SG Morning Highlights | Sembcorp H2 Profit Rises 15% to S$412 Million on Growth in Gas, Renewables Segments

Good morning mooers! Here are things you need to know about today's Singapore markets:

●Singapore shares opened lower on Tuesday; STI down 0.12%

●Maybank Forecasts Positive Impact of Budget 2024 on Singaporean Banks, Industrials, and Energy Companies

●Banking, Computer Software, and Healthcare Industries Among Top Career Choices for Singaporean Students

●KPMG: Singapore to Remain Attractive with Refundable Tax Credit Scheme

●Stocks to watch: Sembcorp, SGX, Gallant Venture

●Latest share buy back transactions

-moomoo News SG

Market Snapshot

Singapore shares opened lower on Tuesday. The $FTSE Singapore Straits Time Index (.STI.SG)$ dropped 0.12 percent to 3,222.15 as at 9.03 am.

Advancers / Decliners is 62 to 61, with 110.83 million securities worth S$65.75 million changing hands.

Breaking News

Maybank Forecasts Positive Impact of Budget 2024 on Singaporean Banks, Industrials, and Energy Companies

Maybank has identified that the Budget 2024 announced by Deputy Prime Minister Lawrence Wong on Friday has a more discernible "investment tilt" to spur on investments in green transition, human capital, critical infrastructure and high-quality foreign investments. The bank's economists believe that the enhanced support should benefit companies in the renewables space as well as boost loan growth and related fees for banks. Furthermore, the additional $1 billion to be invested in AI will help ensure Singapore can secure access to advanced chips that are key to AI development and deployment. From Maybank's perspective, this will be positive for the clutch of tech companies under its coverage.

Banking, Computer Software, and Healthcare Industries Among Top Career Choices for Singaporean Students

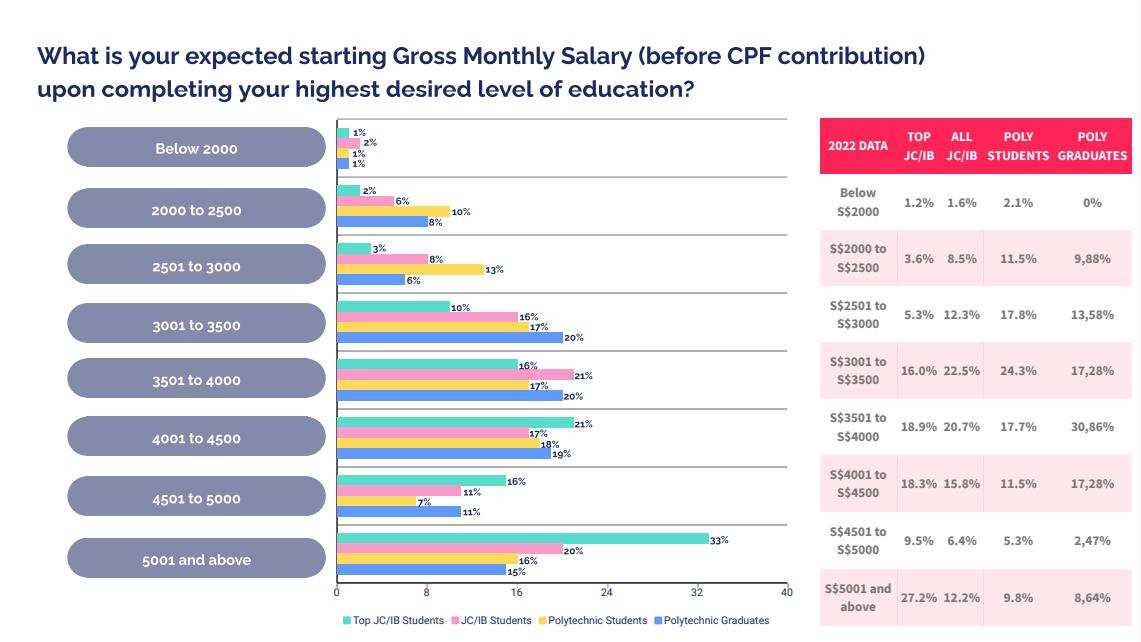

According to BrightSparks' 16th annual scholarship and education survey, banking, computer software, and healthcare are the top career choices for collegiate students in Singapore. The survey showed that the top career choices upon graduation for top junior college (JC) and international baccalaureate (IB) students were banking and computer software.

Meanwhile, the banking industry emerged as the top pick for regular JC/IB students, computer software for polytechnic students, and healthcare for polytechnic graduates. Career growth and opportunities were the top priority for all four student groups, followed by job security and salary, with top JC/IB students and polytechnic graduates prioritizing salary, and regular JC/IB students and polytechnic students prioritizing job security.

KPMG: Singapore to Remain Attractive with Refundable Tax Credit Scheme

KPMG in Singapore has stated that Singapore can remain attractive to businesses with its Qualified Refundable Tax Credits (QRTC) scheme, which provides tax credits on qualifying expenditures that can be used to reduce corporate tax payable or claimed through cash or cash equivalents within four years. The auditing giant explained that these tax credits would provide businesses with a lifeline akin to grant programmes, with added flexibility, allowing them to receive support over an extended period without the need to apply for support before initiating a specific project or activity. The introduction of the Refundable Investment Credit (RIC) in Singapore's Budget 2024 further strengthens the country's appeal to businesses, particularly since more countries are adopting the global minimum tax of 15%.

Stocks to Watch

$Sembcorp Ind (U96.SG)$: Sembcorp Industries has released its full-year results for FY2023, with net profit before extraordinary items reaching $1.018bn, up 38% YoY, and $1.02bn after EI, up 45% YoY. However, total turnover dropped 10% YoY to $7.042bn. Net profit from the gas and related services segment grew 30% to $809m, while net profit before EI from the renewables segment rose 42% to $200m. The company's CEO Wong Kim Yin said the firm would focus on executing its 2024-2028 strategy to drive energy transition and transform its portfolio from brown to green.

$SGX (S68.SG)$: Singapore Exchange (SGX) has launched and priced a $300m issuance of notes due 2027 under its $1.5bn multicurrency debt issuance programme (MTN programme). The notes will have an issue price of 100% of their principal amount, in denominations of S$250,000, and carry a coupon rate of 3.45% per annum, payable semi-annually in arrears. The notes are expected to be issued on Feb 26 and mature in February 2027. The net proceeds from the issue of the notes, after deducting issue expenses, will be used by SGX for the refinancing of existing debt and for general corporate purposes.

$Gallant Venture (5IG.SG)$: Gallant Venture and GHY Culture & Media have posted separate profit guidances for their full-year results. Indonesia-focused utilities provider Gallant Venture expects to report a net loss due to higher finance costs and lower profit contributions from associated companies, while concert organiser GHY Culture & Media anticipates a net loss attributable to foreign exchange losses and the recognition of credit loss allowance. Both companies said further details would be disclosed when their financial results are announced.

Share Buy Back Transactions

Source: Business Times, SGinvestors.io

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment