Option Traders Positioned for Volatility Ahead of Jackson Hole Conference

As the annual Jackson Hole Economic Policy Symposium approaches, option traders are positioning themselves for potential market swings, with Federal Reserve Chair Jerome Powell's speech on Friday set to be the focal point. This year's conference, held in Grand Teton National Park, Wyoming, from August 22 to 24, is particularly crucial as it precedes the Fed’s next interest rate decision in September.

Wall Street is keenly anticipating signals from Powell regarding future interest rate cuts. Market expectations are leaning heavily toward a reduction in borrowing costs at the Fed’s September meeting. However, Powell's historically cautious approach leaves room for uncertainty.

If traders hear cuts are coming, stocks will react favorably," said Eric Beiley, executive managing director of wealth management at Steward Partners Global Advisory. "If we don't hear what we want, that would trigger a big selloff."

The $S&P 500 Index (.SPX.US)$ has recently been buoyed by a $3.3 trillion rebound following a global growth scare in early August. However, the market’s current bullish sentiment could be upended if Powell remains non-committal about rate cuts.

"Markets are so confident that rate cuts are coming very soon," Beiley added. "It would be a huge surprise if Powell didn't reinforce that's the path ahead."

"Looking at past Jackson Hole speeches, it's not likely we'll get very prescriptive remarks from Powell," said Tom Hainlin, national investment strategist at US Bank Wealth Management. "He probably won't signal the size of the first cut, particularly with a jobs report coming on Sept. 6."

Option Market Position

Options traders are preparing for volatility, with the cost of at-the-money puts and calls suggesting the S&P 500 could swing over 1% in either direction on Friday, according to Citigroup Inc.

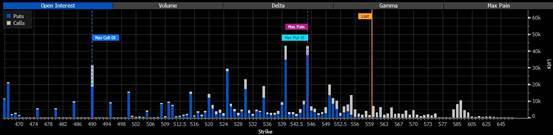

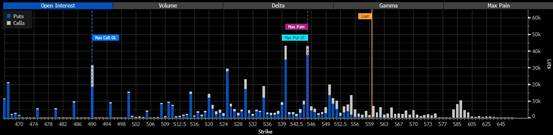

For the options expiring this Friday, open interest for the etf that tracks S&P 500 is concentrated below the current price. The maximum pain and maximum put open interest are centered around 545, while the current stock price sits aroud 560.

This suggests that many traders have placed their bets on the stock price to pull back to around 545 by this Friday. "Max pain" refers to the price point where the most options would expire worthless, causing the least profit for option holders and the most profit for option writers. If the stock price drops to 545 by the expiration date, it would align with where the largest number of put options are held, potentially minimizing losses for option sellers.

Despite the uncertainty, traders are betting on a rate reduction at the next Fed meeting. The stakes are high for Powell's remarks, especially with few Fed officials scheduled to speak in the coming days. This has led to a cautious optimism on Wall Street, with open interest in options betting on a decline in the $CBOE Volatility S&P 500 Index (.VIX.US)$ near its highest level since June 2022 relative to contracts betting on gains, data compiled by Bloomberg show.

Meanwhile, forex options traders are positioning for further dollar losses as they anticipate that Federal Reserve Chair Jerome Powell will reinforce the case for interest-rate cuts during the central banks annual gathering in Jackson Hole. They are paying more for options that benefit if the dollar slumps over the next week and month, as indicated by indexes of risk reversals on a basket of the currency’s major trading partners. This implies that traders are preparing for the currency to drop ahead of both the Jackson Hole symposium and the Fed's September policy announcement. A Bloomberg gauge of the dollar has already fallen 1.6% in August, reaching its lowest level in five months on Monday.

Historical Performance

Historical data underscores the significance of Powell's speech: since 2000, the S&P 500 has averaged a 0.4% gain in the week following the Jackson Hole gathering, according to DataTrek.

Nevertheless, caution is warranted. Powell’s appearance at Jackson Hole in August 2022 serves as a stark reminder of the impact his words can have. His warning about the need for restrictive monetary policy to combat inflation led to a 3.4% drop in the S&P 500 that day, with another 3.3% loss in the following week.

DataTrek views 2022 as an "outlier year" for the S&P 500 due to the Fed's aggressive interest-rate hikes aimed at controlling high inflation. Powell's Jackson Hole speech that year "surprised markets" by signaling a strong commitment to reducing inflation, even at the cost of economic pain and slower growth, as noted by Nicholas Colas.

Analysts Opinion

Analysts widely expect Powell to highlight that inflation is moving in the right direction, giving the Fed more confidence in reaching its 2% target. "I suspect that he will say something along the lines that, given the deterioration in the unemployment rate, it may make sense that we do start to cut rates a bit sooner," said James Knightley, chief international economist at ING.

However, Steve Sosnick, chief strategist at Interactive Brokers, warns that investors may have set the bar too high. "What if Powell comes out and simply says that we might want to adjust interest rates a bit lower, but we don't need to slash them?" Sosnick said.

The stock market's recent rebound could be at risk. "I'm preaching a bit of caution ahead of Jackson Hole,” Sosnick added. “Particularly as the more we rally in advance, the more fragile [the stock market] might be.”

With Powell's speech looming, traders are holding their breath, hoping for clarity that could either reinforce the market's upward trajectory or trigger a significant selloff. The historical performance of the stock market around Jackson Hole suggests a tendency for muted but mostly positive reactions. However, the context of this year's conference — following a period of extreme market volatility and heightened recession fears — could lead to more pronounced market movements.

"Powell doesn’t need to scare markets,” said Stephanie Lang, chief investment officer at Homrich Berg. “He needs to give confidence that inflation is ebbing and officials are comfortable with bringing restrictive rates to a more neutral level.”

As the countdown to Jackson Hole continues, all eyes will be on Powell, whose words could set the stage for the Fed's next moves and, by extension, the direction of the stock market in the weeks to come.

Source: Bloomberg, MarketWatch

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Laine Ford : like it

Laine Ford : good stock buy

Laine Ford : good stock