Santa Claus Rally Is Around the Corner. What Does It Mean for the Market in 2024?

Bank of America suggests that Santa Claus rally might be more than a small advance beyond the official seven-session stretch from December into January for the $S&P 500 Index (.SPX.US)$.

Bank of America's technical research strategist, Stephen Suttmeier, in a Monday note, delved into the historical performance of the S&P 500 during the year-end period, revealing insights that extend beyond the traditional Santa Claus rally. Traditionally defined as the last five trading days of December and the first two of January, the Santa Claus rally has historically seen the S&P 500 gain 79% of the time, with an average return of 1.66%, as per the analyst's findings.

However, Suttmeier's analysis suggests that the positive momentum often begins earlier and extends beyond this seven-session stretch. He noted that in the final ten sessions of December, dating back to 1928, the S&P 500 has risen 72% of the time, achieving an average return of 1.17%. The index rallied 3.3% over the first ten sessions of December in the year of 1928, which historically led to a more modest return of 0.88% in the final ten days of the month.

This year, the S&P 500 rallied 3.3% over the first 10 sessions of December, which ran through the 14(th) of the month, Suttmeier found. When the first 10 sessions are up, the final 10 days of the month are positive, but garner more modest returns of 0.88% on average, he said.

The absence of a rally in this period can also be an early indicator of market downturns. A 4.0% decline in 2000 foreshadowed the bursting of the tech bubble and a 2.5% loss in 2008 preceded the second worst bear market in history, according to the data compiled by StockTraderAlmanac.

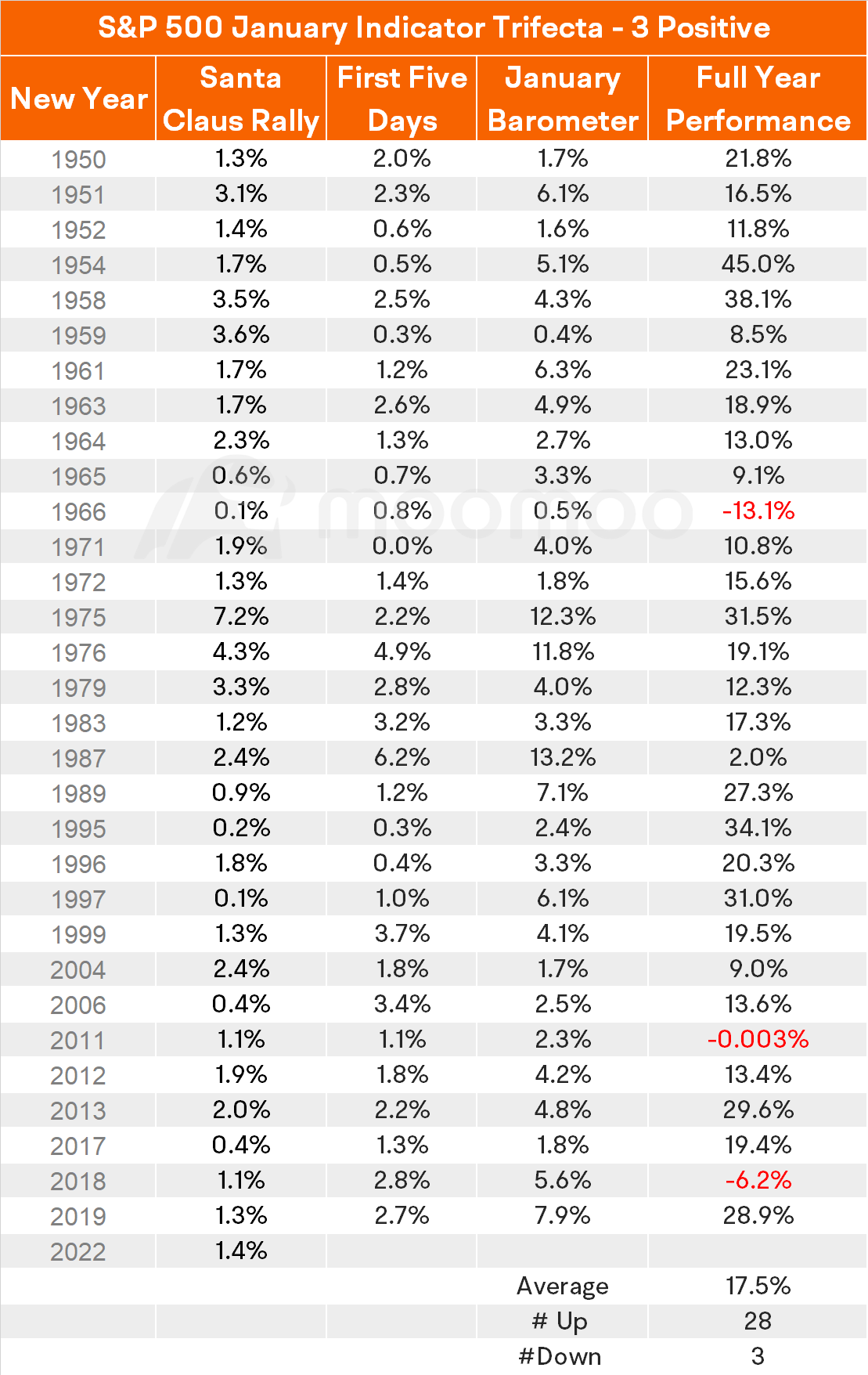

In addition, after recording the best first-day gain since 2000-2001, the S&P 500 maintained its performance, ending the Santa Claus rally period with a 1.4% gain. Including this year, the Santa Claus rally has occurred 58 times since 1950. On 31 of these occasions, both the First Five Days, which means the first five trading sessions of January, and the January Barometer, which means stock performance in January, were positive. When all three indicators were positive, the full year saw positive returns 90.3% of the time, with an average annual gain of 17.5%.

The probable cause for a Santa Claus rally is difficult to identify. The possible reasons involve general optimism around the holidays, people investing holiday bonuses, and an increased influence from individual investors.

Source: CNBC, StockTraderAlmanac

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment