Options Market Statistics: Nvidia Faces Two DOJ Antitrust Probes, Options Pop

News Highlights

$NVIDIA (NVDA.US)$ stock dropped 1.78%. Its options trading volume was 7.64 million. Call contracts account for 56.7% of the total trading volume. The $105 puts expiring August 2 were traded most actively.

Nvidia is reportedly facing two separate DOJ antitrust investigations. One probe is related to the company's acquisition of Israeli startup Run:ai, which specializes in GPU visualization. The other is investigating whether Nvidia pressured customers not to buy its rivals' products. The DOJ has reportedly reached out to several of Nvidia's competitors, including Advanced Micro Devices, to gather information about the complaints. Nvidia denies any illegal activity and insists that it competes fairly and transparently. The company has stated that it will provide any information regulators need.

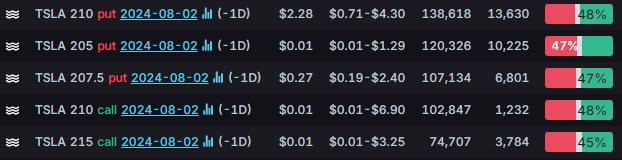

$Tesla (TSLA.US)$ stock declined 4.24%. Its options trading volume was 7.64 million. Call contracts account for 49.3% of the total trading volume. The $210 puts expiring August 2 were traded most actively.

A Delaware judge expressed skepticism about a vote by Tesla shareholders that could potentially reinstate Elon Musk's $56 billion pay package. Earlier this year, the judge invalidated the package, stating that Tesla's board had breached its legal duty in approving it. Tesla and its board of directors argued that a shareholder vote in June to reapprove the package should give grounds to reverse the decision. However, the judge questioned whether a shareholder vote could override her findings and suggested that Tesla should consider crafting a new pay scheme instead. The judge will rule on the matter later.

$Apple (AAPL.US)$ stock climbed 0.69%. Its options trading volume was 2.15 million. Call contracts account for 49.1% of the total trading volume. The $220 puts expiring August 2 were traded most actively.

Apple's stock finished flat following its third quarter earnings report, despite a decline in iPhone sales. The company reported a year-over-year decrease in iPhone sales, particularly in China, where revenue fell short of expectations. However, the overall revenue and earnings per share exceeded analyst estimates. Additionally, Apple's services revenue, iPad sales, and Mac revenue showed positive performance.

The company is also preparing to launch its Apple Intelligence software, powered by generative AI technology, later this year, which has garnered mixed expectations from analysts regarding its potential impact on iPhone sales. The software will only be compatible with iPhone 15 Pro and newer models, which could drive upgrades to new devices.

Unusual Stock Options Activity

There was a noteworthy activity in $TeraWulf (WULF.US)$, where multiple calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 30.6x with 4,103 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Catherine See : Hello

Catherine See : I have moomoo at telegram they also say they from moomoo management

Scott Gaius : hi

Space Dust : about a month ago, I mentioned this happening and someone ridiculed me. DOJ, behind the scenes, are all up in Nvidia for multiple things that " just don't look right".

Space Dust Space Dust : I will say, there is a slight stench of ENRON wafting about the markets. somewhere

tiaaaammmo Catherine See : y need to check with moomoo cs becarefully

Space Dust : .. one day the word coreweave will come up.

Kenneth Chee :

RVLTN : Well our politicians don’t even hide their insider trading and the drunk, Pelosi, just purchased a large amount of NVDA. I’d say weee in the clear

Options Newsman OP Catherine See : Please beware moomoo would not contact you this way.

View more comments...