Short-term trends: the market erupts in despair, rises in hesitation, and dies in joy - beware of the risks brought by deep declines.

Partially realize some floating profits around 320-324-327, sell some long positions, at least to avoid losses and make major mistakes.

Going all in is a wrong investment trading strategy. It carries the risk of shorting and missing the target, while also easily causing anxiety - worrying about shorting and getting stuck at the top and high levels.

Rothschild family motto: The reason we have survived until now is because we jump off the bus in advance, leaving a generous tip, so as not to be disliked by others.

Those who enjoy feasts greedily, eat in an unsightly manner, finish even the bones and soup, and refuse to leave a tip will surely be disliked by others.

Short-term trend: Being perfect means the short-term trend has reached its peak.

It's time to remember that rising is a process of accumulating risks, and it's time to sell when it rises but not when it falls.

Except for 60% of the position for Tesla's long-term value investment, the rest are already on the path of selling, most of the profits have been realized, securing gains.

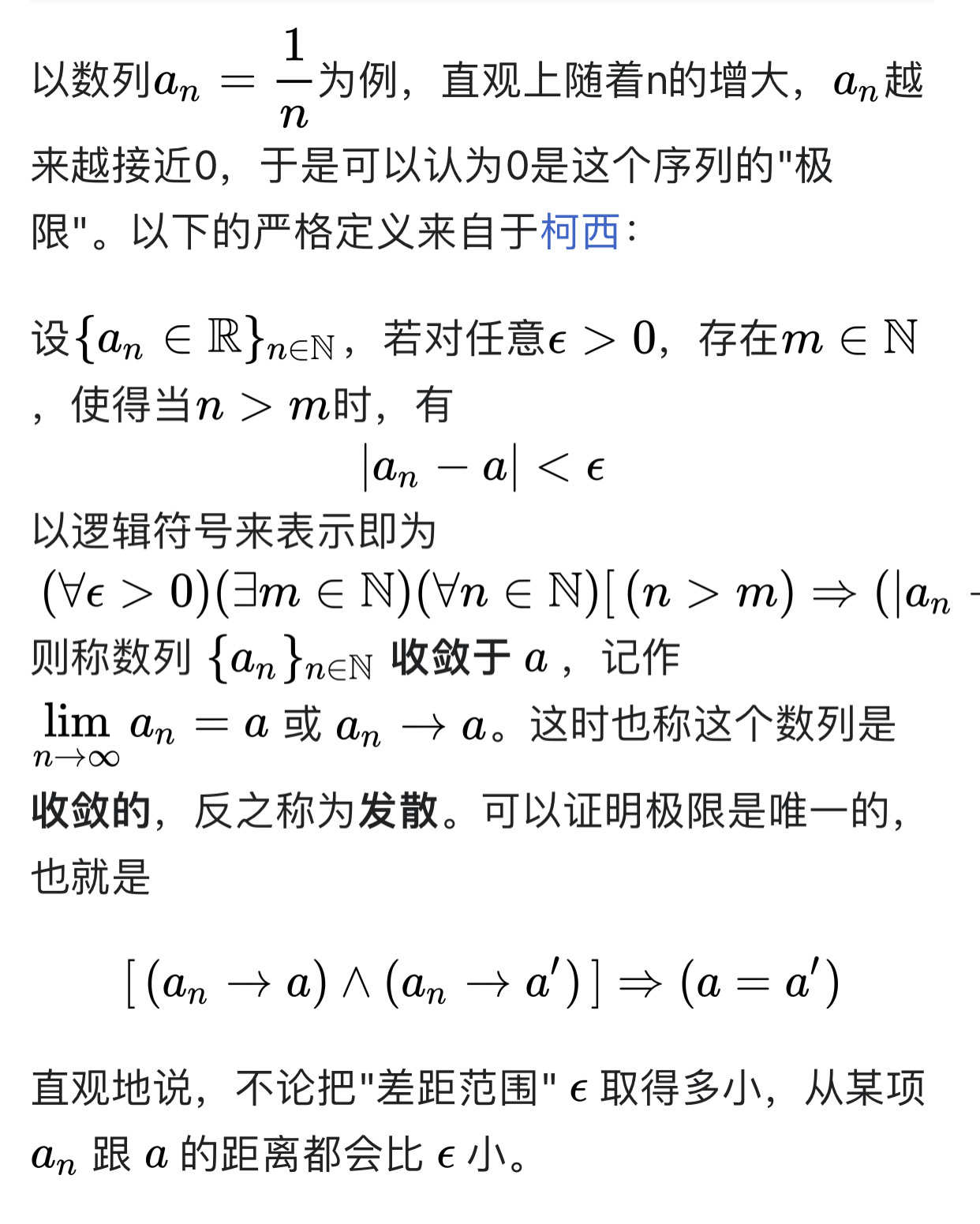

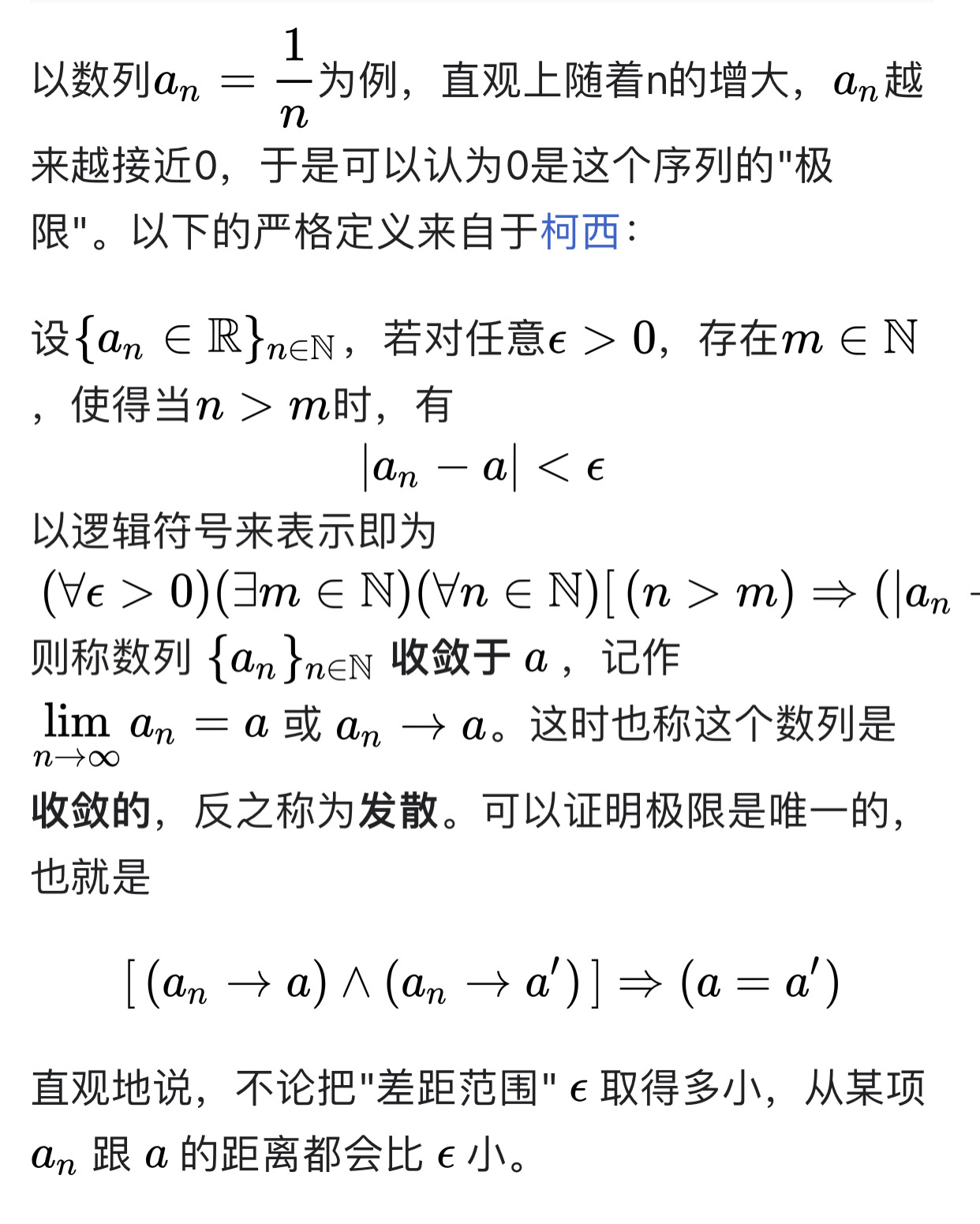

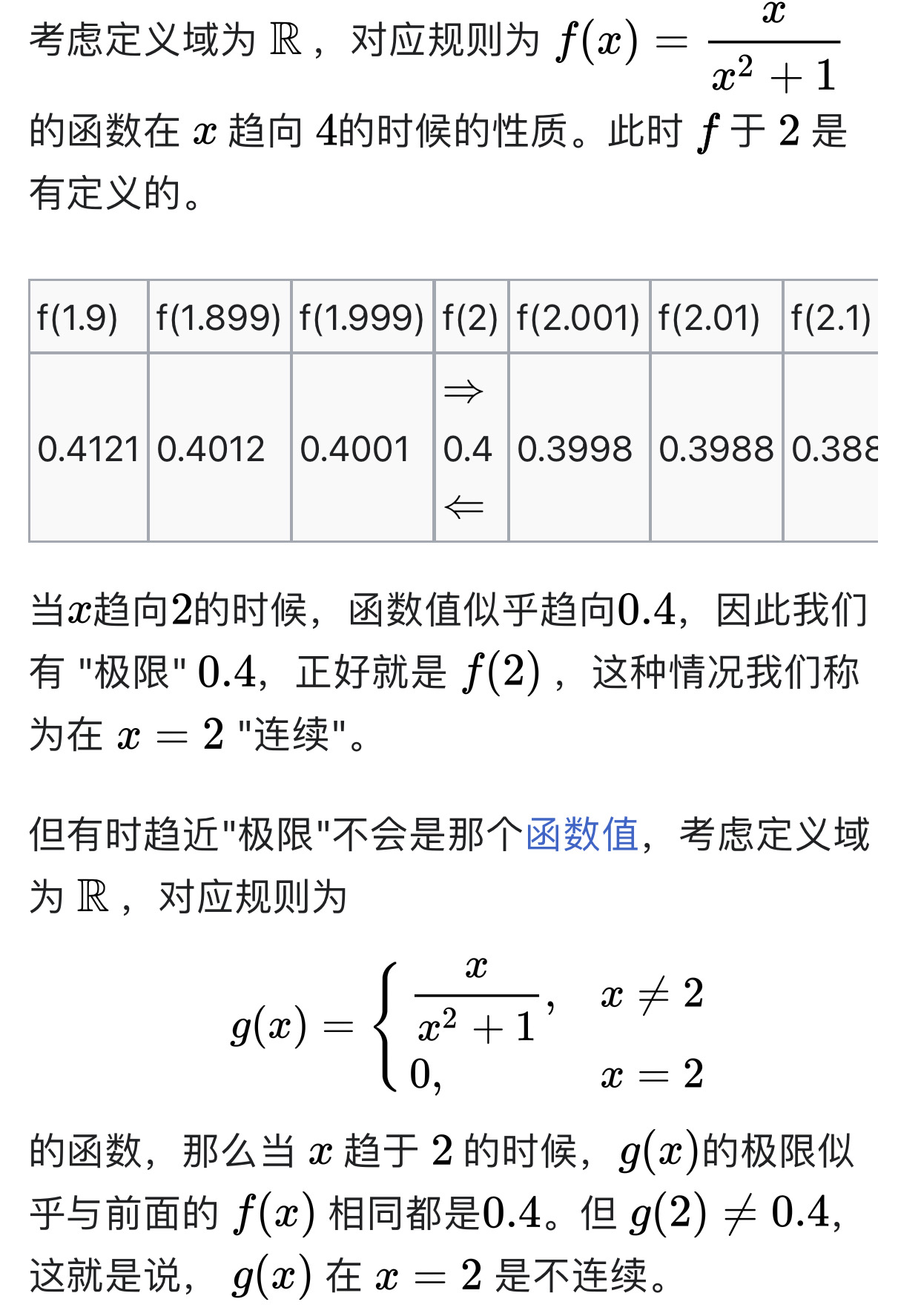

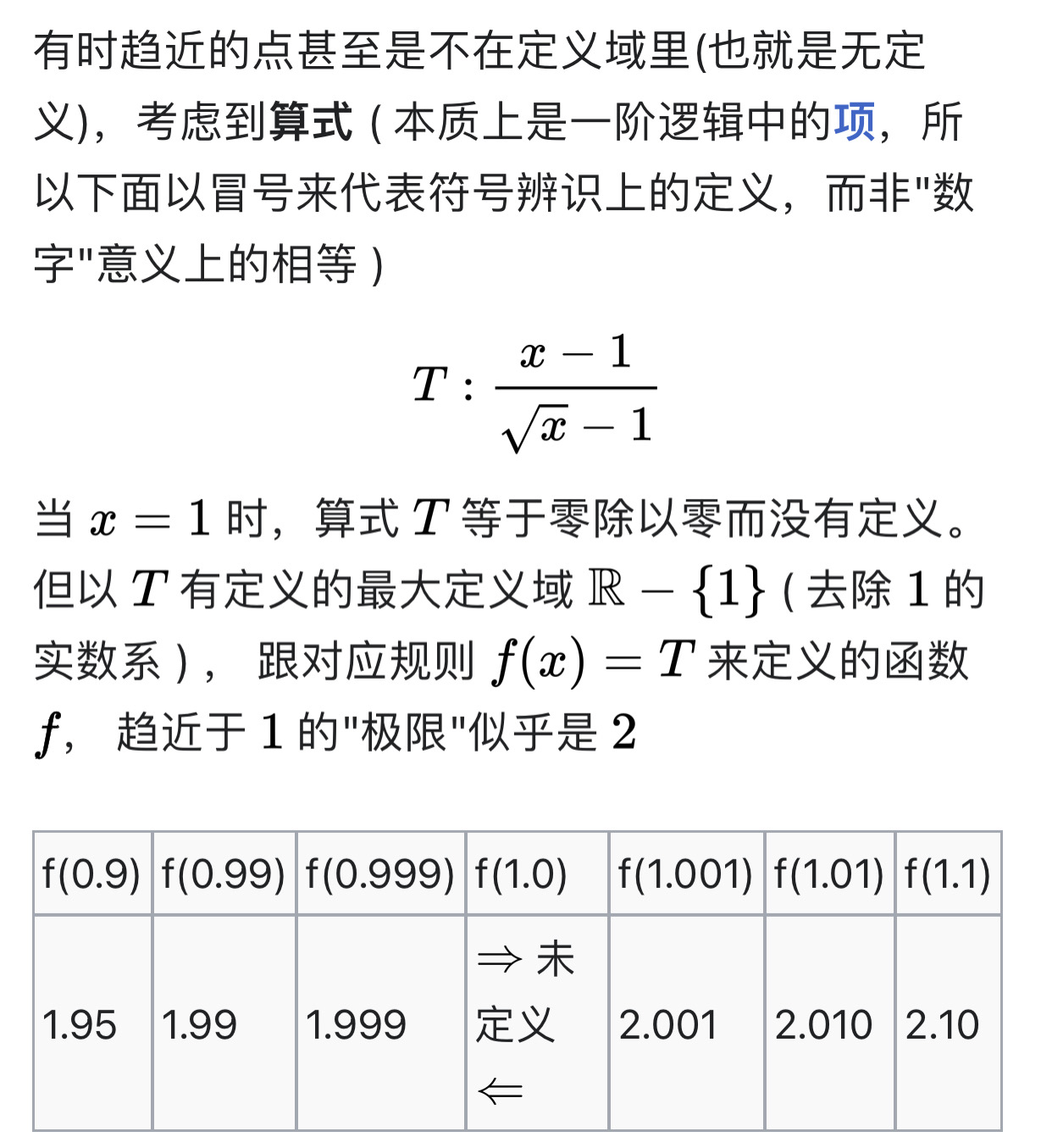

Limit is the value that a function approaches when the independent variable becomes infinitely large or infinitely small, or in a certain range. It is also an important basic concept in mathematical analysis or calculus, where continuity and derivatives are defined through limits. Limits are used to describe the trend of a sequence as the subscripts get larger (sequence limit), or to describe the trend of the function value as the independent variable approaches a certain value (function limit).

The period of massive oscillation is approaching, and this is beyond human control.

Education is like copper, ability is like silver, connections are like gold, mindset is like a trump card. Jesus is the king of cards, the king of all kings. Successful people do not win at the starting point, but at the turning point.

Rising is the process of accumulating risks, while falling is the process of releasing risks.

High probability in the securities market is manifested in the following forms:

1. Ongoing positive feedback. The strength of the trend is powerful, follow the main trend and counter the secondary trend. Failing to do so makes it impossible to implement low-risk arbitrage trading in the financial markets.

2. Triple positive feedback. The first level: follow the main trend of the market. The second level: stronger stocks than the large cap. The third level: a portfolio of high probability strong stocks, cost combination.

3. Force assistance. The first assistance: assistance from the classic technical analysis indicators window. The second assistance: assistance from the leading examples. The third assistance: assistance from the supply and demand relationship.

1. Ongoing positive feedback. The strength of the trend is powerful, follow the main trend and counter the secondary trend. Failing to do so makes it impossible to implement low-risk arbitrage trading in the financial markets.

2. Triple positive feedback. The first level: follow the main trend of the market. The second level: stronger stocks than the large cap. The third level: a portfolio of high probability strong stocks, cost combination.

3. Force assistance. The first assistance: assistance from the classic technical analysis indicators window. The second assistance: assistance from the leading examples. The third assistance: assistance from the supply and demand relationship.

Video playback link.🔗: - YouTube

The greatest distance in the world is between knowing and doing

1. All meaningful knowledge is ultimately for action.

2. As alchemists, we often discover some gold mines and gaming opportunities, but we often mistakenly believe that just thinking and talking about it will suffice. In reality, the greatest distance in this world is between knowing and doing.

3. In the stock market, the obstacles between knowing and doing are mainly psychological fears and greed. Aspire to score 100, while the bridge between knowing and doing is moderation, seeking progress, aiming for 80 points, 75 points are also good.

4. Be very careful with controllable things; stay optimistic about things that are uncontrollable.

5. People can only do things within their own abilities. You must accept this fact and face everything with optimism.

6. Because people always like to pursue the optimal choice, but the result of pursuing the optimal choice often goes against their wishes!

In the stock market, if one can achieve smoothness, moderation, repeatable control, and advantages, the result will be good.

1. All meaningful knowledge is ultimately for action.

2. As alchemists, we often discover some gold mines and gaming opportunities, but we often mistakenly believe that just thinking and talking about it will suffice. In reality, the greatest distance in this world is between knowing and doing.

3. In the stock market, the obstacles between knowing and doing are mainly psychological fears and greed. Aspire to score 100, while the bridge between knowing and doing is moderation, seeking progress, aiming for 80 points, 75 points are also good.

4. Be very careful with controllable things; stay optimistic about things that are uncontrollable.

5. People can only do things within their own abilities. You must accept this fact and face everything with optimism.

6. Because people always like to pursue the optimal choice, but the result of pursuing the optimal choice often goes against their wishes!

In the stock market, if one can achieve smoothness, moderation, repeatable control, and advantages, the result will be good.

Invest in your stocks account like managing personal retirement accounts (IRA and 401(K)) just as you do with Vanguard's individual retirement accounts and fund accounts.

Elias=JC family trading iron law (repetition cannot be overemphasized):

Win in bear markets; win in volatility; win in courage; win in wisdom; win in composure; win in learning; win in change; win in adaptation; win in mathematics; win in physics; win in models; win in functions; win in oscillations; win in quantification; win in frameworks; win in moderation; win in probability; win in technology; win in psychology; win in dexterity; win in flexibility; win in oscillations; win in long-term; win in investment; win in mentality; win in forgiveness.

Lose in closed-mindedness; lose in self; lose in rigidity; lose in self-abandonment; lose in self-deception; lose in chasing highs; lose in chasing strength; lose in overtrading; lose in stagnant growth; lose in one-sidedness; lose in gambling; lose in defense positions; lose in full positions; lose in financing; lose in liquidation; lose in perpetual motion; lose in gambling; lose in complaining; lose in excuses; lose in blaming; lose in wishful thinking; lose in plans; lose in predictions; lose in short term gains; lose in impatience; lose in greed; lose in mindset.

98% of people can never overcome the bias of preferring rising to falling and trying to predict the market. Without a certain proportion of reserve funds and a strong backup plan, 98% of people can only end up in failure. Trading is a way of making a living, not being a stock slave or engaging in battles of opinions (Elias=JC does not participate in opinion warfare, not interested). It's about winning through investment and trading.

Alarm bell rings: The first and last chapters of the Book of Wisdom both write 'There is no such thing as a free lunch in the world.' Don't expect to make money without hard work by just looking at others' post-market replay charts analysis. Here, at this moment, all JC's posts are personal expressions before, during and after the market, research and exploration, without emotional views, stock recommendations, or spiritual chicken soup, which cannot be used as the basis for trading. Therefore, the resulting gains and losses in trading can only be borne by oneself, regardless of profit or loss, all self-inflicted.

We were originally strangers, let alone in the financial realm. Even if you are capable, in this money-playing financial market, it's easy for others to see you as a swindler. Therefore, JC will never use research results as a means to give away money for free, because there's no need for it. Are there really any true friends in the financial market? Each person goes their own way, does their own thing, being firm without desires. JC won't depend on you, won't adhere to your ways, won't care about your opinion. Except for Jesus Christ (who is actually God, the Holy Trinity of the Father, the Son, and the Holy Spirit), JC fears no one.

Disclaimer: There are many crazy people in the securities market, so it is better to clarify what needs to be clarified. This article is a personal trading diary, not an opinion or stock recommendation. This is the well-regulated US securities market, not the A-share securities market. The blogger has a long-term trading style. However, in special circumstances, such as when the market is particularly good and the profit chip ratio exceeds 80-90% for a long time, the blogger will choose to sell and close the position to realize the floating profit. When the market and individual stocks are not good, especially when it is extremely bad, such as when the profit chip ratio is less than 21-7%, JC will choose to build a scattered random variable position in a gradient and batch manner. Therefore, ordinary traders should not imitate this operation.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment