Options Market Statistics: Intel Stock Climbs as Amazon and U.S. Government Provide Support to Struggling Chipmaker

News Highlights

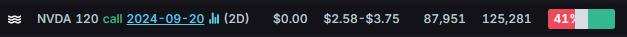

$NVIDIA (NVDA.US)$ shares dropped 1.02% Tuesday to close at $115.59, with option volume of 2.25 million, and calls accounted for 63.8% of the volume. The $120 calls expiring September 20 were traded most actively.

Nvidia's stock climbed above its 50-day moving average on Tuesday, recovering from a recent dip and adding to last week's 16% gain, but remains volatile due to market dynamics and news of diversified chip interests. Nvidia's strong second-quarter results, with earnings and sales surpassing expectations and a positive outlook, have driven significant gains in 2023. The company continues to benefit from its AI and data center ventures despite recent setbacks, including design delays and regulatory scrutiny. Nvidia's strategic partnerships and AI advancements remain critical to its growth, though institutional selling and competitive pressures present ongoing challenges.

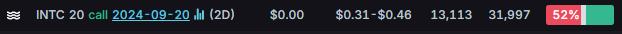

$Intel (INTC.US)$ shares climbed 2.68% Tuesday to close at $21.47, with option volume of 0.98 million, and calls accounted for 75% of the volume. The $20 calls expiring September 20 were traded most actively.

Intel's stock rose on Tuesday following announcements of U.S. government funding and a strategic alliance with Amazon Web Services. The company plans to make its foundry business an independent subsidiary and is pausing manufacturing projects in Poland and Germany. Additionally, Intel intends to reduce real estate holdings and sell a stake in its Altera unit. Despite these moves, most analysts remain cautious, with only three out of 45 recommending a buy. The recent developments are seen as positive steps but are expected to weigh on Intel's financials in the near term.

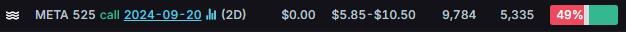

$Meta Platforms (META.US)$ shares were up 0.57% Tuesday to close at $536.32, with option volume of 0.28 million, and calls accounted for 63.6% of the volume. The $525 calls expiring September 20 were traded most actively.

Meta Platforms and Ray-Ban maker EssilorLuxottica have extended their partnership to develop multi-generational smart eyewear products into the next decade. Meta's latest Ray-Ban smart glasses feature an HD camera, calling capabilities, and voice-enabled AI assistant features, receiving positive reviews. Meta's stock rose slightly on the news, continuing an upward trend. The partnership builds on Meta's broader metaverse ambitions, with the latest glasses performing better than expected. Financial details of the expanded partnership were not disclosed. Meta stock has gained 51% this year, significantly outperforming the S&P 500.

Unusual Stock Options Activity

There was a noteworthy activity in $Roku Inc (ROKU.US)$, where $79 calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 134.2x with 30,725 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment