Real Estate Stocks Soar: Why the Rally Shows No Signs of Slowing Down

The S&P 500's real estate sector has gained 10% over the past three months, outpacing the information technology sector's 7% growth during the same period. This surge in real estate is underscored by the median home price in Silicon Valley, which topped $2 million in the second quarter, marking the first time a U.S. metropolitan area has exceeded that threshold. As housing prices continue to climb, here is why the housing industry recovery might extend further.

The U.S. real estate market is roughly divided into three categories, residential construction, non-residential and residential real estate service companies, and equity-based commercial real estate REITs.

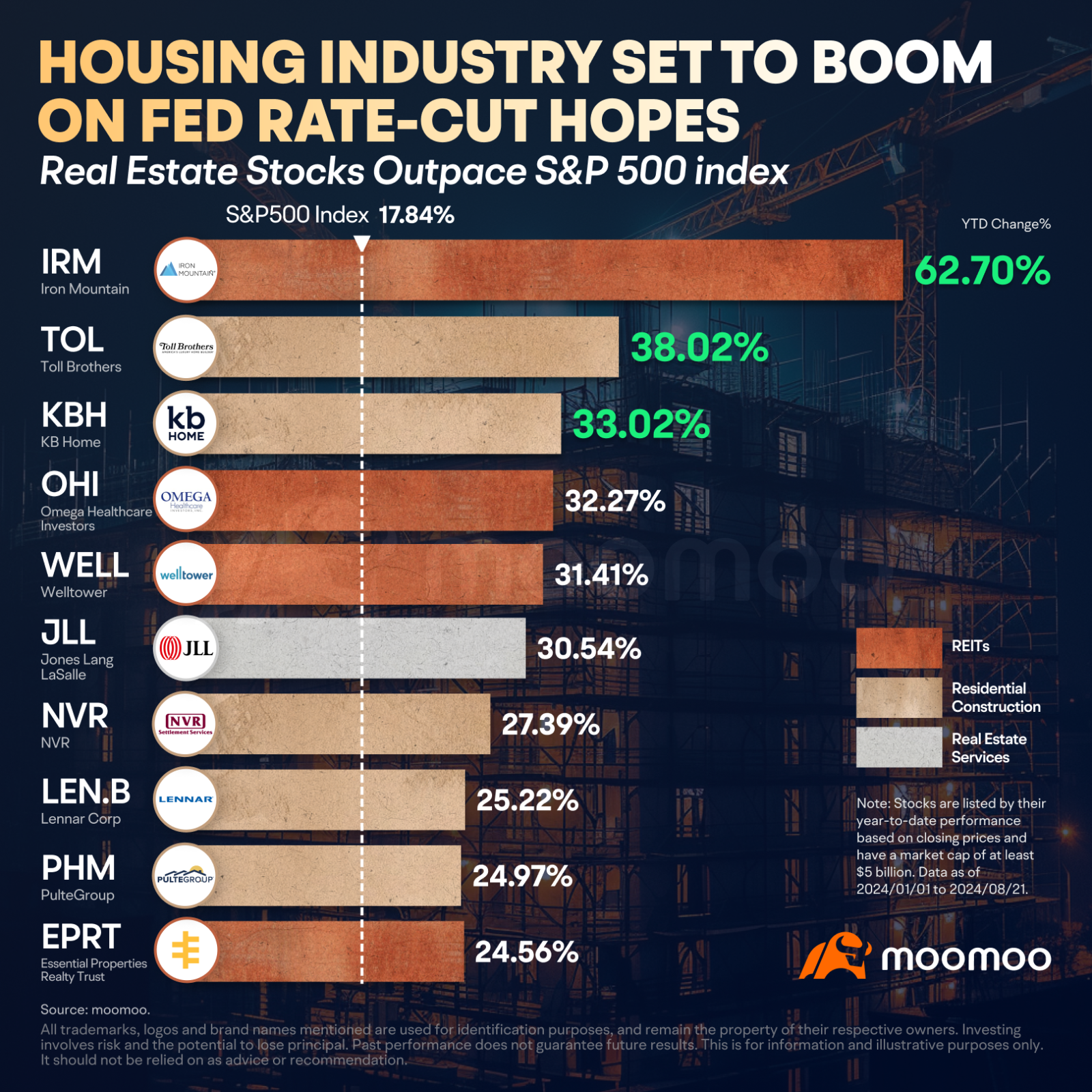

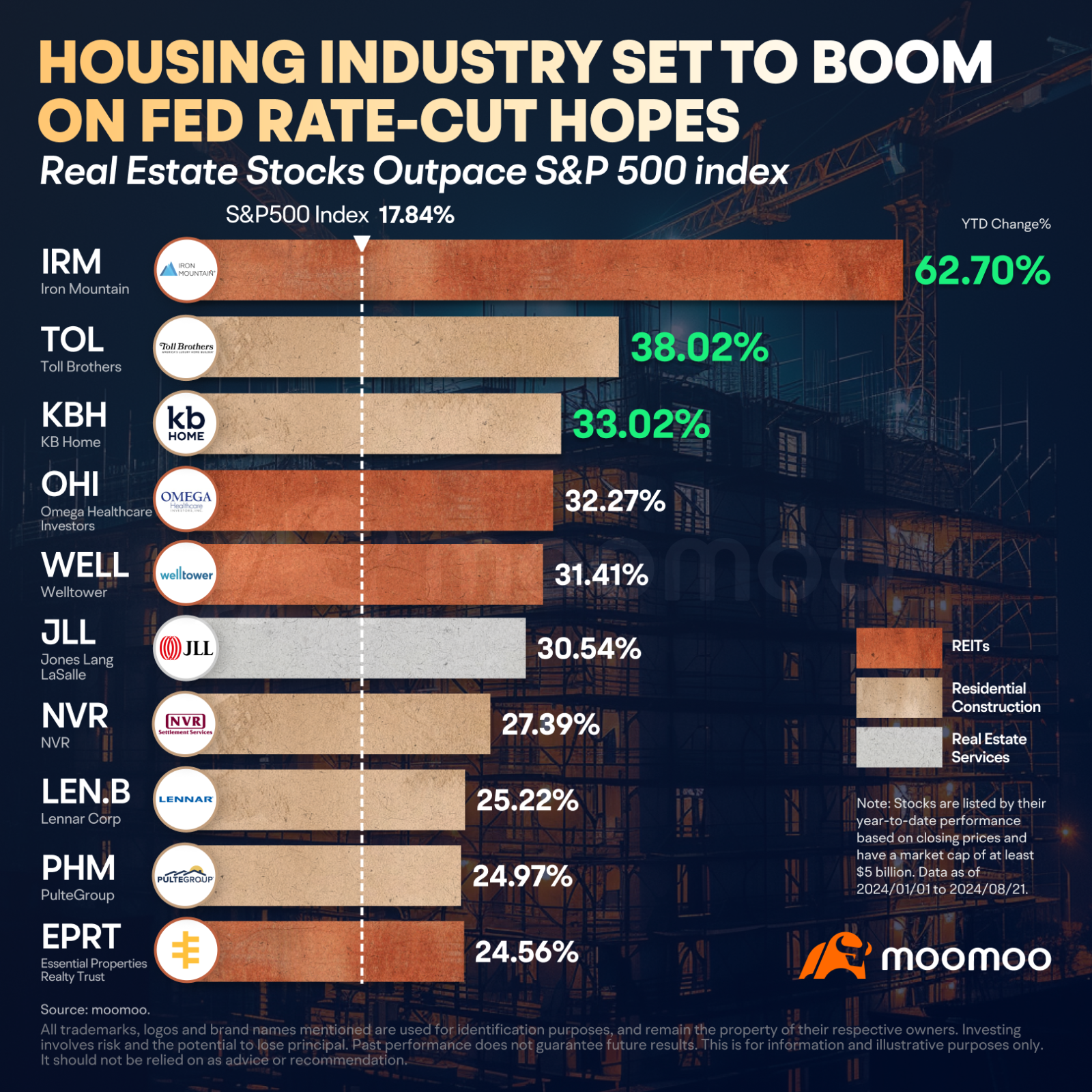

Some of the industry's top performers have outshined the $S&P 500 Index (.SPX.US)$ significantly this year.

Supply, Demand and Reflexivity

The Case-Shiller U.S. National Home Price NSA Index, released July 30, 2024, reported a 5.9% annual increase in May 2024, marking three consecutive months of new all-time highs.

"Covering the six-month period dating to when mortgage rates peaked, our national index has risen the past four months, erasing the stall experienced late last year," provided by research of S&P Dow Jones Indices. This indicates that the rising trend in home prices might persist.

The primary cause of record-high home prices has two simple answers: a dearth of available homes and high demand. Although they have been increasing, stocks are still incredibly low—4.1 months' worth of supplies as indicated by NAR's June data, while a balanced market typically has a 5- or 6-month supply of housing inventory. Price appreciation hasn't even been halted by high mortgage rates.

Reflexivity, the idea that market actions can influence economic fundamentals, suggests that rising home prices could boost buying activity even further. As prices increase, potential buyers may rush to purchase homes before they become even more expensive, creating a self-reinforcing cycle.

CPI and Affordability

The overall CPI rose by 0.2% in July, which will bring the annual rate to the lowest level in more than three years, 2.9%.

Inflation concerns have recently taken a back seat, paving the way for potential Federal Reserve rate cuts in September. Lower interest rates could significantly improve housing affordability, which, in turn, could drive more buyers into the market.

"Our home price index has appreciated 4.1 percent year-to-date, the fastest start in two years," said Brian D. Luke, head of commodities, real & digital assets at S&P Dow Jones Indices, in a statement.

Confidence From Home Builders: A Leading Indicator

$D.R. Horton (DHI.US)$, a major player in the homebuilding industry, reported a rise in profit for the third quarter, beating expectations. The Texas-based homebuilder's profit for the three months ended June 30 rose to $1.35 billion, or $4.10 a share, compared with $1.34 billion, or $3.90 a share, in the year-prior period.

"Although inflation and mortgage interest rates remain elevated, the supply of both new and existing homes at affordable price points is still limited, and demographics supporting housing demand continue to be favorable," said Executive Chairman David Auld. The National Association of Home Builders (NAHB)/Wells Fargo housing market index also rose by six points from 51 in June to 57 in July, indicating strong industry confidence and suggesting the rising trend might extend.

D.R. Horton narrowed its full-year revenue projection to between $36.8 billion and $37.2 billion from a prior estimate of $36.7 billion to $37.7 billion. The company also now expects to close 90,000 to 95,000 homes in fiscal 2024, up slightly from 89,000 to 91,000.

Builders have been careful in their pace of construction since they are all too familiar with the effects of the Great Recession. Builder confidence and new home construction are considered leading indicators because they reflect the builders' outlook on future economic conditions and housing demand. When builders are confident and ramp up new home construction, it typically signals their expectation of a healthy economy and strong demand for housing.

In addition, the commercial real estate market also shows signs of stabilizing, which could further boost confidence in the broader real estate sector.

"Things like the publicly traded [real estate investment trust] market appear to have bottomed out a few months ago, with shares up 10% to 15%," said Mike Acton, managing director and head of research at AEW.

While the sector has faced challenges due to the pandemic and higher refinancing rates, sentiment is improving. Acton added that if property prices haven't already hit a bottom, they certainly feel like they've been "in the neighborhood."

Analyst Opinion

"Despite the slow pace of the overall transaction market during the past 18-24 months, the net lease REITs have largely relied on tenant relationships to continue external growth," Wedbush analysts said in a note.

Lower interest rates could help improve the cost of capital for the entire sector. There could be renewed competition from private investors, which could impact deal volume and cap rates, the note said.

"As such, we are positioned with a positive sector bent," the analysts said.

The investment firm said EPRT's equity cost of capital advantage and higher average acquisition cap rates are believed to lead to continued earnings growth, at least in the near term.

Source: Bloomberg, Market Watch

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Clement Lemons : okk

Clement Lemons : okk

kyneo :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103539497 : hi

104166257 : hi

Malik ritduan :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103677010 : noted

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

102188459 : Tq

龙邦第一财子 : very good

View more comments...