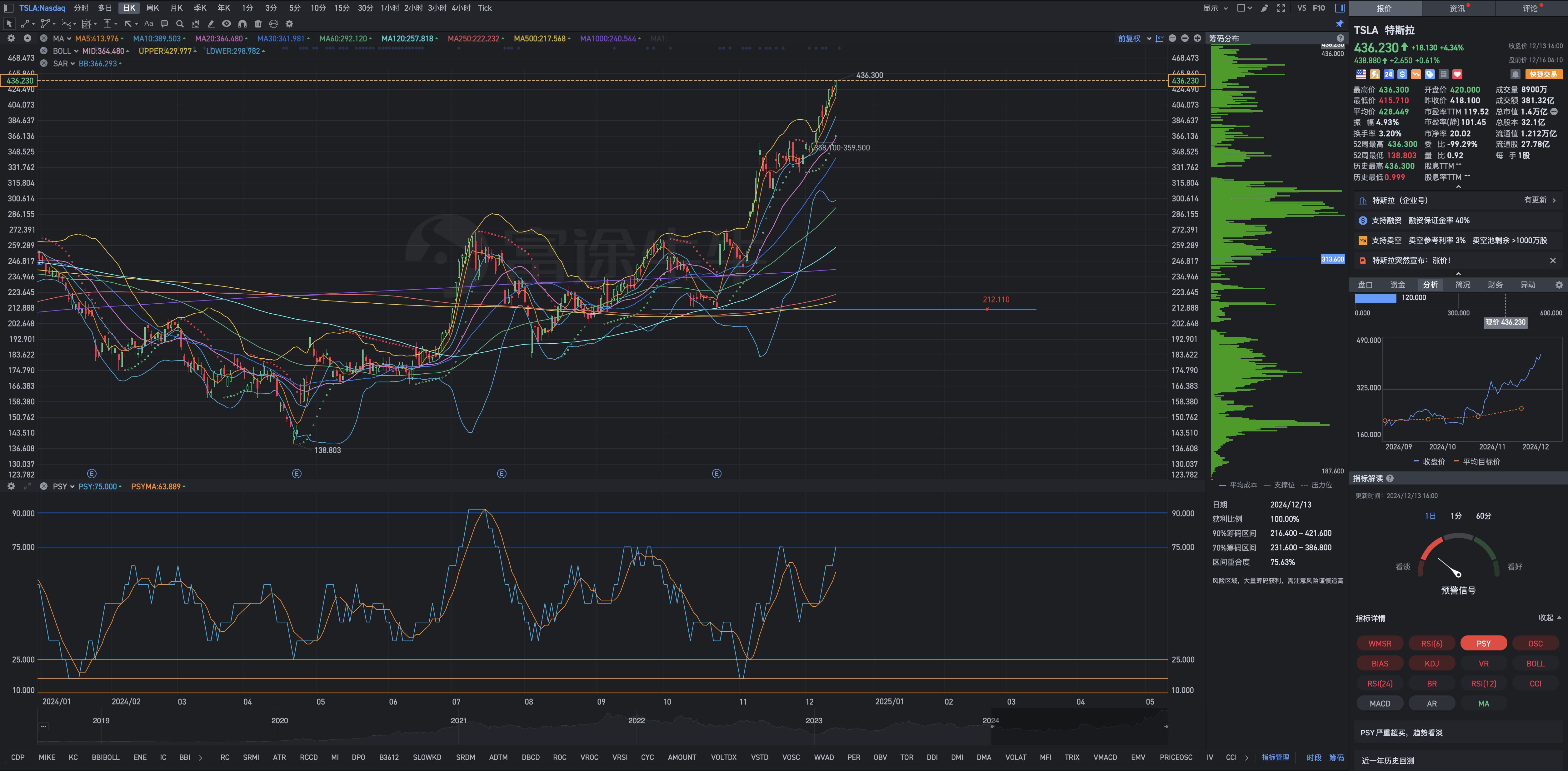

When the PSY reaches or falls below 25, it indicates that within N days, the number of falling days is far greater than the number of rising days, the bearish force is relatively strong, and there is a strong pessimistic atmosphere in the market, causing the stock price to decline all the way. But from another perspective, due to the large number of falling days, the market shows signs of overselling, especially in the case of large price declines, there are few sell-offs in the market, the selling pressure is light, and the stock price may rebound upwards.

MIB :