Build a deep drop re-buy fund.

Following the main trend (primary trend, long-term trend), counter technology (secondary trend, short-term trend), against human nature (overcoming the restriction and constraint of liking to rise and hating to fall, people abandon and I take). Gambling is always high consumption. There are surprises, but more despair.

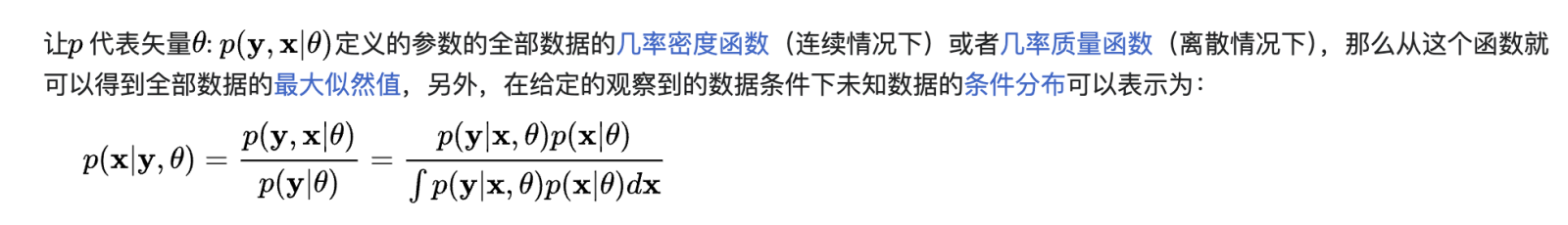

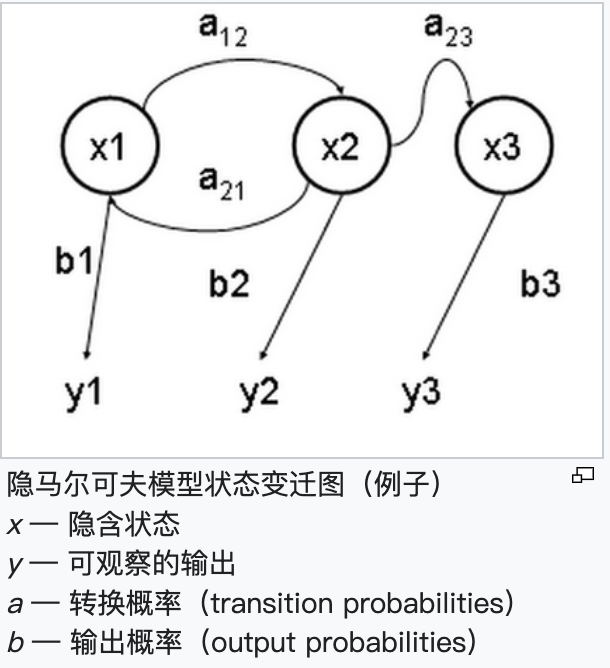

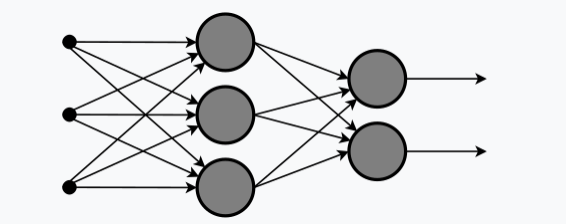

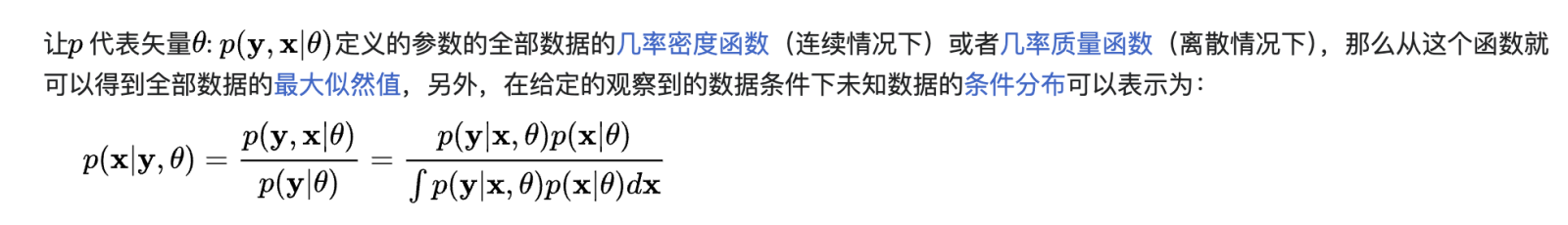

When the Baum-Welch algorithm model and Hidden Markov model, as well as the profit-chip ratio function curve trajectory equation, are crucial, it is essential to find.the primary settlement area of high probability events; then deploy the main capital firepower in that area; For the high probability events innon-primary settlement areaAs a result, to a certain extent, it is ignored, greatly improving the effectiveness and efficiency of capital firepower. This is also the main reason why in 1988, led by the world-class mathematician, investor, and philanthropist with a net worth of over $24 billion, James Harris Simons, Renaissance Technologies LLC founded the company's most profitable investment portfolio, the "Medallion Fund", dominating Wall Street in the financial markets, outperforming stock market guru Warren Edward Buffett and overshadowing financial titan George Soros, averaging a yearly ROI of over 70%. The quantitative model of the Medallion Fund is based on the improvement and expansion of the Baum-Welch algorithm model by Leonard Baum, to explore the profitability correlation, a modification completed by algebraist James Coase. Simmons and Coase established a fund based on this, named "Medallion" to commemorate the mathematical honors they once received.

Arrogance, impetuosity, and empty talk cannot achieve great success in the financial industry. Serious research, developing various plans, forming protective funds and deep buying funds are the correct way for world-class professional investors to deal with it.

Manage your stocks account for investment trades just like Vanguard manages individual retirement accounts (IRA) and 401(k) fund accounts.

Tesla's Robotaxi unveiling event, scheduled to take place on October 10th, is seen as another important milestone for the company since the introduction of the Model 3.

Preview of the Robotaxi unveiling event

In this highly anticipated event, Tesla is expected to showcase its latest self-driving vehicle model - the 'Cybercab.' The design concept of this model is fully automated and may not include a steering wheel and pedals, relying entirely on Tesla's Full Self-Driving (FSD) software.

The manufacturing cost of Cybercab is expected to be very low, aiming to provide a fare close to that of a bus ticket, and plans to mass produce using the innovative 'unboxing' manufacturing strategy at the super factory in Texas, with the expectation to achieve this by 2024.

Although Tesla has been promoting the development of self-driving taxi business for many years, it has not been widely popularized. However, with the clear timetable given by Musk at the July financial report meeting and the teaser poster released officially on September 26, public expectations have been pushed to a climax.

Tesla may introduce two new models: Robovan cargo van and a new electric car with a starting price of approximately 0.025 million US dollars. The introduction of these new models may help Tesla further expand market share. Although these models may be introduced at a press conference, it is not expected to reveal too many specific details.

Preview of the Robotaxi unveiling event

In this highly anticipated event, Tesla is expected to showcase its latest self-driving vehicle model - the 'Cybercab.' The design concept of this model is fully automated and may not include a steering wheel and pedals, relying entirely on Tesla's Full Self-Driving (FSD) software.

The manufacturing cost of Cybercab is expected to be very low, aiming to provide a fare close to that of a bus ticket, and plans to mass produce using the innovative 'unboxing' manufacturing strategy at the super factory in Texas, with the expectation to achieve this by 2024.

Although Tesla has been promoting the development of self-driving taxi business for many years, it has not been widely popularized. However, with the clear timetable given by Musk at the July financial report meeting and the teaser poster released officially on September 26, public expectations have been pushed to a climax.

Tesla may introduce two new models: Robovan cargo van and a new electric car with a starting price of approximately 0.025 million US dollars. The introduction of these new models may help Tesla further expand market share. Although these models may be introduced at a press conference, it is not expected to reveal too many specific details.

Tesla's sales in 2024 are expected to be flat compared to 2023, indicating a relatively conservative market expectation for its future sales. However, the affordable Model 2 could be key for Tesla to expand its market share.

Tesla's self-driving technology has always been the core of the company's technological innovation. Through continuous software updates and improvements, Tesla hopes to achieve true self-driving capabilities, thereby fundamentally changing people's way of travel.

Robotaxi Day is of great significance to Tesla, as Musk needs to prove the company's technological attributes. Wall Street values Tesla's potential in the field of AI, Robotaxi, and Optimus projects, which are particularly important when the electric vehicle market conditions are unfavorable.

Executive Departures, a Positive Sign?

At this critical moment, Tesla executive Nagesh Saldi will leave the company a few days before the Robotaxi event.

Saldi is Tesla's Chief Information Officer (CIO) and works closely with Elon Musk. In recent months, his main focus has been on expanding Tesla's new datacenters in Texas and New York to enhance the company's computing capabilities and accelerate the development of artificial intelligence and self-driving cars.

The former Chief Information Officer's work is closely related to the progress of the company's Robotaxi fleet, and the timing of his departure has inevitably sparked widespread speculation.

Some may interpret Saldi's departure as a bad omen for Tesla. After all, his departure leaves Tesla with only three executives. The remaining executives are Elon Musk, Chief Financial Officer Vaibhav Taneja, and Senior Vice President of Autos Tom Zhu.

This year, Tesla has experienced some executive departures, including Drew Baglino, Rohan Patel, and Allie Arebalo. While executive departures may be seen as a negative signal, sometimes it also means that the company has achieved certain goals and needs a new leadership team to face new challenges. Tesla is entering a new phase of self-driving cars and Robotaxi, which may require new leaders to lead this transformation.

In terms of stock price, Tesla's stock experienced fluctuations in 2024, but with the approach of Robotaxi Day, the stock has significantly risen. Investors are closely watching whether Tesla can further solidify its position as an ai company through this event and launch more affordable new car models.Model 2。

Tesla's self-driving technology has always been the core of the company's technological innovation. Through continuous software updates and improvements, Tesla hopes to achieve true self-driving capabilities, thereby fundamentally changing people's way of travel.

Robotaxi Day is of great significance to Tesla, as Musk needs to prove the company's technological attributes. Wall Street values Tesla's potential in the field of AI, Robotaxi, and Optimus projects, which are particularly important when the electric vehicle market conditions are unfavorable.

Executive Departures, a Positive Sign?

At this critical moment, Tesla executive Nagesh Saldi will leave the company a few days before the Robotaxi event.

Saldi is Tesla's Chief Information Officer (CIO) and works closely with Elon Musk. In recent months, his main focus has been on expanding Tesla's new datacenters in Texas and New York to enhance the company's computing capabilities and accelerate the development of artificial intelligence and self-driving cars.

The former Chief Information Officer's work is closely related to the progress of the company's Robotaxi fleet, and the timing of his departure has inevitably sparked widespread speculation.

Some may interpret Saldi's departure as a bad omen for Tesla. After all, his departure leaves Tesla with only three executives. The remaining executives are Elon Musk, Chief Financial Officer Vaibhav Taneja, and Senior Vice President of Autos Tom Zhu.

This year, Tesla has experienced some executive departures, including Drew Baglino, Rohan Patel, and Allie Arebalo. While executive departures may be seen as a negative signal, sometimes it also means that the company has achieved certain goals and needs a new leadership team to face new challenges. Tesla is entering a new phase of self-driving cars and Robotaxi, which may require new leaders to lead this transformation.

In terms of stock price, Tesla's stock experienced fluctuations in 2024, but with the approach of Robotaxi Day, the stock has significantly risen. Investors are closely watching whether Tesla can further solidify its position as an ai company through this event and launch more affordable new car models.Model 2。

Historically, Tesla's new product launches have a significant impact on stock prices. For example, after the launch of Model 3 in 2016, the stock price rose by 12% in the short term, while the debut of Optimus in 2022 resulted in a 16% drop in stock price.

The next trend in Tesla's stock price will depend on Musk's performance at the Robotaxi Day on October 10th.

At the same time, Tesla's valuation is currently at a high level, with a forward PE ratio of up to 90 times in the next 12 months. Market expectations for Tesla's future growth mainly stem from the execution of its AI projects, especially Robotaxi and the humanoid robot Optimus.

The next trend in Tesla's stock price will depend on Musk's performance at the Robotaxi Day on October 10th.

At the same time, Tesla's valuation is currently at a high level, with a forward PE ratio of up to 90 times in the next 12 months. Market expectations for Tesla's future growth mainly stem from the execution of its AI projects, especially Robotaxi and the humanoid robot Optimus.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Elias Chen OP : Well said , gambling is always a high cost. There were surprises, but more hopelessness.

, gambling is always a high cost. There were surprises, but more hopelessness.