Moomoo US Users: Possible Higher Tax Burdens From Problems with Moomoo's Cost Basis Coding

Just a quick warning from my latest round from Moomoo Customer Support! It could very well be an issue for users outside the US too - I have no knowledge of international tax systems.

This topic arose initially due to being incorrectly flagged for day trading. I had shares which I had purchased weeks ago with a pending limit order. I purchased a few more shares today. Moomoo interprets that purchase as a day trade despite no sale actually having occurred.

Even if a sale had taken place, the only possible way it could have met the legal definition of a day trade was if the order used a Last in First Out cost basis (i.e. the most recent share purchased gets sold first)

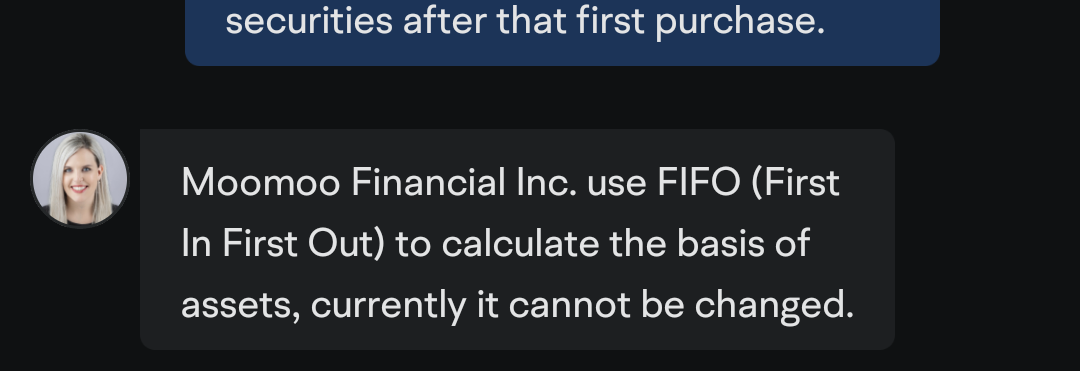

It became a much bigger program when the Agent shared that, according to Moomoo, the platform *only* supports First In First Out trading.

If the Agent's statement were true, it would not have been possible for my actions to constitute a day trade. This means Moomoo has a considerable fault in regards to cost basis, how it screens for Day Trades, or both. I honestly can't tell or know what information I can trust.

In a nutshell, cost basis (e.g. Last in First Out, First in First Out) is the #1 determinant of what your tax liability will be. Here are two scenarios:

Example 1) Long-term vs Short-Term Capital Gains

Say you purchased 50 shares in a company >= 12 months ago. You then purchased 50 more shares yesterday. Today, you sell 50 shares.

Using First in First Out cost basis will sell those shares from a year ago first. This greatly reduces the taxes owed on your return.

If a share is held for at least a year, it is considered long-term capital gains taxable - which has tax brackets of 0%, 15%, and 20%. The 0% rate in 2024 extends to ~$47,000 income for a single filer or double for married filing jointly. The 15% extends up into > $550,000/year. So most folks are going to fall in either the 0% or 15% brackets.

If Last in First Out cost basis was used instead - your return would be the same but you are now subject to short-term capital gains rates. These are the same tax rates as your normal wages. Roughly, that means the folks with 0% will now have to pay 10%-12% in taxes; the 15% bracket will face 22%-35% taxes.

Last In First Out would be a tremendous monetary penalty - which is why it is so concerning to me that Moomoo can't seem to decide which it wants to use (let alone allow the user to choose, like most other brokers)

Example 2) Different Purchase Prices and Short-Term Capital Gains

Say you bought 50 shares in Feb 2024 of a company at $25 each. The stock price rises and you double down by purchasing 50 more shares at $50 each in July. In October, the prices increase a healthy amount, but you think they could be higher later, so you only sell half your position at $75 each

If the sale goes through under First In First Out cost basis, you are going to *double* the amount you owe in taxes. The capital gains income (i.e. what determines your tax amount) is calculated as the sale price - the purchase price.

If you sell the shares you purchased at $25, you get the same amount of money from the sale - but the IRS is now going to tax that gain of $50 (75-25) per share.

If you use Last In First Out cost basis in this case, your gain will only be $25 (75-50) per share and you face half the tax burden.

If you end up selling off all your shares for the same price, it will yield the same result. But being able to choose leaves far more freedom to reduce taxes.

For example, Last In First Out would sell the most recent shares first and you could simply wait until a year passes on the other shares for long-term tax rates.

In a case you want to cut your losses like the October share price was actually $35/share, First In First Out will still create a capital gain and add to your taxes. Last in First Out would create a capital loss - which has no tax obviously - but also will reduce what you owe if you had other profitable trades in the year.

There are more than these two cost basis choices. This article summarizes them well. Save on Taxes: Know Your Cost Basis

From a technical / coding standpoint - this shouldn't be difficult for Moomoo to implement. It could literally be as simple as adding one extra Boolean to the sale page.

As that article goes into, many other brokerages can automatically select cost basis to minimize taxes for each trade.

Which leaves me very confused as to why Moomoo only "offers" a single cost basis and why even that doesn't remain consistent when using the app.

I will stay out of the tin-foil hat territory where folks claim conspiracy with whoever a broker hands the orders off to or a broker colluding with big financial interests (aka disillusioned customers of that one confetti filled app 🫠) but it's still an extremely important number to factor into your net P/L results!

I would hate for anyone to end up having wages garnished or their property physically taken to pay off an IRS debt they didn't realize they were building up if they are used to more cost basis options!

Be careful out there!

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Moomoo Buddy : Dear customer, I will have your inquiries recorded and send them to our specialists for further investigation. We will send you a follow-up email regarding your inquiries within one to two business days.