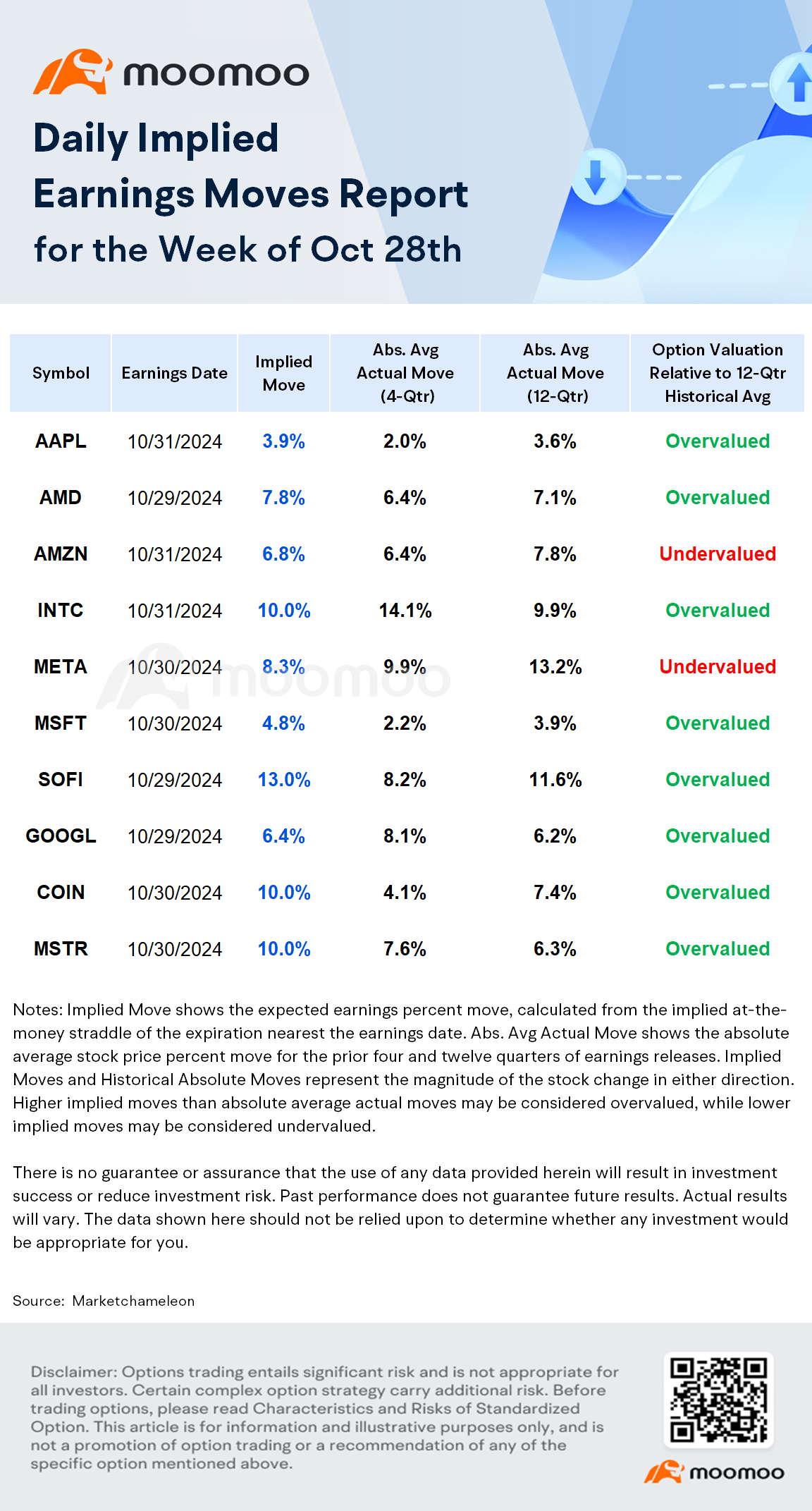

Earnings Volatility | Market Braces for Big Swings Following Upcoming Earnings of AAPL, AMZN, and META

Implied volatility often spikes before a company releases its earnings, as market uncertainty drives up demand for options from speculators and hedgers. This heightened demand inflates both the implied volatility and the price of the options. Following the earnings announcement, implied volatility generally returns to normal levels.

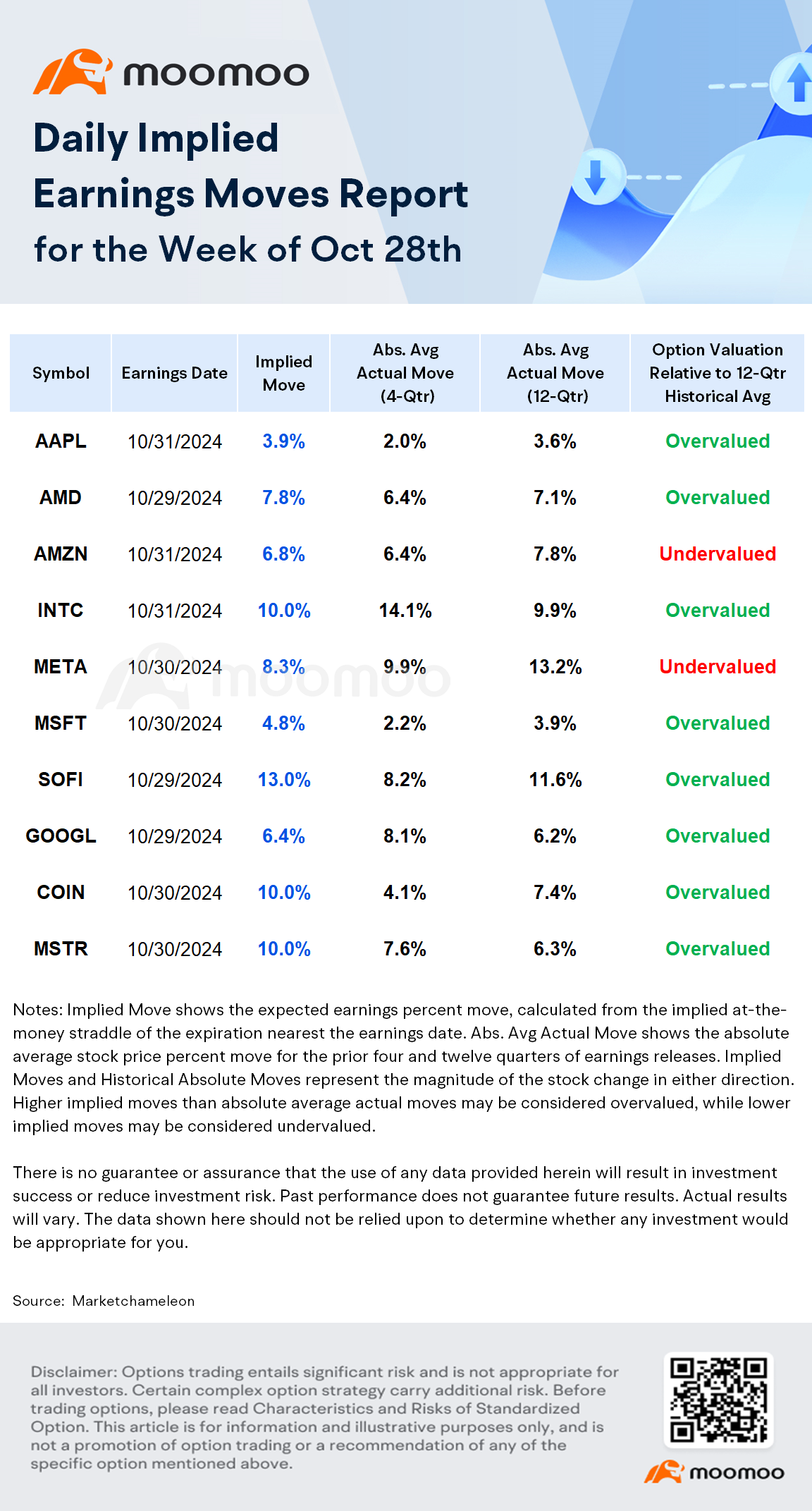

Here are the top earnings and volatility for the week:

$Apple (AAPL.US)$

Earnings Release Date: AAPL is set to report earnings on October 31, 2024 after market close

Earnings Release Date: AAPL is set to report earnings on October 31, 2024 after market close

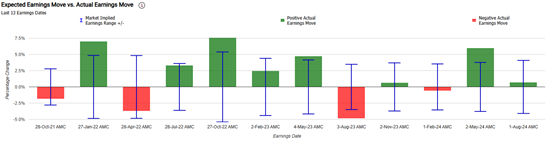

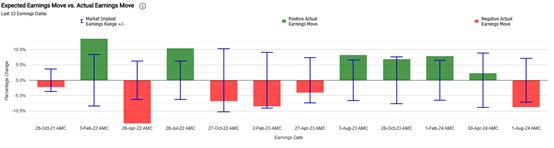

The options prices predicted a ±4.1% post earnings move, compared to a +0.7% actual move in the last quarter. The options market overestimated Apple stocks earnings move 62% of the time in the last 13 quarters. The predicted move after earnings announcement was ±4.0% on average vs an average of the actual earnings moves of 3.4% (in absolute terms).

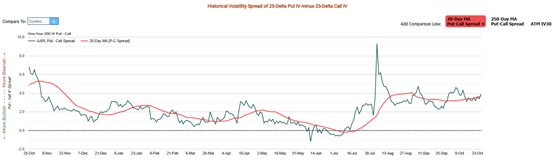

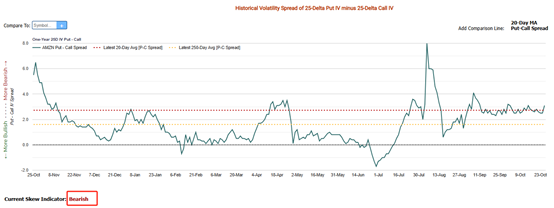

The implied volatility skew shows the market's bias for pricing in volatility risk to the option premium of downside puts and upside calls. If the implied volatility for downside puts is increasing relative to upside calls, then that suggests the market is pricing in a larger fear to a downside move.

The current skew indicator shows that market sentiment is Bearish on Apple.

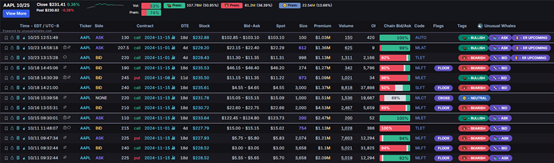

In single options trades with a premium over 1 million, most of the options with an expiration date of less than 30 days are calls that expire on Nov. 1, 2024 and Nov. 15, 2024. However, these calls are mostly slightly bullish or bearish.

Earnings Release Date: Amazon is expected to report earnings on 10/31/2024 after market close.

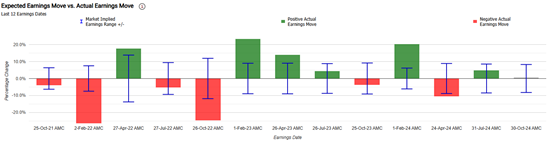

The options prices predicted a ±7.1% post earnings move, compared to a -8.8% actual move in the last quarter. The options market overestimated Amazon stocks earnings move 46% of the time in the last 13 quarters. The predicted move after earnings announcement was ±7.0% on average vs an average of the actual earnings moves of 7.8% (in absolute terms). This shows that Amazon tended to be more volatile than the options market predicted for the earnings stock price reaction.

From the perspective of implied volatility skew, market sentiment is Bearish on Amazon.

A key focal point for Q3 will likely be AWS, which is Amazon’s high-margin business. AWS accounts for two-thirds of the company’s profitability. AWS sales growth has been accelerating, rising from 12% to 19% over the last four quarters, and the company maintained its leadership in the cloud market with a 32% share. The key question is how long this growth can be sustained.

On the flip side, concerns remain about how much AWS margins will continue to decline after being unsustainably high earlier in the year. Although AWS operating margins were around 37.6% in Q1, they dropped to 35.5% in Q2. The market now seems to accept that margins will continue to soften. However, even with this probable continued decline, analysts believe Amazon’s operating income will remain strong.

Earnings Release Date: Amazon is expected to report earnings on 10/30/2024 after market close.

The predicted move after earnings announcement was ±9.0% on average vs an average of the actual earnings moves of 13.2% in the last 12 quarters. This shows that Meta tended to be more volatile than the options market predicted for the earnings stock price reaction. The average 1-day return for an option straddle was +9.8% according to Market Chameleon.

Meta implied volatility (IV) is 46.2, which is in the 85% percentile rank. This means that 85% of the time the IV was lower in the last year than the current level. The current IV (46.2) is 4.5% above its 20 day moving average (44.2) indicating implied volatility is trending higher.

Over the last 12 quarterly earnings, during regular trading hours after the earnings was released, the biggest increase was +23.3%, and the largest price decrease was -26.4%.

Source: Market Chameleon, Unusual Whales

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Sabrina Hendricks : great info