What is your investment trading strategy?

Will new opportunities emerge in May? What kind of new opportunities must be seized?

What are the conventional operational thinking and current key points to pay attention to? Sharpening your investment trading skills before the critical moment to make them more professional, and then improve a bit?

Important life investment stocks are currently at low levels, do you have prepared life investment stocks? What are they? How are you prepared to invest?

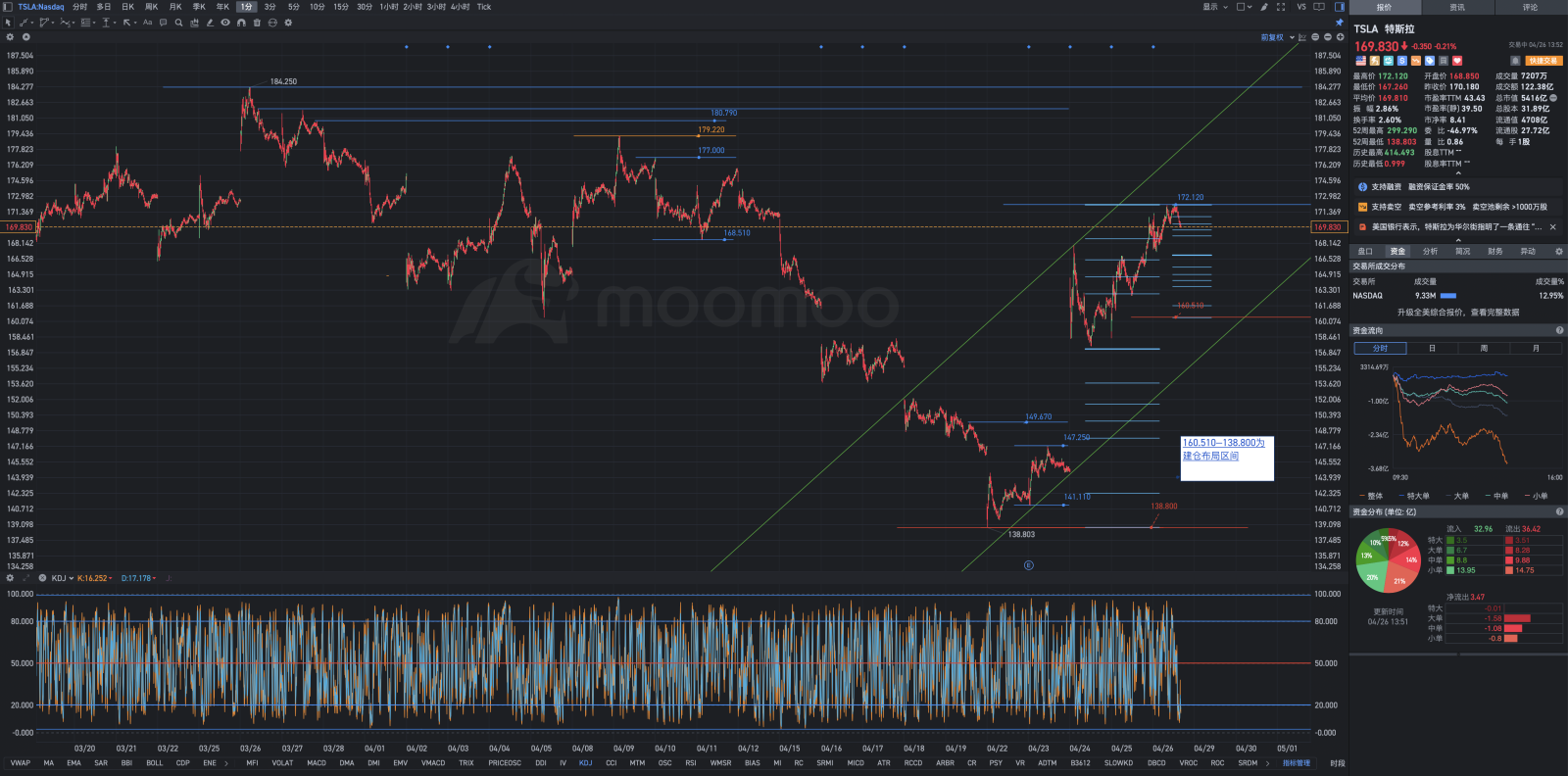

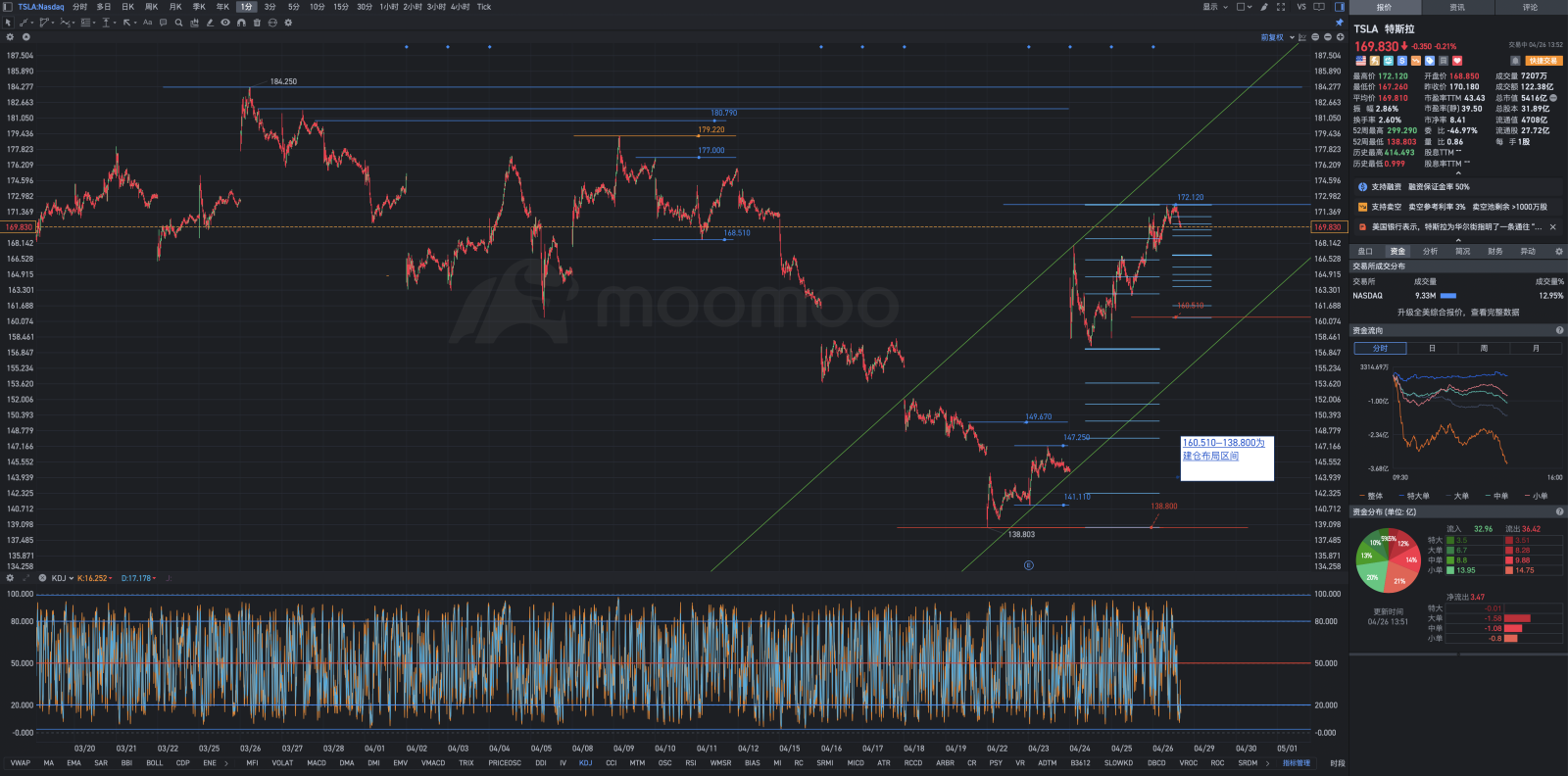

Tesla has been through twists and turns, falling from 265.130 to 220.280 (44.85 points); then dropping from 220.280 to 205.600 (14.68 points); further down to 160.510 (45.09 points); stabilizing and rebounding at 160.510. A routine assessment of poor financial reports caused Tesla's stock price to plummet from 160.510 by 138.800 (21.71 points), swiftly pulled up by bottom-fishing capital, rebounding to 173.780 (34.98 points). What does the recent volatility imply? Should one be dismayed and fearful, or should one pick oneself up and recover, not in vain enduring the previous "hardship"?

Once a person's thinking becomes fixed, it is difficult to change. Therefore, one must develop the habit of statistics, not hold personal fixed ideas, and comply with statistical data regularities.

Decide how to invest and trade based on your own understanding of Tesla, your objectives, and your financial nature and situation.

When technical chart patterns and technical indicator function curves, and their corresponding function values are at their worst, it is also a relatively safe position for establishing a position. When profit chip ratios enter the single-digit percentage oscillation zone; the stock price approaches the lower rail of the downtrend channel infinitely; most technical indicators enter an oversold or severely oversold state; intermittent appearance of technical phenomena such as bottom divergence; that is, the so-called four-body resonance, then the probability of the appearance of a similar bottom area is high.

In the late stage of a bear market decline, you can consider starting to gradually and in batches, with discrete random variables, establish a position. Follow the trend, counter the technology, and go against human nature.

According to Elias, trends are divided into primary trends and secondary trends. Once Elias locks the target of his investment trade, he also locks in the perpetual uptrend of the target of the investment trade, otherwise he will decisively abandon it. When the primary trend sharply conflicts with the secondary trend, short-term trend, or even short-term trend, it is time to start building a position.

According to Elias, Tesla is a huge piece that is being cut, only a small part has been cut but has already revealed a world-shocking natural high-quality jade. It is currently difficult to quantify an estimate. The weekly chart shows that KD has formed a golden cross in the 20.000-0.000 area. Although the technical indicators on the weekly chart lag behind, they are highly reliable. The future repair of short-term technical indicators is bullish, so it is a good time to build a position during the decline.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Ryan赚钱要冷静 : downtrend

101891496 :

71601323 : I can't understand

夏日时光 : Yes, should we sell it?