Stock price drops after earnings. How to deal with it?

Updated on October 15

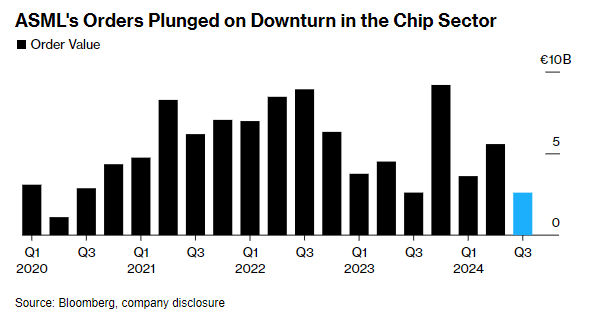

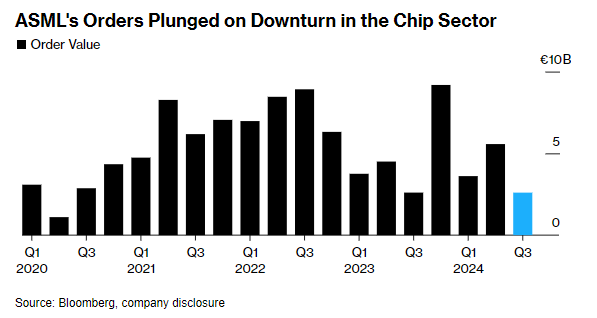

Semiconductor company $ASML Holding (ASML.US)$ experienced its largest drop in 26 years on October 15 after reporting only about half the orders that analysts had anticipated from chipmakers, signaling a significant slowdown for this key industry player, according to Bloomberg.

The disappointing results were further exacerbated by the company accidentally releasing its earnings report a day early. This news prompted a widespread selloff in chip-related stocks, including $NVIDIA (NVDA.US)$.

As the new earnings season kicks off, markets are expected to experience notable stock price fluctuations, which is a typical occurrence. Many investors will likely take this opportunity to review their portfolios, whether by closing some positions or adding new ones to capitalize on market volatility. Earnings reports are crucial as they serve as key indicators of a company's health.

This article will focus on technical analysis and trading strategies during earnings season.

Take $PDD Holdings (PDD.US)$ as an example, the company announced its 2024 Q2 earnings report before pre-market trading on August 26, with revenue falling short of expectations, causing its stock to plummet over 28% on the same day.![]()

Source: moomoo. Data as of August 26, 2024.

On August 26th, its stock price trend broke below the key MA200 bull-bear dividing line. Looking at the support and resistance, PDD broke through several supports overnight.

In the event of a significant drop in the company's stock price, how should investors respond?

1. Cut losses and sell in time.

2. Stay optimistic for the long term and continue to hold.

3. Anticipate further declines and sell to short after exiting.

To answer this question, we first need to make a judgment on the future trend of stock prices. The pattern called Bad Earnings Surprises can help investors make better judgments.

The decline pattern after earnings reports was discovered by Thomas Bulkowski, referring to a short-term continuous bearish pattern, where the stock price breaks lower and continues to decline after the company's earnings report.

A downward breakout occurs when the price closes below the intraday low posted on the announcement day.

As an investor, after identifying this pattern, what should you consider doing?

– Stop losses in time and sell after the pattern appears.

– Hold for the long term, as according to Bulkowski's experience, the decline may not be significant.

– Swing trade, profiting by shorting after the pattern appears.

More detailed strategies can be learned in depth in our premium courses - Stock Price Falls After Earnings. What's Next?

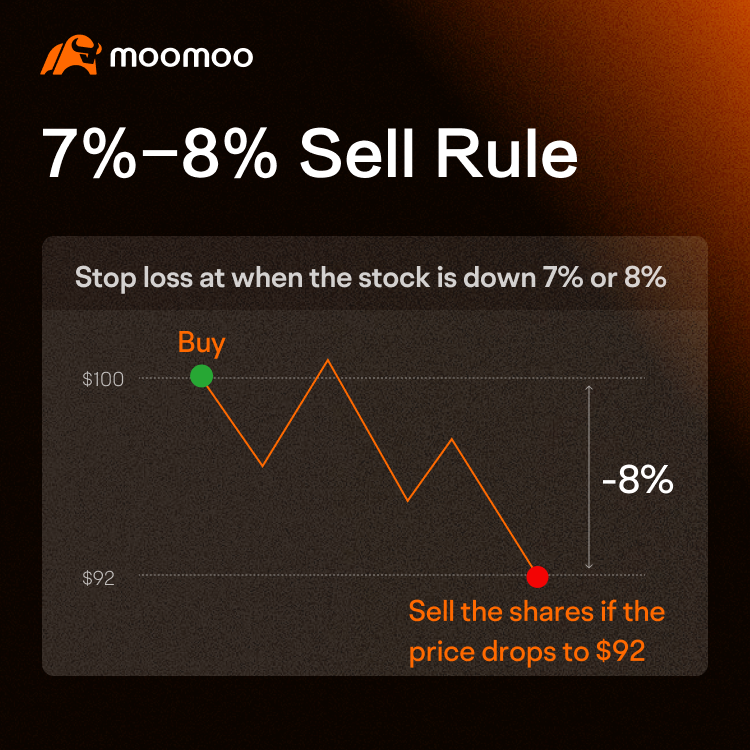

Cutting losses is one of the most important principles in stock trading. It involves setting a price point at which you sell to prevent bigger losses.

Even if the stock price drops in the short term, traders may be optimistic about the company's long-term development and continue holding.

But here's the thing: if you don't cut your losses and keep waiting and hoping the stock will bounce back, you might end up in an even worse situation. ![]()

So, how to set the price point?

Some traders adopt a 7%-8% sell rule- when the stock price falls 7%-8% from the purchase price, they cut the loss.

– Pros: Ease of use, reduced emotional decision-making, and prevention of larger losses

– Cons: Frequent selling may lead to missing out on potential rebounds.

If you are still optimistic about the future development of the company and want to hold shares for a long time, then there are two methods that can help you reduce the cost of holding positions:

– Add positions at dips. You can use technical indicators to confirm the point of adding positions, such as the stock price falling to a key support level, RSI being oversold, etc. However, if the stock price continues to fall, potential losses will be magnified.

– Use covered calls. By selling calls, you can earn option premiums to offset losses. However, when using this method, selling 1 call represents 100 shares. If you hold less than 100 shares, the extra part will become a naked selling call. It is relatively risky.

The essence of swing trading involves predicting short-term price movements, initiating a position, and securing profits if the trade unfolds favorably.

There are many popular swing trading strategies, such as trading based on price patterns, channel trading, breakout trading, and the use of technical indicators.

It's important to note that, according to Bulkowski's statistics, the Bad Earnings Surprises pattern is not always effective. When making trading decisions, you also need to combine fundamental analysis and other technical indicators for a comprehensive judgment.

There are many possible reasons for prices dropping.

– Market sentiment.

– Deteriorating fundamentals.

– Technical pattern weakens.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Ahmad Albab yg Punya : what if stock price goes south before and after a good earning?

Warren Buffed : Hold. We

103157007 : 2000

104601585 : If fundamentals are good, we should consider holding

2024leggo : i exited yesterday, good thing i cut my losses, if not the losses would have been way too much. and scalped this stock a little yesterday and today.

Invest With Cici : Cool sharing. Learning how to stop loss is important in investing because it helps to protect your capital and manage risk.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

CamThao2019 : Good stocks will rise again

Banana Milk CamThao2019 : For sure mates, %

Banana Milk : Another ancient stock? MARA - few years back. Gold ETF alternatives have a good look for some in the stock exchange

104327919 : hold

View more comments...