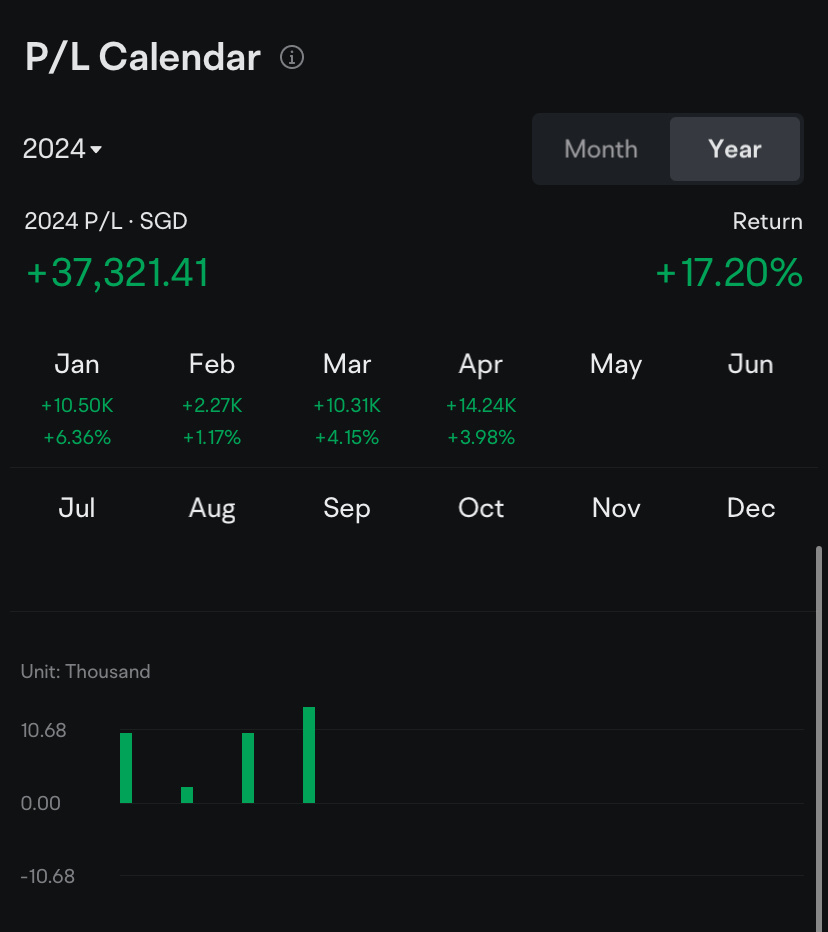

April was a dynamic and volatile month for my portfolio. My investment strategies yielded a profit of SGD 14,240 (USD 7,463), which is a 4.31% money-weighted monthly gain (3.98% simple-gain). The Quarterly earnings and interest rate uncertainty drove high implied volatility, presenting opportunities for premium gains from put selling. The market's reaction to Q1 earnings allowed me to capitalize on well-timed entries.

JkdTk : Can you fly off with me? Lost in the past few days

74396734 : keep going borther thats amazing

约翰の理财库 OP JkdTk : I do not coach or take any responsibility for others' investment. It's important to understand your own risk tolerance and the potential for losses with the companies you invest in. Decisions should be made with clear outcomes in mind (both positive and negative.) If you only expect positive outcomes, it's like gambling, which often leads to losses, especially if there's no backup plan and decisions are made in panic. I wish you resilience and the strength to come back strong in your investment journey!

约翰の理财库 OP 74396734 : Thank you![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

LP Sam : Great sharing

I Am 102927471 : Well one words to say. Congratulations

约翰の理财库 OP LP Sam :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Thank you

Thank you

约翰の理财库 OP I Am 102927471 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Thanks

Thanks

Need money 4 Porsche : How can I be as good as you, my portfolio sucks and I almost went bankrupt this month![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

I Am 102927471 约翰の理财库 OP : Welcome![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...