I'll let you know what's great about JC later

The average price of JC's positions is so low that you can't imagine, because JC always opens positions when others are afraid to buy.

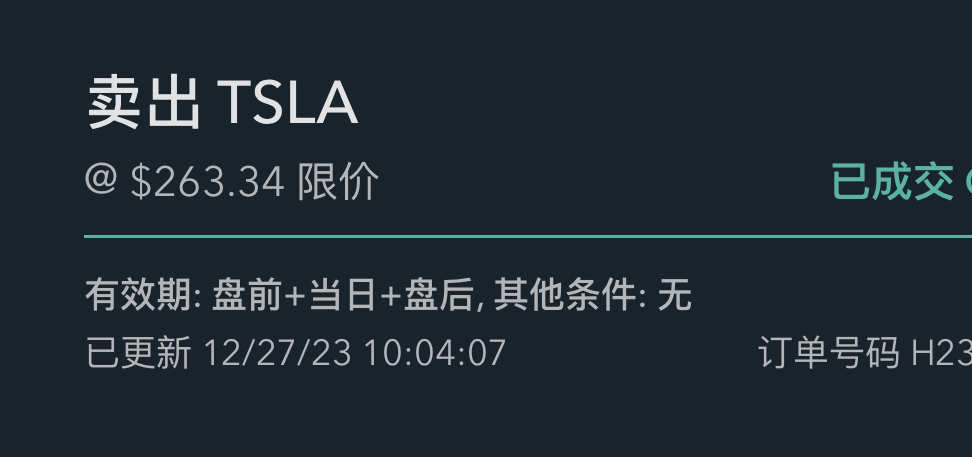

JC did the opposite when others refused to reduce their positions and lose pounds and redeemed their profits.

JC itself is a dynamic position, a flexible position.

These waves of feedback information are exactly what JC needs to verify its own findings.

Selling and closing a position is not at all the same thing as bearish short selling. Even these two things are unclear, and they dare to talk nonsense under JC under JC.

Give holiness, glory, praise, honor, etc. to the Lord Jesus Christ, who is God.

JC is an eternal bully (Tesla to be exact), don't you know?

Humiliated, indifferent to others. Look at people's faults and do no good to others. I feel that people are deceived, and I'm not outraged by others. Keep the container in your body and wait for it to move from time to time. If you want to be a goshawk, don't fight with birds.

JC attaches importance to the control of the time function and the function of time, accepts falling market trends, attaches importance to falling market losses, studies falling market declines, breaking down falling market trends, extracting future market gains from falling markets, and begins to open positions in gradients and batches in extreme regions of falling markets.

You like to predict and guide the world. You are good at dualism. It's either white or black; it's either rising or falling; at most, you just add another sideways trade, either going long or short. You rejoice in the rise and hate the fall. If you think of the stock market as a casino, or if you think of trading as playing for money and gambling, there are surprises, but more of them are hopeless. You never read charts; rich people use money to deceive people..., what else?

The JC family's ironclad trading rules (I can't emphasize repetition too much):

Winning in the falling market; winning in amplitude; winning in boldness; winning in wisdom; winning in open-mindedness; winning in learning; winning in change; winning in adapting; winning in mathematics; winning in physics; winning in models; winning in function; winning in vibration; winning in quantification; winning in framework; winning in moderation; winning in probability; winning in technology; winning in psychology; winning in dexterity; winning in the long term; winning in oscillation; winning in the long term; winning in investing: winning in mentality; winning in tolerance for error.

Losing to oneself; losing to oneself; losing in solidification; losing in abandonment; losing in self-reliance; losing in pursuit of strength; losing in rushing; losing in stagnation; losing unilaterally; losing in gambling; losing in protecting positions; losing in full position; losing in financing; losing in reversal; losing in Yongdong; losing in gambling; losing in complaining; losing on excuses; losing in scolding; losing in dreaming; losing in planning; losing in prediction; losing in the short term; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry Greed; losing mentality.

98% of people will never be able to give up on ups and downs or predictions, and there are no plans of any kind that use a certain percentage of the battle sequence of treasury funds as a strong and strong backing, so 98% can only end in failure. Trading earns a living, not being a stock slave, not an opinion fight (JC does not participate in opinion fighting, has no interest.) Instead, the investment deal wins.

Alarm bells are ringing: The first and last chapters of the Book of Wisdom both read “There is no empty lunch in the world.” Don't expect to read other people's post-market review chart analysis; you can make money without effort on your own. Here, at this moment, all of JC's posts are private pre- and post-market personal statements, research and exploration. There is no passionate struggle of opinions, stock recommendations, and even less spiritual soup. They cannot be used as a basis for trading. The resulting trading profits and losses can only be borne by oneself. Regardless of profit or loss, all blame is taken by oneself.

We have never known each other in the first place. What's more, even if you have any financial skills, it's easy to be treated as a scammer in this financial market where you play with money. Therefore, JC will not use research results as a vehicle for free money delivery at all, because there is no need for this. What are the so-called true friends in the financial markets? There is a long road ahead. Everyone walks their own way, and if they don't want to, then it's just that. If JC doesn't eat your meal, if you don't eat that kind of thing, you don't need to look at your face. Except for Jesus Christ (who is actually God, Father, Son, and Holy Spirit in one.) No one is afraid of JC.

Disclaimer: There is a lot of neurosis in the securities market, so it is better to explain clearly or clearly. This article is a personal trading journal, not opinions or individual stock recommendations. This is a well-structured US securities market, not an A-share securities market. Bloggers have a long-term operating style. However, under special circumstances, such as when the market is particularly good and the profit chip ratio exceeds 80-90% for a long time, the blogger will choose to sell and close the position to cash out the floating profit. The general market and individual stocks are bad, especially weak to extremely bad. For example, when the profit margin ratio is less than 21-7%, JC will choose a discrete random variable position layout in gradients and batches, so ordinary traders cannot imitate this operation.

Winning in the falling market; winning in amplitude; winning in boldness; winning in wisdom; winning in open-mindedness; winning in learning; winning in change; winning in adapting; winning in mathematics; winning in physics; winning in models; winning in function; winning in vibration; winning in quantification; winning in framework; winning in moderation; winning in probability; winning in technology; winning in psychology; winning in dexterity; winning in the long term; winning in oscillation; winning in the long term; winning in investing: winning in mentality; winning in tolerance for error.

Losing to oneself; losing to oneself; losing in solidification; losing in abandonment; losing in self-reliance; losing in pursuit of strength; losing in rushing; losing in stagnation; losing unilaterally; losing in gambling; losing in protecting positions; losing in full position; losing in financing; losing in reversal; losing in Yongdong; losing in gambling; losing in complaining; losing on excuses; losing in scolding; losing in dreaming; losing in planning; losing in prediction; losing in the short term; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry Greed; losing mentality.

98% of people will never be able to give up on ups and downs or predictions, and there are no plans of any kind that use a certain percentage of the battle sequence of treasury funds as a strong and strong backing, so 98% can only end in failure. Trading earns a living, not being a stock slave, not an opinion fight (JC does not participate in opinion fighting, has no interest.) Instead, the investment deal wins.

Alarm bells are ringing: The first and last chapters of the Book of Wisdom both read “There is no empty lunch in the world.” Don't expect to read other people's post-market review chart analysis; you can make money without effort on your own. Here, at this moment, all of JC's posts are private pre- and post-market personal statements, research and exploration. There is no passionate struggle of opinions, stock recommendations, and even less spiritual soup. They cannot be used as a basis for trading. The resulting trading profits and losses can only be borne by oneself. Regardless of profit or loss, all blame is taken by oneself.

We have never known each other in the first place. What's more, even if you have any financial skills, it's easy to be treated as a scammer in this financial market where you play with money. Therefore, JC will not use research results as a vehicle for free money delivery at all, because there is no need for this. What are the so-called true friends in the financial markets? There is a long road ahead. Everyone walks their own way, and if they don't want to, then it's just that. If JC doesn't eat your meal, if you don't eat that kind of thing, you don't need to look at your face. Except for Jesus Christ (who is actually God, Father, Son, and Holy Spirit in one.) No one is afraid of JC.

Disclaimer: There is a lot of neurosis in the securities market, so it is better to explain clearly or clearly. This article is a personal trading journal, not opinions or individual stock recommendations. This is a well-structured US securities market, not an A-share securities market. Bloggers have a long-term operating style. However, under special circumstances, such as when the market is particularly good and the profit chip ratio exceeds 80-90% for a long time, the blogger will choose to sell and close the position to cash out the floating profit. The general market and individual stocks are bad, especially weak to extremely bad. For example, when the profit margin ratio is less than 21-7%, JC will choose a discrete random variable position layout in gradients and batches, so ordinary traders cannot imitate this operation.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

ianisme :

Elias Chen OP : These waves of feedback information are exactly what JC needs to verify his own judgment.

70183665 ianisme : Great

Elias Chen OP : After throwing away the stock price, did it fall flat?JCBut there are still plenty of holdings. Hope is only short-term; only God knows the precise short-term concept; he is God. The principle of unfathomability is so powerful that you can't accept it.