Nvidia Adds to Recent Gains with BofA and Goldman Sachs Boosting Price Targets

Nvidia stock surged 4.8% on Monday to a record high, closing at $693.32. This semiconductor giant shares have gained 40% year-to-date and 10% over the past five trading sessions as tech earnings reinforce AI bullishness.

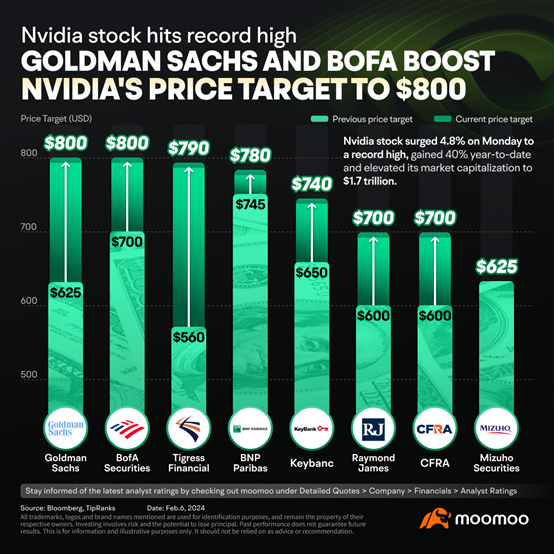

Bank of America raised its price objective for Nvidia to $800

Even after a 350% rally since the start of 2023, Nvidia stock still offers investors a "compelling valuation" with AI demand in its infancy, according to Bank of America.

The bank increased its Nvidia price target to $800 from $700 last Friday, representing potential upside of 23% from current levels.

"Early days, but results from top US cloud customers suggest solid motivation for spending in Generative AI," Bank of America analyst Vivek Arya said.

Following Bank of America, Goldman Sachs also boosts Nvidia's price target

Goldman Sachs reiterated its "buy" rating on Nvidia and lifted its price objective to $800 per share, saying that demand for artificial intelligence (AI) and improved graphics processing unit (GPU) supply could boost the chipmaker's position.

Goldman analysts also raised their fiscal 2025 and 2026 estimates for Nvidia's non-GAAP earnings per share by 22% on average to reflect “recent industry data points indicative of robust AI server demand and improving GPU supply.”

"We no longer assume a drop off in Data Center revenue in 2H 2024 and instead model consistent growth through 1H 2025 driven by continued spending on Generative AI infrastructure by the large cloud service providers, a broadening customer profile, and multiple new product cycles," the analysts wrote.

Goldman noted that while it "expect the trajectory of capital spending on Generative AI infrastructure beyond 2024 to remain as the key debate as it relates to Nvidia," the firm is "increasingly confident, particularly given signs of AI monetization, that demand for accelerated computing will continue to grow in 2025."

However, some pessimistic analysts claim that Nvidia is already in a bubble, and "no one knows the true demand for GPUs in the future."Besides, Nvidia reached "deeply overbought" now with a 12-day RSI above 84, signaling potential pullback. Wolfe Research technical analyst Rob Ginsberg cautious about chasing vertical moves in stocks during such times when they are "deeply overbought."

Source: Yahoo Finance, Seeking Alpha

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment