Nvidia Investors, Speculators Pour Millions of Dollars in Options Market Ahead of Earnings

$NVIDIA (NVDA.US)$ institutional investors and speculators are pouring millions of dollars in the options market days ahead of earnings results that could test how long the AI-favorite could keep beating analysts' estimates.

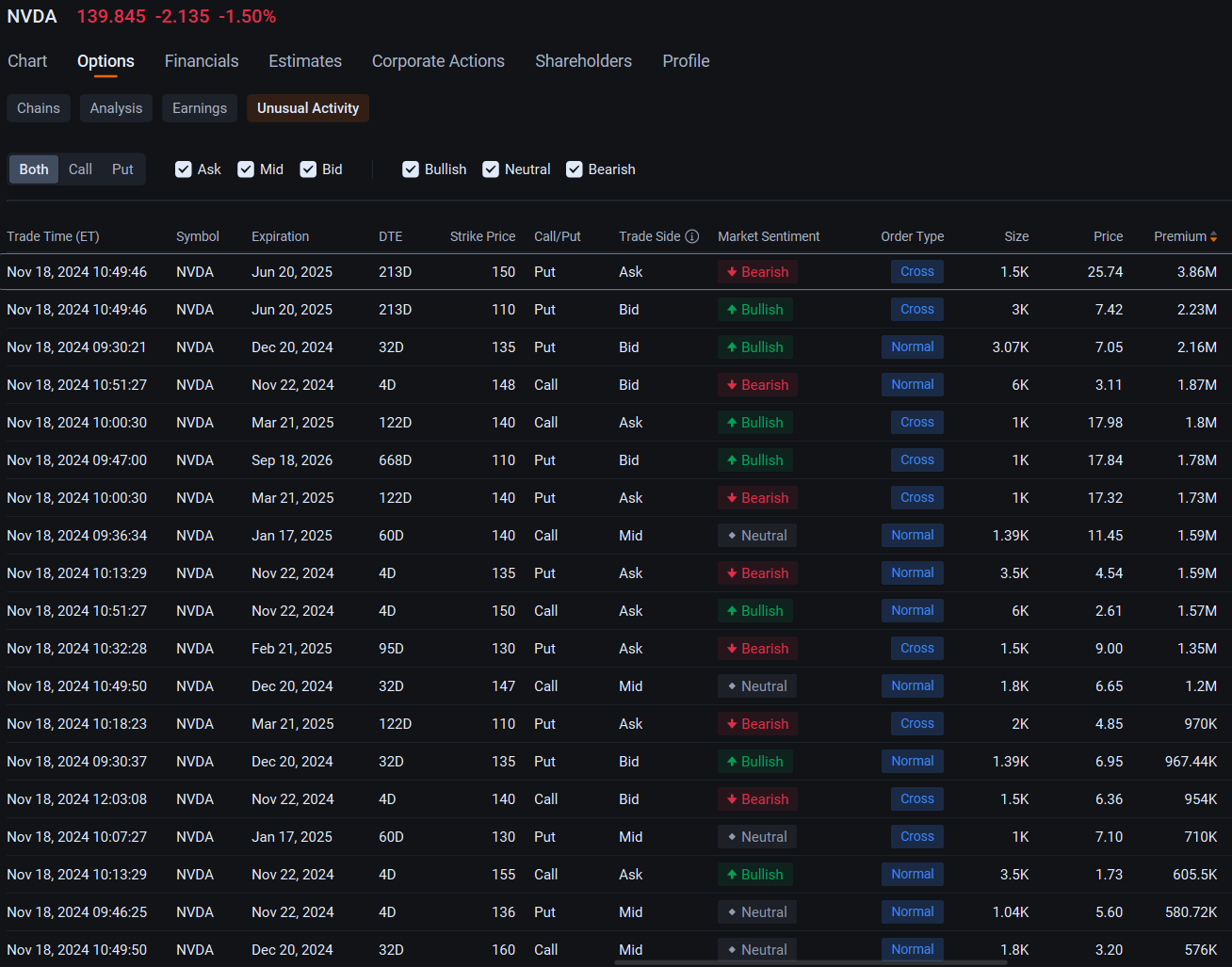

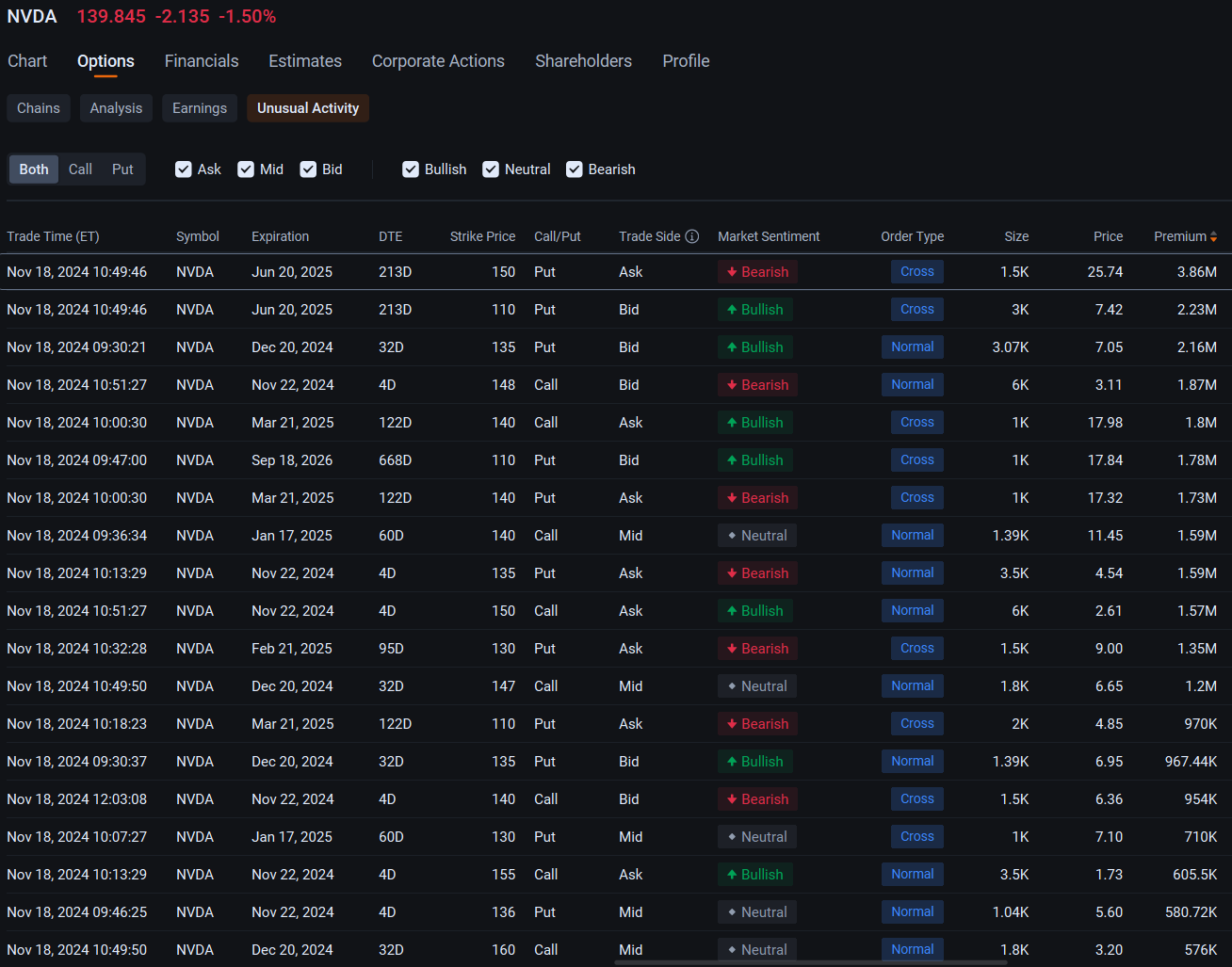

The biggest among unusual options activities seen so far Monday involved a multi-leg trade that had an active buyer paying a $3.86 million premium for put options that gives him or her the right to sell 150,000 Nvidia shares at $150 each by June 20, 2025.

Another part of that trade was the active sale of put options with a $110 strike price expiring on the same date. These trades were both posted at 10:49:46 a.m. in New York Monday, exchange data tracked by moomoo showed.

Amid the tug of war between the bulls and bears playing out in the options market, analysts remain optimistic about Nvidia's outlook, with almost 90% of them having a buy rating on the stock and only two with sell recommendations. The rest say hold.

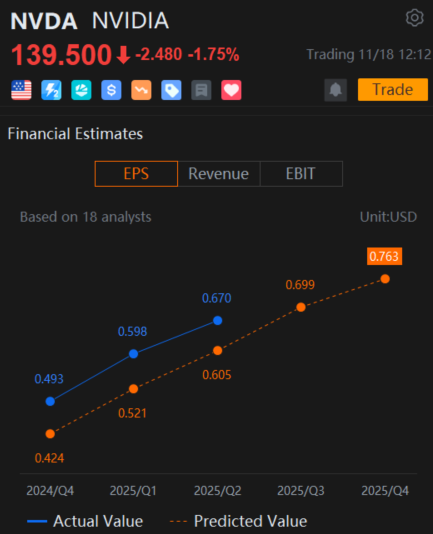

On average, the chip giant is expected to post an 83% jump in revenue to $33.2 billion in the three months that ended Oct. 31 from a year earlier, estimates compiled by Bloomberg show. The company has surpassed Wall Street consensus for eight straight quarters, Bloomberg data show. For the quarter ending in January, the company is seen boosting revenue by 68% to $37 billion when it reports results after the market closes on Wednesday, according to the average estimate.

"Nvidia is likely to solidly exceed 3Q revenue consensus more than it did in the past two quarters and the company will likely raise 4Q guidance, driven by greater adoption of its Hopper family, even as hyperscale customers await the Blackwell ramp-up in 2025," Bloomberg Intelligence analyst Oscar Hernandez Tejada said in a note last week.

Tejada was expecting the initial shipments of Nvidia's Blackwell graphic processing units to start shipments to key customers beginning in the fourth quarter, adding that concerns about delays were resolved in the previous quarter. News reports of overheating of Blackwell over the weekend could cloud that view.

Shares of Nvidia slipped as much as 3.4% Monday morning after reports that that the chip giant asked its suppliers to change the design of server racks Blackwell GPUs to for Blackwell due to overheating issues. Nvidia explained that engineering iterations are expected, Barron's reported, citing the company's response to its queries on the issue. The stock has since pared those losses to 0.5%.

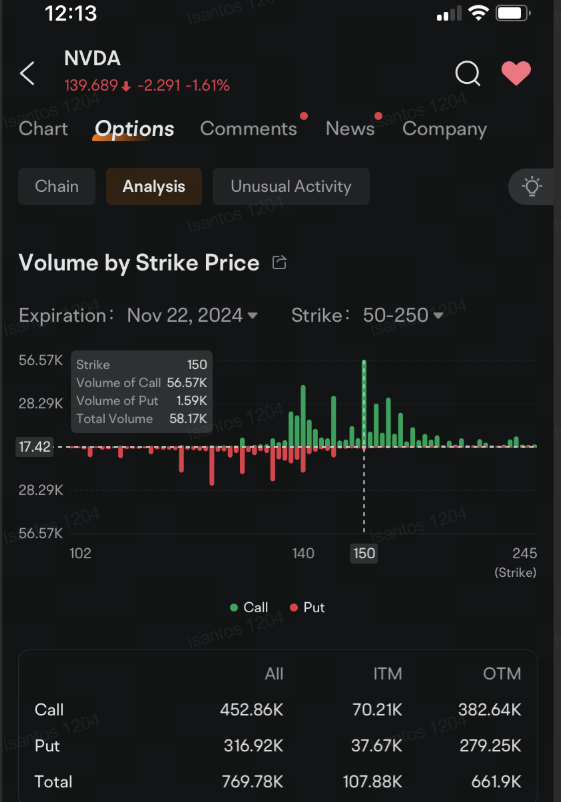

Call options that give holders the right to buy Nvidia shares at $150 by the end of the week attracted the heaviest volume, with 55,570 contracts changing hands so far. The price of those calls tumbled 29% as the stock price falls deeper below that strike price.

The second-most active Nvidia options are the $140 calls expiring in four days. Volume reached 40,490, exceeding open interest of 28,820.

Despite the reported Blackwell issue, analysts at BPN Paribas Exane, Mizuho Securities, Evercore ISI, and Redburn reiterated their outperform or buy rating on the stock, while maintaining their price targets, data compiled by Bloomberg show. On average, analysts expect the stock to reach $158.26 over the next 12 months, implying an upward potential of about 13%.

Share your thoughts on Nvidia in the comments section. Do you see potential longer delays to Blackwell shipments? Does that dim the outlook for the stock? And if you have a price forecast on Nvidia, please vote below.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

151458830 : Around 150.

70647118 : Yes

70196850 : $160

kyneo :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Alen Kok : Oh.

72055161 : Yas I no

72055161 : Yas I no

Liya GAO : Common sense!

102615938 : I believe Nvidia is still strongly in demand despite Blackwell's overheating issue.

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...