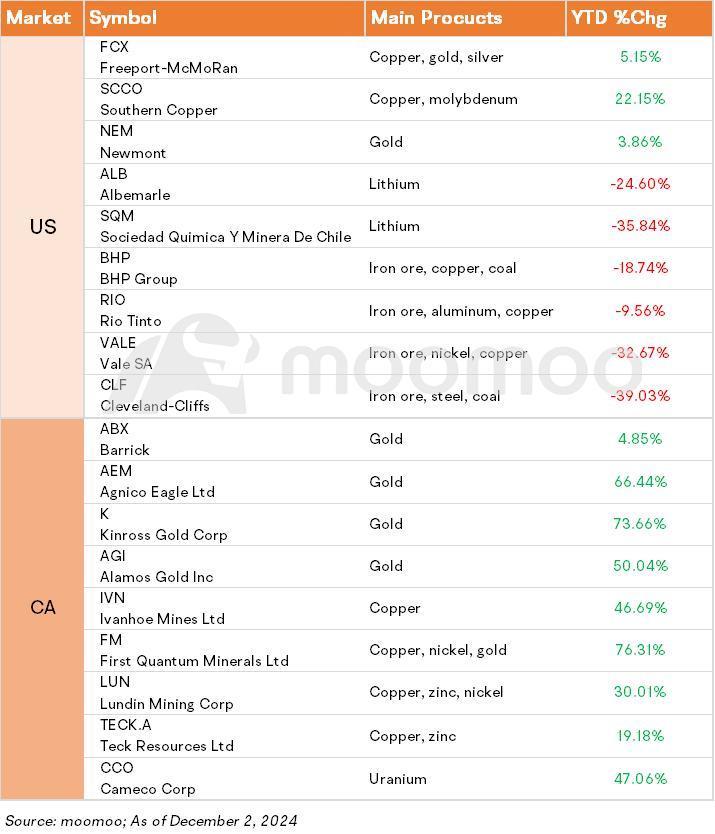

Metals & Mining Monitor |Zinc Price Experiences Significant Weekly Rise; Tariffs Worry Canadian Uranium Miners

Hello mooers! Check out the latest market dynamics of the metals and mining industry over the past week.

• Base metals: Zinc prices rise to $3092 per tonne

• Energy metals: Li carbonate prices drop 0.7% in the past week

• Precious metals: Gold prices drop 1.6% to $2651 per oz

• Bulk commodities: Iron ore prices rise 4.2% in the past week

Spot Price Snapshot

Key Price Moves

Spot gold fell by 1.6% to $2651 per ounce last week. The ceasefire agreement between Israel and Lebanon had led to a surge in market risk sentiment, resulting in a drop in gold prices. Israel's security cabinet voted to approve the ceasefire agreement with Lebanon, which was expected to bring an end to the cross-border conflict with Hezbollah that had lasted for over a year. The agreement was set to take effect at 4 a.m. local time on Wednesday. Consequently, as a safe-haven asset, gold prices had plummeted to around $2620 on Monday, with a significant decline of nearly $100 throughout the day.Following Trump's threat to impose a 25% import tariff on Canada and Mexico, and an additional 10% tariff on all imports from China, the dollar rose, causing gold prices to fall. $Gold Futures(FEB5) (GCmain.US)$

On Monday, copper futures fell below $4.05 per pound as the dollar gained strength following comments from President-elect Trump. Over the weekend, Trump warned BRICS nations of imposing 100% tariffs if they develop or support a currency to rival the dollar. A stronger dollar tends to make commodities priced in dollars more costly for international buyers, potentially reducing demand. At the same time, recent data indicated that Chinese manufacturing activity grew for the second month in a row in November, spurred by a series of stimulus measures from Beijing. Investors are now focused on upcoming major political meetings in China this month, anticipating policy announcements that could influence the demand outlook from the world's largest copper consumer. $Copper Futures(MAR5) (HGmain.US)$

Top Company News

Teck Names New Vice President for Investor Relations

Teck Resources ( $Teck Resources (TECK.US)$ $Teck Resources Ltd (TECK.A.CA)$ $Teck Resources Ltd (TECK.B.CA)$ ) has appointed Emma Chapman as the new Vice President of Investor Relations, starting December 1, 2024. She will take over from Fraser Phillips, who will retire in early 2025. President and CEO Jonathan Price highlighted Chapman's strong background in the mining industry and her expertise in investor relations, investment banking, and corporate finance as key assets for her new role. Chapman joined Teck in 2023 as Director of Investor Relations and has nearly 20 years of experience, including her previous position as Head of Investor Relations at Anglo American Platinum. She holds a B.Sc. (Honours) in Economics from the University of Bath, completed Harvard Business School's Program for Leadership Development, and is a Fellow Chartered Accountant (FCA).

Canadian Uranium Miners Concerned About Potential Tariffs

Canadian uranium miners are increasing production and locking in contracts to supply U.S. energy companies, responding to supply constraints following Russia's restrictions. However, these miners are now worried about the potential imposition of tariffs by U.S. President-elect Donald Trump. Confident in their ability to satisfy U.S. uranium needs, they are nonetheless facing uncertainty due to these tariff threats.

Cameco ( $Cameco Corp (CCO.CA)$), a leading publicly traded uranium mining company, has voiced its desire for "unencumbered" trade in nuclear goods between Canada and the U.S. The company stressed the necessity for a dependable Western uranium fuel supply to support the rising electricity demands in the U.S. Cameco pointed out that Russia's recent actions highlight ongoing concerns about vulnerabilities in the nuclear fuel supply chain. The company calls for a unified Western response, driven by the industry and bolstered by government actions, to lessen dependence on Russia and other state-controlled entities.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment