Tesla Q4 2023 Earnings Preview: Growth Challenges, Falling Margins, and Hefty Valuation

As the market anticipates $Tesla (TSLA.US)$'s Q4 earnings, the automaker wraps up a year marked by aggressive price cuts that boosted deliveries to record highs. However, these measures to enhance vehicle affordability have taken a toll on profit margins, with the average selling price declining more rapidly than production costs.

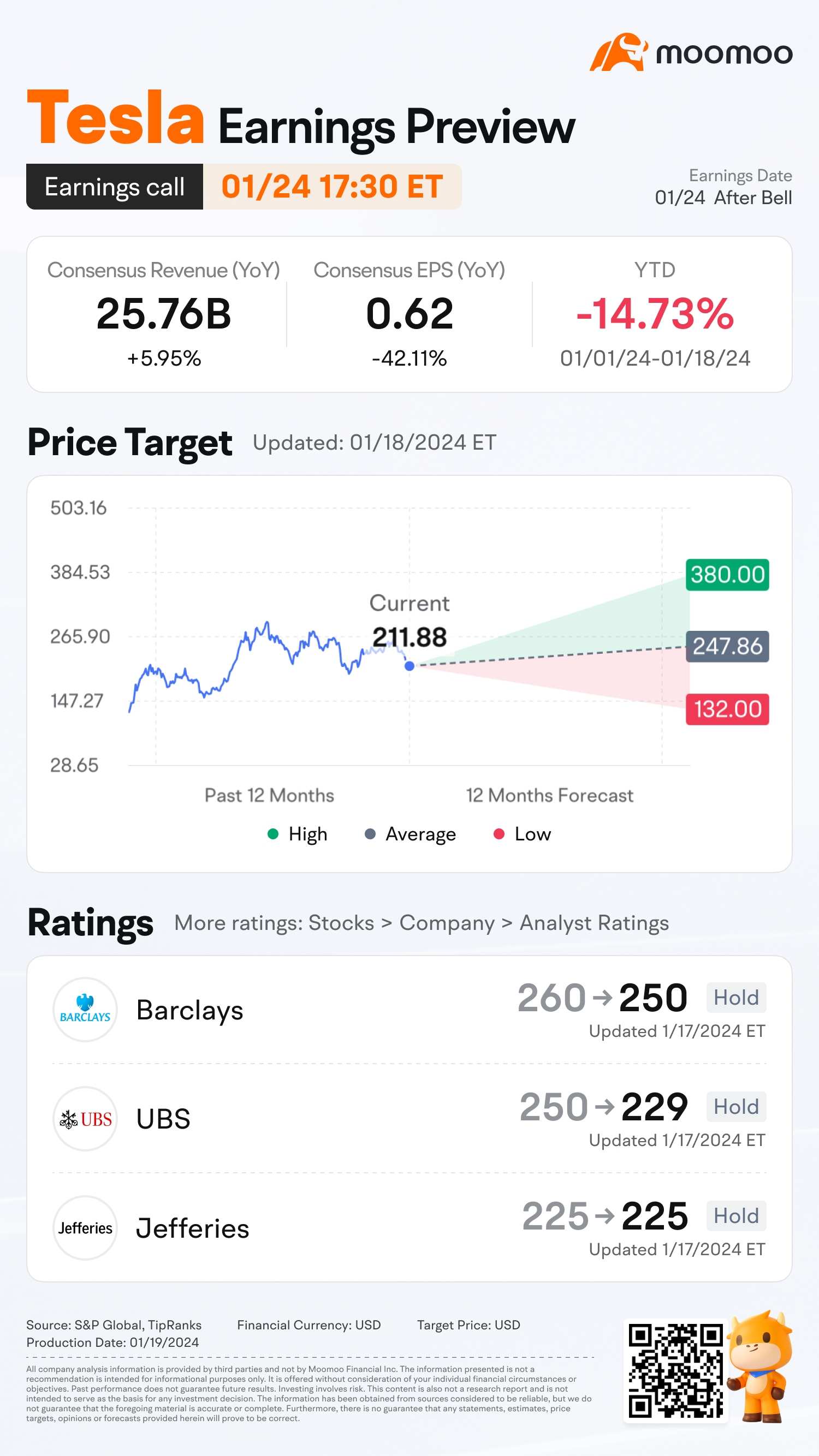

Analysts predict a year-over-year dip in earnings and increased revenues for Tesla's Q4 of 2023.

Consensus Estimates

● Earnings of $0.62 per share, down by 42.11% compared to last year.

● Revenues expected to climb 5.95%, reaching $25.76 billion.

● An average price target for Tesla at $247.86, indicating a potential 16.98% increase from its closing price on Jan. 18th.

Growth

In 2023, Tesla's global electric vehicle deliveries reached approximately 1.81 million, marking a 38% increase from the prior year, albeit with a slight deceleration in growth as the company navigates a more competitive market landscape. In contrast, BYD's sales surged, with the company selling close to 1.6 million battery-powered vehicles, a significant jump of over 70% from 2022.

Tesla fell behind BYD in Q4 2023 EV sales as growth slowed

Barclays analyst Dan Levy believes the most central theme for Tesla in 2024 is that it faces volume pressure in a demand constrained environment. This year marks the first time in the company's history that volume will likely be more a function of demand than of Tesla's production capacity, possibly causing investors to revisit long-term volume expectations. The firm expects Tesla to deliver 1.97M units in 2024, below the consensus at 2.19M units, and marking "only" 9% year-over-year growth in deliveries.

Tesla currently lacks immediate catalysts for significant revenue growth, with the Cybertruck's substantial impact not expected until 2025 and no definitive timelines for lower-priced model launches.

Revenue growth comparisons showed Tesla's rate slowing down while the auto industry accelerates, though Tesla still outpaces its peers.

Automotive Margins

The core narrative for the Q4 earnings remains centered on Tesla's shrinking margins. The past six quarters have revealed a downward trend, influenced by falling average selling prices and stable vehicle production costs.

Despite Tesla's price adjustments to stay competitive, particularly against BYD in China, the company's gross profit margin has suffered, dipping to 17.9% in Q3 2022 from the 2022's 25.1%.

There is risk to the consensus core auto margin estimate of 17.1% for the December quarter due to the ramp in Cybertruck, said Tesla bull Gene Munster, Managing Partner at Deepwater Asset Management. Despite the decline, Munster said this is a "directional positive" as it would end Tesla's four-quarter declining margin streak. Munster expects CFO Vaibhav Taneja to guide to stable margins during 2024. He, however, sees core auto margins to come in at 17-18%, below the current consensus of about 18.5%.

It is worth noting that other automotive companies are not seeing a similar decline in their margins profile.

Strategic Moves

Tesla's strategic price reductions align with its broader vision of increasing vehicle accessibility and market penetration. This approach also aims to strengthen its AI-driven automotive technologies, including the Tesla Dojo supercomputer for Full Self-Driving (FSD) development.

Munster said he agreed with Tesla CEO Elon Musk's view that a polished FSD would become a reality as the company has the best "real-world AI team in the world."

"We will see a ChatGPT moment when it comes to FSD, when the product quickly moves from a science product to a must-have mainstream feature," Munster said. He, however, questioned whether FSD will become a reality in three years.

The following chart's upward trajectory is intensifying as Tesla aims to make its cars more accessible, catering to the mass market.

Reaching the mass market also hinges on Tesla rapidly expanding its supercharger stations, which have exhibited robust growth, averaging 32.5% year over year for the past five quarters.

Valuation

Tesla's valuation reflects its potential in areas like FSD, Optimus, and Energy Generation & Storage, despite these segments being in early stages or contributing modestly to revenue. The valuation band may be more comparable to the "Magnificent 7" rather than traditional automakers.

Currently, Tesla's stock trades at 63 times the projected earnings for 2024, compared to lower P/E ratios for $NVIDIA (NVDA.US)$, despite Tesla's slower anticipated earnings growth of 29.9% and sales increase at a 22.5% compound annual growth rate over the next two years.

Tesla's one-year forward P/E is also at a hefty 96.3% premium to the average 32.1 P/E ratio of "Magnificent 7". This premium pricing reflects confidence in Tesla's long-term growth, despite current earnings and sales growth projections.

Besides hefty valuation, Jefferies analyst Philippe Houchois said that Musk's demand for more Tesla control "raises the risk of near-term de-rating and further volatility" because Tesla's valuation multiples are already factoring in significant upside from nonauto activities.

Source: Seeking Alpha, GuruFocus, Forbes, Tesla, Benzinga

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpyderCall : Musk himself stated that the end of 2023 would be tough. But he also said that he would buy the dip if there was a dip. So far, it doesn't look like this current dip is over.

ZnWC : The article is very informative but tends to focus on only the negative perspective. It is a good practice to look at the earning expectations on both sides - negative and positive. I shared a few points (or articles) which we should also consider before the earnings release. Here is the link to my post:

Additional Information you should know prior to Tesla Q4 Earnings Release

https://www.moomoo.com/community/feed/111785273982982?global_content=%7B%22invite%22%3A%22101709443%22%2C%22promote_content%22%3A%22mm%3Afeed%3A111785273982982%22%7D&data_ticket=212ca245a589f1e400fb2e247953bc77&futusource=nnq_noticetab&content_type=feeddetail&channel_name=10

Revelation 6 : Never underestimate Mr. Musk. Never.

ZnWC SpyderCall : Besides Tesla, other EV stocks like Rivian, Lucid, BYD, Nio, Xpeng, Li Auto etc are experiencing sell-off. The media blames Tesla's price cutting but data shows that the downtrend started even before the latest price cut was announced which implies that it could be due to other reasons like China's weak economy performance and EV demand falling.

Will the share price of EV stocks in general dip further? Many analysts said they are 'oversold' and rate the EV stocks as 'buy'. Anyone can easily check the TA indicators using Moomoo app to confirm. Buy the dip, sell now or hold, I think no one is certain in the short term.

We like to conveniently compare Tesla share price with the other Magnificent Seven stocks. But ignore the fact that Tesla and other EV stocks prices move in the same direction most of the time. Based on investopedia, I learned that we should compare stock valuations like P/E or P/B ratio under the same industry and within the same period. When it comes to Tesla stock, such basic knowledge is selectively forgotten.

NIO Down Nine Consecutive Days, Longest Losing Streak Since March 2020

https://www.moomoo.com/community/feed/111783585579014?global_content=%7B%22invite%22%3A%22101709443%22%2C%22promote_content%22%3A%22mm%3Afeed%3A111783585579014%22%7D&data_ticket=212ca245a589f1e400fb2e247953bc77&futusource=nnq_personal_host

SpyderCall ZnWC : Very often, you will see companies within the same industry have their share prices move in sentiment with one another. It happens in just about every sector or industry.

TSLA is definitely trading well above its industry average. It could be argued that TSLA is the leader of the EV industry, and the valuation is justified. It can also be argued that the share price is overvalued based on the extremely high ratios.

I'm assuming that investors have priced in massive future growth. If this next earnings report doesn't reflect this already priced in future growth, then we might see more selling.

MonkeyGee SpyderCall : really great explanation!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

bullrider_21 SpyderCall : Earnings this year is expected to be weak.

ZnWC SpyderCall : Thanks for the clarification. I recently read an article which implies that a better way to measure valuation is to use both price-to-earnings and growth, PEG ratio, a favorite metric of famed hedge fund manager Peter Lynch. Since high P/E companies tend to have high growth rates, the PEG is a good way to compare valuations of both high- and low-growth stocks.

Lynch theorized that an accurately valued stock would trade at a PEG of 1, while a PEG over 1 would indicate the stock was overvalued, and a PEG under 1 would mean that it's undervalued. Based on recent data, Tesla trades at a moderate PEG of 2.3. That ratio actually makes the stock looks cheaper than the average stock on the Dow Jones Industrial Average, which has a PEG of 4.74. Tesla is also relatively not expensive if you compare the PEG ratio with S&P500, which has an estimated ratio of 2. See also PEG chart of Magnificent Seven Stocks.

Based on trending, EV stocks including Tesla will continue to be bearish in next week but it may not conclude that the stocks are overvalued. Tesla's earnings may look better than expectations if you compare the EV industry and I'm more worried about those EV companies which are currently in net loss and still follow Tesla EV price cutting strategy.

https://www.google.com/amp/s/www.barrons.com/amp/articles/magnificent-seven-stocks-peg-ratio-c259b161

SpyderCall bullrider_21 : That appears to be the consensus.

SpyderCall ZnWC : Good stuff. I haven't followed PEG ratios before.

View more comments...