Options Market Statistics: Nvidia to Report Q3 Earnings Wednesday as AI Fever Continues to Power Wall Street, Options Pop

News Highlights

1. $NVIDIA (NVDA.US)$ will report its Q3 earnings after the bell next Wednesday, giving Wall Street its best and latest look into the strength of the AI trade.

The world’s largest publicly traded company by market cap, Nvidia’s stock price has continued to rocket higher throughout 2024, thanks to the explosive growth in AI across the tech landscape and beyond. Shares of Nvidia were up 189% year to date as of Friday, easily outpacing any of the company’s chip rivals. $Advanced Micro Devices (AMD.US)$, Nvidia’s closest competitor, has seen its stock price sink nearly 8% year to date, while $Intel (INTC.US)$ , which is contending with a difficult turnaround, has seen its stock plunge 51%.

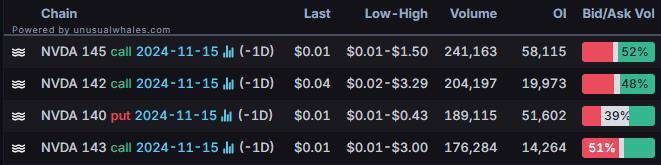

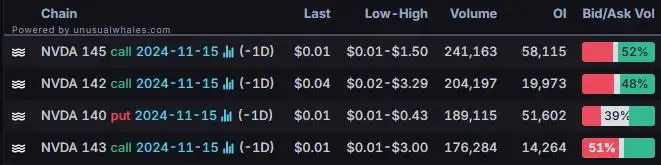

The options market was notably active, with a volume of 5.45 million contracts, where calls constituted 60.1% of the activity. The most traded calls are contracts of $145 strike price that expire on November 15. The total volume reaches 241,163 with an open interest of 58,115.

2. $Super Micro Computer (SMCI.US)$ faces a Monday deadline for filing a plan with Nasdaq to regain compliance with its financial reporting requirements or get delisted from the exchange. SMCI stock wavered on Friday.

Meanwhile, many Wall Street analysts believe SMCI stock is simply too radioactive to touch right now.

"We believe it is difficult to have a strong stance on SMCI until either: 1) downside risk is minimized with either the company approaching prior valuation lows matching 2018 or worst-case scenarios play out minimizing future downside risk, or 2) more details are available including a path to SMCI resolving its current issues," Wedbush Securities analyst Matt Bryson said in a client note Friday. He has a neutral rating on SMCI stock.

The trading session was marked by substantial options activity, with a volume of 1 million contracts, of which 44.5% were calls. The most actively traded options were the $18.5 calls set to expire on November 15.

Unusual Stock Options Activity

There was a noteworthy activity in $Amcor (AMCR.US)$, with $10.00 calls topping the highest volume to open interest ranking. The highest volume over open interest ratio reaches 101.5x with 10,560 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg, MarketWatch

Bloomberg Option Volume: [Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Chak : Pathetic AMD sucks

105596775 : wow

CCathay : Thank you for sharing.

bmehaffy : nice moves!