Summarize the past and look forward to the future.

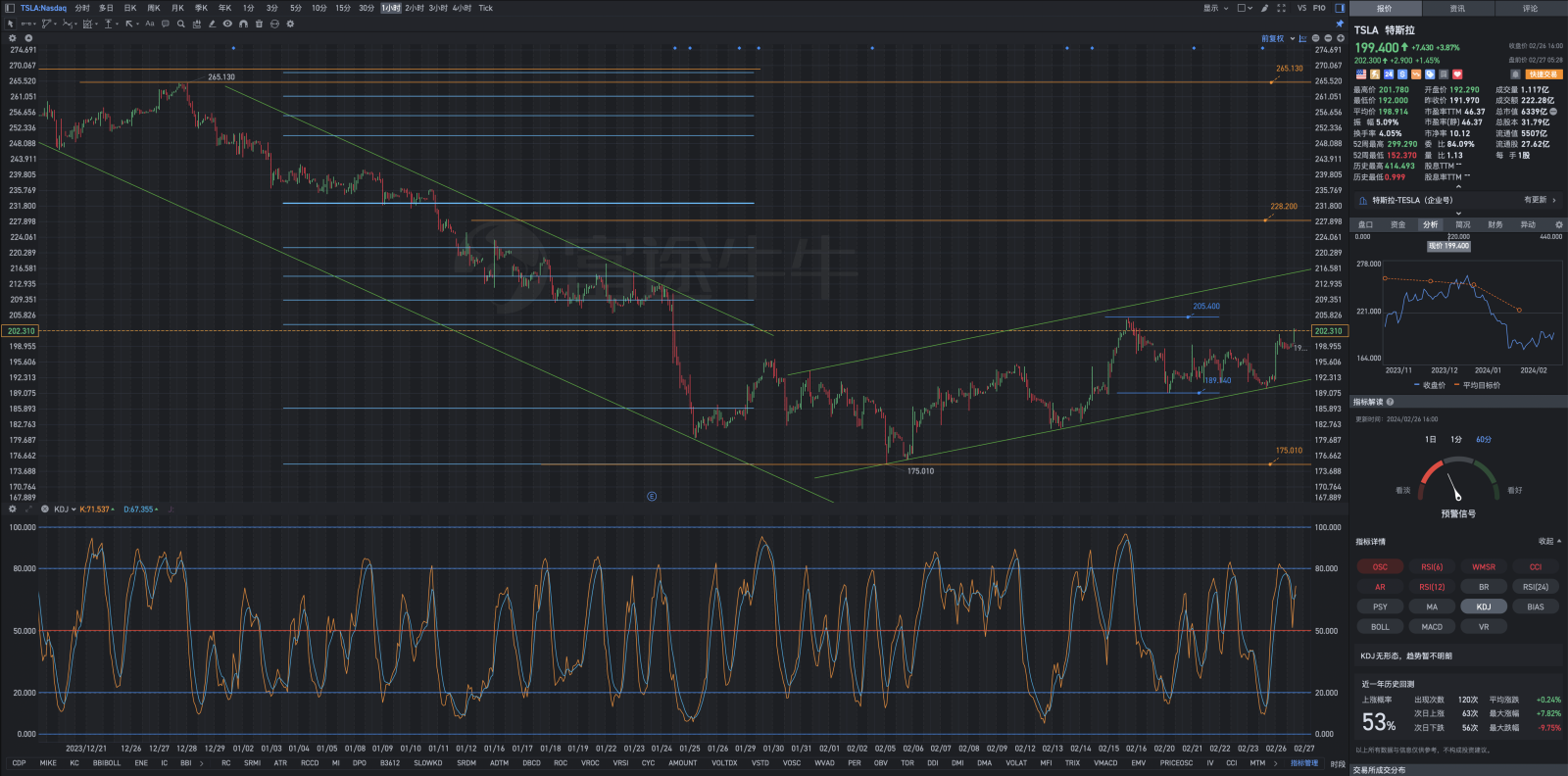

The essential summary must be kept in mind that what we will encounter in the future will also be of great help to current investment transactions. The factors that determine success or failure in life are wins and losses at critical moments and wins and losses at key events. The factors that determine the success or failure of life in the stock market are wins and losses during periods of major fluctuations in the stock market. Winning or losing at a critical moment depends not only on a person's professional experience, but also on a person's overall quality, as well as a moderate mindset and detailed rhythm. Tesla experienced an individual stock market crash in January and early February 2024, and many investors experienced the fate of many investors as a result. JC also experienced this Tesla stock crash firsthand (also experienced a sharp drop in Tesla's stock price before). Next, I will summarize the experiences and lessons of this stock disaster, hoping that it can become a valuable spiritual asset, and also have a clear understanding of the current situation, which is of great help to current operations.

Summarizing the past two months is also very helpful in understanding the future. The suffering experienced must be turned into wisdom and wealth, so this experience of suffering is worth it. The principles of thinking about operating strong stocks. Everyone in the stock market has it, and there is no shortage of neuroses. Some people are extremely underwhelming about Tesla. They don't approve of Tesla's strong stock at all. They think it was in the past. Yesterday, Tesla's stock price was just a set of ordinary car companies that didn't increase or decrease the series. They only had 50 or 30 values at most, and they couldn't let them be delisted.

1. Psychological principles: The state of technology and fundamentals are not particularly important; the authenticity of the subject and the trend trend at the time. The market isn't always right; financial magnate George Soros is very correct and important. JC is seeing that the vast majority of people in the market, including some large organizations, do not recognize Tesla as an AI (artificial intelligence) company. It is only an ordinary car company, and single-handedly focuses on interpreting Tesla's financial reports, undermining sales and boosting money. What is particularly surprising is that various media continue to repeatedly report negative news about Elon Musk and Tesla; it's not even news, but old news. In the end, Elon Musk had to personally confirm that Tesla is an AI high-tech listed company. It was only later that I saw media reports that Morgan Stanley analysts endorsed Elon Musk's statement. Behind Tesla, there are also a number of projects that not only far surpass the Artificial Intelligence concept, but even fall under the category of the second application level Quantum Technology Revolution (quantum technology revolution). Artificial Intelligence, or artificial intelligence, began 30 years ago, and large-scale applications have been around for a few years. An even more powerful Quantum Technology Revolution (quantum technology revolution) has arrived later. Compared to the Quantum Technology Revolution (Quantum Technology Revolution), Artificial Intelligence (Artificial Intelligence) is simply not worth mentioning; it's not on the same level at all. Surprisingly, almost all of Elon Reeve Musk's industrial projects are inseparable and inseparable from the Quantum Technology Revolution (Quantum Technology Revolution). Tesla, led by Elon Reeve Musk, is very forward-looking in the layout of the high-tech industry. Three 2022 Nobel laureates in physics, Alain Aspect (French physicist), John Francis Clauser (John Francis Clauser, American theoretical physicist and experimental physicist), and Anton Zeilinger (Anton Salinger, Austrian quantum physicist) talk about Artificial Intelligence and Quantum Technology in an interview Revolution's unanimous opinion. Elon Reeve Musk himself is a Fellow of the American Academy of Engineering. Who can say Tesla isn't likely to be a latecomer?

2. Principle of action: You must not only be decisive and heavy, but also keep a three-step rhythm. Don't covet a low price that you are not sure of; buy one if it is suitable; buy one more at a lower level; and buy another one when there is a strong impact.

3. Settlement principle: Smooth the flow and achieve huge profits, and let the profit run for a while; always hover around the cost price, settle early, and re-establish positions later. Handle the contradiction between huge profits and small losses and small profits, use success rates as your belief, and do a good job of stopping losses and gradually stopping profits.

4. Excessive pursuit of so-called speculative arbitrage to gain profit and avoid harm is not necessarily a good thing. The so-called ups and downs still have a lot of human factors. Stocks such as Tesla, which are both extremely forward-looking and have at least partially proven to have broad prospects, should be treated more from a medium- to long-term investment perspective rather than operating with short-term speculative trading arbitrage. Of course, it's best to have both. From this perspective, when Tesla's stock price continues to drop sharply, including hitting new lows, that is, graded batching, discrete random variables, and position opening layout. At a stage where the market has not completely changed from a downward bear market mentality, when Tesla's stock price is at a high level in the 15 to 60 minute short-term technical indicator function curve and corresponding function value, and the stock price stagnates again, it is entirely appropriate to split the position in two. 6:4 is more appropriate to cash out some of the gains and wins, and sell the stock. With this money, wait for an opportunity and then go down below to rebuild the position layout. Such a strategy can ease some of the anxiety of worrying about losing your chances of winning or losing them. A decline is a process of risk release, and an increase is a process of risk accumulation.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Mr Careful : I can still remember a lot of u are crying in the forum, worrying the price might go down further. this is just 24 hrs ago. now there is a sudden greed that price might go much higher. euphoria.