Options Market Statistics: Tesla Is New Pick for Daniel Loeb's Third Point; Options Pop

News Highlights

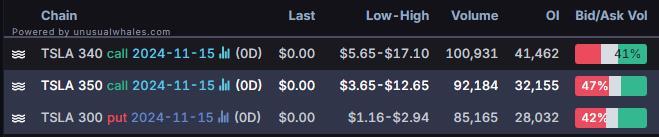

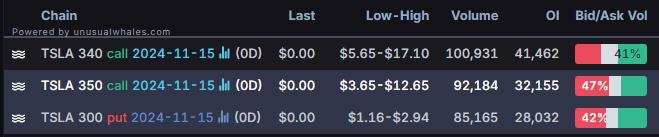

1. $Tesla (TSLA.US)$ stock fell 5% on Thursday. The most traded calls are contracts of $340 strike price that expire on Nov. 15. The total volume reaches 100,931 with an open interest of 41,462, while the most traded puts are contracts of $300 strike price that expire on Nov. 15. The total volume reaches 85,165 with an open interest of 28,032.

Third Point, a hedge fund, filed its Form 13F on Thursday, revealing the fund's trades from the prior quarter. Here's a look at Third Point's most significant recent trades.

2. $Boeing (BA.US)$'s shares were down 1%, with the most traded puts are contracts of $145 strike price that expire on Nov. 15. The total volume reaches 5,598 with an open interest of 20,828.

Boeing is starting to show progress in its turnaround plans. New CEO Kelly Ortberg has a list of things he wants to accomplish to turn around the struggling company. Struggling might understate things. Entering Thursday trading, Boeing stock was down almost 70% from its all-time closing high reached in early 2019 shortly before the second deadly 737 MAX crash. The incident led to the worldwide grounding of all MAX jets between March 2019 and November 2022.

Unusual Stock Options Activity

There was a noteworthy activity in $Newell Brands (NWL.US)$, with $11 calls topping the highest volume to open interest ranking. The highest volume over open interest ratio reaches 61.4x with 10,071 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg, MarketWatch

BloombergOption Volume: [Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Space Dust : hi O.N., on the Daniel Loeb reference, would you be able to " say that in another way" ? what exactly do you take away from that?

Hills : just missed this trends

71570786米兰 : What will happen?