Super Micro Joins Nvidia, Tesla in Top Options Volume as Stock Tumbles

$Super Micro Computer (SMCI.US)$ attracted heavier options volume as the stock price slumped to the lowest since May 2023 after the developer of server solutions said it's unable to file its financial report for the quarter ended Sept. 30. That compounded concerns that the company could be delisted.

The company still hasn't hired a new auditor. Ernst & Young resigned in October, noting that it's "unwilling to be associated with the financial statements prepared by management.” In an earlier filing with the Securities and Exchange Commission, SMCI quoted EY as citing information that "raised questions, including about whether the company demonstrates a commitment to integrity and ethical values."

The latest delay adds to investor worries that came after the company missed an earlier deadline to file its annual report for the year ended June 30. In September, Nasdaq notified the company of its non-compliance to the exchange's listing rule that requires the timely filing. Under that rule, SMCI has 60 days to file its form 10-K, a comprehensive annual report submitted to the SEC.

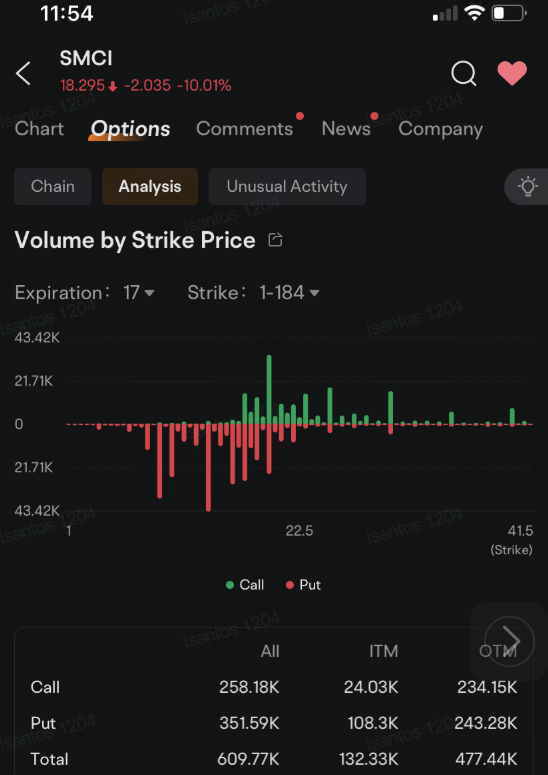

Source: moomoo mobile app

More than 609,700 put and call options changed hands as of 11:54 a.m. in New York Thursday across 17 expiration dates that stretch through Jan. 15, 2027. About 58% of that total is in put options amid rising demand for protection against further declines for a stock that has already seen an 84% slump from a record high in March.

That total volume made SMCI the third most active stock option, behind $NVIDIA (NVDA.US)$ and $Tesla (TSLA.US)$, exchange data tracked by moomoo showed.

That total volume made SMCI the third most active stock option, behind $NVIDIA (NVDA.US)$ and $Tesla (TSLA.US)$, exchange data tracked by moomoo showed.

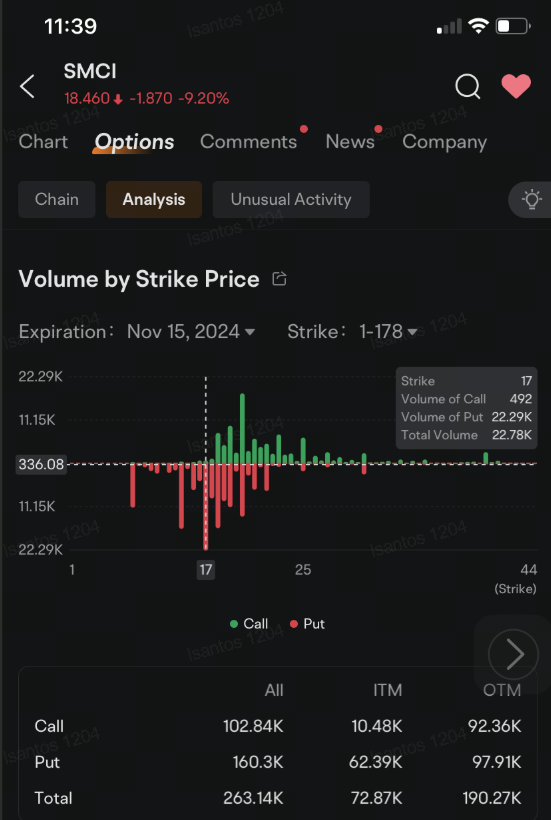

Source: moomoo mobile app

Put options that give the holders the right to sell the stock at $17 attracted the heaviest volume, with 22,290 contracts changing hands as of 11:39 a.m. in New York Thursday, almost double the open interest. The price jumped 200% for that contract that protects the holder from further stock price slump. The stock last traded at $18.43, down 9.4%.

That's a steep descent from a record high of $122.90 reached in March, the same month the stock joined the S&P 500 index. The rally came amid market frenzy of stocks that are viewed by investors to be the beneficiaries of increasing demand for artificial intelligence. By Aug. 28, when the company announced the delay in filing its annual report, the stock price has tumbled 61% from that all-time peak.

Ernst & Young wasn't the first to raise issues over SMCI's financial statements. In April, former SMCI employee Bob Luong filed a whistleblower lawsuit accusing the company of accounting violations, according to a Wall Street Journal report. Hindenburg Research announced it placed bets against the company's stock in late August, citing in part the allegations made by Luong, according to the report.

The company will likely ask for an extension beyond Nov. 16 of its annual and quarterly filings with Nasdaq, Woo Jin HO, a senior analyst at Bloomberg Intelligence, wrote in a note Wednesday. "Though we expect the company a plan by the deadline, what's unclear is whether it will be enough to satisfy the Nasdaq enough to avoid the delisting process."

Share your thoughts on SMCI or any other stock that you're watching in the comments section. Do you see SMCI heading back to its previous record high? If you have a price forecast for SMCI, please vote below.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Patientvirtue : DC

73372627 : If delist, will be one of the bigger capital market on the OTC and probablly the most traded stock there. If also there will not fill the forms, then interesting to see who will offer to merge or buyout: HP or NVDA or other????

Interesting that no insider sell or Institutional. Something fishy here.

arkar0225 : Terrible…

Space Dust : will Nvidia join SMCI?

Jermy123 : if delisted, what happened to one's share that they own in this company?

Nzm Nhr : No hound dogs (auditors) means no one can sniff any

374250 : Because I just bought it, I hope it can appreciate.

Shatavia Eskdrige077 : https://medium.com/@vaughnmcnair0/dont-miss-grandmaster-obi-live-on-friday-11-15-24-at-8-15-am-ct-your-path-to-market-success-c812d0f206f8

Looking4World : Let me ask a question: If a company is delisted, what would the value of a bearish put option be after the delisting?

美股小旋风 : There has been a violent surge before the market opens.

View more comments...