Tesla Q2 deliveries dropped Y/Y while stock flies

Tesla Q2 deliveries dropped Y/Y while stock flies

Views 896K

Contents 484

Tesla's second-generation humanoid robot, Optimus, will make its debut at the World Artificial Intelligence Conference for the first time.

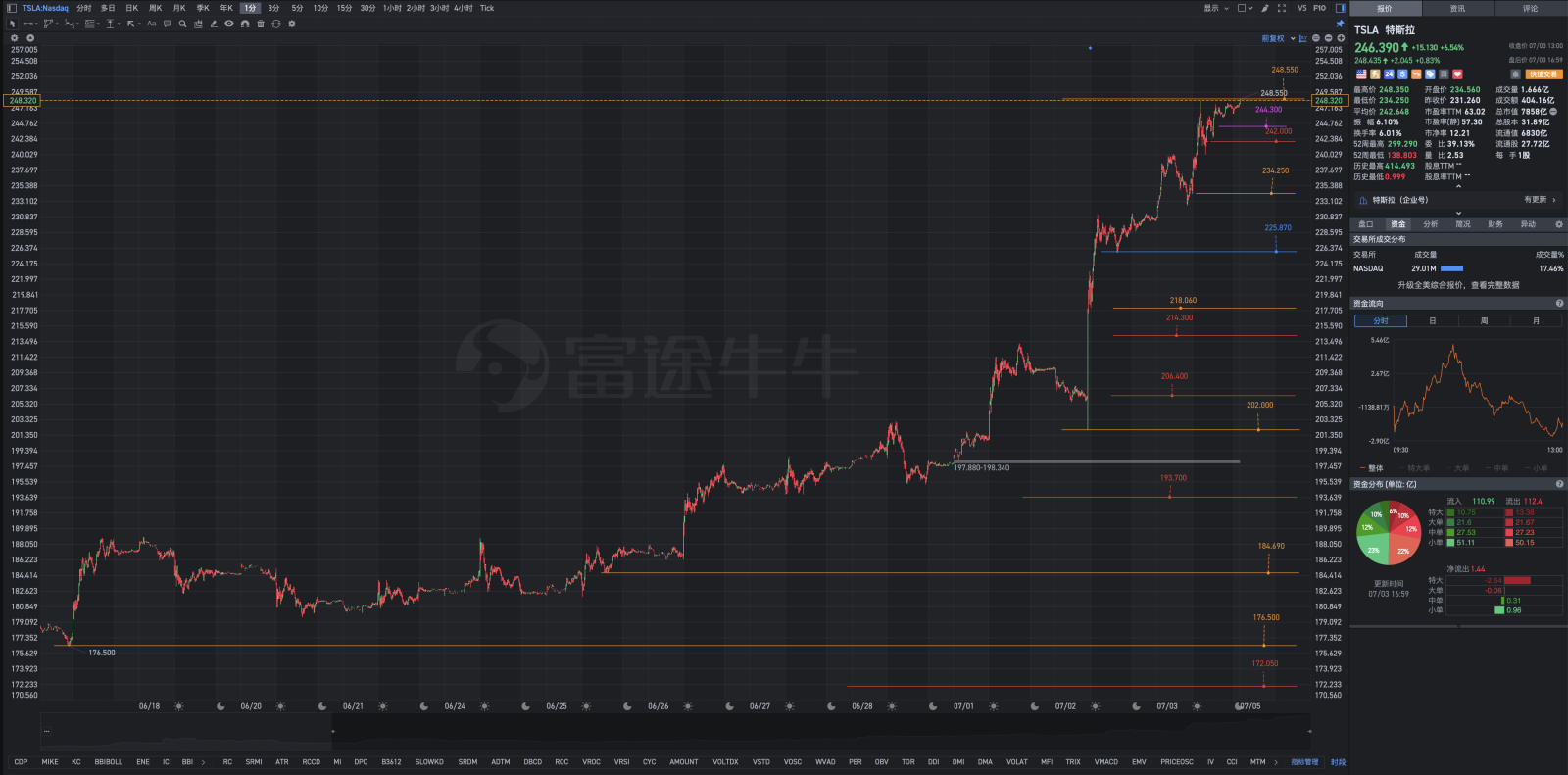

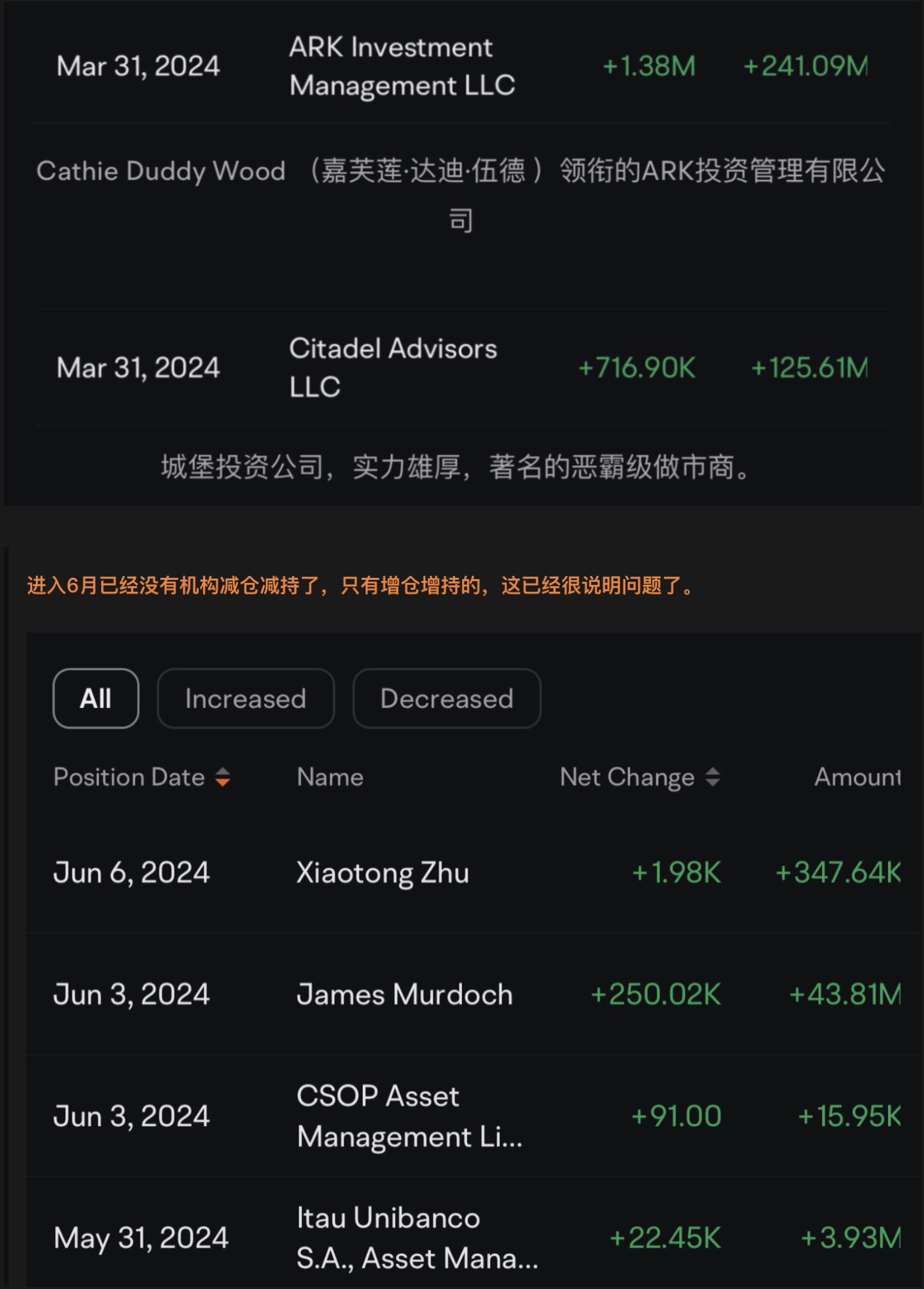

The stock price is constantly reaching new highs, leaving no time for chart updates. Even so, there are still foolish Tesla speculators who aim to sell high and buy low, and sell low and buy high. In the end, they end up sitting on a volcano and self-immolating. It is truly astonishing to see someone so greedy, completely disregarding the principles of 'uncertainty' and 'spatial orientation obstacles'.

On the evening of July 3rd, Tesla's official Weibo announced that the second-generation humanoid robot Optimus will make its first appearance at the 2024 World Artificial Intelligence Conference in Shanghai from July 4th to 7th, witnessing the further evolution of humanoid robots.

Below are some viewpoints from analysts of major financial institutions on Wall Street that were released before the significant rise in Tesla's stock. Read them and appreciate the wit.Happy Independence Day!

Major analysts at large banks support Tesla: a strong rebound will begin in the second half of the year, and Robotaxi is the turning point!

Renowned strategist Dan Ives from Wedbush stated that Tesla's stock price is expected to rebound in the second half of this year, as the situation of this struggling electric car manufacturer is finally turning around.

Ives stated that the release of Robotaxi in August may represent a major turning point for Tesla's stock price. He previously referred to this robot taxi as the company's "magical model".

He believes that Musk's comeback story will start with the Robotaxi day in August. He said, I believe that this stock will soar in the second half of this year. I think that Tesla's stock price is telling you... the worst time for Musk and Tesla is over.

For years, Ives has always believed in Tesla's growth potential. Despite a jump of 6% on Monday, Tesla's decline this year has exceeded 21%. The company previously announced a new car purchase financial policy in China. This includes a 0% interest and low interest purchase policy for 1-5 years for the Model3/Y standard range version in China, with a daily rate starting as low as 85 yuan.

He expressed optimism about Tesla despite its lackluster performance in 2024. Ives previously stated that the decline in Tesla's stock price in 2024 was mainly due to weak demand for electric vehicles, intensified competition in the Chinese market, and multiple legal disputes related to Musk.

But Ives said that these unfavorable factors are easing, especially as the situation in China begins to stabilize. Tesla has stopped lowering prices for its main models, which may be a sign of strengthening demand.

"Tesla has encountered significant competitive resistance in China, but now we see it coming back strong," he said.

Ives said that Tesla's second-quarter delivery data, scheduled to be released this Tuesday (July 2nd), may be disappointing, but this could be the automaker's "last bit of bad news."

Currently, the market widely expects Tesla's deliveries in the second quarter to face challenges again. According to a survey by the London Stock Exchange Group (LSEG) of 12 analysts, the expected deliveries in the second quarter of Tesla are 0.438 million units, compared to 0.466 million units in the same period last year. Among the seven analysts, expectations have been significantly lowered in the past three months.

This could be the first time that the world's largest electric vehicle manufacturer has seen two consecutive quarters of declining deliveries. In the first quarter, Tesla delivered 386,810 vehicles worldwide, down 8.5% from the same period last year.

Overall, Wedbush reiterated its "outperform" rating on Tesla with a target price of $275, implying a 31% increase from the current level. As of the time of writing, Tesla's stock was up 0.04% in after-hours trading.

Ives also said that if Trump is reelected, the related profitability may expand, as Trump is "pro-Musk" compared to Biden, who has been "actively ignoring" Tesla.

Other analysts seem less certain about the prospects for Tesla. Long-term investors and banking forecasters warn that the stock's downside potential could be as high as 91% ($14).According to FactSet data, the market expects Tesla's Q2 sales to decline by 6.5% to 0.436 million vehicles.Wells Fargo strategist earlier this year stated that this is due to critical issues in the company's business model and unfavorable factors that may continue for several years.

Tesla's Q2 sales figures are about to be released! The stock has rebounded over 40% from its low point, and major banks are shouting: it can rise another 50%!

According to FactSet data, the market expects Tesla's Q2 sales to decline by 6.5% to 0.436 million vehicles.

As July approaches, global electric vehicle leader Tesla is also about to announce its Q2 delivery data. Although FactSet data shows that the market expects Tesla's Q2 sales to decline by 6.5% to 0.436 million vehicles, it has not stopped the stock's strong rally, with an increase of over 8% in the past four trading days, temporarily surpassing the $200 mark.

Tesla's detailed sales data should be disclosed on the official IR website. However, a Weibo post this morning subtly revealed some sales information. In a Weibo post about Tesla's '5 years 0 interest' car purchase policy, it stated that 'Tesla's sales in June hit a new high,' but then realized it was inappropriate and deleted the related statement. We don't know how much of a boost this will have on Q2 sales, but at least we know that June's sales won't be too pessimistic.

Tesla has rebounded over 40% from its low point.

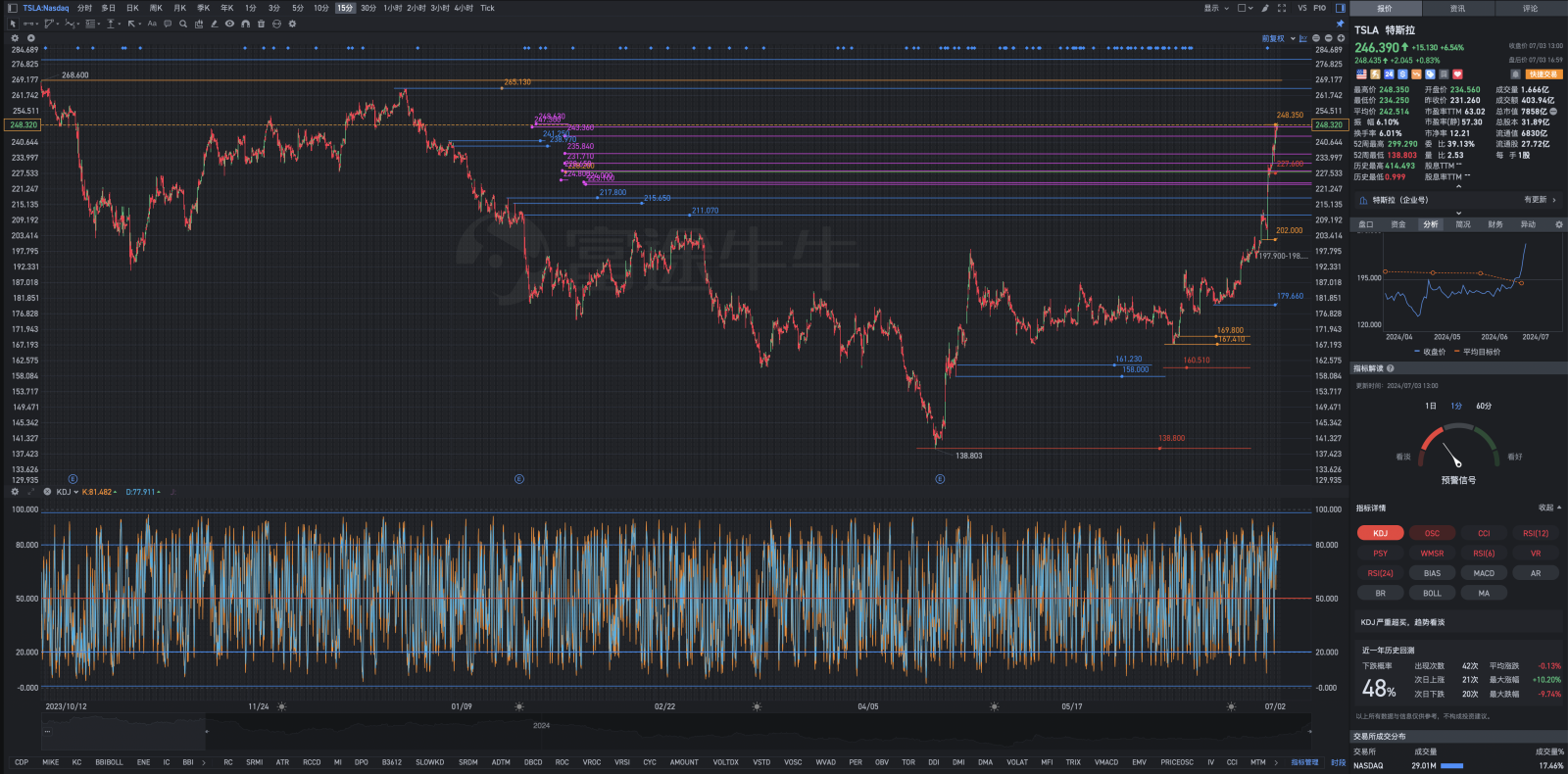

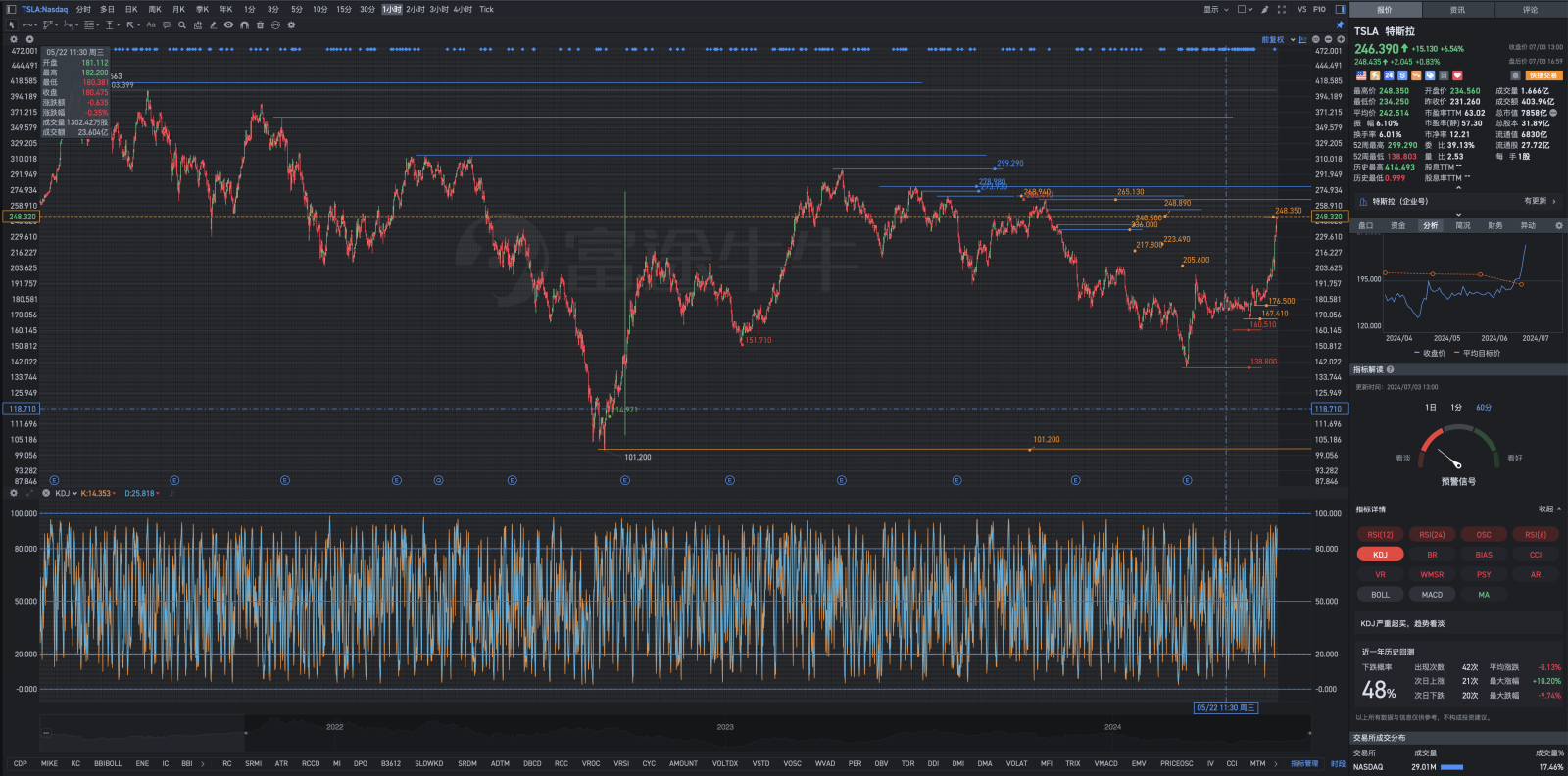

In the previous Q1, Tesla delivered 0.38681 million vehicles, the first year-on-year decline since the pandemic, which is much lower than the analyst's expectation of 0.44908 million vehicles. This also led to Tesla's stock price being in a downward channel for a long period of time, reaching a low of 138.8 US dollars at one point.

However, with the release of Q1 performance on April 24th and Musk reaffirming the importance of FSD and the accelerated launch of affordable models, Tesla has experienced a strong rebound. As of the close on June 28th, Tesla has rebounded by over 40% in a period of over two months. In the same period, as a 'new force in the car-making industry', NIO recorded only a 15% increase, while XPeng recorded a 12% increase and Li Auto fell by over 28%.

Debate between long and short positions on Wall Street.

Q2 sales volume is uncertain, and there are differing target prices for Tesla from major Wall Street institutions. The target price difference between JP Morgan and Morgan Stanley is as high as nearly $200. The largest bullish JP Morgan's target price is aimed at $310, which means Tesla still has over 50% upside potential.

Morgan Stanley: Tesla is the key 'ace' in the next round of AI investments.

Morgan Stanley analyst Adam Jonas believes that AI data centers are being built across the United States, and these data centers will become 'power-hungry giants', putting a huge burden on the US power grid. Jonas said that by 2030, the electricity consumption of US data centers could be equivalent to the electricity consumption of 0.15 billion electric vehicles. In other words, the projected growth in electricity consumption by US data centers from 2023 to 2027 is equivalent to adding 59 million electric vehicles on US roads, an increase of 21% in the total number of vehicles on the road.

And Jonas is bullish on Tesla's energy business, believing that the power demand brought about by the AI boom will make Tesla a key player in the US energy market.

Morgan Stanley predicts that Tesla's energy business will potentially increase its after-tax net operating profit by $3.95 billion by 2030, with an EPS of over $1. Morgan Stanley values Tesla's energy business at $130 billion. At the same time, Morgan Stanley raised Tesla's target price to $310 and gave it an 'overweight' rating. This means there is still over 50% upside potential.

Stifel: The forward-looking profit expectations have bottomed out, and the core technological advantages are obvious.

Last week, analyst Stephen Gengaro, under Stifel, also released a bullish report, covering Tesla for the first time and giving it a buy rating with a target price of $265, implying about 35% upside potential. Gengaro believes that despite the recent slowdown in electric car sales, Tesla's momentum will gradually improve with the expansion of the supercharging network, the launch of affordable models, and overall technological advancements:

From a financial and profit perspective, Tesla's long-term profit expectations have already bottomed out. Gengaro pointed out that the consensus expectations for Tesla's 2024 earnings before interest, taxes, depreciation, and amortization (EBITDA) have declined by 41% in the past 12 months. Consensus expectations for earnings before interest and taxes (EBIT) have dropped by 46%, and as "negative expectations gradually get revised," it may partially boost the stock price.

Gengaro is particularly bullish on Tesla's core technological advantages, believing that the company has no competitors in the electric car field:

"Traditional auto manufacturers lack the technical knowledge required for electric cars; they are far behind in this electrification game."

"And they don't have a CEO like Musk."

JP Morgan Chase:The future of Tesla's self-driving taxi business is uncertain.

In contrast to the optimistic attitude of Morgan Stanley, small Morgan analyst Ryan Brinkman believes that it may take many years for Tesla's self-driving taxi business to generate substantial revenue.

Brinkman mentioned that Tesla stated that its next wave of growth will be led by the introduction of low-cost models expected to be launched by 2025, which will utilize existing platforms and assembly lines instead of the previously planned next-generation platform.

Brinkman believes that this indicates a relatively small decrease in sales costs in the short term. J.P. Morgan Chase rates Tesla's stock as sell with a target price of $115.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more 7

7

PAUL BIN ANTHONY : very nice