Immortal Guidance 237.77?

Let's talk about two things first, say big or not, and say small or not. They are actually quite important things.

First, Ronald Stephen Baron, an American Jewish billionaire, investor, and philanthropist, has actually been eyeing Tesla's stock for a long time, but he has never invested, or has always been bothered by short-term technical trends. He believes that the stock price is too high, and it is always difficult to get started. At the time, the stock price had already risen 4-5 times. Ronald Baron decided to invest in Tesla until 2014, when he had the opportunity to meet Elon Musk in person and interview Elon Musk. He invested and bought 380 million US dollars of Tesla shares at an average cost of 43.07 US dollars per share.

Second, BlackRock, or BlackRock, their CEO, or CEO, Stephen A. Schwarzman, or Stephen Alan Schwartzman, also known as Su Shimin, a Jewish American billionaire, investor, philanthropist, and the 3rd US President George Walker Bush are all Yale alumni. They are also members of the Skeleton Club. They are optimistic about Tesla and the world economy (the world economy is bad, can you fish in muddy water? (Risk is the only chance.) It has always been divided into batches with falling point gradients, discrete random variables, and position opening layout. He is in China attending a summit hosted by top Chinese leaders. Don't think they can spend as much money as they want; they only spend money for a purpose, so they won't mess around with their investments (back then, Su Shimin spent 40,000 US dollars to share delicious food at the same table with her boss in San Francisco. As soon as the feast ended, it was Su Shimin who ordered the emptying of all of his business in Tianchao, leaving only cooperation with Tsinghua University and donating 400 million US dollars to charity and education programs — the Schwartzman Scholarship. Now he is in China again to attend the summit. (This is recent.) I don't know if Kuroishi will increase its Tesla holdings again in 2024 (it will increase its holdings in 2023), but in an unofficial interview, Su Shimin told a friend that they have bought a lot and are still buying them. If stocks aren't falling, can they be bought when they are rising? Heishi, Su Shimin, you can search and find out for yourself (preferably in English. More than 60% of the world's most important first-hand information is written in English; Chinese people like to cut down and block according to their own preferences).

Again, everyone is responsible for what they say and do, especially when it comes to investing and speculative games. We never knew each other before. The road was full, and we all went everywhere and did our own thing.

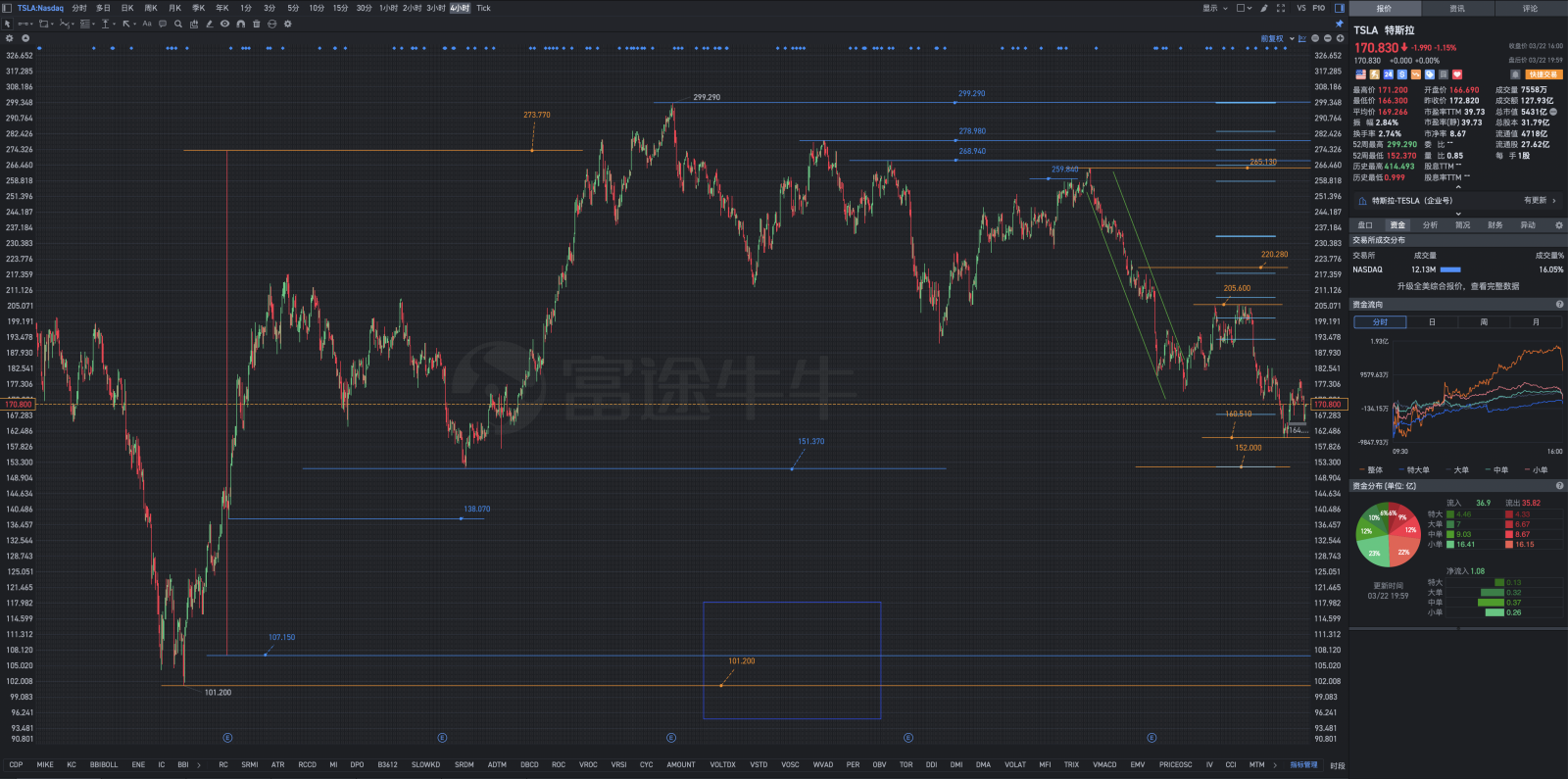

On Tuesday, January 24, 2023, one K-line was particularly remarkable: opening 143.890, high 237.770, low 107.150, closing 140.970, change of -2.920, increase or decrease of -2.03%, volume of 4.08 million shares, turnover of 587.4 million shares.

On Tuesday, January 24, 2023, the data on the daily chart was as follows: opening 143.000, high at 146.500, low at 141.100, closing at 143.890, up and down +0.10%, trading volume of 158.7 million, turnover of 22.773.9 billion, turnover of 6.06%, and price-earnings ratio of 88.11.

A mysterious Wall Street agency has tested Tesla's possible fluctuation range during the main trading period of January 24, 2022 and after-hours trading after that.

This mysterious Wall Street agency is actually BlackRock Inc., or BlackRock Inc., or BlackRock (Group), which is comparable to Wall Street's other top financial institution, The Vanguard Group (Pioneer Pilot Group). They are also known as Wall Street's two magic pins. They did a small test.

What can really support you is a rich knowledge reserve — theoretical physics and applied mathematics, modeling, quantitative analysis, functions, non-linearity; sufficient economic foundation — decent clothing, food, lodging, and travel; continuous emotional stability — trusting God, having an eternal future, and not following this world; a controlled rhythm of life — lifelong learning and progress, optimism and cheerfulness; and your unbeatable self — use your courage and wisdom to lock down one (one is enough) worth owning forever in the US stock, a relatively accurate surgical random discrete framework Variable position opening layout, flexible position long-term holding.

We're not originally from the same latitude: I don't know your world; you don't understand mine. Why must the position layout be reopened when the decline stops? The so-called bottom is originally the concept of a “group”; it is a “face” connotation. How can investment transactions be one-size-fits-all? Stocks anticipate the future. Depending on their growth, the standard configuration is a high price-earnings ratio. As long as it has a future and growth potential, even if profit margins fall over a long period of time, strategic investors can tolerate it, and Tesla can only be born in the US.

There is always an instinctive premonition when something bad happens, yet good things always come quietly and silently. Tesla's rare historical opportunity unwittingly came to you and me. Some people saw the downturn like a flood; others were eclectic and eclectic.

Investment trading arbitrage ultimately depends on results, isn't that the case? When you take a life cycle, what you see is the times and humanity, and what you see is the rules.

-- When you use a ten-year cycle, what you see is a change in common sense and rules.

-- When you take a cycle of three or five years, what you see is courage and vision.

-- When you use a one-year cycle, you believe in talents and abilities.

-- If you use the sky as a unit, if you don't have a background in theoretical physics or applied mathematics at the same time, you probably can't see anything; you can only hope for miracles and luck.

They are also people who have lost their share career, so why should they brag about it again when they meet?

-- When you use a ten-year cycle, what you see is a change in common sense and rules.

-- When you take a cycle of three or five years, what you see is courage and vision.

-- When you use a one-year cycle, you believe in talents and abilities.

-- If you use the sky as a unit, if you don't have a background in theoretical physics or applied mathematics at the same time, you probably can't see anything; you can only hope for miracles and luck.

They are also people who have lost their share career, so why should they brag about it again when they meet?

Pay attention to the decline, study the decline, take advantage of the decline, and use it for yourself.

The root area of Tesla's stock price history: 205.600-160.510; (The result of quantitative modeling analysis was a wide fluctuation in this region for a period of 4-7 trading months)

The flood zone at the root of Tesla's stock price history: 160.510-152.370-146.410; (The results of quantitative modeling analysis show that the probability is relatively small.)

Tesla stock price super extreme area: 101.810-36.600-23.370 (The results of quantitative modeling analysis showed that the probability was minimal.)

Currently, in the historical region of Tesla's stock price, 205.600-160.510: Always keep a clear mind, neither pessimistic, nor blindly optimistic.

The factors that determine success or failure in life are wins and losses at critical moments and wins and losses at key events. The factors that determine the success or failure of life in the stock market are wins and losses during periods of major fluctuations in the stock market; winning or losing at critical moments depends not only on a person's professional experience, but also on a person's overall quality, as well as a moderate mentality and detailed rhythm of handling.

All gains are born from falling trends. If this is the case, why should we be happy to rise and hate falling?

If you have a blueprint in your mind, you won't be pessimistic; you won't be afraid of the money and chips in your hands: you have to wait for the vast majority of people to rise and hate falling, depending on the stock price spill area of 162.900-152.370 (there is also time to wait until Tesla's stock price falls to 36.600-23.370 before you can rest easy.) It's like a flood beast, and you take it as a godsend: with the investment mentality of the strong and the strong and never coming back, resolutely open positions, withstand oscillations and all kinds of temptations, and consider cashing out some of the floats in the 183.810-205.600 region. There will definitely be a relatively high turnover rate here (it is determined that Tesla is only a car company, overtaken by EVs in mainland China. There are many people who watch Tesla decline. They will insist on selling Tesla at high prices and try to make a lot of money quickly. (Competition), pick up chips when technology is relatively low Come back. If the stock price conquers the 205.600-220.270 area and stabilizes at the upper limit of 220.270, it will start the main upward trend. The sword points to 265.130, and the target is 414.490. The future; it cannot be limited; it is extremely optimistic.

My own trading system is very high. I try to use mathematical modeling and quantitative analysis to do short US stocks, and the winning rate of US stocks is very low. I used practical experience and lessons to tell everyone, don't short US stocks. US stocks often fall from a technical point of view, but they just can't fall. I'm in deep contemplation. Why can't US stocks fall? After thinking about it for a long time, I finally figured it out, because the fundamentals of US stocks are so good (in particular, these big technologies represent the future development direction of all mankind), so good that the technical side can be reversed at will. Those who short US stocks are only shorted by looking at the technical K-line. At a loss, the fluctuation domain of the downward function curve often narrows rapidly, causing the stock price fluctuation range to narrow rapidly, and the bearish short selling time cannot be properly grasped, causing profits to evaporate in an instant. However, many people who long on US stocks only look at fundamentals in value investing; instead, they make big profits! On the technical side, bearish US stocks tend to be distorted! The accuracy rate is very low. From now on, I will only go long on US stocks and not go short. Only then can you make a big profit in this market. Theoretically, there is asymmetry between going long and short. The risk of bearish short selling is limitless. It actually has an amplification factor (leverage principle). Furthermore, judging from historical big data, the US index and US stocks are inherently long and short. FREE, FREEDOM. I DO NOT CARE.

People are isolated, helpless, and insignificant in the face of the two major demons of financial markets: unfathomable principles and spatial orientation disorder. Even with mathematical modeling and quantitative analysis capabilities, they still have parameter setting confusion and non-functional problems, and the limitations of human weakness, fear, and greed.

Wealth Jinshan is guarded by evil beasts. As long as they are not cleaned up by evil beasts, they can return home with a full load.

A straight line is a special curve with zero curvature. At the end of the line is a trap. All beautiful things approach their goals with twists and turns. Everything straight is deceptive, all truth is curved, and time itself is a closed curve that starts over and over again.

There was a time before dawn when it was very dark, there were no stars, and no moon, but you must know that it's already past 4 a.m.

The biggest difference between the poor and the rich is that the rich can make money both fast and slow. They know how to fish for big fish in the long term, but the poor are afraid of being poor and only want to make quick money; their hearts are desperately poor. The poor want to earn a little bit every day, a little every week, even if they make a little money to eat and add meals. Seems like there's nothing wrong with it, and it's natural. Actually, it's a huge problem. I'm blind, and I don't know it at all. Although Tesla has grown in the short term, it is a target worth investing in the long term. FREE, FREEDOM.

Big data from world financial history has long proved: speculation cannot be used to invest; investments can also be broad and detailed, making relatively accurate investments.

In the end, when you invest in stocks, you can make a lot of money by investing in stocks and trading depends on a firm belief in the midst of large fluctuations. Even blue chip stocks with high growth and high performance will plummet. This kind of sharp drop in stocks is a blessing from God, a gift package with makeup on, and a drop of gold from the sky. It knocked you out, blew up, and someone else picked it up. But it requires great courage and wisdom. And this is exactly what the vast majority of people don't have. There are many ways to succeed, so don't accept the ones you aren't used to seeing. Adults can only be screened, not educated. Restrain yourself to correct other people's thoughts and desires, because people can never wake up; people can only wake up painfully. There are many people out there who are bullish about you, especially the view that you are bullish and continuously falling in batches, discrete random variables, and position opening layout. They regard you as a fraud, want to ship yourself, and run away in a hurry to find a successor. The bunch of idiots never knew or understood how to give something in the dark; they were only good at chasing high, chasing strong purchases as the icing on the cake.

What is stabilization? What does it mean to wait until it stabilizes before buying? This is a static ideal state imagined by speculators on both ends of their own wishful thinking; it simply doesn't exist in actual financial gaming. The stock price itself is constantly beating continuously, and the amplitude is even impressive. Investment guru Peter Lynch said, “There have been 40 stock market crashes in the past 70 years. Even if I had predicted 39 of them in advance and sold all of my stocks before the crash, I would regret it a lot in the end. Because of even the biggest stock crash, the stock price will eventually rise back up and rise higher than before.”

Excellent companies will continue to reach record highs and can cross the bull and bear. For excellent companies, the bear market is only temporary; the bull market is eternal.

Core technology: Overcoming human weaknesses is difficult to achieve; the vast majority cannot do it or only has a limited amount of what it can do.

Follow the trend -- For Tesla, once it is locked in the target of an investment transaction, its main trend is always upward. Currently, the secondary trend is downward, and it is in serious opposition to the main trend.

Follow the trend -- For Tesla, once it is locked in the target of an investment transaction, its main trend is always upward. Currently, the secondary trend is downward, and it is in serious opposition to the main trend.

Anti-technology -- extending 3 to 5% below the stop loss level of traditional technology and start dividing the gradient into batches (the gradient interval depends on one's own capital, risk resistance, and the rate of decline, combined with the Fibonacci series), discrete random variables (definitely not to continuously seek revenge and open positions due to the intention to set back the root cause. (There is a high possibility that all of the precious reinforcements will be wasted, old feuds will not be reciprocated, and new ones will be added.)

Reverse-humanity -- if you don't see the devil, the wolf will go to the bottom. All kinds of media will exaggerate their ability to exaggerate. The crowd is even more bearish and short selling to a very thrilling and surprising point, trying to make a lot of money and quick money. This bottom is the dynamic “bottom”, the “bottom” of the group, and the “bottom” of the group has unlimited scenery.

Have a nice weekend

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment