The abnormal variations and frequency changes of Tesla to maintain an overbought state are the main reasons for wiping out the bearish short-selling group.

1. The uncertainty principle constrains.

2. The principle of spatial orientation obstruction constrains.

Entering the 'lucky month,' is there hope for another surge? Tesla's performance in November is mostly strong, with three major factors to watch for in the future.

Since its listing in 2010, November has been Tesla's second strongest month, with an average monthly ROI of 9.8% and a 71% probability of stock price increase.

Overnight, the US stock market belongs to Tesla!

After releasing the market-shaking Q3 performance, investors' enthusiasm was quickly ignited! Tesla surged unilaterally throughout the day, with the stock price soaring nearly 22%, marking its best single-day performance in 11 years.

Meanwhile, Tesla's total market cap skyrocketed by over $154 billion in a single day, equivalent to the combined market cap of 'Volkswagen + BYD,' propelling it back into the top ten of the US stock market by market cap.

After releasing the market-shaking Q3 performance, investors' enthusiasm was quickly ignited! Tesla surged unilaterally throughout the day, with the stock price soaring nearly 22%, marking its best single-day performance in 11 years.

Meanwhile, Tesla's total market cap skyrocketed by over $154 billion in a single day, equivalent to the combined market cap of 'Volkswagen + BYD,' propelling it back into the top ten of the US stock market by market cap.

Bull and bear arguments on Wall Street

Although the market has extreme recognition of Tesla's performance, there are still differences in future expectations among major Wall Street banks.

Bank of America analyst John Murphy aggressively raised Tesla's target price. BofA believes that by 2025, it will be "in a favorable position", and Tesla will usher in a "second wave of growth".

Although the market has extreme recognition of Tesla's performance, there are still differences in future expectations among major Wall Street banks.

Bank of America analyst John Murphy aggressively raised Tesla's target price. BofA believes that by 2025, it will be "in a favorable position", and Tesla will usher in a "second wave of growth".

Bull and bear arguments on Wall Street

Although the market has extreme recognition of Tesla's performance, there are still differences in future expectations among major Wall Street banks.

Bank of America analyst John Murphy aggressively raised Tesla's target price. BofA believes that by 2025, it will be "in a favorable position", and Tesla will usher in a "second wave of growth".

Although the market has extreme recognition of Tesla's performance, there are still differences in future expectations among major Wall Street banks.

Bank of America analyst John Murphy aggressively raised Tesla's target price. BofA believes that by 2025, it will be "in a favorable position", and Tesla will usher in a "second wave of growth".

Murphy stated that he is pleased to see the strong gross margin of the automotive business, with energy and service business (Tesla expected to double sales by 2025) gross margin higher than expected. Therefore, he raised the target stock price from $255 to $265 and maintained a buy rating on the company.

Morgan Stanley also remains bullish, with Morgan Stanley believing that by 2025, the annual growth rate of Tesla's electric vehicles will be 14% (2.07 million units), equivalent to a quarterly delivery of about 0.51 million to 0.52 million units.

The team believes that in the third quarter, investors are more focused on reducing car costs and improving the profitability of the automotive business, rather than attempting to assess the value of Tesla's transition to artificial intelligence and other businesses. Tesla remains Morgan Stanley's "top pick", with a target price of $310.

However, on Wall Street, the most bullish on Tesla is undoubtedly its 'die-hard fan', the well-known analyst Dan Ives from the American investment bank Wedbush. Ives stated that by combining profit margins with Tesla's artificial intelligence and self-driving products as well as other growth drivers, it will eventually bring a market cap of over a trillion dollars.

He said: "Now, price reductions have completely become a thing of the past. For Wall Street, this is a key factor in proving Tesla's ability to increase profit margins in the coming years as it continues its AI/FSD transformation."

Other Wall Street big shots bullish on Tesla include: Deutsche Bank analyst Edison Yu (target price of $295), Piper Sandler analyst Alexander Potter (target price of $310), and Truist Securities analyst William Stein (target price of $238).

JPMorgan analyst Ryan Brinkman's view is in contrast to them, as he believes that while investors may be excited about Tesla's unusually high profit growth, the catalysts driving this surge in stock price cannot be seen as long-term growth factors.

JPMorgan analyst Ryan Brinkman's view is in contrast to them, as he believes that while investors may be excited about Tesla's unusually high profit growth, the catalysts driving this surge in stock price cannot be seen as long-term growth factors.

He specifically mentioned that Tesla's quarterly profits and cash flow have improved, but the driving force behind it is indeed unsustainable. This includes the so-called 'selling carbon' revenue from selling carbon emission credits, and abnormally high operating working capital returns.

"Lucky November" approaching? Tesla's performance in November is mostly strong. A single-day surge of nearly 22% is inevitably causing investors to have "fear of heights", but looking back at history, the upcoming November can be considered Tesla's 'lucky month'. Since its IPO in 2010, November is the second strongest month for Tesla's performance, with an average monthly ROI of 9.8%, and a 71% probability of stock price increase.

A surge of nearly 22% in a single day is likely to make investors feel 'fear of heights', but historically, the upcoming November can be considered Tesla's 'lucky month'. Since its IPO in 2010, November is the second strongest month for Tesla's performance, with an average monthly ROI of 9.8%, and a 71% probability of stock price increase.

What other factors should investors pay attention to in the future?

USA election

Considering Tesla as a potential beneficiary of the 'Trump trade', if Trump wins in November, it may provide a good boost to Tesla's future performance.

Elon Musk recently pledged that before the November election, he will randomly select one lucky person each day from those who have signed an online petition supporting the American Constitution and give them 1 million US dollars. This means that by the official US election on November 5, Musk will have provided a total of 17 million US dollars in bonuses to the petition signatories.

In addition, another conservative Super Political Action Committee called 'Sentinel Action Fund' reported receiving 2.3 million US dollars from Musk.

According to Bloomberg, Trump has expressed his hope for Musk to join the government if he successfully wins re-election. Musk may be involved in the 'Department of Government Efficiency' (humorously abbreviated as DOGE), which is also synonymous with the cryptocurrency he supports.

FSD may be listed in Europe and China.

On September 5th, Tesla AI posted on the social media platform 'X' that Tesla plans to launch its advanced driving assistance system called 'Full Self Driving' in China and Europe in the first quarter of next year.

Several sources revealed that the Chinese government supports testing some FSD features under existing laws and regulations. However, the introduction of FSD to China has not yet been approved by regulatory authorities, and relevant assessments are still ongoing.

Considering Tesla as a potential beneficiary of the 'Trump trade', if Trump wins in November, it may provide a good boost to Tesla's future performance.

Elon Musk recently pledged that before the November election, he will randomly select one lucky person each day from those who have signed an online petition supporting the American Constitution and give them 1 million US dollars. This means that by the official US election on November 5, Musk will have provided a total of 17 million US dollars in bonuses to the petition signatories.

In addition, another conservative Super Political Action Committee called 'Sentinel Action Fund' reported receiving 2.3 million US dollars from Musk.

According to Bloomberg, Trump has expressed his hope for Musk to join the government if he successfully wins re-election. Musk may be involved in the 'Department of Government Efficiency' (humorously abbreviated as DOGE), which is also synonymous with the cryptocurrency he supports.

FSD may be listed in Europe and China.

On September 5th, Tesla AI posted on the social media platform 'X' that Tesla plans to launch its advanced driving assistance system called 'Full Self Driving' in China and Europe in the first quarter of next year.

Several sources revealed that the Chinese government supports testing some FSD features under existing laws and regulations. However, the introduction of FSD to China has not yet been approved by regulatory authorities, and relevant assessments are still ongoing.

In addition, there has been a recent traffic accident involving a Tesla with FSD that resulted in the death of a pedestrian, prompting the National Highway Traffic Safety Administration (NHTSA) in the United States to launch an investigation, which is also a risk that investors need to carefully consider.

Will the self-driving 'big cake' fall short again?

For the market, Tesla's innovation in autonomous driving technology is absolutely top-notch. Musk claims that by 2025, Robotaxi will be launched in Texas and California, but he has previously disappointed the market multiple times, leading to doubts about his statements.

As early as 2017, he promised to achieve fully autonomous driving from Los Angeles to New York by the end of that year – but obviously failed. In 2019, he predicted that 1 million autonomous taxis would hit the road by 2020 – yet this also turned out to be empty promises.

Therefore, whether next year's 'big cake' of Robotaxi can be realized will also become a crucial determining factor in its stock price trend.

Jefferies Financial is relatively pessimistic about this. Analysts believe that Musk has not provided 'verifiable evidence' of Tesla's progress in autonomous driving technology, and there is currently no precedent for achieving a higher level of autonomous driving based solely on visual methods.

However, at the earnings conference, Tesla CEO Elon Musk stated that if he were to obtain a potential position in the U.S. government, he would promote a more streamlined regulatory approach to approve the use of fully autonomous driving cars nationwide in the United States. Obviously, the prospect of Trump's victory has significantly increased the credibility of Robotaxi.

Will the self-driving 'big cake' fall short again?

For the market, Tesla's innovation in autonomous driving technology is absolutely top-notch. Musk claims that by 2025, Robotaxi will be launched in Texas and California, but he has previously disappointed the market multiple times, leading to doubts about his statements.

As early as 2017, he promised to achieve fully autonomous driving from Los Angeles to New York by the end of that year – but obviously failed. In 2019, he predicted that 1 million autonomous taxis would hit the road by 2020 – yet this also turned out to be empty promises.

Therefore, whether next year's 'big cake' of Robotaxi can be realized will also become a crucial determining factor in its stock price trend.

Jefferies Financial is relatively pessimistic about this. Analysts believe that Musk has not provided 'verifiable evidence' of Tesla's progress in autonomous driving technology, and there is currently no precedent for achieving a higher level of autonomous driving based solely on visual methods.

However, at the earnings conference, Tesla CEO Elon Musk stated that if he were to obtain a potential position in the U.S. government, he would promote a more streamlined regulatory approach to approve the use of fully autonomous driving cars nationwide in the United States. Obviously, the prospect of Trump's victory has significantly increased the credibility of Robotaxi.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

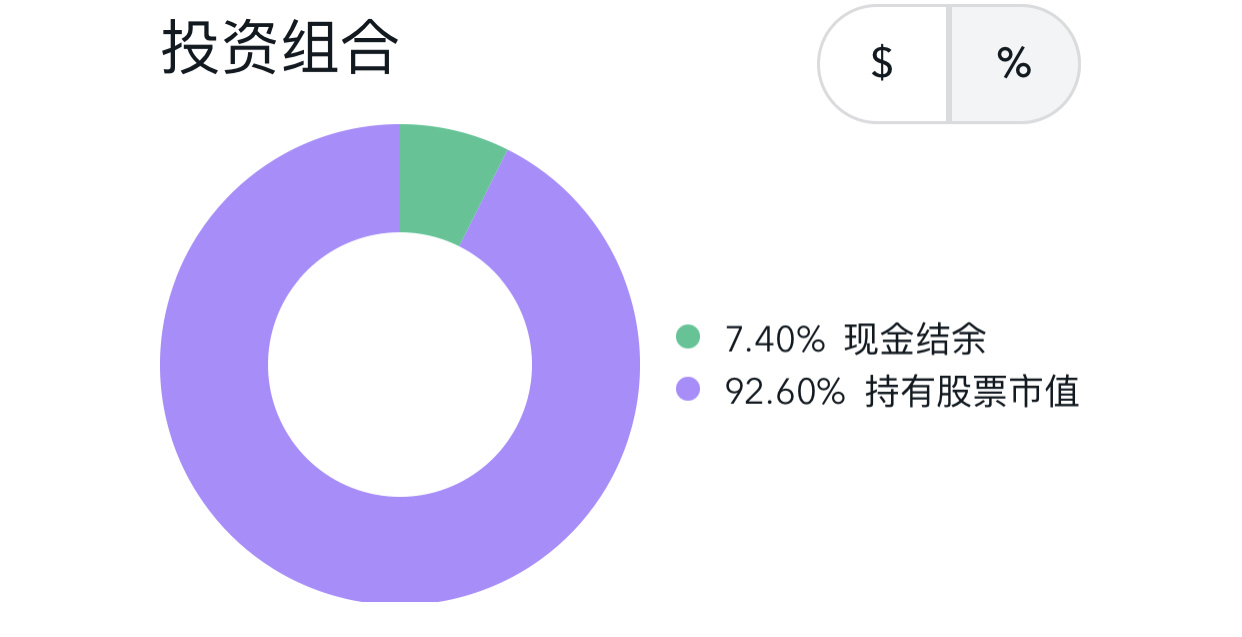

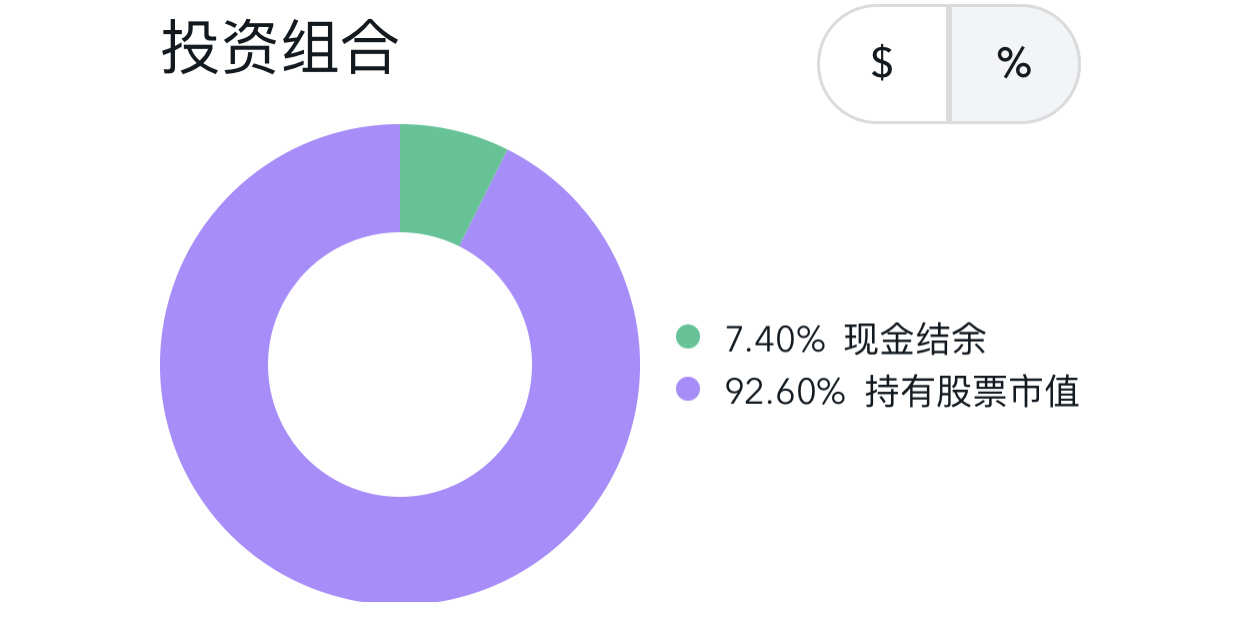

71066059 : Is the warehouse almost full?