Apply mathematics to solve transactional problems

The more it falls, the more pessimistic?

[Author's opinion: Don't follow the example of this world. Long-term investment and phased game trading complement each other. Wealth Jinshan is guarded by evil beasts. As long as they are not cleaned up by evil beasts, they can return home with a full load. The biggest difference between the poor and the rich is that the rich can make slow money. They know how to fish for big fish for a long time, while the poor just want to make quick money. The poor want to earn a little bit every day, a little every week, even if they make a little money to eat and add meals. Seems like there's nothing wrong with it, and it's natural. Actually, it's a huge problem. I'm blind, and I don't know it at all. Tesla is a target worth the long-term investment. Watching the decline and short selling Tesla is simply a wild thing; it is of no use to oneself or anyone else. FREE, FREEDOM Keep the following two things in mind and take them as a warning. In particular, when the world is not optimistic about Tesla, and the market also seems to be falling sharply to support this view, will you be shaken by this? That's the key. In 2010, Tesla lost money for a long time, and its stock price remained low for a long time. More than 90% of market participants sold cheap Tesla shares with a sense of depression and extreme frustration. At almost the same time, Stephen A. Schwarzman (Stephen Alan Schwarzman), a Jewish-American superrich philanthropist worth over $10.8 billion, and one of the founders of BlackRock, also jokingly refers to him as Su Shimin for his Chinese affections. However, they are telling their family, from adults and children to young grandchildren, that every week they save a little money from other places every week, even if they can only buy one Tesla stock, and store it there like a bank. On August 26, 2018, or about 8 years later, Tesla's stock price finally climbed from 1.13 to 371. This is almost a 33,000% increase. Is Tesla really worth our long-term investment and holding? This is a major issue. It is directly related to our views on it and corresponding measures when the stock price continues to plummet in the future. The Quantum Technology Revolution (quantum technology revolution) is something that ordinary people with no background in theoretical physics or applied mathematics can see or feel, so much so that they think they are very far away. In fact, the vast majority of Wall Street's so-called technical analysis experts are also the same. Not to mention 30 years ago, 10 years ago, Wall Street technical analysts were just as incapable of predicting that NVIDIA would become the current leader in artificial intelligence. Therefore, we need to have a clear understanding of the limitations of technical analysis. Besides that, the leader is not immutable either. If Tesla and the industrial project behind it are an artificial intelligence quasi-overall environment, then Nvidia is only an important part and one of the key links. Three winners of the 2022 Nobel Prize in Physics have answered this question. Behind Tesla, there are also a number of projects that not only far surpass the Artificial Intelligence concept, but even fall under the category of the second application level Quantum Technology Revolution (quantum technology revolution). Artificial Intelligence, or artificial intelligence, began 30 years ago, and large-scale applications have been around for a few years. An even more powerful Quantum Technology Revolution (quantum technology revolution) has arrived later. Compared with the Quantum Technology Revolution (Quantum Technology Revolution), Artificial Intelligence (Artificial Intelligence) is simply not worth mentioning; it's not on the same level at all. Surprisingly, almost all of Elon Musk's industrial projects are inseparable and inseparable from the Quantum Technology Revolution (Quantum Technology Revolution). Tesla, led by Elon Reeve Musk, is very forward-looking in the layout of the high-tech industry. Three 2022 Nobel laureates in physics, Alain Aspect (French physicist), John Francis Clauser (John Francis Clauser, American theoretical physicist and experimental physicist), and Anton Zeilinger (Anton Salinger, Austrian quantum physicist), talk about Artificial Intelligence and Quantum Technology in an interview Revolution's unanimous opinion. Elon Musk himself is a Fellow of the American Academy of Engineering. Who can say Tesla isn't likely to be a latecomer? In the current situation, it goes without saying that the profit of chips is indeed higher than that of automobiles. Only when Tesla has achieved AI (Artificial Intelligence) transformation of some electric vehicles, such as the official sale of FSD in the European and North American markets, large-scale use of humanoid robots, large-scale investment in super production plants, and a sharp drop in production costs, can Tesla's profitability completely overtake Nvidia. Behind Tesla, there are a number of projects that not only far surpass the Artificial Intelligence concept, but even fall under the category of the second application-level Quantum Technology Revolution. The glory that comes later will definitely be greater than the glory before. How to follow the trend, counter technology, and reverse humanity? This is a major topic. In line with Meng Fu, when the stock price continues to fall sharply below the so-called technical stop-loss level, when it deviates from the extreme value region of the region, God revealed that we needed to be alert and prevent fear (very difficult to do and operate) and launch a gradient batch, discrete random variable, and position layout system to increase our holdings. When the stock price rises to an overbought — seriously overbought — extreme value region, God revealed that we needed to keep a clear mind, be wary and prevent greed (which is also very difficult to do and operate), launch a gradient batch, discrete random variable, sell a position closure system, and reduce our holdings. How do you view inverse indicators? This is also an important topic. First, reverse indicators cannot be directly used as a basis for one's own specific transactions. Doing so is itself extremely irresponsible for oneself, and it is also not serious. Because the inverse indicators themselves also fluctuate, there are times when neurosis is normal. Therefore, reverse indicators can only be used to verify and verify references and targets for one's own transactions.]

Let's talk about how to apply mathematical methods to solve the problem of relatively accurate transactions at the level of quantitative analysis. (If you don't have a math background, you can skip around to avoid boredom and boredom. (No offense.)

1. Select and determine the functional curve trajectory of stock prices.

2. Based on the known function curve trajectory, find the relationship (function curve equation) for the corresponding function curve trajectory.

3. Use the method of deriving derivatives to calculate the function curve relationship and determine its domain, value range, and monotonic range. A defined domain determines the approximate range of fluctuations; a monotonic range determines the approximate range of a one-sided rise or one-sided decline, which is of great significance.

4. Why the emphasis on general scope? Because some parameters are difficult to set, parameters are also called parameters. Different settings can have very different results. There doesn't seem to be a good way to deal with it right now. JC adopts continuous adjustments according to experience for different trading partners, at different times and stages. Flexibility is the best ability. No matter how powerful a math tool is, it's just a static tool, and we need to use it flexibly.

5. There are no absolutely accurate technical indicators; only shareholders who know half the truth.

6. Indicators are useful to users; indicators are harmful to non-users.

7. Extremely strong stocks don't look at indicators, extremely weak stocks don't look at indicators, and high control stocks don't look at indicators. Jerome Chen isn't speaking at this moment today, can you know?

8. Technical indicators are only a reference point for stock prices at a stage, and also an important reference factor for logical evaluation.

9. At a certain stage, some stocks watch certain technical indicators operate in a regular manner. To discover their rules, they also need to discover their changes.

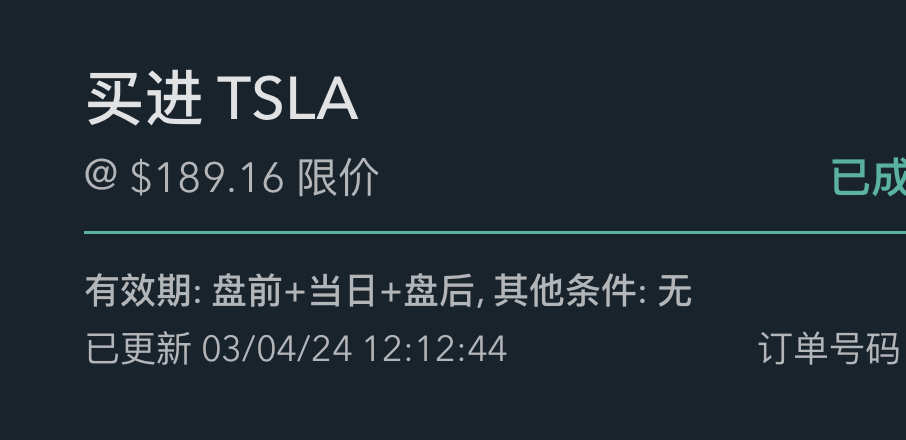

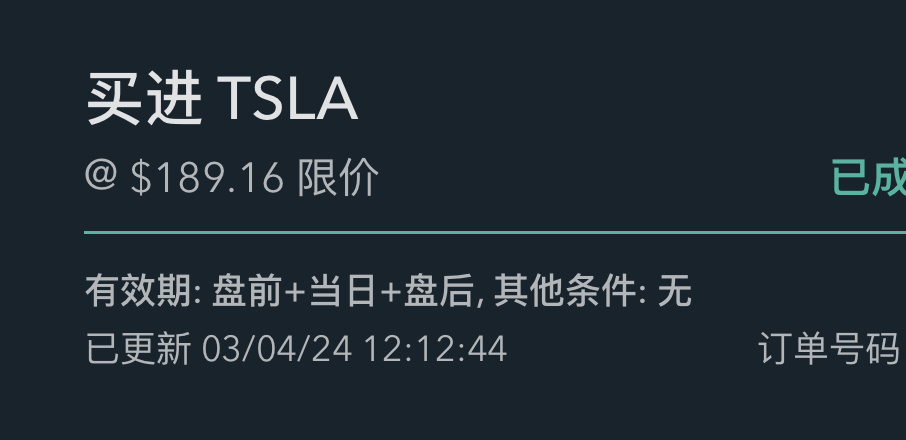

10. Through modeling, quantitative analysis, and combined with previous historical big data, Tesla may also have to oscillate in a wide range of 188.860-228.200, which is the maximum fluctuation range of 188.860-228.200, which may take as long as 4-7 months. More people sell stocks as a result. When the main players in control have accumulated enough momentum MV, the main rise in the true sense of strength and sustainability will break through the historical high of 414.490 after the split. Tesla regains the crown and reaches a new high point.. Investment guru Peter Lynch said, “There have been 40 stock market crashes in the past 70 years. Even if I had predicted 39 of them in advance and sold all of my stocks before the crash, I would regret it a lot in the end. Because, even in the biggest stock crash, the stock price will eventually rise back up and rise higher than before.”

Excellent companies will continue to reach record highs, and they can overcome bulls and bears. For excellent companies, the bear market is only temporary; the bull market is eternal.

Excellent companies will continue to reach record highs, and they can overcome bulls and bears. For excellent companies, the bear market is only temporary; the bull market is eternal.

Link 🔗:youtu.be/8ccojq...

Link 🔗:Youtubevideo/sho...

Link 🔗:Youtubevideo/sho...

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment