Semiconductor Stocks Plunge: Opportunity or Risk?

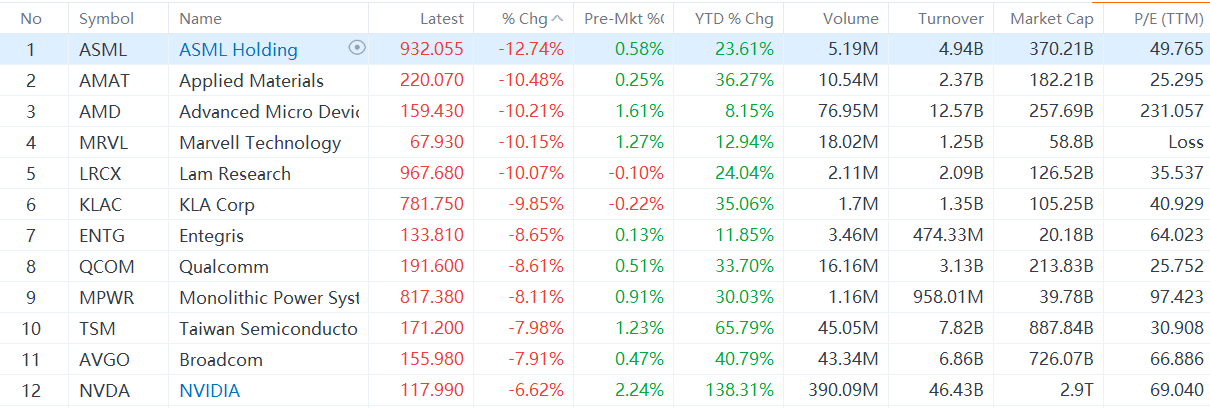

Semiconductor stocks suffered a brutal sell-off on Wednesday, with the $PHLX Semiconductor Index (.SOX.US)$ dropping nearly 7%, marking its worst performance since 2020. $ASML Holding (ASML.US)$ plunged more than 12%, while $Applied Materials (AMAT.US)$, $Advanced Micro Devices (AMD.US)$, $Marvell Technology (MRVL.US)$, and $Lam Research (LRCX.US)$ all fell more than 10%, and $NVIDIA (NVDA.US)$ dropped 6.6%.

What Happened?

The sharp decline in the semiconductor sector on Wednesday was mainly due to ongoing style rotation in the US stock market. Market sentiment was also affected by news of tighter restrictions on China's chip trade, comments from former President Donald Trump, and lower-than-expected earnings guidance from ASML.

1. Baird Technology Strategist Ted Mortonson stated that sector rotation has been very evident in the past week, with industries related to Trump's "Make America Great Again" ideology, such as industrial stocks, experiencing an uptick.

2. Bloomberg reported on Tuesday that President Joe Biden is considering severe trade restrictions if chip manufacturers continue to allow China access to advanced semiconductor technology. Additionally, Republican presidential nominee Donald Trump said that Taiwan should pay for its own defense costs to the US, and blamed Taiwan for taking away nearly 100% of America's chip business.

The likelihood of Trump winning the US presidential election has increased significantly. Ajay Rajadhyaksha, global head of research at Barclays Bank, said that Wednesday's drop in semiconductor stocks reflects investor concerns about geopolitical risks.

3. ASML, the largest supplier of computer chip manufacturing equipment, reported Q2 revenue of €6.24 billion, exceeding management's upper limit of €6.2 billion. The gross margin of 51.5% also surpassed the upper limit of the revenue forecast provided by management. Although the company delivered satisfactory Q2 results, the stock price plummeted significantly due to lower-than-expected revenue and gross margin guidance for Q3.

Market Outlook

Some analysts are becoming more pessimistic, suggesting that the US stock market may be nearing the end of its bull run.

Goldman Sachs strategist Scott Rubner believes that the US stock market correction has only just begun, and that the S&P 500 will continue to decline. According to data from 1928 onwards, changes in the market on July 17th indicate a turning point in stock index returns, especially in August, which is usually the month with the most outflows from passive management funds and mutual funds. Scott also mentioned that after a series of rallies, the US stock market faces the risk of weak fund inflows and is susceptible to negative news.

Jonathan Krinsky, an analyst at BITG, holds a similar view to Scott, believing that the US stock market is nearing the typical end of a bull market, and that market sentiment is still very high. Even if the market style shifts from large technology stocks to small-cap stocks in cyclical sectors, a new leader may not emerge until the US stock market experiences a more significant correction.

Sector rotation may continue amidst background of rate cuts and Trump trade.

On Wednesday, while the Nasdaq plunged more than 2.5% for the first time since 2001, the Dow Jones Industrial Average rose, indicating ongoing capital rotation. With rate cut bets and Trump trades, the market is betting that the stock market will rise overall and is shifting its focus from large technology stocks to other sectors that have previously underperformed. Rate cuts have boosted hopes for economic recovery, and Trump's tax cuts and "America First" policy have further stimulated domestic company, especially small and medium-sized enterprise, profit expectations.

Tom Lee of Fundstrat predicts that the small-cap stock rally could last for around 10 weeks, with a rebound of up to 40%, even exceeding the 27% seen in Q4 2020, as institutional short positions are currently high. It is just beginning now.

John Woods, the chief investment officer for Asia at Credit Suisse, said on Bloomberg TV that "I will not immediately give up trading technology stocks, but there are concerns about valuation. I think there are opportunities outside of the technology sector."

There are also marginal signs of improving market sentiment in the semiconductor sector.

TSMC's better-than-expected earnings boost market sentiment

Before the market opened on July 18th, TSMC released its Q2 earnings, with revenue reaching NT$247.8 billion, exceeding expectations and achieving the fastest growth since 2022. The company also raised its full-year revenue growth forecast. TSMC's shares rose more than 4% after the earnings release. As of the time of writing, chip stocks rose in night trading, with NVIDIA up 3%, ASML and AMD up significantly.

Since the beginning of this year, hot money around artificial intelligence has driven significant increases in the share prices of companies such as Microsoft and NVIDIA, and boosted the market. However, in recent weeks, Wall Street has become concerned about how long it will take for the billions of dollars invested by big tech companies in AI infrastructure to pay off. TSMC's upward revision of its forecast shows its confidence in the sustainability of the AI trend.

Intel, GlobalFoundries, AMD are worth watching

GFS and INTC were the only two companies to rise in the brutal sell-off of the Philadelphia Semiconductor Index on Wednesday, with gains of 6.82% and 0.87%, respectively. As $Intel (INTC.US)$ and $GlobalFoundries (GFS.US)$ have manufacturing capabilities in the US, they may continue to benefit from support for domestic chip manufacturing amid escalating geopolitical tensions.

In addition, Melius Research, a well-known Wall Street investment firm, released a report stating that "latecomers" like Intel and $Advanced Micro Devices (AMD.US)$ in the AI field may lead a new "AI investment frenzy" in the second half of this year with their specific strengths in certain areas. Intel is participating in the AI PC layout with its x86 ecosystem advantages, while AMD is competing with NVIDIA in the data center AI chip market and has the potential to gain market share.

by moomoo News Olivia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

74858182 : can someone help me to trade with you please so I can deposit

so I can deposit

Siti Rahimah : good

102145738 : Is it right time to trade Nvidia

SalamiFaruk 74858182 : Hello

74858182 : hello

I need to invest or trade and no one is interested to help me to deposit

ql000lp 74858182 : you can contact customer support, reply is very fast.

Jiuhuboy 102145738 : Not yet - 110

EarnMilkPowder 74858182 : @Moo Live can assign someone to help?

上班对冲风险投资 74858182 : check this: https://www.moomoo.com/us/support/categories/90?from_platform=4&platform_langArea=us&global_content=%7B%22promote_id%22%3A13764%2C%22sub_promote_id%22%3A17%7D

Turnbuckle 上班对冲风险投资 : Thank You for this valuable info

View more comments...