My P/L Review for Q3 & YTD and Outlook for Q4

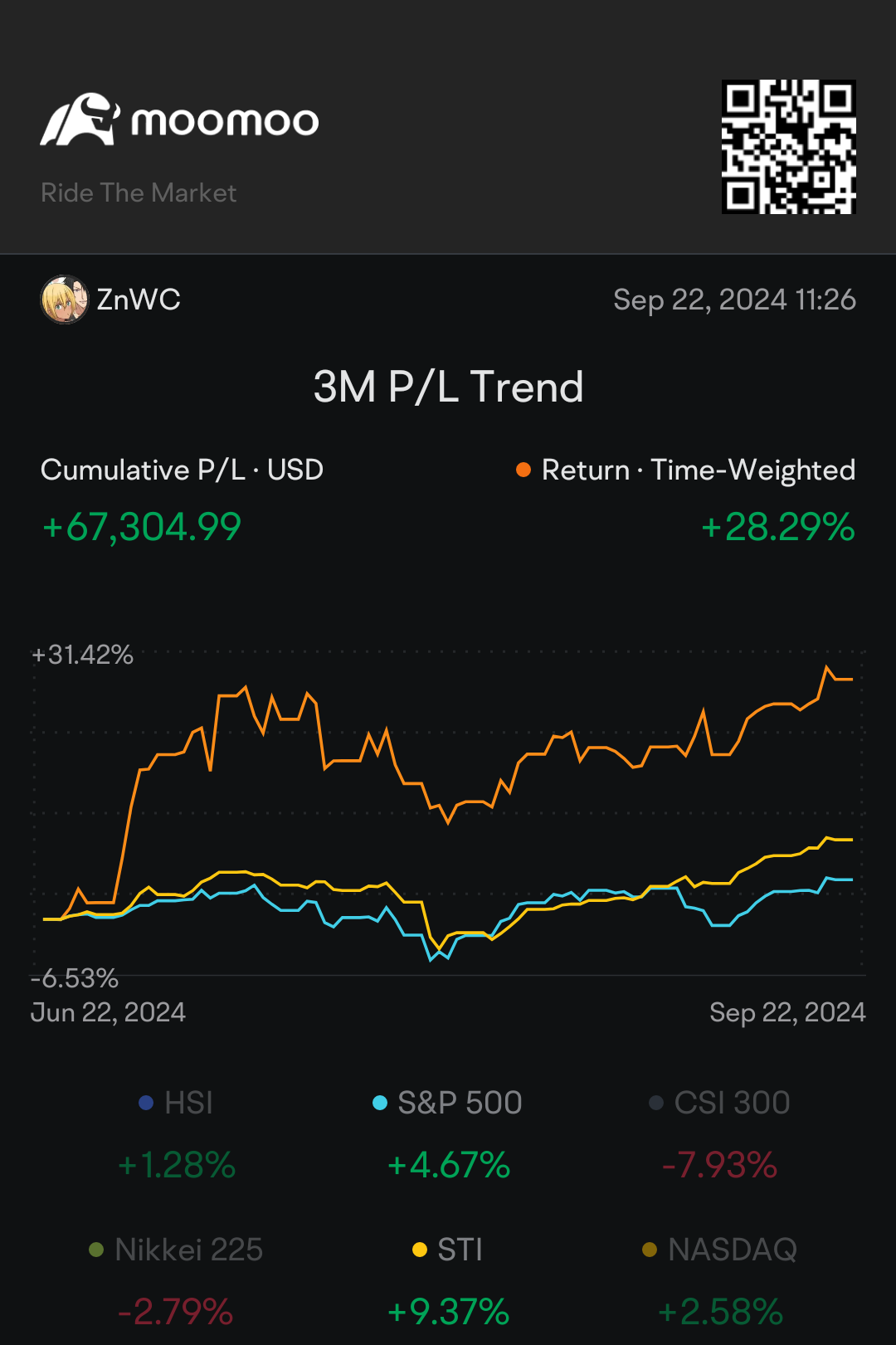

1) The Fed rate cutting higher than expected (50 bps) prompts me to adjust positions or portfolio in Q3. I can see almost all my stocks increase in book value. See screenshots of my P/L cumulative in Q3 and YTD.

2) This is the result of investing in stocks or ETFs for the past 2 years (when they are cheap) and taking a long position. It also showed my Four "D" trading strategies work - Diversification, Disciplined, Distribution and DYODD. Read here:

2024 H1 Recap: Four "D" Trading Strategy and H2 Outlook

3) I don't reveal the details of my P/L and portfolio. Those who follow my posts know that my investment is mainly based on technology stock or ETFs like S&P500 and Mega Cap stocks (M7). Based on some sources, industries that will outperform after Fed rate cut are Technology, REIT, Consumers and Healthcare.

2024 H1 Recap: Four "D" Trading Strategy and H2 Outlook

3) I don't reveal the details of my P/L and portfolio. Those who follow my posts know that my investment is mainly based on technology stock or ETFs like S&P500 and Mega Cap stocks (M7). Based on some sources, industries that will outperform after Fed rate cut are Technology, REIT, Consumers and Healthcare.

4) Based on past experiences, the stock market will take time to digest the positive news from the Fed. We should expect volatility which is due to uncertainties brought by US recession risk, US presidential election outcome, Oil price sudden surge, China-US tension, escalation of Ukraine-Russia conflict etc. We should avoid emotional trading like FOMO buy (greed) and panic sell (fear).

5) My outlook for Q4 is bullish and will continue my current trading strategy especially Diversification and Discipline. In addition, I am also trading options (puts/calls) to take advantage of the uptrending market. If the Fed cut rate further in Q4, I may consider taking some profit and revamp my portfolio.

Disclaimer: The above is just my P/L review and should not be taken as financial advice. Selling puts/calls options is risky as the loss is unlimited and may result in margin call if it is exercised. We should invest based on our risk appetite and within our means.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

MooMamaLlama : Yay!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) well done my friend!!!!

well done my friend!!!! ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) I like to see you doing so well, makes me happy! Your insights are always intriguing and make a lot of sense. Perspective and patience is important, as you've proven so well over the years.

I like to see you doing so well, makes me happy! Your insights are always intriguing and make a lot of sense. Perspective and patience is important, as you've proven so well over the years. ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ZnWC OP MooMamaLlama : Your perspective on Australia stocks is inspiring. I hope Moomoo will allow us to trade AU stocks here soon.

Daring Lu : Rate cut may not immediately increase borrowing of companies.

- mkt or demand may have slow down if recession may already started

- most may want to remain on the sideline until year end or after election when the coast is clearer

- there is likelihood that inflation may creep up as oil price increases, import gets more expensive, etc

Continue to see volatile 4th Quarter of 2024.

ZnWC OP Daring Lu : Thanks for sharing. Some of the uncertainties I have already mentioned in point 4.

Savvy inSavyInvestor : Hi - Thanks for the above details and sharing your views on the market forecasting.Good to know yourP&L is in green nd beating the avg returns.I have entered late into this bandwagon so as for a newbie what all details l need to know before taking any positions. Will be great if you can share your experience. Though I am new to us market but not new to markets .thanks