Pelosi's Broadcom LEAPS options Bet: How Small Investors Can Skillfully Mimic Her Moves!

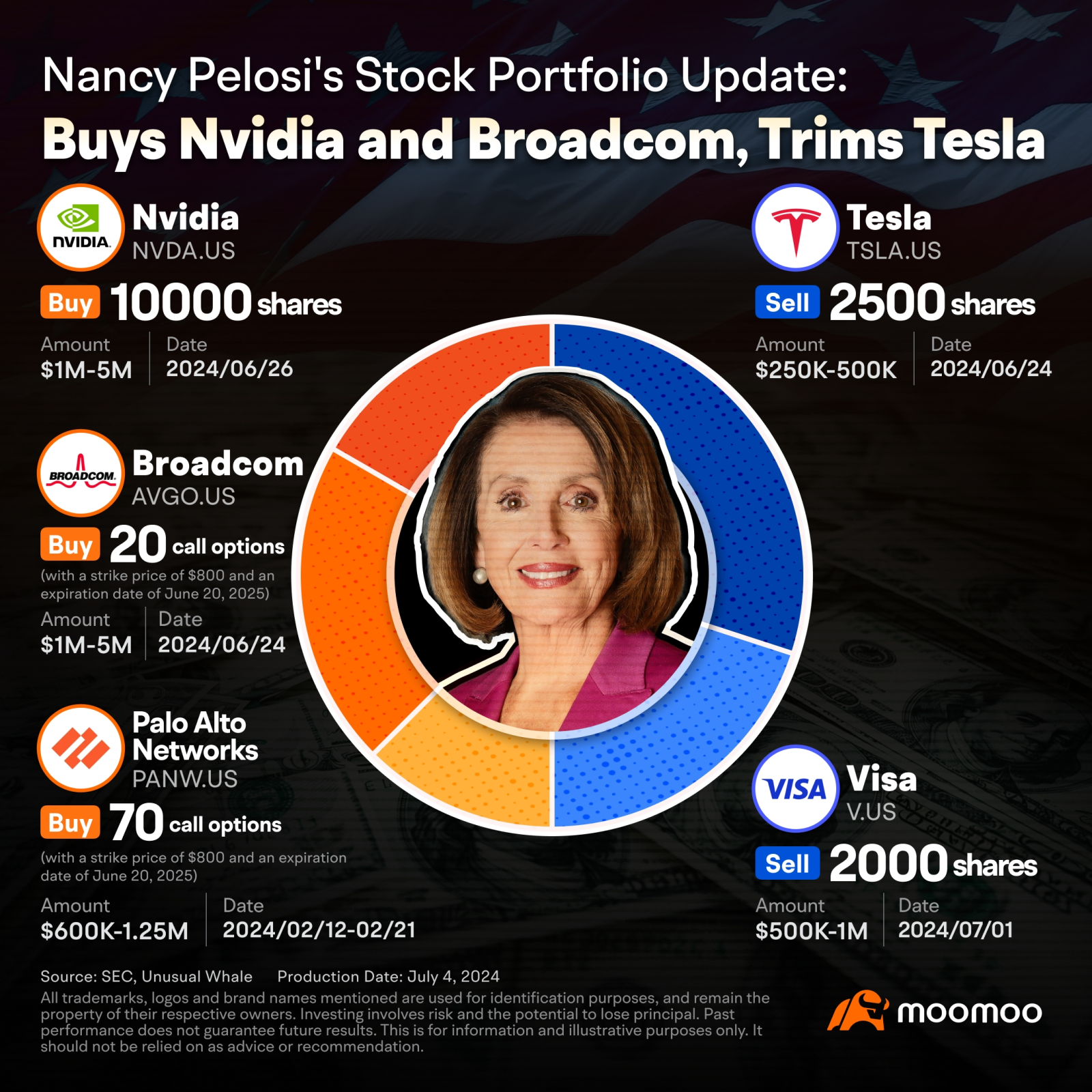

In a recent disclosure, US Representative Nancy Pelosi reported buying call options for $Broadcom (AVGO.US)$![]() .

.

These options, which are Long-term Equity Anticipation Securities (LEAPS), have a strike price of $800 and are set to expire in June 2025![]() .

.

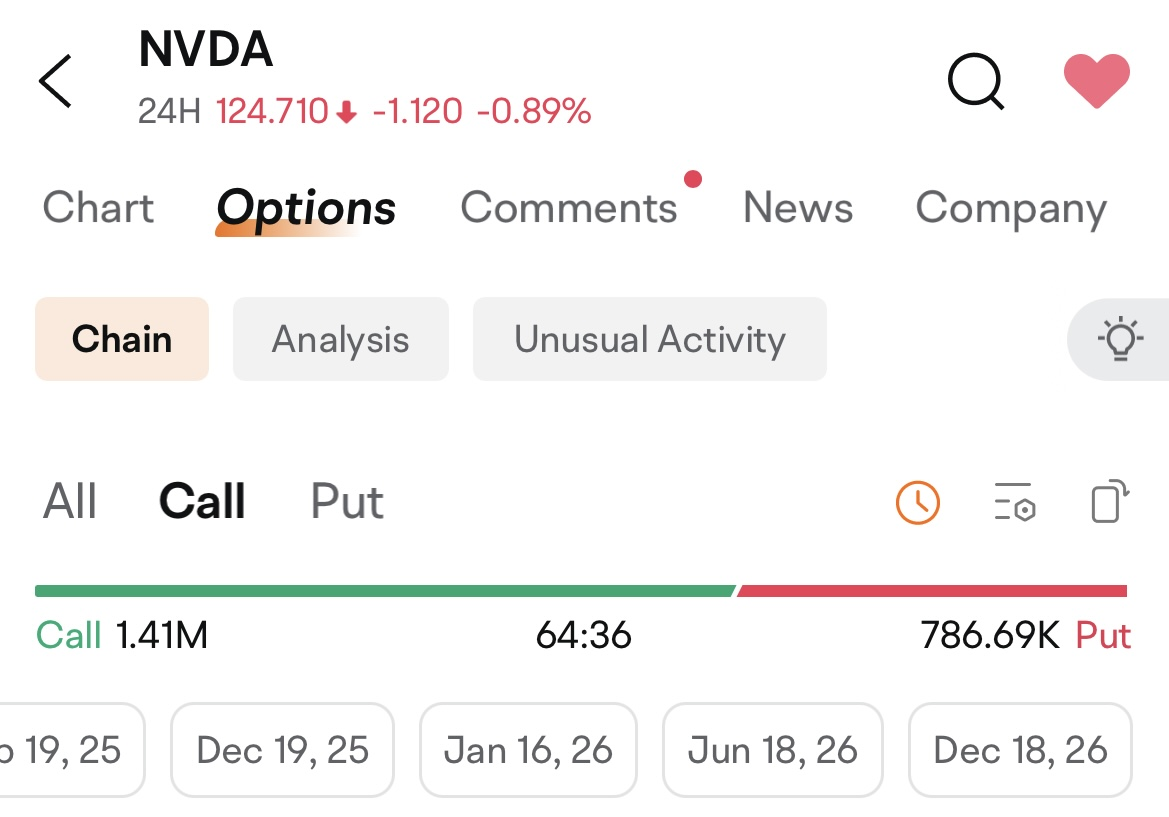

Nancy Pelosi's investment strategy has paid off before—she previously bought LEAPS call options for $NVIDIA (NVDA.US)$ and $Palo Alto Networks (PANW.US)$, reaping substantial gains as both stocks surged in value![]() .

.

Her latest moves could be an intriguing reference for those who track political figures' investments.

So, would you consider following Pelosi's lead and diving into the stock market?

I. What stands out in Pelosi's options trade?

Nancy Pelosi's recent options trade raises intriguing questions:

The options will expire in June 2025, over a year from the trade date, and are deep-in-the-money, carrying a hefty premium.

What could be the strategic reasoning behind this significant investment? Let's analyze the intricacies of this move step by step.

Please be aware that this is a case study for educational purposes only and should not be considered as a recommendation for any investment or investment strategy.

Standing for Long-Term Equity Anticipation Securities, LEAPS are essentially long-dated options that extend beyond the typical one-year period of standard options. They can potentially offer higher returns than owning stocks outright if managed properly, with potentially lower risks.

Regular options typically have a lifespan of no more than one year, whereas LEAPS are usually for periods extending beyond one year. This comes at a price though as LEAPS usually come with higher premiums.

LEAPS are typically American-style options, allowing exercise at any time before expiration. They're offered for select stocks, indices, and ETFs but not universally.

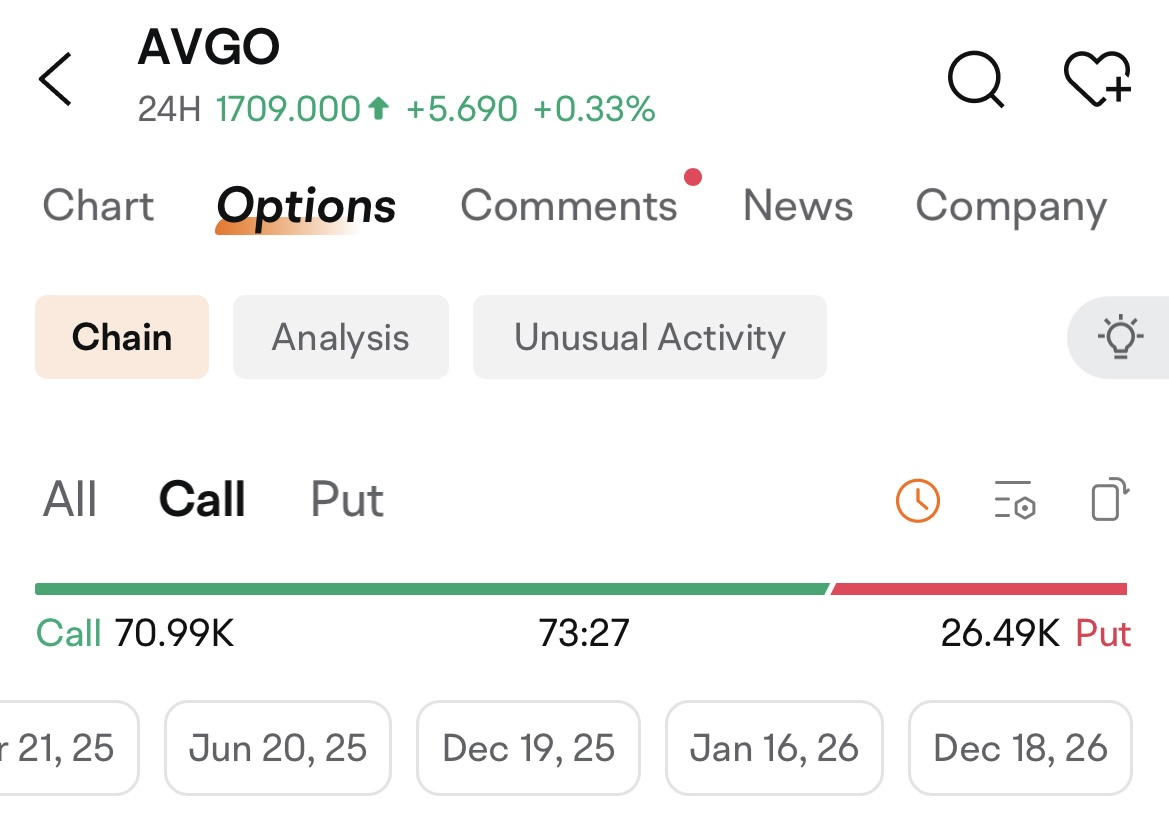

To locate LEAPS, simply filter by expiration date in the options chain on moomoo to see longer-term options.

If you would like to learn more about the basics of LEAPS options, tap the following link to learn more:

LEAPS options come in both puts and calls, just like shorter-dated options. The contract specifics and trading rules are largely similar.

To learn more about options, go to Trade Optionos: Quickstart Guide.

Pelosi's 20 LEAPS options contracts effectively covered about 2,000 shares of the underlying stock but only required an investment of approximately $1.67 million.

At that time, the average price of AVGO's underlying stock was about $1,600. If she had used that money to buy the stock outright, she would have been able to buy only approximately 1,000 shares.

The LEAPS approach necessitated less capital upfront and allowed for a more efficient use of funds.

As a result, it could potentially offer a higher return on investment compared to purchasing the stock directly for the same level of profit.

If the stock soared, the returns from the LEAPS investment could be much greater than those from buying the stock outright.

Imagine locking in a purchase price at $800 per share, plus the cost of the option; if AVGO's stock price rose, the total cost might still be cheaper than buying the stock at the time.

If the stock price doesn't change much, the passage of time might erode some of the profits, leading to a slight loss.

However, the LEAPS strategy limits the loss in case of a stock price decline, and while it may sometimes sacrifice some gains or incur additional losses, these are typically controllable.

Overall, LEAPS options offer a compelling choice for investors who are bullish on the long-term value of a stock but do not want to tie up substantial capital for an extended period. Whether used as an alternative to direct stock ownership or for speculation or hedging, LEAPS options have their unique advantages.

II. Can we follow Pelosi's investment moves?

Can we follow Pelosi's footsteps and trade Broadcom options just like she did?

Well, it might not be affordable for everyone, as the costs are quite high.

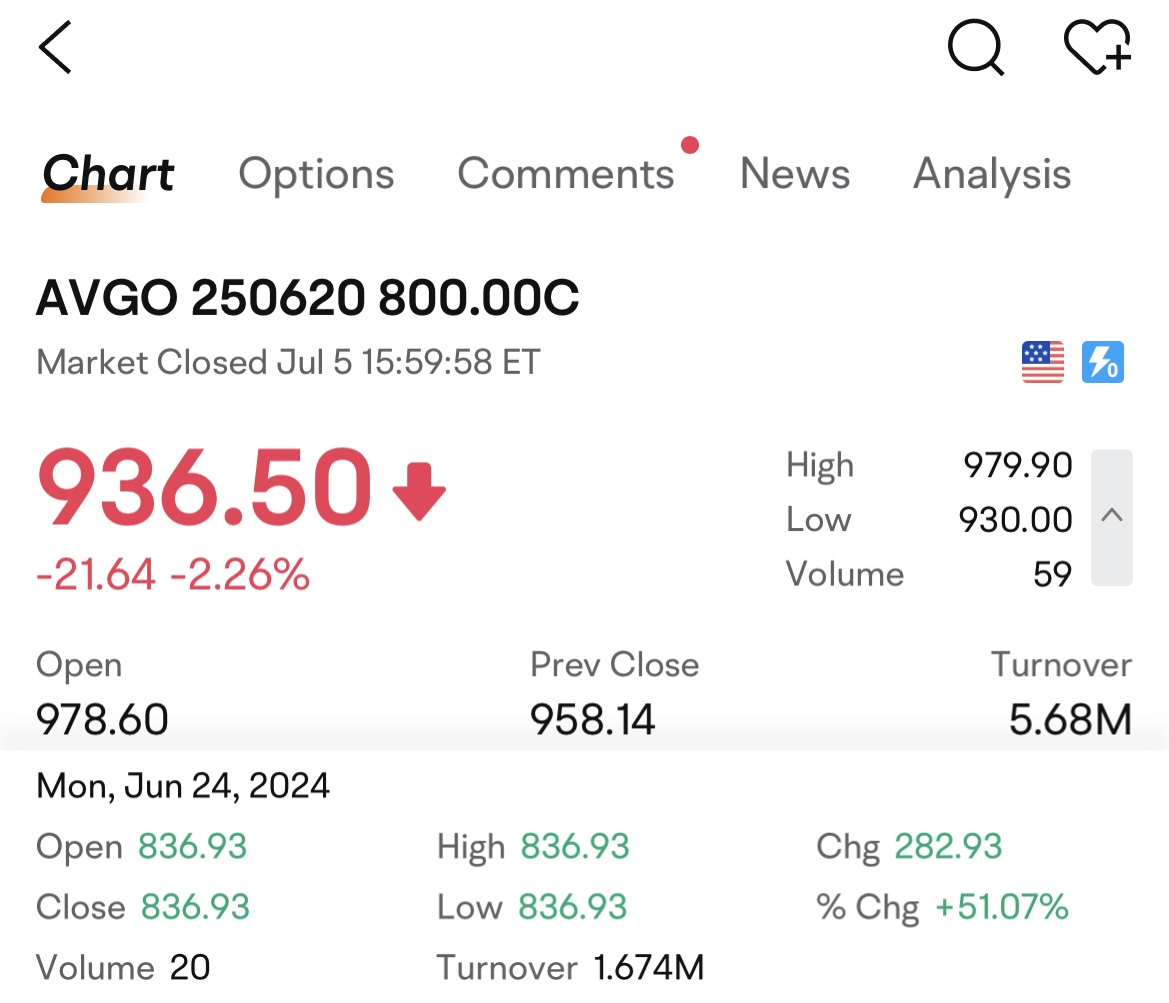

Currently, the price for AVGO 250620 800.00C has surpassed $900. This means buying a single contract would cost at least $90,000, a significant amount for the average investor.

However, since the beginning of the year, both Nvidia and AVGO have seen their share prices surge due to increased spending related to artificial intelligence, and Pelosi clearly also holds an optimistic view on the future prospects of these two chip giants.

If you agree with this assessment, there are actually several alternative approaches that can be taken to participate in investing with limited capital.

1)OTM options or expiring options

As is widely known, the value of an option is composed of intrinsic value and time value.

Weeklies, referring to options contracts that expire on a weekly basis, have low prices due to their nearly zero time value, but they offer higher leverage.

When filtering the expiration date on the options chain, you can choose to trade options expiring this week. Be sure to promptly take profits and cut losses when trading weeklies.

For calls, this means the strike price is greater than the current stock price, and for puts, the strike price is less than the current stock price. These options have lower intrinsic value, and therefore the option premium is relatively cheap.

Swipe on the options chain screen: the white section represents out-of-the-money options, while the blue section represents in-the-money options. Swiping left and right will reveal more field information.

However, overall, compared to $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$, and $Apple (AAPL.US)$, $Broadcom (AVGO.US)$'s options are still relatively pricey.

AVGO's current high stock price has deterred many small and medium investors. To make investing more accessible, AVGO plans to implement a measure similar to Nvidia's—a 1-for-10 stock split scheduled for July 15th. This will significantly lower the barrier to options trading.

2)Waiting for post-split to trade options

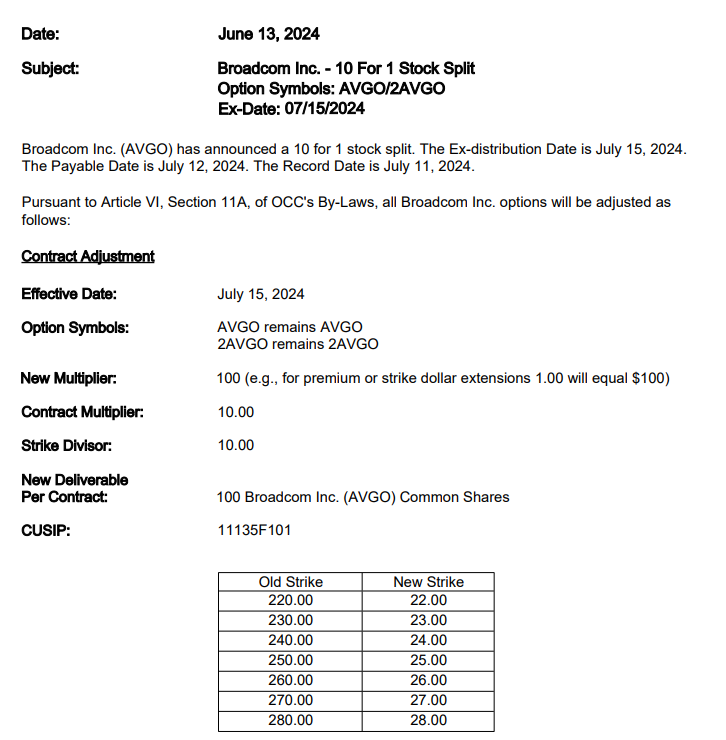

According to the announcement from the OCC:

In this stock split, options, just like shares, are split proportionally.

Specifically, after the split, the number of options contracts you hold will increase tenfold, while the strike price of each contract will be reduced to one-tenth of its original value.

It's like turning 1 membership coupon into 10, each with 1/10th of the purchasing power. In the end, the total value of your investment remains the same before and after the split.

This also means that the price of AVGO options will decrease accordingly.

Currently, an option contract following Pelosi's investment strategy requires over $90,000, but after the anticipated stock split, the price of a single options contract is expected to drop to around $9,000, only requiring one-tenth of the original cost.

Similarly, the current cost to buy an at-the-money weekly option expiring this week is approximately $3,000 to $5,000 per contract.

After the split, this cost is expected to decrease to about $300 to $500, making it more affordable and suitable for investors with limited budgets.

3) Trading Multi-Leg Options

We can also use multi-leg option strategies to lower costs. If you prefer to reduce your expenditure, you might consider employing selling strategies.

You could buy a lower strike put option (Put 1) while selling a higher strike put option (Put 2) to establish a bull put spread strategy.

This strategy often results in receiving a net option premium, thereby reducing your cost.

You can sell short-term options with higher implied volatility (IV) and buy LEAPS options with lower IV, creating a long calendar spread position.

If the short-term call options are not exercised, you keep the full premium from selling the short-term options. This is equivalent to buying the LEAPS options at a cheaper price when establishing the strategy. If the underlying stock price increases, you could further profit.

Moomoo supports multi-leg options trading:

Click on the "Strategies" button at the bottom of the "Options Chain" interface → choose "Calendar Spread" / "Vertical Spread" → select the appropriate "Strike Price" and "Direction" on the options chain → click "Trade".

The "Trade" interface also displays the current market quote for the Multi-Leg Options, and you can choose a suitable price to make your offer.

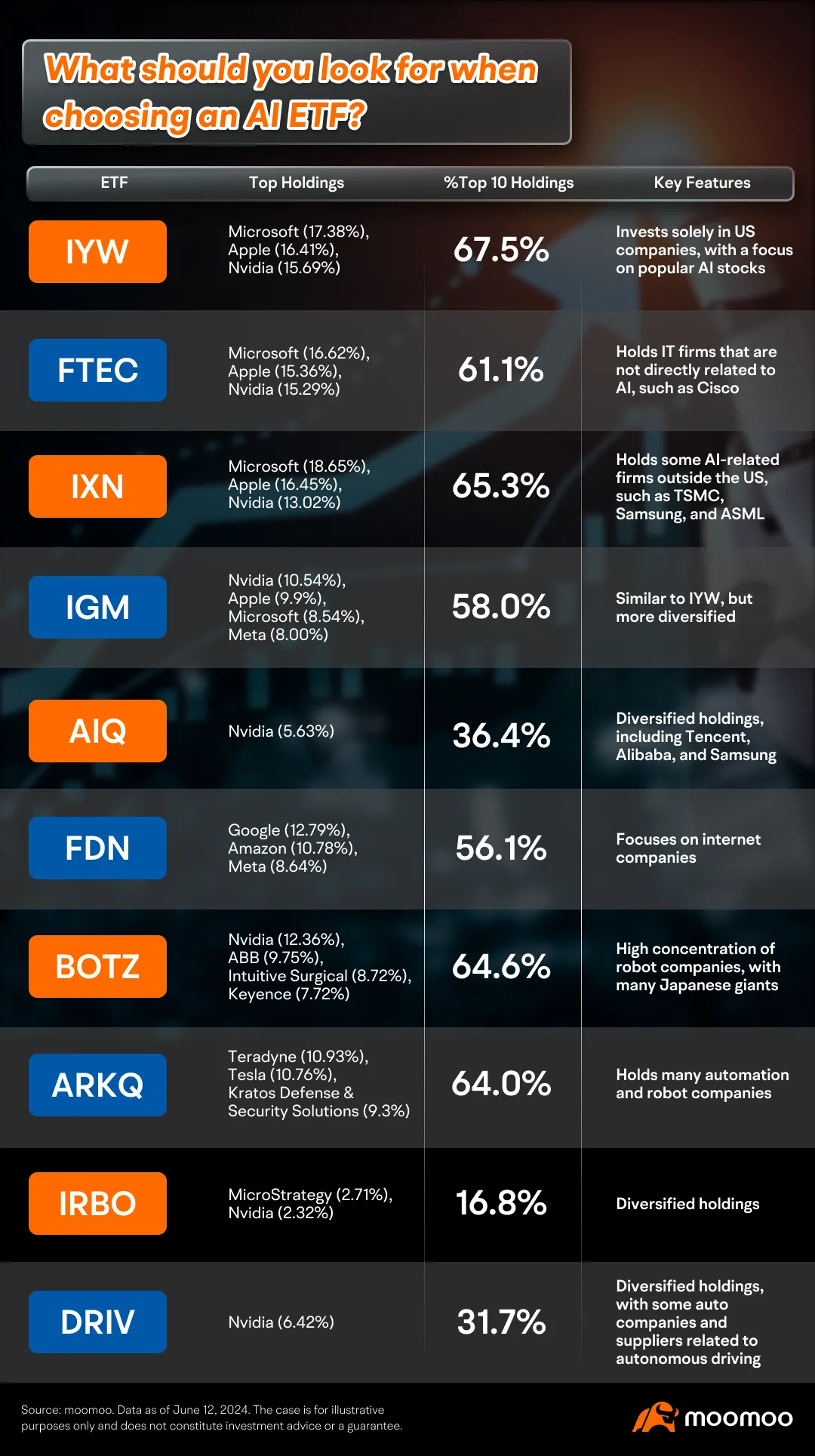

4)Paying attention to ETFs tracking AI stocks

If you are optimistic about the AI industry and want to diversify investment risks, consider investment in Exchange-Traded Funds (ETFs) that track AI stocks. ETFs provide immediate diversification by investing in multiple companies, thereby reducing the specific risks associated with exposure to a single stock.

Here are some ETFs that track AI (Artificial Intelligence) stocks:

When selecting an ETF, it's important to examine its holdings to ensure that they align with your investment goals for AI stocks.

Additionally, consider factors such as the ETF's expense ratio, trading volume, and assets under management (AUM).

Also, a reminder to everyone: trade options on ETFs tracking AI with caution, as the liquidity may be relatively low.

If you're interested in ETF investment, it is recommended to directly purchase shares of the ETF rather than its options.

Click here to learn more:Afraid of NVDA's heights? Try an AI ETF!

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

White_Shadow : it's not rocket science, $Broadcom (AVGO.US)$![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

recently destroyed analysis estimates for earnings as well as Declared a 10-4-1 Splitty, follow the leader in the Bull pen A.I Tech arena, its a no brainer $Broadcom (AVGO.US)$ will continue to rally behind continuing Strength and one of the Leaders in the A.I race....

BelleWeather : LEAPS in general are a favorite tool, especially on high priced tickers. These are ITM, so nearly a proxy for shares.

SPACELIGHT : I'm not a Pelosi groupie.

samuelcferguson : om

B3autyr0x : I think so yes