Options Market Statistics: Nvidia CEO Reports 'Incredible' Demand, Stock Surges and Options Pop

News Highlights

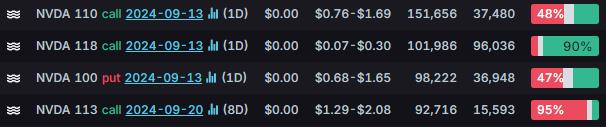

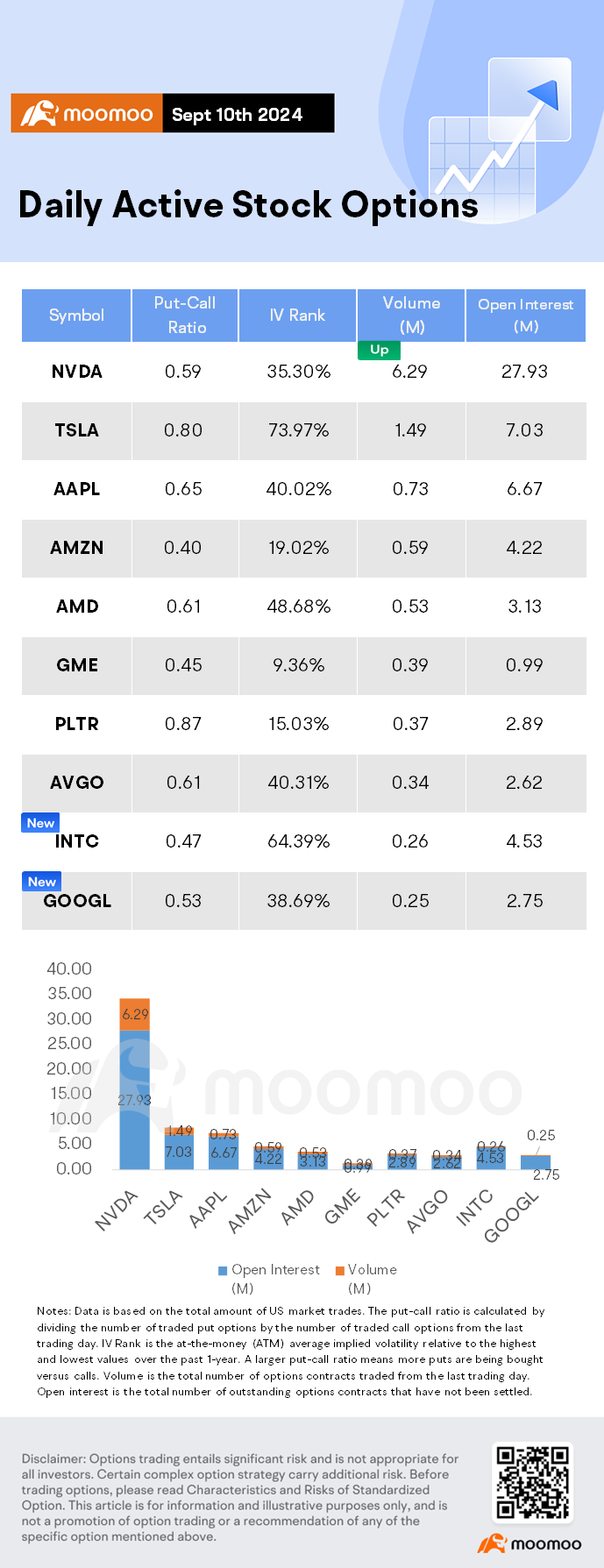

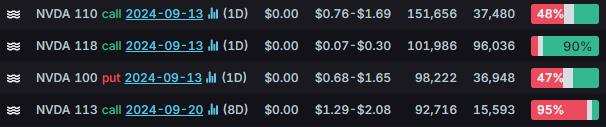

$NVIDIA (NVDA.US)$ shares surged 8.15% Wednesday to close at $116.91, with option volume of 6.29 million, and calls accounted for 63% of the volume. The $110 calls expiring September 13 lead the flow with the highest volume.

Nvidia shares jumped 8% on Wednesday after CEO Jensen Huang announced "incredible" demand for the company's AI-supporting products, claiming "everything is sold out." Speaking at Goldman Sachs' Communacopia + Technology Conference, Huang noted that Nvidia collaborates with every major AI company globally. He highlighted the strong return on investment for cloud providers using Nvidia's infrastructure, stating that each dollar spent translates to $5 in rentals. Major cloud providers like Microsoft and Amazon plan to increase their AI infrastructure spending.

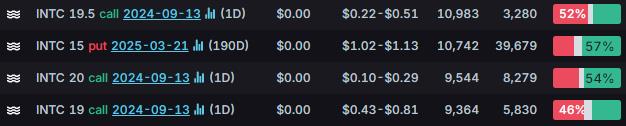

$Intel (INTC.US)$ shares climbed 3.48% Wednesday to close at $155.89, with option volume of 0.26 million, and calls accounted for 68.1% of the volume. The $19.5 calls expiring September 13 lead the flow with the highest volume.

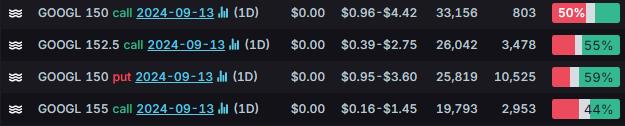

$Alphabet-A (GOOGL.US)$ shares rose 1.68% Wednesday to close at $151.16, with option volume of 0.25 million, and calls accounted for 65.4% of the volume. The $150 calls expiring September 13 lead the flow with the highest volume.

Unusual Stock Options Activity

There was a noteworthy activity in $ZipRecruiter (ZIP.US)$, where $12.5 calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 193.2x with 35,937 contracts.

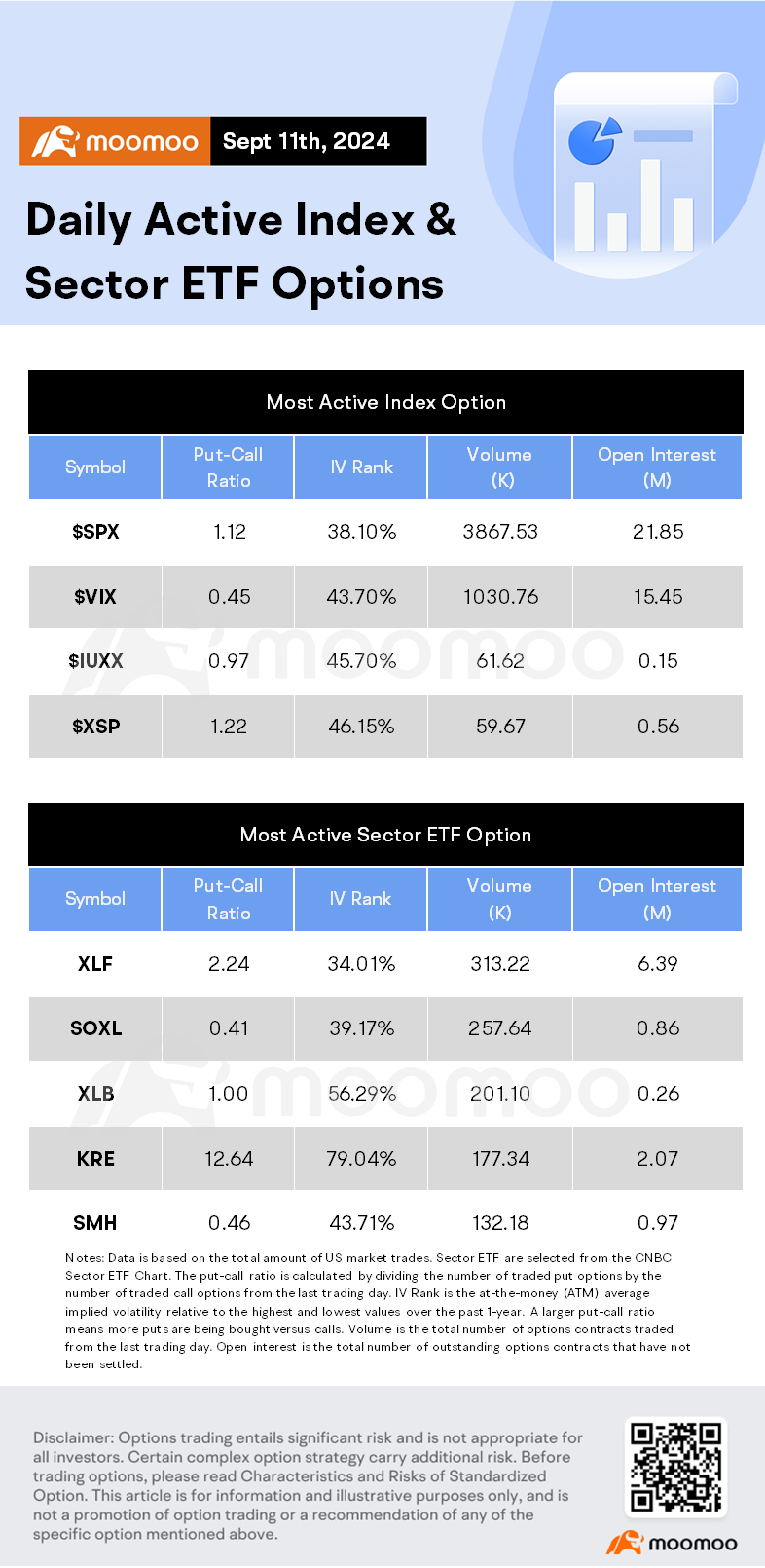

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

AdrianZIZZOGomez : $Bitcoin (BTC.CC)$

Chak : When the fuck did he announce there was no news I was checking CNBC the whole day which website published this news? why you did not publish this whenever during market hours?

74423696 : I love it , it’s amazing wow

Cypher09 : He said exact same thing during earnings call - clear proof of how the market is manipulated by big money.

Learning by Doing Chak : as usual bro

for tomorrow market rush

Derpy Trades : Come to find out later that "everything is sold out" because they realized there was decreasing demand and stopped making as many chips and are just spinning the story.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

72235832 Chak : There is on Yahoo Finance.

Chak : You can buy the stock in the extended market if you think it’s going to rally tomorrow a little bit

tinybird :

Cypher09 : Typical sell the news scenario, inveigle and execute.

View more comments...