Options Market Statistics: SoundHound AI Soars on Wedbush's Strong 2025 Growth Forecast; Options Pop

News Highlights

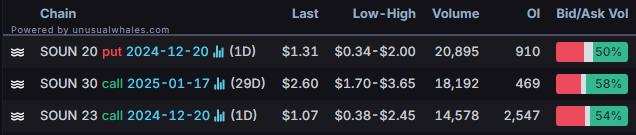

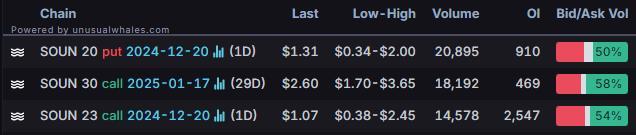

1. $SoundHound AI (SOUN.US)$ closed up 7% with the most traded calls are contracts of $30 strike price that expire on Jan 17, 2025. The total volume reaching 18,192 with the open interest of 469, while the most traded puts are contracts of $20 strike price that expire on Dec 20.

Turning to Quantum Computing, the stock has been on an upward tear since yesterday when the company announced that it had received a contract from NASA. Under the deal, the space agency will utilize the firm's s entropy quantum optimization machine to facilitate its advanced imaging and data processing activities.

SOUN stock has been soaring since Monday, when Wedbush Securities analyst Dan Ives hiked his price target on the shares to $22 from $10 while keeping an outperform rating on the name.

Calling SOUN "an underappreciated pure play AI company," Ives predicted that the company's total addressable market and growth would both increase in 2025. Specifically, the analyst wrote that the company, whose customers include Chip0tle (CMG) and Panda Express, would move into the e-commerce sector nest year.

Unusual Stock Options Activity

There was a noteworthy activity in $Vale SA (VALE.US)$, with $5 puts topping the highest volume to open interest ranking. The highest volume over open interest ratio reaches 140.7x with 18,015 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg, MarketWatch

BloombergOption Volume: [Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment