SG Morning Highlights | OCBC to Expand Digital Silvers Programme to Help 10,000 Seniors Learn Digital Banking Skills by Year End

Good morning mooers! Here are things you need to know about today's Singapore markets:

●Singapore shares opened higher on Tuesday; STI up 0.37%

●Singapore Enjoys $1.01bn in Net Retail Inflow to Listed Firms in H1

●Singapore Leads Flight-to-Quality Trend in APAC, Reports CBRE

●Stocks to watch: SingTel, OCBC

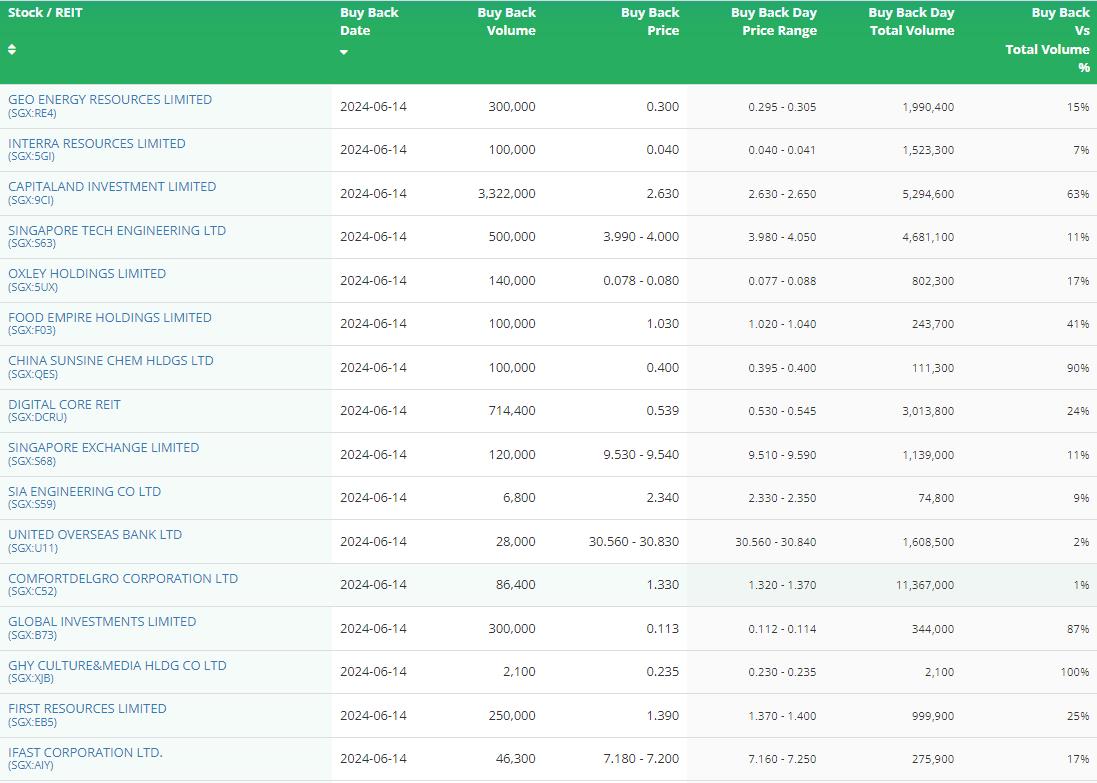

●Latest share buy back transactions

-moomoo News SG

Market Snapshot

Singapore shares opened higher on Tuesday. The $FTSE Singapore Straits Time Index (.STI.SG)$ rose 0.37 percent to 3321.20 as at 9:10 am.

Advancers / Decliners is 134 to 67, with 98.55 million securities worth S$124.32 million changing hands.

Breaking News

Singapore Enjoys $1.01bn in Net Retail Inflow to Listed Firms in H1

Singapore has recorded $1.01bn in net retail inflow in Singapore-listed companies from 1 January to 13 June this year, with most of the inflows occurring in Q1, according to the Singapore Exchange (SGX). However, Q2 saw net inflows slow to $50m, mainly due to $597m in net retail outflow in the three major banks. Despite that, the outflow was offset by the $646m of net retail inflow seen in other Singapore-listed stocks. The largest net retail outflow was experienced by UOB during the 1 April to 13 June period, with outflows of $366m, reversing the net buying in the previous two quarters.

Singapore Leads Flight-to-Quality Trend in APAC, Reports CBRE

According to a new report by CBRE, Singapore, alongside Japan and Australia, is leading the ongoing flight-to-quality trend in Asia Pacific (APAC), where occupiers are preferring or moving to higher quality workspace. The demand for premium, core office locations in Singapore has been among the strongest in APAC, with upgrading to buildings with premium green features or green building adoption rate also high. CBRE attributes the demand in Singapore to employees' preference to work in the central business district, government incentives, and high green building adoption in the city-state. Despite the strong demand, Singapore lagged in office rental growth compared to its peers in APAC, which CBRE said might be caused by an already high rental base and limited product offerings.

Stocks to Watch

$OCBC Bank (O39.SG)$: OCBC Bank has announced that it will expand its Digital Silvers Programme to more locations to equip up to 10,000 seniors with digital banking skills by the end of 2024. The bank aims to help seniors who are "digitally shy"- those who lack confidence using technology or may feel overwhelmed by new technology - by hosting at least five workshops, mini carnivals and outreach activities at community centres and Housing Board pavilions in the second half of 2024 to reach more seniors. Participants in the programme can learn how to make QR payments, perform cash withdrawals and make use of anti-scam security features. The bank said there was a drop of 76% in customers who physically go to its branches for basic services.

$Singtel (Z74.SG)$: Optus Mobile, a unit of Singapore Telecommunications (SingTel), has commenced trial in the Federal Court of Australia over allegations that the company committed 3.6 million data breaches of the Australian Telecommunications Act 1979 during a cyber attack in September 2022. The Australian Communications and Media Authority (ACMA) had filed proceedings against the company in May. Optus reiterated that it will defend these proceedings and stated that only 10,200 customers were affected by the attack where their personal information was published on the internet. The telco operator stressed that it had taken significant steps to minimize harm to its customers, including working with the police and other authorities.

$HG Metal (BTG.SG)$: The Competition and Consumer Commission of Singapore (CCCS) has called for public feedback on Green Esteel's proposed acquisition of new shares in HG Metal Manufacturing. Esteel is seeking to subscribe to 34 million new ordinary shares in HG Metal, giving it up to a 29% stake in the company. The regulator noted some overlap in the processing and distribution of certain products in Singapore, such as rebar, cut and bend, prefab, and mesh. CCCS said it is studying whether the proposed transaction will result in less competition in any market in Singapore. The public can share their feedback from 13 June until 26 June.

Share Buy Back Transactions

Source: Business Times, SGinvestors.io, Business Review

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment