PDD Q4 Earnings Preview: Can Temu's Robust Growth Reverse the Declining Stock Price?

In 2023, $PDD Holdings (PDD.US)$'s shares soared by nearly 80% driven by strong domestic earnings and Temu's viral shopping sensation that extended to the U.S. and beyond. However, in 2024, PDD's stock price entered a downward trend, plunging by over 15% during the year. This decline was partly fueled by mounting regulatory concerns for Temu, which faced increased scrutiny in the U.S.

Given this situation, PDD is planning to release its latest financial report to the public before the stock market opens on March 20th. This report is expected to provide important insights into PDD's financial standing and future growth strategy amid the current challenges.

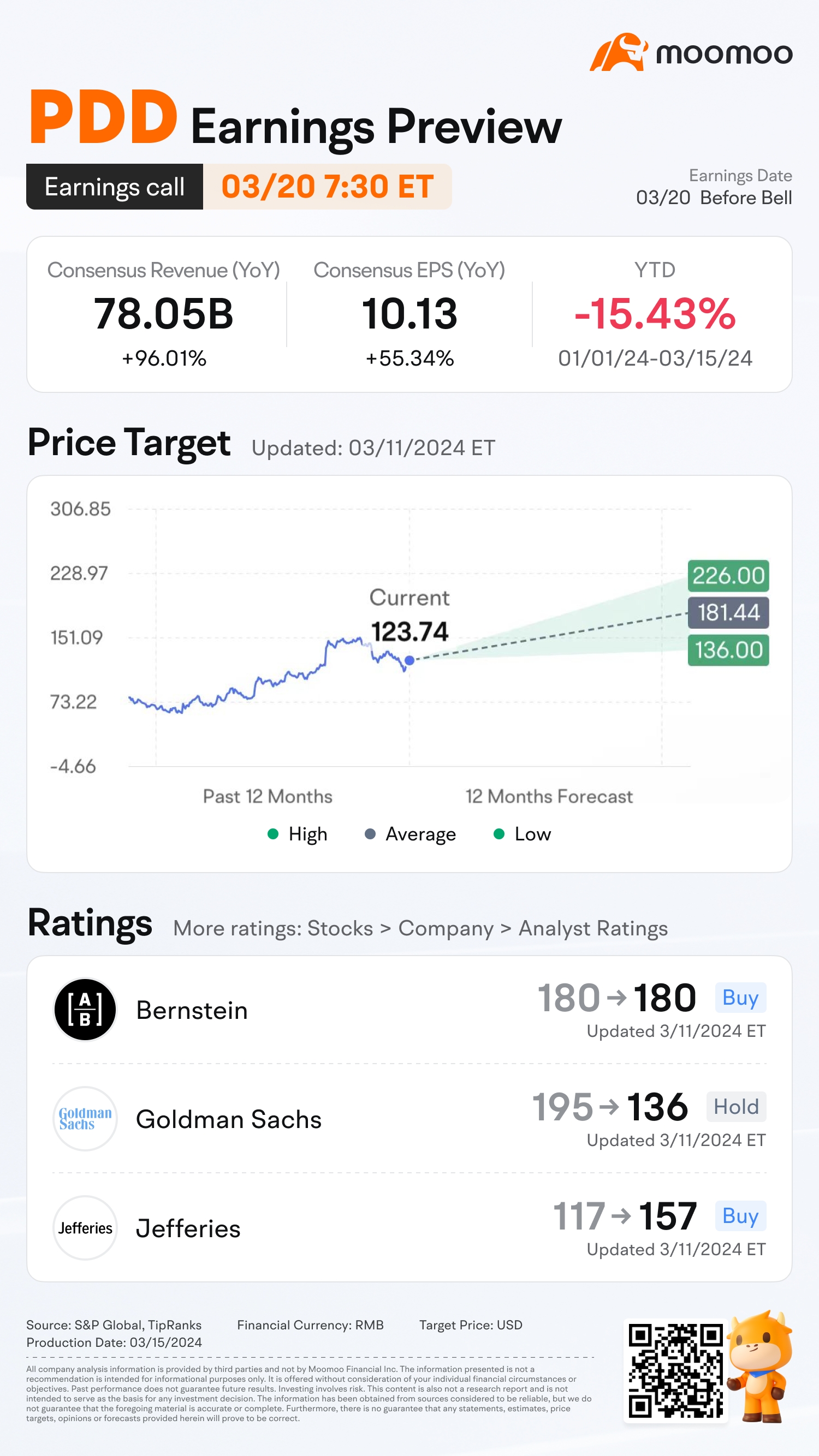

According to Moomoo, market expectations for the FY2023Q4 financial performance of the company are as follows:

●The company is projected to achieve a revenue of RMB78.05 billion, representing a year-over-year increase of 96.01%.

●Earnings per share are anticipated to be RMB10.13, an increase of 55.34% compared to the same quarter in the previous year.

●The average price target for PDD is $181.44, suggesting a potential increase of 46.63% from the stock price at the close of the previous week.

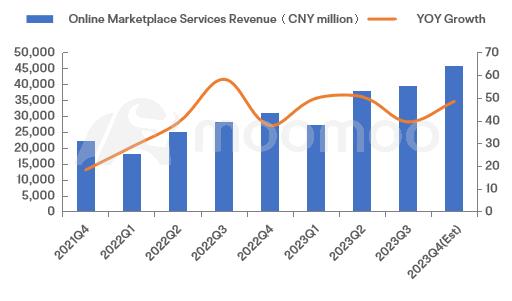

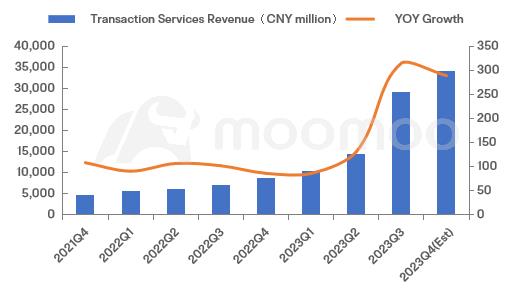

Continious Strong Business Growth

Specifically, PDD's online marketplace services revenue is expected to reach RMB46.03 billion in Q4, up 48.65% YoY, while transaction services revenue will reach RMB34.237 billion, up 289.21% YoY, according to Bloomberg forecasts. The significant growth is expected to be primarily driven by Temu's overseas expansion, as the company collects more service fees from a larger pool of merchants selling on its platform.

Additionally, Bloomberg believes that these gains, combined with lower unit costs resulting from economies of scale, are likely to offset some of the increase in Q4 marketing expenses.

The Myth of Temu's Overseas Expansion

Temu was the most downloaded app in the U.S. last year and has achieved good results overseas. As of the end of 2023, Temu's global app downloads reached 234 million, with 85 million downloads in the U.S. alone, accounting for 36%, according to Data.ai. As of January 2024, Temu has entered 49 countries and regions, covering Asia, Europe, North America, South America, Oceania, and South Africa.

According to HSBC estimates, Temu is expected to gain 3-6% market share in developed markets in the US, Europe and Asia. The institution predicted that Temu to achieve a global GMV of $16.5 billion in 2023, and the estimates suggest that after just one year of operation, it has gained 1% market share in the US.

Introducing Innovative Business Model

During its initial stages, Temu adopted a fully hosted model to ensure a high degree of control over the selection, pricing, and store operations of its listed products, achieving a positioning of ultimate cost-effectiveness for platform products. In this model, suppliers are responsible for producing and shipping products to domestic warehouses, while pricing, operations, logistics, and after-sales services are all handled by the platform.

Recently, Temu has launched a semi-hosted model, targeting sellers who possess overseas warehouses and local dispatch capabilities. The main difference of the semi-hosted model lies in the shipping location, whereby suppliers can choose to have their products shipped to overseas warehouses through warehousing and logistics service providers. This means that Temu can explore high-priced and large-scale products such as furniture, and further expand its product supply while still maintaining control over key aspects such as pricing.

Major Concerns

1. Risk of intensified competition: Pinduoduo, the domestic e-commerce platform of PDD, is experiencing increasingly fierce competition in China, particularly from $Alibaba (BABA.US)$'s Taobao. In response, Alibaba underwent leadership changes and articulated a clear strategic focus and priority selection for the entire group last year. Alibaba's 'Return to Taobao' initiative is a direct response to the competitive threat posed by Pinduoduo.

2. Policy risk: In February, two U.S. senators called on Biden to end duty-free treatment for e-commerce shipments valued at under $800. They said that current policy unfairly benefited foreign companies and e-commerce platforms such as Temu and Shein, and put U.S. companies at a competitive disadvantage.

Furthermore, last week, the U.S. House of Representatives overwhelmingly passed a bill that would require ByteDance, the Chinese owner of the short-video app TikTok, to divest its U.S. assets within six months or face a ban. Although TikTok has a certain inherent difference from social media and e-commerce platforms such as Temu, policy risks remain a significant risk factor in the U.S. election year.

Different Opinions Among Analysts

Morgan Stanley is optimistic about PDD and has raised their target price for this year from $170 to $180. Analysts believe that Pinduoduo's domestic market share continued to expand in the fourth quarter of last year, while Temu's overseas business also maintained strong growth momentum, potentially reaching around $9 billion in GMV. Concerns about the potential impact of tariff policies on Temu have already been reflected in the stock price performance.

Jefferies' analysts have elevated PDD's rating to 'buy' from 'hold' last week, increasing the price target from $117 to $157. The upgrade is based on their belief that geopolitical risk factors are already reflected in the price, and PDD's subsidiary, Temu, continues to expand its market share both domestically and internationally. Jefferies analysts wrote "we believe the recent Super Bowl event will drive consumer mindshare on Temu" and projected that Temu will continue to expand in other countries as well, raising its non-U.S. share of GMV to about 66% in the 2024 fiscal year.

But other analysts on Wall Street had a different perspective. In a note to clients, Goldman Sachs' analysts downgraded PDD from buy to neutral. The group of analysts, led by Ronald Keung, also lowered the price target for PDD shares from $196 to $136. Keung explained that Goldman is reevaluating its risk-reward analysis for PDD due to the swiftly changing policy landscape surrounding cross-border businesses and heightened competition in PDD's domestic market.

Source: Bloomberg, Investopedia, Investor's Business Daily

By Moomoo News Marina

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment