Rio Tinto: Strong Moat, Stable and Optimistic Long-Term Outlook

Who is RIO?

$Rio Tinto Ltd(RIO.AU$ is a global leading mining company and one of the largest resource extraction companies in the world, with headquarters in Australia and operations spanning multiple countries and regions. The company has extensive industry experience and a wide range of business interests in metals and mining, including the extraction and processing of various mineral resources such as iron ore, copper, aluminum, and diamonds.

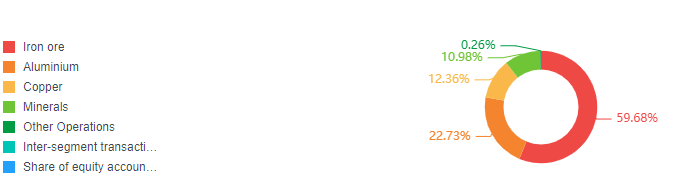

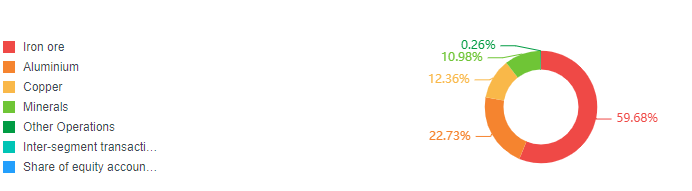

The company's largest source of revenue comes from iron ore mining, followed by aluminum and copper.

In terms of revenue distribution, Rio Tinto's operations are spread across the globe, with over half of its revenue coming from China.

As a mining company, Rio Tinto's revenue is closely tied to commodity prices, as we have seen with our previous analyses of BHP and Newmont Corporation.

The above chart shows the price trend of Rio Tinto's largest business segment, iron ore. It is not difficult to see that after the end of the COVID-19 pandemic, iron ore prices have been on an upward trend, but recently there has been some fluctuation and downward trend due to slowing demand, especially in some areas of oversupply. Correspondingly, market expectations have had some impact on Rio Tinto's stock price, resulting in some fluctuations.

However, do we need to worry about this excessively? Perhaps not.

In the short term:

Despite some fluctuations in commodity prices, Rio Tinto's outlook for iron ore remains stable. According to the company's financial reports, China's iron ore imports increased by 5.5% YoY in Q1 2024, while steel exports reached a new high in 8 years. Rio Tinto's guidance for iron ore production remains unchanged from Q4 2023. The report also notes that China's steel demand is shifting from the real estate industry to manufacturing and infrastructure construction, which helps to offset any decrease in real estate-related demand.

In addition to increased sales, Rio Tinto has also weathered the impact of falling metal prices through favorable exchange rate movements. Overall, Rio Tinto's short-term outlook for iron ore remains unchanged from Q4 2023.

In the long term:

As demand gradually decreases and shifts towards high-grade, low-impurity ore suppliers, Rio Tinto is well prepared for this transition, with the Simandou project in Guinea set to become the most important supplement for high-grade iron ore.

Therefore, I believe that although overall demand for iron ore may decrease, the demand for high-quality iron ore will continue to remain high, and this is undoubtedly good news for Rio Tinto, which has a strong moat.

In addition to iron ore, as concepts such as electric vehicles and new energy batteries become increasingly popular, demand for copper and aluminum in the market is expected to rise. Rio Tinto has also made strategic deployments in this regard, enhancing the company's growth potential in new energy materials such as copper and lithium through projects such as Oyu Tolgoi in Mongolia and Rincon Lithium in Argentina.

Furthermore, Rio Tinto's dividend policy is also attractive, with a policy of distributing 40-60% of earnings as dividends. Historically, the company's dividend yield has remained around 5%, and currently stands at 4.55%.

Rio Tinto's balance sheet remains strong, with free cash flow of $8.07 billion as of December 31, 2023, which should be sufficient to support the company's higher dividends.

At present, Rio Tinto's P/E ratio is 13.84, which is lower than its top competitor, BHP, with a P/E ratio of 20.81. With its readiness for the low-carbon opportunities of the next decade and optimistic dividend level, Rio Tinto is worth buying.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment