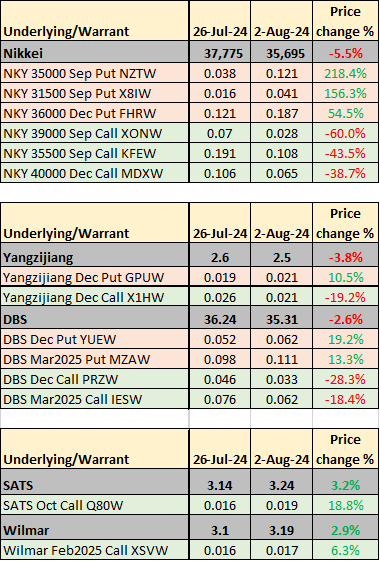

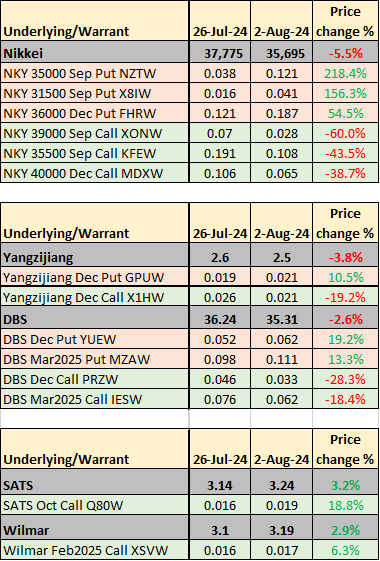

Nikkei puts surge between 55% to 218% over the past week on the back of BOJ rate decision

➡️ Nikkei put warrants took this week’s top gainers position after the Nikkei 225 tumbled 6% during the week ending 2 August 2024 on the back of the Bank of Japan’s rate hike on Wednesday and chatters about yet another rate hike in October. The Nikkei225 September futures index is down another 6.5% this morning to 33,580 as of 924AM.

➡️ In Singapore, Yangzijiang and DBS led the market lower with a 3.8% and 2.6% drop during the week, and respectively down another 3% and 4.3% as of 924AM this morning. Last week, the put warrants were up between 13% and 19% - potentially offsetting short-term losses in the stock pull-back for those who hedged with these put warrants.

➡️ Despite the market rout, there were few standout performers such as SATS and Wilmar which were both up 3%, leading the trending call warrants tracking both stocks to increase 19% and 6% respectively.

🔎 Find out what to look out for this week and the warrants you can use to trade further volatility in the markets.

📌 Below is a summary for some of the top warrant movers over the past week ending 2 August 2024:

❗Warrants highlighted are the trending warrants which remain on tight spreads as of 2 August 2024

📖 https://tinyurl.com/MMB05Aug24

➡️ In Singapore, Yangzijiang and DBS led the market lower with a 3.8% and 2.6% drop during the week, and respectively down another 3% and 4.3% as of 924AM this morning. Last week, the put warrants were up between 13% and 19% - potentially offsetting short-term losses in the stock pull-back for those who hedged with these put warrants.

➡️ Despite the market rout, there were few standout performers such as SATS and Wilmar which were both up 3%, leading the trending call warrants tracking both stocks to increase 19% and 6% respectively.

🔎 Find out what to look out for this week and the warrants you can use to trade further volatility in the markets.

📌 Below is a summary for some of the top warrant movers over the past week ending 2 August 2024:

❗Warrants highlighted are the trending warrants which remain on tight spreads as of 2 August 2024

📖 https://tinyurl.com/MMB05Aug24

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment