Options Traders Brace for Wild Stock-Market Swing Ahead of Momentous Fed Rate Decision

As the Federal Reserve approaches a pivotal moment, transitioning from an extended cycle of interest rate hikes to potential rate cuts, market participants are on edge. The central bank's decision, set to be announced on Wednesday, has sparked considerable debate among traders and analysts, with conflicts over the magnitude of the rate cut—whether it will be a 50 basis-point reduction or a more modest 25 basis points—fueling heightened uncertainty and potential market turbulence, something that day traders are please to brace for.

Conflicting Expectations Add to Market Uncertainty

The debate over the size of the anticipated rate cut is particularly intense. Market volatility stands at an extreme level—the highest since the Federal Reserve's March 2023 meeting, which followed the collapse of Silicon Valley Bank.

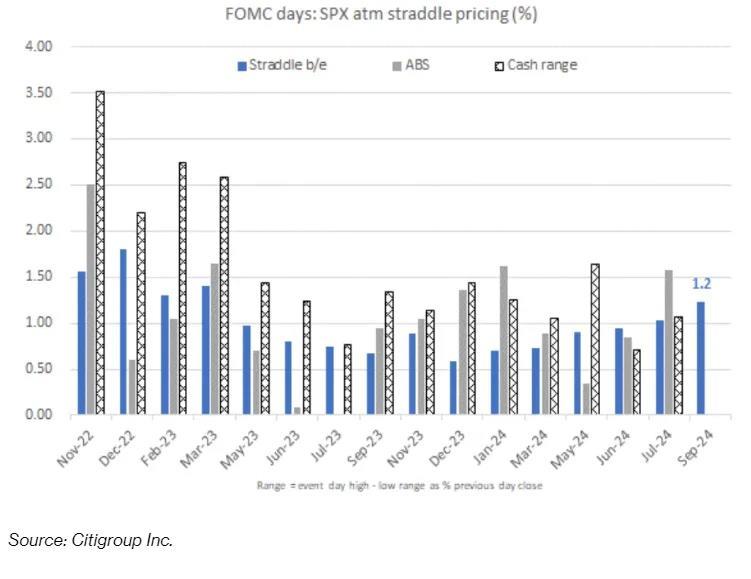

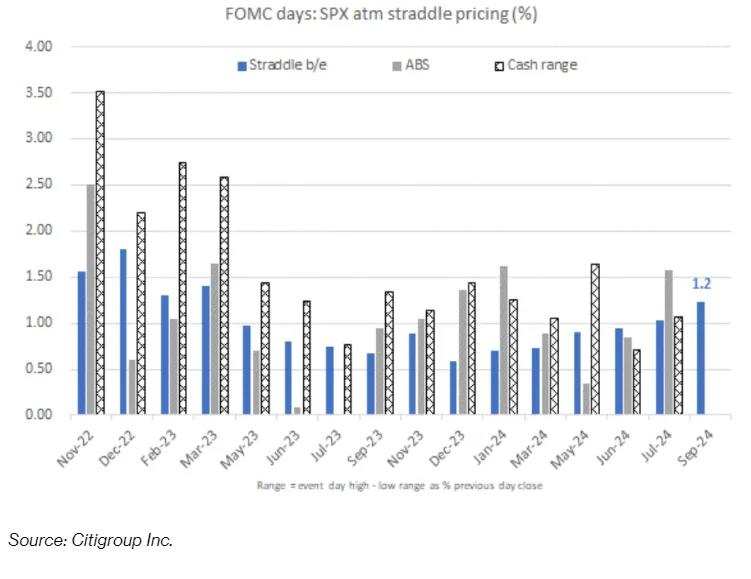

This sentiment has been noted by Citi strategists, who highlighted that an at-the-money straddle strategy on the $S&P 500 Index (.SPX.US)$ would require a swing of 1.2% in either direction to be profitable on Wednesday, reflecting the heightened anticipation of volatility. A straddle involves buying both a call option and a put option at the same strike price and expiration date, allowing traders to profit from significant price movements in either direction.

The market's indecision is evident, with interest-rate futures seesawing as traders grapple with the likelihood of either a 50-basis-point or a 25-basis-point cut. As of Wednesday morning, data from the CME Group indicated a 63% chance of a 50-basis-point cut, although the situation remains fluid.

Traders are acutely aware of the risks associated with the Fed's decision. A 50-basis-point cut is seen as an indication of rising concerns about economic weakness, while a 25-basis-point reduction may disappoint markets given recent movements in fed futures.

As Citi strategists noted in a report, "A 50-bps cut likely indicates rising expectations for a weaker economy, while 25 bps may be negatively received by the market."

Option Traders Place Protective Bets

Ahead of the decision, option traders have been actively placing protective bets to hedge against potential market swings, even though the S&P 500 index has just reached a new historical high. The market has also rebounded quickly from the selloff on August 5, which marked its biggest daily drop since 2022. This uncertainty has significantly boosted demand for hedges, as indicated by the elevated put-call skew.

For options expiring Wednesday, open interest is largely concentrated at the 5730, 5635, and 5625 calls, as well as the 5550 and 5545 puts, with the current price of the S&P 500 index standing at 5710. These levels of concentrated open interest can act as significant support and resistance points for the index.

The high open interest at the 5730 calls suggests a potential resistance level, where traders might face selling pressure as the index approaches this level. Conversely, the significant open interest at the 5550 and 5545 puts indicates possible support levels, where buying interest might emerge if the index declines to these points.

However, upward momentum could be capped in the immediate term unless significant buying pressure breaks through this resistance. On the downside, the support levels at 5550 and 5545 provide a buffer against steep declines. But a rapid market selloff from a disappointed rate decision results can easily break it as well.

Beyond Wednesday: Continued Market Apprehension

The anxiety surrounding the Federal Reserve's decision extends beyond Wednesday. Demand for insurance against a steep market selloff has remained robust, even as stocks have rebounded from recent bouts of turbulence.

Despite the heightened demand for downside protection, other indicators of near-term anxiety appear more subdued. For instance, the Cboe Volatility Index, commonly known as the VIX or Wall Street's "fear gauge," stood at 17 on Monday, below its long-term average. However, the $VVIX Index (.VVIX.US)$, which measures demand for hedges tied to the $CBOE Volatility S&P 500 Index (.VIX.US)$, remains elevated, indicating that demand for crash protection has not waned.

However, Amy Wu Silverman, managing director and head of derivatives strategy at RBC, notes that the VVIX index, which gauges demand for hedges linked to the VIX, has remained above 100, indicating that the need for crash protection has remained "sticky."

In anticipation of the Federal Reserve's rate decision and amid concerns over an economic slowdown, traders have been bolstering their positions in defensive stocks such as utilities, consumer staples, and real estate. According to data compiled by Deutsche Bank AG, these sectors have seen positions increase to above-average levels following the global market selloff in early August. Conversely, exposure to technology stocks has significantly decreased from record levels in July and now sits just above average.

"Investors are becoming more defensive as we head into the seasonally weak months of September and October, reducing risk exposure ahead of the U.S. elections," said Chris Murphy, co-head of derivatives strategy at Susquehanna International Group. "However, if the AI frenzy resurfaces, investors might be forced back into tech stocks even before the elections, as we typically see the stock market strengthen towards the year-end."

Ultimately, the market's reaction will depend heavily on Federal Reserve Chair Jerome Powell's comments and the latest batch of economic projections released by the Fed. As traders navigate these conflicting signals, the markets remain on high alert, bracing for the impact of the Federal Reserve’s decision and its subsequent ripple effects across various asset classes.

Source: Bloomberg, Market Watch

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Akboy907 : yeah what he said!

73279472 : i

KC67 Chan : Strike it rich if you get it right , today is the day

74423696 : Thank you , thank you so much my God. .

104166257 :

bright Turtle_9281 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)