October has been a rollercoaster, particularly for those of us who had high hopes for Chinese markets. Early in the month, I took a significant position on YINN, buying $60 call options with the expectation of an upward trend in Chinese stocks. Unfortunately, the market had other plans. A severe downturn in Chinese equities led to a substantial loss on October 8, reminding me of the inherent risks tied to such speculative plays. However, setbacks often provide the best learning moments, and this instance was no exception.

Adapting Strategies for Recovery

Realizing that sticking to my initial strategy would only deepen my losses, I quickly pivoted. Instead of doubling down, I opted to sell $70 call options on YINN, based on my assessment that it wouldn’t hit that price by November 15. This adjustment brought in an additional $3,000, effectively turning a challenging situation around. Now, I’m simply letting the option expire, allowing the premium to roll in without further action.

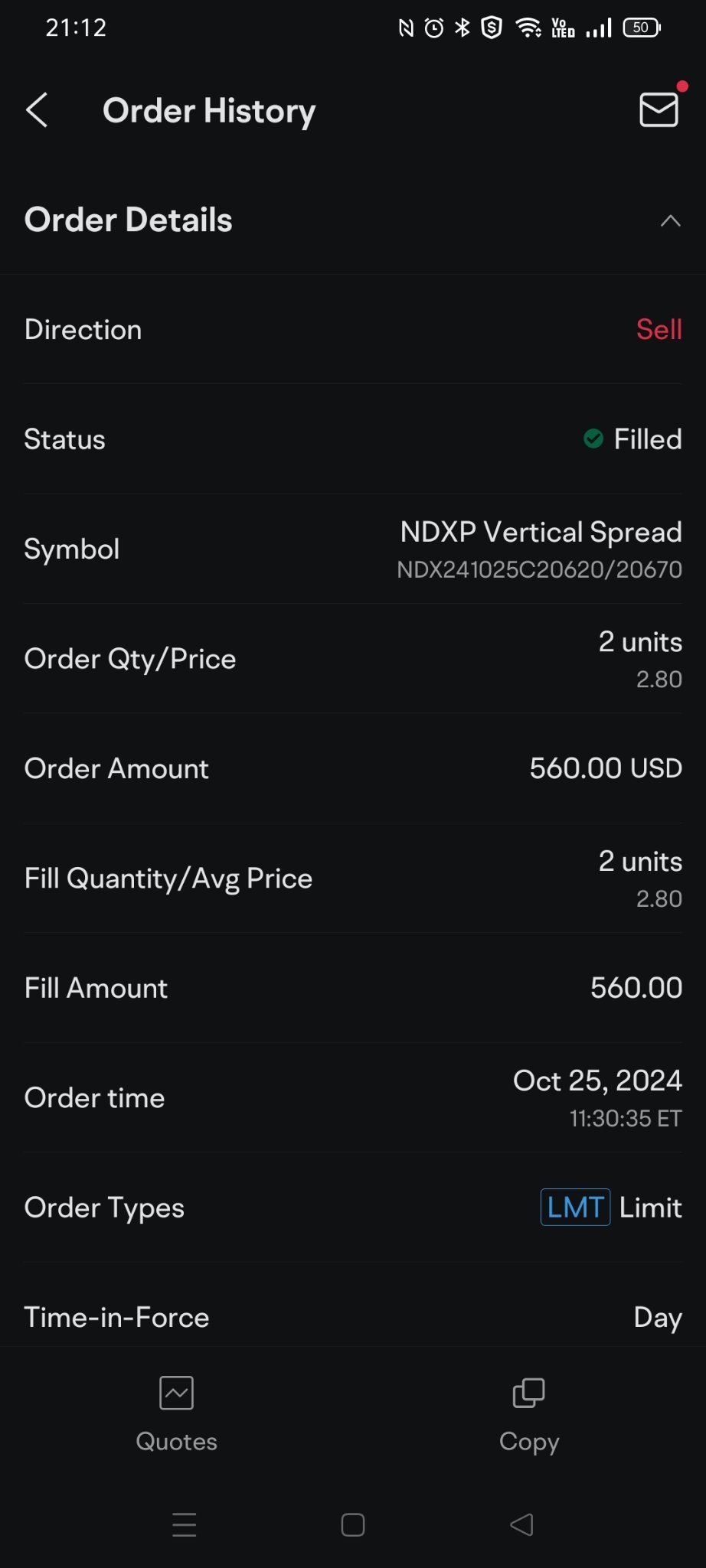

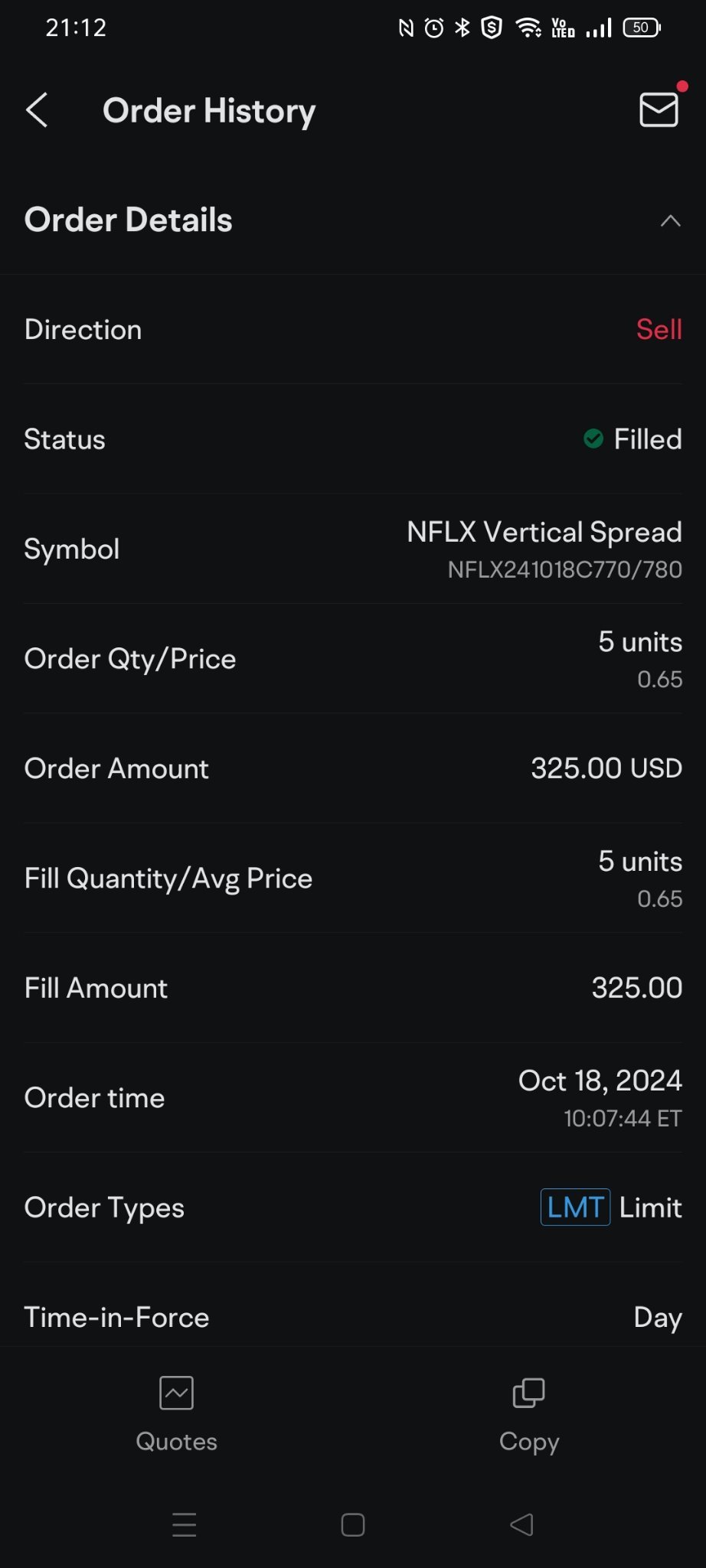

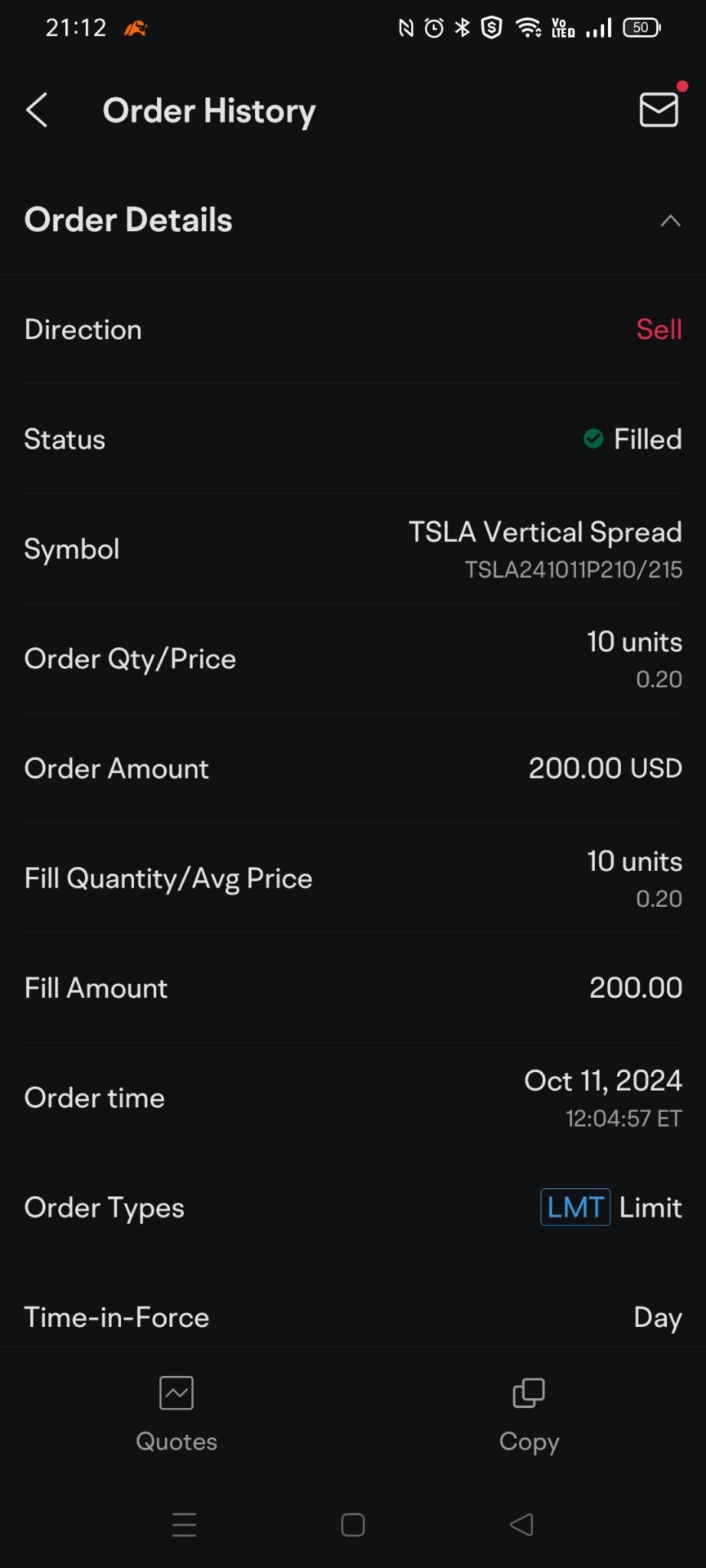

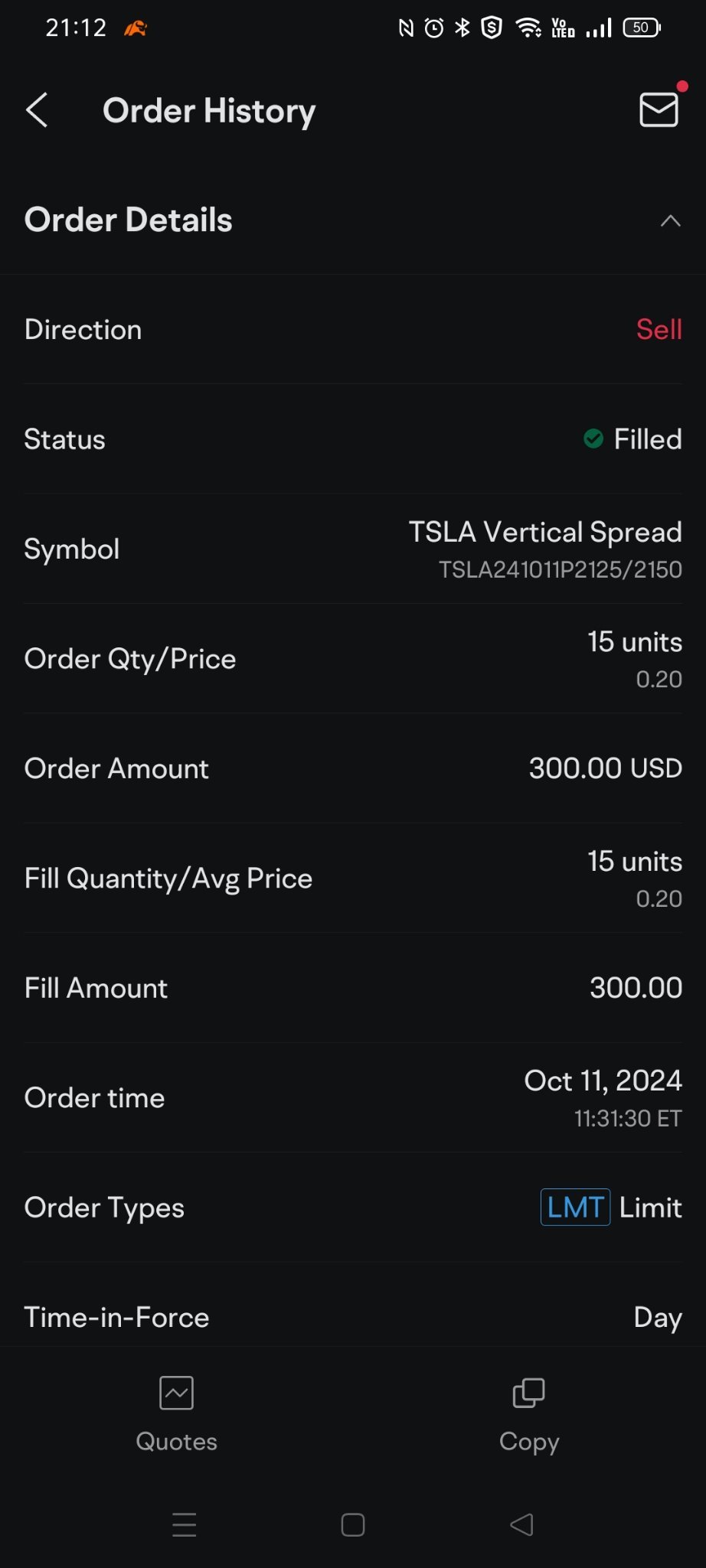

In addition, I took advantage of 0DTE (zero-day-to-expiration) options across different assets, including Netflix (profit $325), Tesla (profit $500), and Nasdaq Index (profit $560). These trades collectively brought in around $1,385, helping to offset earlier losses and stabilize the portfolio.

A Month of Modest Gains and Valuable Lessons

Reflecting on October, I’d say the performance was decent but not exceptional. Achieving a 4.85% return amid various market challenges was satisfactory, though there's always room for improvement. This month reinforced the importance of flexibility—sticking to a rigid plan can be counterproductive in volatile markets. I've come to appreciate that in trading, the ability to pivot quickly is as valuable as any well-researched strategy.

Final Thoughts

Looking back, October’s market turbulence underscored that no strategy is foolproof. While my initial YINN call option didn’t yield the expected results, the adjustments salvaged the month’s performance, keeping the portfolio in positive territory. Moving forward, I’ll keep refining my approach, balancing speculative moves with calculated decisions to navigate the ups and downs of an unpredictable market.

---

If you found this analysis insightful, feel free to like and follow for more market updates. I’ll be sharing further reflections on my trading journey and strategies, so stay tuned!

Cdawg Blues : Thank you for your story and insight gained and know shared.

Cdawg Blues Cdawg Blues : *now

73744816 Cdawg Blues : I got caught in the same loop, so you are not alone. Thank you for sharing!