Taiwan Semiconductor: Strong Buy, note before Q3 earnings

*Disclaimer: I DO NOT own TSMC stocks and this post reflects my personal views. Always DYOR (Do your own research).

TSMC is going to release 24Q3 earnings result on next Thursday(10/17), some ideas to explain why I am bullish and suggest considering a buy.

Recent Performance

$Taiwan Semiconductor (TSM.US)$ has significantly outperformed market indices YTD, achieving a 85% return compared to the S&P 500's 21% gain. The company's Q2 2024 earnings exceeded expectations, with net income growing by 36.3% and revenue by 40.1%, driven by increased demand for 5nm and 3nm products. This growth positions TSMC at the forefront of the semiconductor industry, benefiting from the AI and mobile phone sectors.

Earnings and revenue projections

For Q3 2024, TSMC anticipates revenues between $22.4 billion and $23.2 billion, marking a 31.8% increase from Q3 2023. Analysts project earnings per share of $1.79, reflecting a 39% yoy growth. The company's consistent track record of surpassing earnings expectations suggests potential for further upside surprises in its financial performance.

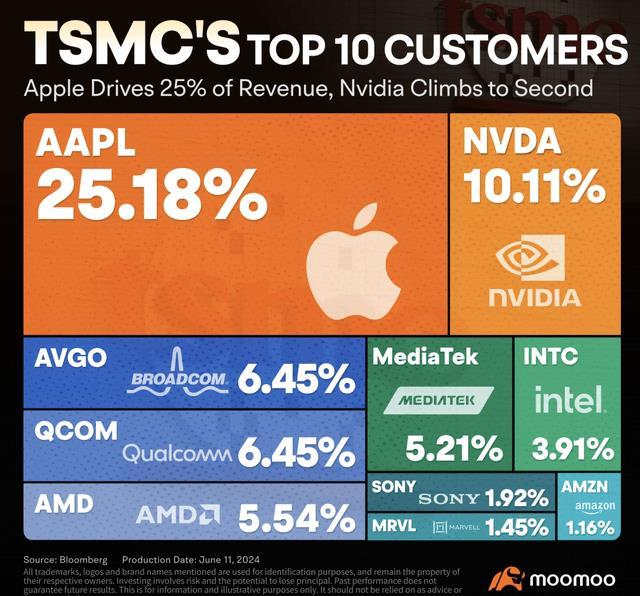

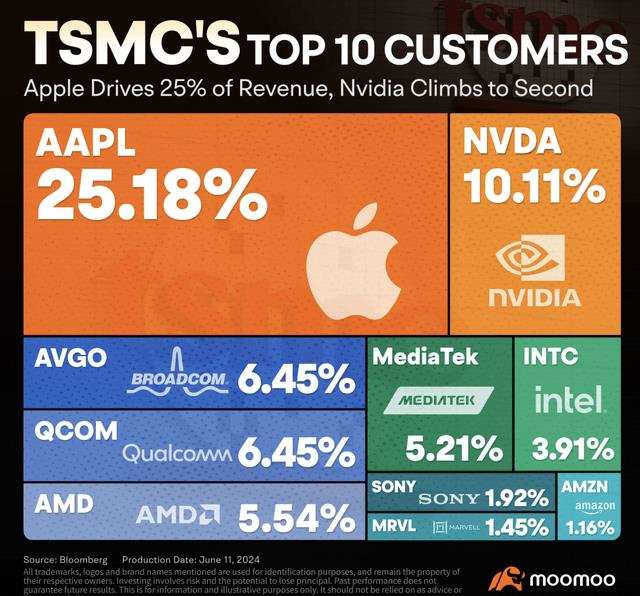

Growth drivers - AI

TSMC holds a commanding 62% share of the global foundry market, cementing its position as the go-to provider for cutting-edge semiconductor solutions. This dominance provides TSMC with significant pricing power and the ability to secure long-term contracts with major tech companies such as Apple, NVIDIA, and AMD. The company's leadership in manufacturing 5nm and 3nm chips positions it uniquely to capitalize on the increasing demand for high-performance computing. Recent sales figures show a 39% yoy increase in September revenues, reinforcing TSMC's role as a key supplier to AI giants like NVIDIA. The company's strategic investments in AI chip capacity are likely to yield continued revenue and earnings growth.

Option bets ahead of earnings

In the past two weeks, the largest options trade for TSMC was a call option with a premium value of $3.17 million, a strike price of $160, and an expiration date of January 17, 2025. Such a large, deep in-the-money call option suggests that the buyer is highly optimistic about TSMC's prospects. If you're considering investing, you might consider buying a deep-in-the-money call option like this with a very small amount of capital instead of going all in. Always DYOR.

Valuation

Despite its recent rally, TSMC remains attractively valued with a forward P/E ratio of 28x for 2024, which is significantly lower than peers like Intel(~90x) and AMD(~50x). This valuation, coupled with TSMC's dominant 62% global foundry market share, underscores its strong investment appeal. While the forward P/S ratio of about 11x is slightly elevated, when compared to Qualcomm (4.39x) and Intel (1.9x).

Final thoughts

TSMC's robust financial performance, attractive valuation, and strategic market position make it a strong buy ahead of the Q3 earnings release. The company's ability to capitalize on AI demand and its dominant market share suggest potential for continued growth and value creation for investors. As such, I am bullish on TSMC with confidence that the company will continue to outperform market expectations and deliver substantial shareholder value.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Dan’l : Thank you, MONTA CFA, yet again… sure hope folks listen, and follow/share.

MONTA CFA OP Dan’l : Really appreciate your supports. It means a lot to me. Have a good one!

Dan’l MONTA CFA OP : Thanks; your kindly noticing reminded me that I’d completely forgotten $Taiwan Semiconductor (TSM.US)$ (which came to me as a bought lesson, at higher after-hours cost ~;-)