Options Market Statistics: Alibaba Stock Jumps on Bullish Fiscal Q1 Results, Options Pop

News Highlights

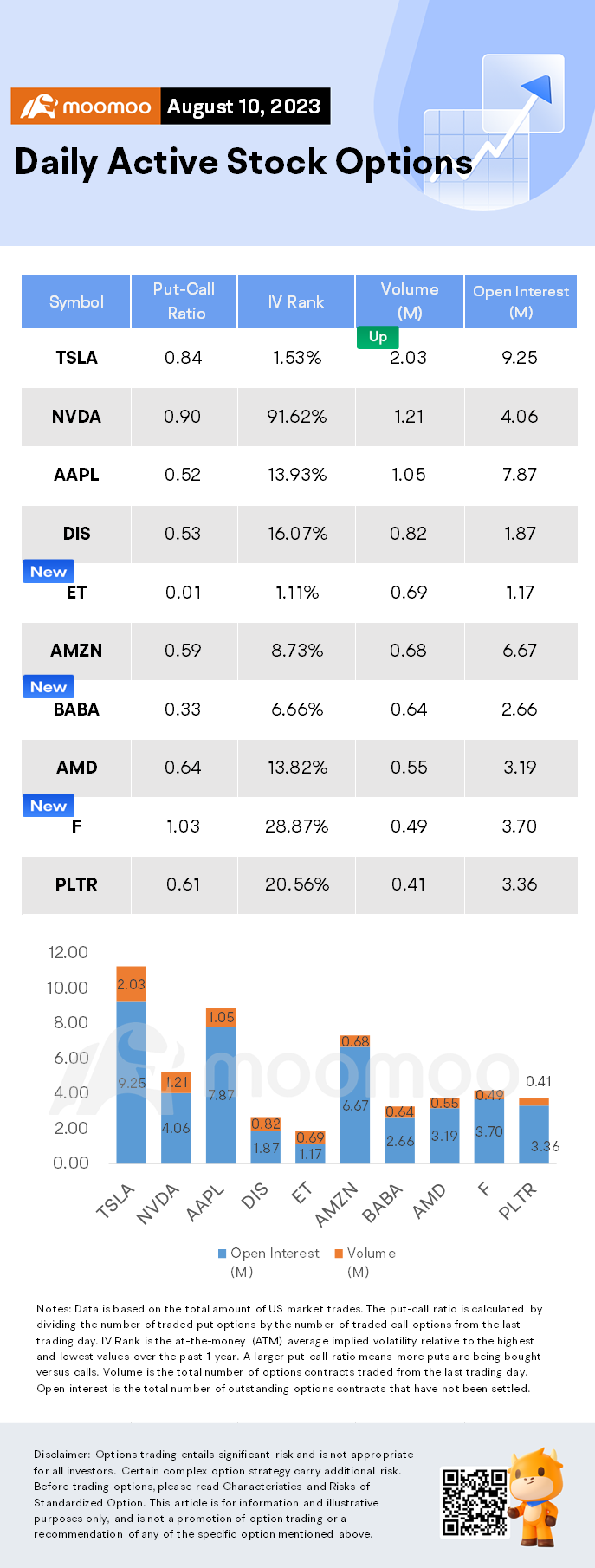

$Alibaba (BABA.US)$ shares rose by 4.60%, closing at $99.21. Its options trading volume is 0.64 million. Call contracts account for 75.2% of the whole trading volume. The most traded calls are contracts of $100 strike price that expire on August 11th. The total volume reaches 55,951 with an open interest of 20,173. The most traded puts are contracts of a $75 strike price that expires on October 20th; the volume is 11,676 contracts with an open interest of 2,971.

Alibaba reported first-quarter FY23 revenue growth of 14% year-on-year to $32.29 billion, beating the consensus of $31.20 billion. Non-GAAP earnings per ADS of $2.40 beat the consensus of $2.02.

After experiencing turbulent adjustments and changes, Alibaba Cloud, which briefly stalled in growth last year, has once again returned to an era of high profit growth. In response, Zhang Yong, chairman of the board of directors and CEO of Alibaba Group and chairman and CEO of Alibaba Cloud Intelligence Group, said that due to the model training and reasoning scenarios brought about by the development of next-generation artificial intelligence, demand for AI cloud services is very strong, but due to the shortage of GPUs in the Chinese market in the short term, such demand has only been partially satisfied, and the incremental opportunities brought about by AI-related services have just begun to be unleashed.

$Ford Motor (F.US)$ shares fell by 4.48%, closing at $12.16. Its options trading volume is 0.49 million. Call contracts account for 49.3% of the whole trading volume. The most traded calls are contracts of $13 strike price that expire on September 15th. The total volume reaches 53,602 with an open interest of 32,097. The most traded puts are contracts of a $12 strike price that expires on August 18th; the volume is 31,449 contracts with an open interest of 11,327.

$General Motors (GM.US)$, Ford, and $Stellantis NV (STLA.US)$ shares are down about 6% on average over the past month, while the S&P 500 and Dow Jones Industrial Average are up about 1% and 4%, respectively. Part of that underperformance results from nervousness about how the labor talks will turn out.

Take the current talks between the traditional Big Three Detroit vehicle manufacturers and the United Auto Workers. The union's demands could raise costs by a cumulative $80 billion over the life of the contract, which would run from September through September 2027.

That is a big number, but investors should remember that the auto business is huge. Ford Motor, General Motors, and Chrysler's parent Stellantis generated 2022 sales of almost $500 billion. They had a combined operating profit of almost $50 billion from selling more than 13 million cars.

$Tesla (TSLA.US)$ shares rose by 1.30%, closing at $245.34. Its options trading volume is 2.03 million. Call contracts account for 54.3% of the whole trading volume. The most traded calls are contracts of $250 strike price that expire on August 11th. The total volume reaches 189,982 with an open interest of 25,170. The most traded puts are contracts of a $245 strike price that expires on August 11th; the volume is 134,582 contracts with an open interest of 14,450.

Unusual Stock Options Activity

There were noteworthy activities in $Ford Motor (F.US)$ where multiple options have topped volume to open interest ranking. The highest volume over open interest ratio reaches 96.8x with 17,040 contracts.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please readCharacteristics and Risks of Standardized Option.This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Chak : Ironically, I took the hundred dollar call tournament hundred percent