Options Market Statistics: Intuitive Machines Shares Surge, Option Pop Following Major NASA Contract

News Highlights

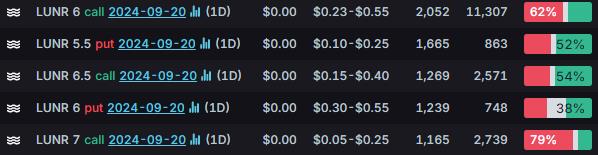

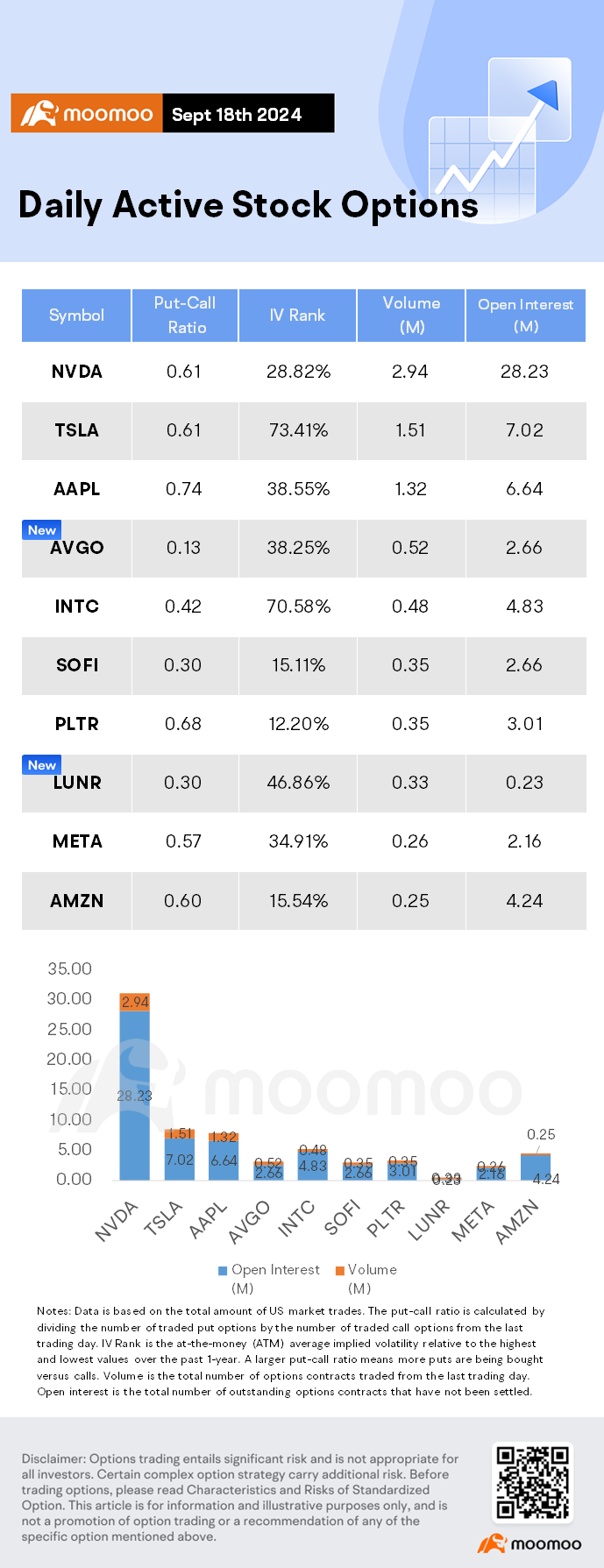

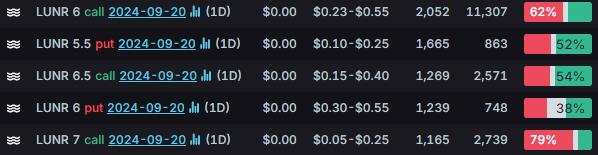

$Intuitive Machines (LUNR.US)$ shares surged 38.33% Wednesday to close at $7.47, with option volume of 0.33 million, and calls accounted for 77% of the volume. The $6 calls expiring September 20 were traded most actively.

Intuitive Machines announced it has secured a contract from NASA valued up to $4.82 billion to provide communication and navigation services in the near space region. As part of the agreement, the company will deploy a constellation of lunar relay satellites to support NASA's Artemis moon exploration program. This news caused Intuitive Machines' shares to surge over 50%, and they have gained more than 200% this year. The five-year contract, with an option for an additional five years, marks a significant milestone for the company. CEO Steve Altemus described the deal as an "inflection point" in the company's leadership in space communications and navigation.

$NVIDIA (NVDA.US)$ shares dropped 1.92% Wednesday to close at $113.37, with option volume of 2.94 million, and calls accounted for 62.1% of the volume. The $120 calls expiring September 20 were traded most actively.

Nvidia's crucial role in AI has made it a top investment choice, but recent comments from CEO Jensen Huang have raised questions about the sustainability of this growth. At the recent Goldman Sachs Communacopia + Technology Conference, Huang discussed the significant responsibilities Nvidia faces due to its extensive partnerships with AI companies, data centers, and cloud service providers worldwide. He highlighted the intense pressure and emotional stakes involved in meeting the high demand for Nvidia's components and technology, which directly impact customers' revenues and competitiveness. Despite their efforts, the company struggles to fulfill everyone's needs, adding to the emotional and tense environment.

$Broadcom (AVGO.US)$ shares fell 0.49% Wednesday to close at $161.67, with option volume of 0.52 million, and calls accounted for 88.1% of the volume. The $170 calls expiring September 20 were traded most actively.

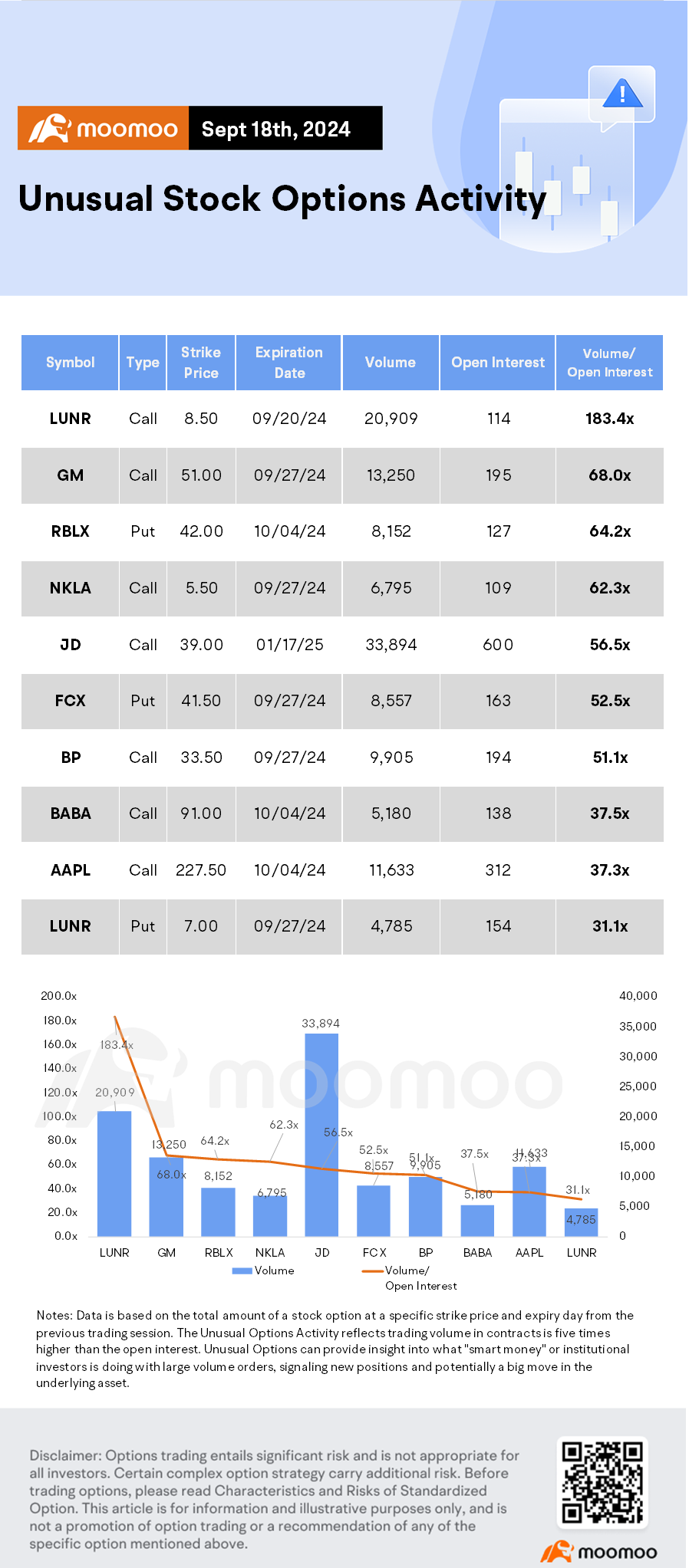

Unusual Stock Options Activity

There was a noteworthy activity in $Intuitive Machines (LUNR.US)$, where $8.5 calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 183.4x with 20,909 contracts.

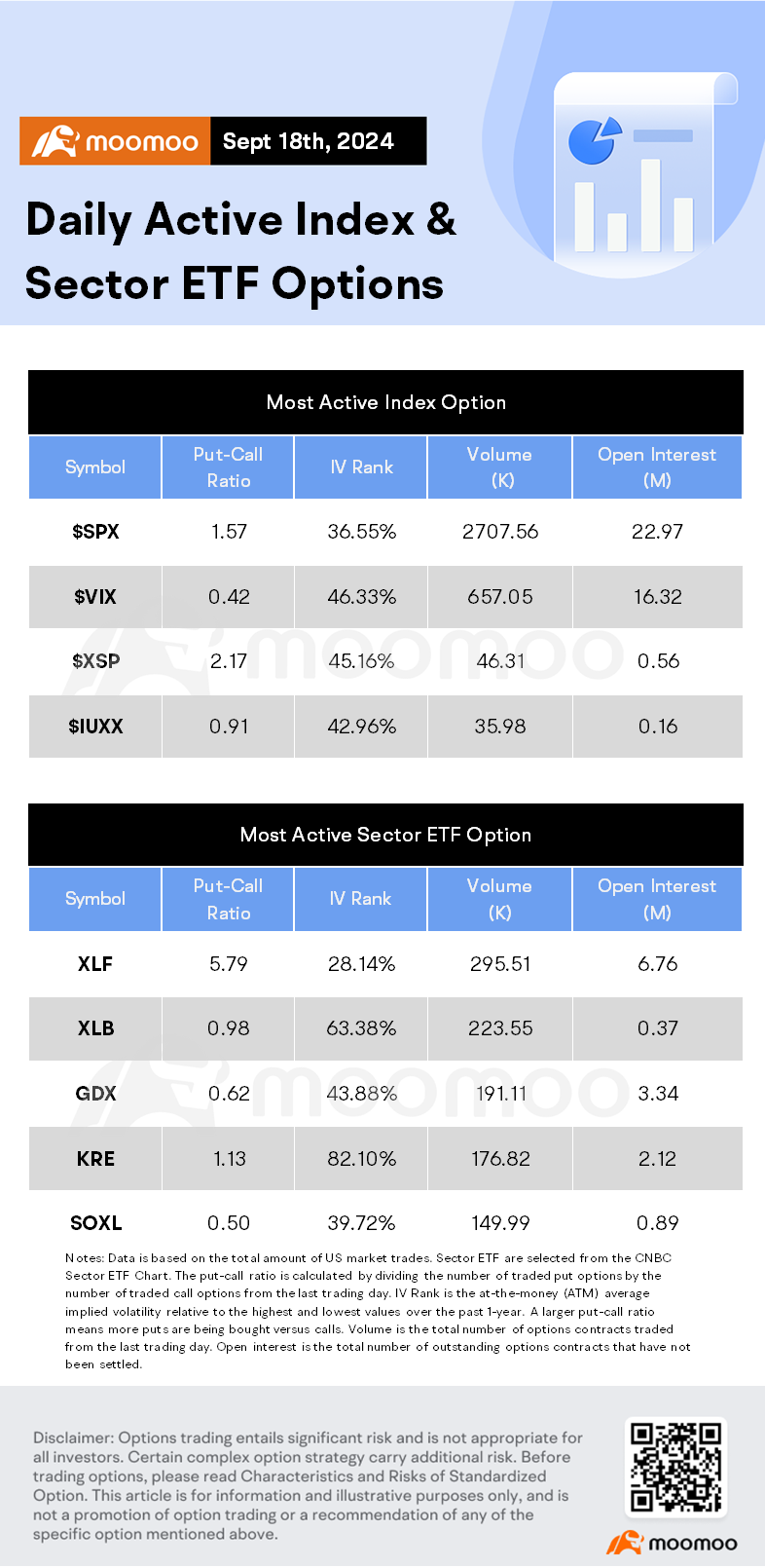

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

74423696 : I like it