STOCKS DROPPING⁉️ DO THIS…

$NVIDIA (NVDA.US)$ (or any SOLID LONG TERM BIG BOY BLUE CHIP stock 🤷🏽♂️)

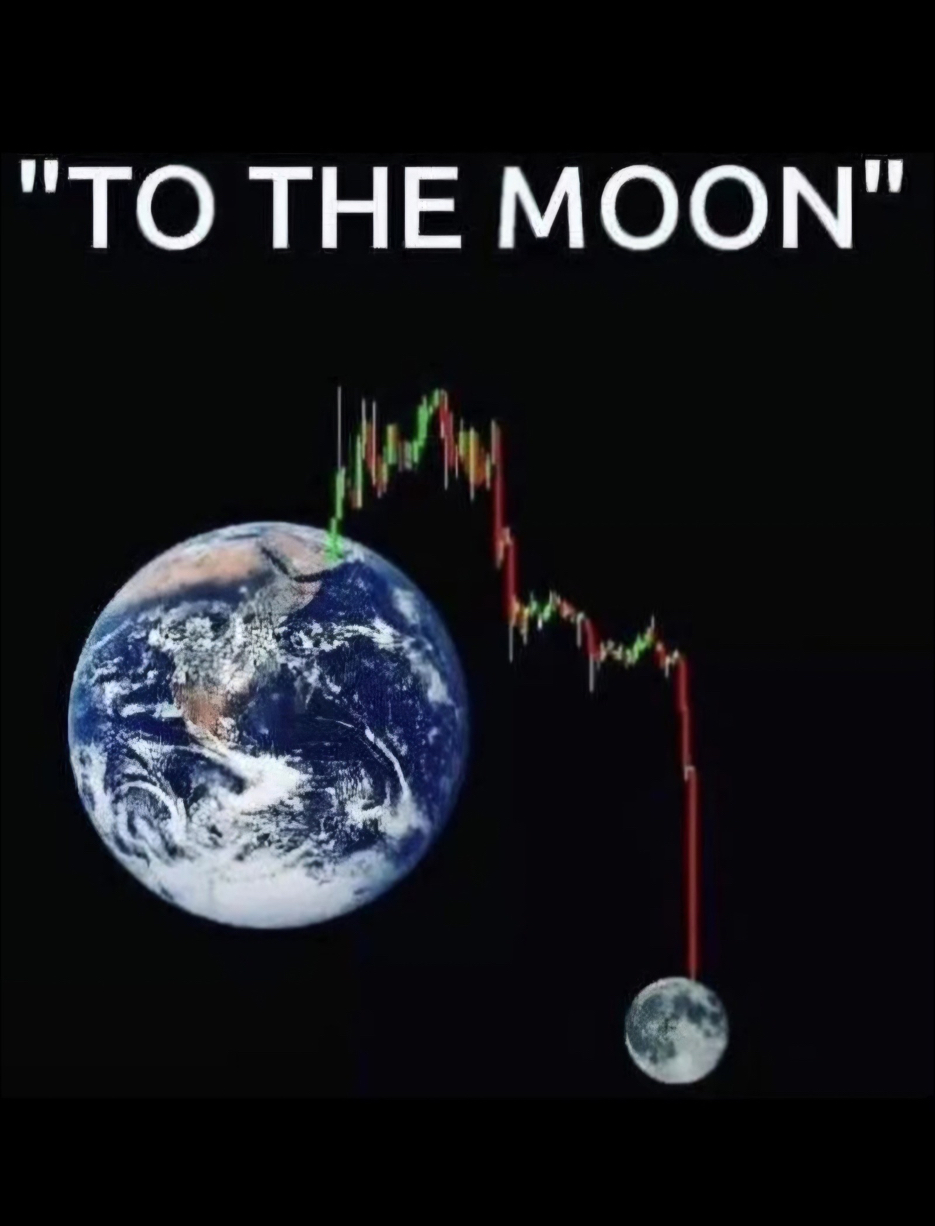

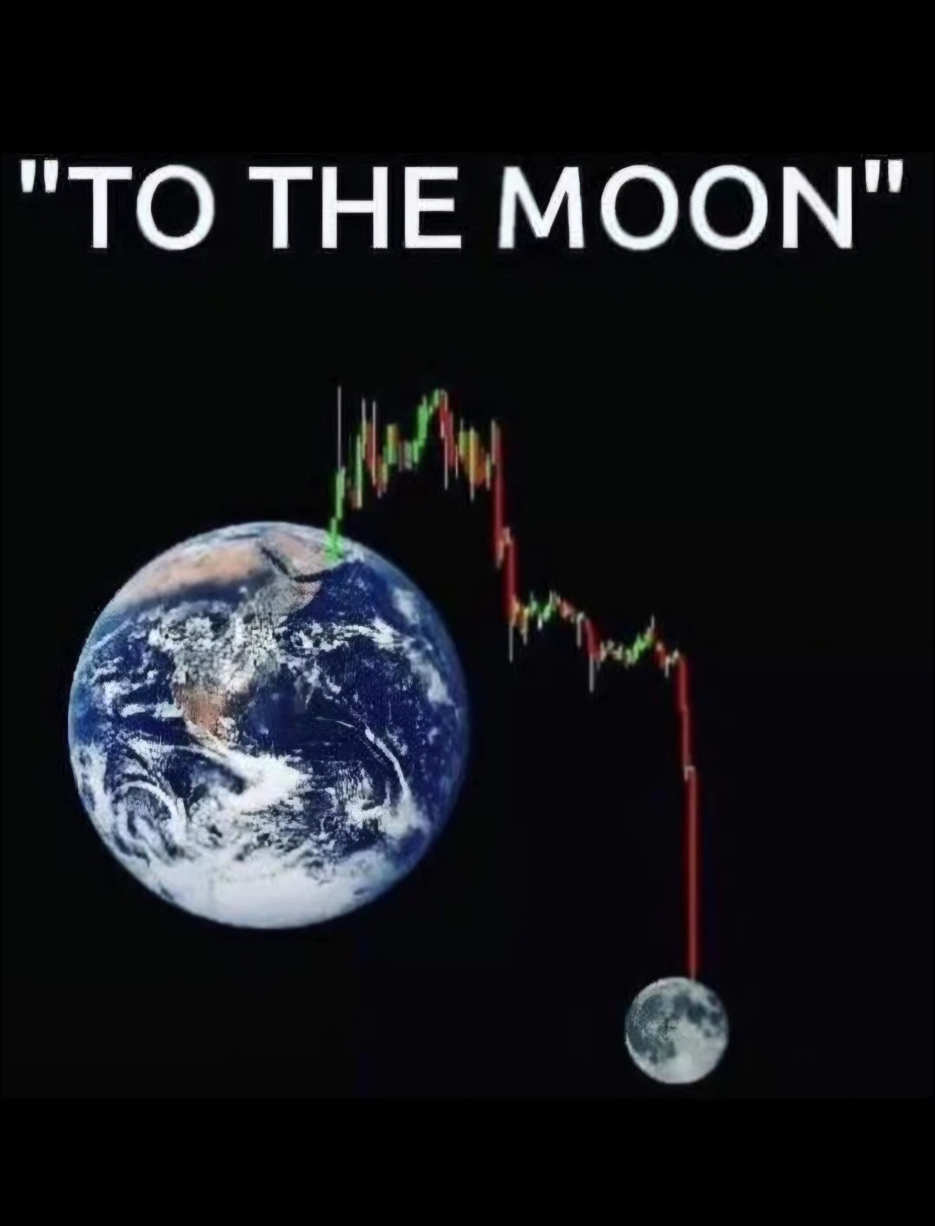

• If your assets do what’s in picture 1…

Either Buy The Dip & Be Patient

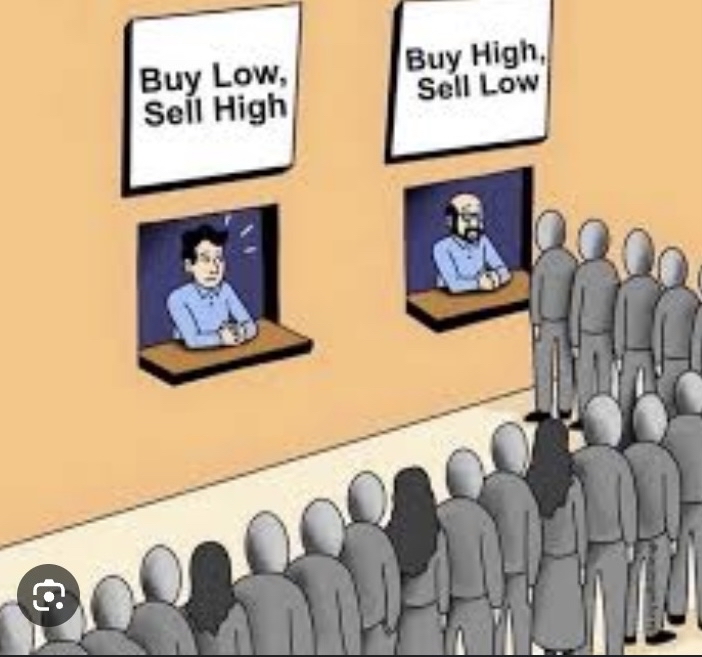

• Please don’t do picture 2

• If your assets do what’s in picture 1…

Either Buy The Dip & Be Patient

• Please don’t do picture 2

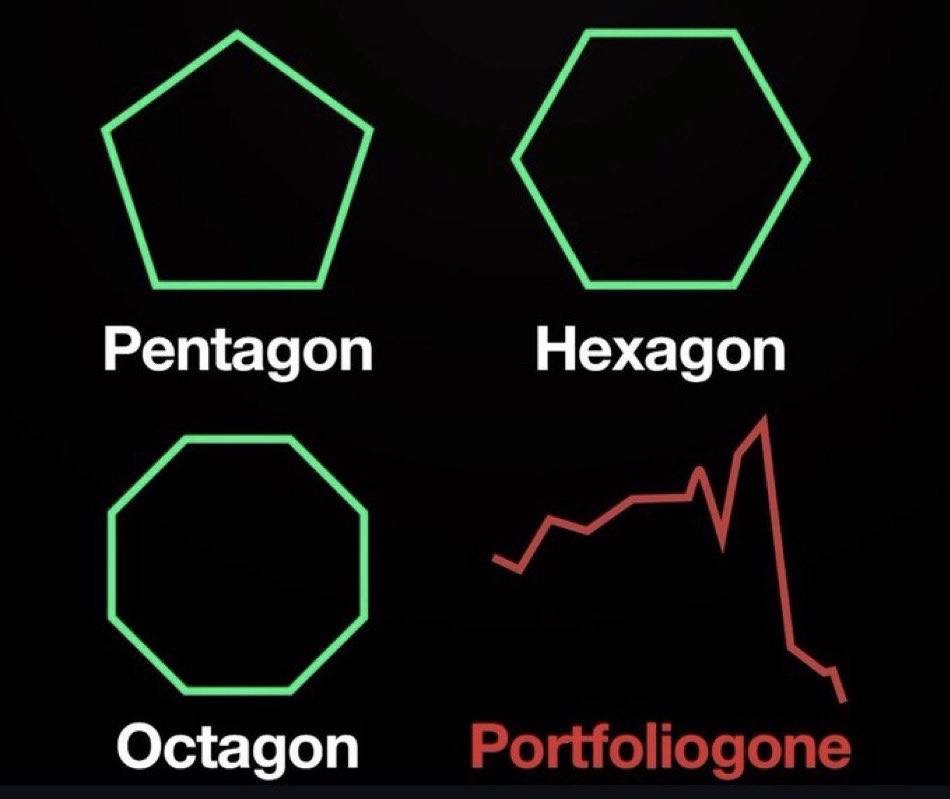

• IF you don’t listen 👂🏽 you’ll have a picture 3

Stuff People don’t wanna hear but it’s True and Important:

• The Market Ebbs and Flows… like the Ocean 🌊 so be like water 💦 my friend

There’s Cycles and Manipulation so it goes Up and Down like a roller coaster 🎢

• Don't let the Wins go to your Head 🧠

Don't let the "losses" go to your Heart ♥️

• The Key 🔑 is

We win 🏅 short term when there’s red because everything’s on discount (we scoop up Solid long term ETFs and stocks for the low)

And

We win 🏅 long term because in 5-10 years when our assets appreciate we can collect on our wealth and enjoy life.

• Get Taught Up so you don't get Caught Up...

• Don’t let ANYBODY tell you accumulating wealth is easy

If it's easy it's sleezy

It’s simple in theory but definitely ain’t easy in practice 💯

• Stop focusing on a quick buck. Hold, and go long.

Collect Assets at a Discount. DCA either way. Be patient.

• IF you’re new, conservative and or emotional

Consider Buying 80% or more a year ETFs like SPLG and FTEC etc

Don’t overly focus on NVDA or individual stocks

Consider Buying ETFs and stocks that do 7-10% a year or more

Do not get caught up in the hype or anything volatile even if you hear 👂🏽 people talking about it

• When it comes to Stocks, ETFs, Real Estate, Businesses, Precious Metals…

or any asset class in your Wealth Wisdom & Asset Accumulation journey:

Stick to your strategy

Adjust when necessary

Rinse and Repeat 🔂

Energy FLOWS where Energy GOES…

👉🏽 So 👈🏽

…Be INFORMED but not INUNDATED.

• When we understand the cycles ☝🏽 we can enjoy the journey more

We can buy the dips and unplug (or do nothing) when there’s downtrends, dark pool market manipulations, sell offs etc

• We can also enjoy the upswings without getting caught up in FOMO and succumbing to the pressure of buying stuff at All Time Highs

• Gotta enjoy yourself otherwise the market is more stressful than a job 🤣

Mindset produces Assets:

Enjoy the journey smile 😃 laugh 😂 this is as much about us Becoming Better as it is about Asset Accumulation.

• Propaganda is linked with Dark Pools and Market Manipulation

Remember that.

• They don’t want you to win 🏆 so they control you with fear 😱 and make you think it’s logic 🧠

IF you let them 😏

Remember that 💯

• Look into Capital Gains Taxes, long term vs short term wherever you’re located

When you sell for a profit there are often larger gains taxes which is good to be aware of so you’re not shocked 😳

• Do you understand what taxing unrealized capital gains means?

You can’t tax anything that’s not liquid.

Wealthy 1 5 10%-ers park millions in certain assets so they won’t be taxed on em 😏

• SUCCESS LEAVES CLUES - WE STANDIN ON BUSINESS:

BIG BOY BLUE CHIP (NO CAP) MEGACAP HYPER-SCALERS with an AMAZING UNDENIABLE HISTORICAL TRACK RECORD

• RESULTS > Opinions, BUSINESS PERFORMANCE > Market Manipulation, HISTORICAL DATA > Chatter

#CoachDonnie

• Q: Coach Donnie, are there any Guarantees with Stocks ETFs or the market overall?

• A: Yes. Nothing is guaranteed.

For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes mentioned

Remember the following:

🚨 DISCLAIMER 🚨

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

• The Market Ebbs and Flows… like the Ocean 🌊 so be like water 💦 my friend

There’s Cycles and Manipulation so it goes Up and Down like a roller coaster 🎢

• Don't let the Wins go to your Head 🧠

Don't let the "losses" go to your Heart ♥️

• The Key 🔑 is

We win 🏅 short term when there’s red because everything’s on discount (we scoop up Solid long term ETFs and stocks for the low)

And

We win 🏅 long term because in 5-10 years when our assets appreciate we can collect on our wealth and enjoy life.

• Get Taught Up so you don't get Caught Up...

• Don’t let ANYBODY tell you accumulating wealth is easy

If it's easy it's sleezy

It’s simple in theory but definitely ain’t easy in practice 💯

• Stop focusing on a quick buck. Hold, and go long.

Collect Assets at a Discount. DCA either way. Be patient.

• IF you’re new, conservative and or emotional

Consider Buying 80% or more a year ETFs like SPLG and FTEC etc

Don’t overly focus on NVDA or individual stocks

Consider Buying ETFs and stocks that do 7-10% a year or more

Do not get caught up in the hype or anything volatile even if you hear 👂🏽 people talking about it

• When it comes to Stocks, ETFs, Real Estate, Businesses, Precious Metals…

or any asset class in your Wealth Wisdom & Asset Accumulation journey:

Stick to your strategy

Adjust when necessary

Rinse and Repeat 🔂

Energy FLOWS where Energy GOES…

👉🏽 So 👈🏽

…Be INFORMED but not INUNDATED.

• When we understand the cycles ☝🏽 we can enjoy the journey more

We can buy the dips and unplug (or do nothing) when there’s downtrends, dark pool market manipulations, sell offs etc

• We can also enjoy the upswings without getting caught up in FOMO and succumbing to the pressure of buying stuff at All Time Highs

• Gotta enjoy yourself otherwise the market is more stressful than a job 🤣

Mindset produces Assets:

Enjoy the journey smile 😃 laugh 😂 this is as much about us Becoming Better as it is about Asset Accumulation.

• Propaganda is linked with Dark Pools and Market Manipulation

Remember that.

• They don’t want you to win 🏆 so they control you with fear 😱 and make you think it’s logic 🧠

IF you let them 😏

Remember that 💯

• Look into Capital Gains Taxes, long term vs short term wherever you’re located

When you sell for a profit there are often larger gains taxes which is good to be aware of so you’re not shocked 😳

• Do you understand what taxing unrealized capital gains means?

You can’t tax anything that’s not liquid.

Wealthy 1 5 10%-ers park millions in certain assets so they won’t be taxed on em 😏

• SUCCESS LEAVES CLUES - WE STANDIN ON BUSINESS:

BIG BOY BLUE CHIP (NO CAP) MEGACAP HYPER-SCALERS with an AMAZING UNDENIABLE HISTORICAL TRACK RECORD

• RESULTS > Opinions, BUSINESS PERFORMANCE > Market Manipulation, HISTORICAL DATA > Chatter

#CoachDonnie

• Q: Coach Donnie, are there any Guarantees with Stocks ETFs or the market overall?

• A: Yes. Nothing is guaranteed.

For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes mentioned

Remember the following:

🚨 DISCLAIMER 🚨

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Gilley : I have bought low to low before and had my account destroyed because of it nadseq changed my order to a short to protect investors lol crazy right the protected the people who choose to sell and gave the person who bought in low a short position at that low and I didn't get the short shares till days later it was up so much by then my whole account went negative on the best position I ever got in I just remember it dropping from like 10 dollars 95 percent down what was also bs is if id have gotten a position 5 cents higher they wouldn't have changed my order felt like they did it on purpose knowing I was the only one in that low fraud at its fullest

Coach Donnie OP Gilley : Whoa

Coach Donnie OP Gilley : That’s wild Bro

Coach Donnie OP Gilley : I wouldn’t be surprised. The issue is they work together and we all work individually. Divide and conquer.

Coach Donnie OP : Have y’all seen Changing World Order by Ray Dalio recently?

Extremely important

Coach Donnie OP : We are Investors, not speculators. We are optimistic not pessimistic. Facts > Feelings Truth > Traditions

makes it easy to be misled and “lose your shirt” because they sell when it’s time to buy and vice versa.

makes it easy to be misled and “lose your shirt” because they sell when it’s time to buy and vice versa.

Persistence Perspective Prosperity) instead of the “Lottery Mentality”.

Persistence Perspective Prosperity) instead of the “Lottery Mentality”.

Once you have certain FORMULAS (understand how each Asset benefits you & how much they appreciate per year, etc), thought processes and understanding

You can make money off Assets whenever you want instead of guessing, chasing money & panic selling like many people do when they start investing.

There’s Investors, Traders, & Speculators

The 1st one has always earned the most (based on historical data),

The second one has earned the second highest…

Speculators are often emotional and have lost the most and continue to because their strategy is emotions vibes logic etc instead of practical wisdom and principles.

Speculators freak out when there’s fear in the market and or in their portfolio, they freak out when there’s fluctuations and or corrections, they also freak out when there’s FOMO (fear of missing out).

This mentality

That’s why it’s Great to have the Farmer Mentality (Patience Prayer

Diversifying your portfolio, learning more about the financial market, choosing to be informed not inundated, learning how the news and historical data play a role in how money moves up and down, only putting in what you can afford to lose (while expecting to win), controlling your emotions, abundance mindset, positive expectancy, choosing Faith > fear, anticipation of gain > fleeing from pain. These things are very helpful tools.

Coach Donnie OP : Decide which type of Investor you’re going to be and you’ll have a better idea of which ones you’ll invest in. All have their + & their - but it’s definitely better to GIVE AND INVEST than to spend and try to save” whatever’s left over while making everyone else wealthy. Hint: Investors (Farmer Mentality) Change More Lives, Have More Fun and Make More Money

#CoachDonnie

Coach Donnie OP : $NVIDIA (NVDA.US)$

Nvidia earnings: What to expect from the market's AI darling

Nvidia overtakes Apple as world’s most valuable company