The $60 billion weight loss drug market: which pharmaceutical companies can benefit?

Follow me on Moomoo to stay informed and connected!

01 What is GLP-1 weight loss drug?

GLP-1 weight loss drugs, full name Glucagon-like peptide-1 receptor agonists (GLP-1). Initially, GLP-1 was a hormone secreted by the gastrointestinal tract mainly used to treat diabetes. However, researchers discovered over time that this hormone can suppress appetite and therefore control weight. Hence, major pharmaceutical companies began exploring the potential of GLP-1 as an anti-obesity and weight management drug.

Danish pharmaceutical company Novo Nordisk (NVO) was the first company to apply GLP-1-like drugs in the field of weight loss. In 2010, the company launched Liraglutide (brand name Victoza), a GLP-1 drug initially used to treat diabetes but later improved for weight loss and introduced as a weight loss drug named Saxenda.

In 2017, Novo Nordisk launched a new product for diabetes treatment, Semaglutide (brand name Ozempic), which received approval for a high-dose version in 2021 and was introduced as a weight loss drug under the brand name Wegovy. Due to its excellent weight loss results, the drug gained popularity on social media platforms such as TikTok and received recommendations from Elon Musk, the world's richest person. Therefore, GLP-1 weight loss drugs gradually became popular.

US pharmaceutical company Eli Lilly And Co (LLY) also introduced several GLP-1 products. In 2014, they launched Dulaglutide (brand name Trulicity), a diabetes treatment drug, which became one of the company's best-selling products.

As of May 2022, Lilly launched a new product Tirzepatide (brand name Mounjaro). Although the drug currently only has approval for adult patients with type 2 diabetes, studies have shown that its weight loss effect is 50% better than Novo Nordisk's Ozempic and Wegovy, making it also highly anticipated.

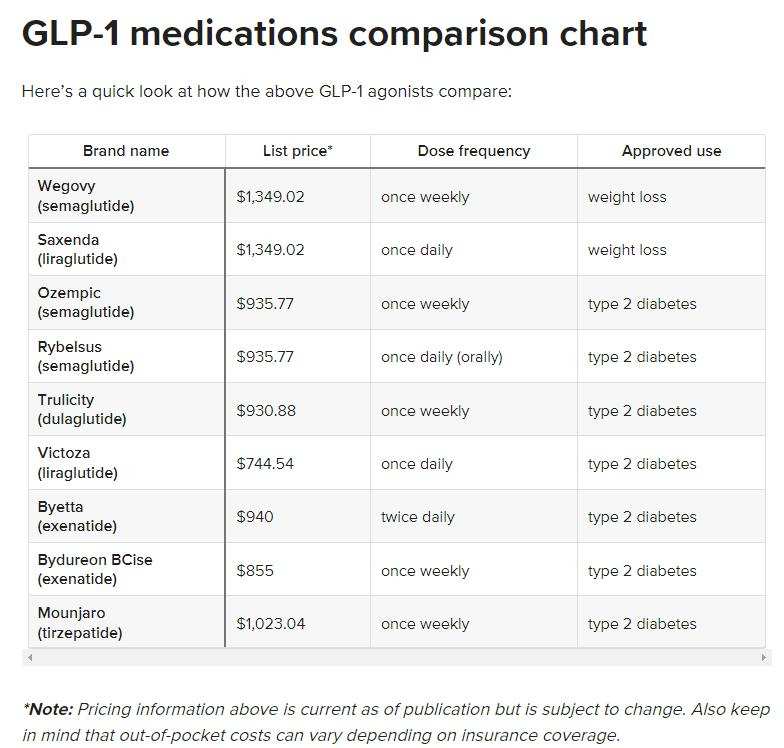

The table below lists approved GLP-1 drugs on the market, including their prices and injection frequencies. It is worth noting that currently, only Novo Nordisk's Wegovy and Saxenda are approved for weight loss.

02 Market prospects for weight loss drugs

Obesity is the main cause of many serious illnesses. According to the World Health Organization's estimates, more than 750 million people worldwide suffer from obesity, leading to a 5% mortality rate.

With the advent of GLP-1 weight loss drugs, the demand for obesity treatment continues to increase. Morningstar analysts predict that the global market for GLP-1 weight loss drugs could reach $60 billion in the next 10 years.

They predict that the average global price of obesity GLP-1 therapy will rise to about $5,400 annually with the introduction of Novo Nordisk and Lilly's obesity treatments, then gradually decline from 2025 with the introduction of competitive treatment methods, down to about $2,800 by 2032. According to their forecast, by 2032, 21 million people worldwide will receive GLP-1 therapy for obesity treatment.

Morgan Stanley has higher expectations for the weight loss drug market. They predict that the global obesity market may grow from $2.4 billion in 2022 to $77 billion in 2030, 43% higher than their previous estimate of $54 billion.

03 Which pharmaceutical companies can benefit?

Currently, Novo Nordisk and Lilly are the two leading companies in the weight loss drug market.

However, Morningstar analysts believe that in addition to these two companies, two bio-pharmaceutical giants, Pfizer Inc. (PFE) and Amgen, Inc. (AMGN), may also emerge as winners in this field.

They predict that by 2032, Pfizer and Amgen's GLP-1 weight loss therapy market share will reach 3% and 4%, respectively, far lower than Novo Nordisk's 36% and Lilly's 40%.

Currently, Pfizer is still choosing between two oral GLP-1 therapies, both of which are expected to obtain phase 2 clinical trial data by the end of 2023 or early 2024 for phase 3 clinical development starting at the end of 2024.

Amgen's GLP-1 therapy has a more differentiated potential compared to Pfizer's oral medication because its drug is a combination of GLP-1 agonists and GIP antagonists, which may make it a competitive drug. However, it is still undergoing phase 2 clinical trials, and relevant data is expected in 2024, and launching may take at least until 2026.

04 Novo Nordisk vs. Lilly

Many investors are curious about which of the two leading companies, Novo Nordisk and Lilly, have more potential?

From a product perspective, Novo Nordisk's advantage lies in having several GLP-1 drugs approved as weight loss treatments and stable growth in the market. However, the downside is that their production capacity currently cannot meet market demand. In contrast, Lilly's new product, Mounjaro, performs better in terms of efficacy. According to clinical trial data from last year, Mounjaro can help reduce up to 22.5% of body weight, while Novo Nordisk's flagship drugs, Ozempic and Wegovy, can only achieve about 15% of weight loss. But the downside of Mounjaro is that it currently only has approval for diabetes treatment, and it may not receive approval for weight loss treatment until the end of this year.

In terms of profitability, Novo Nordisk has stronger profitability. Their gross profit margin and net profit margin are 85.1% and 36.45%, respectively, while Lilly's gross profit margin and net profit margin are only 77.51% and 20.35%, respectively.

Overall, Novo Nordisk's advantage lies in having more mature products and stronger profitability, but weaker growth potential. Lilly's advantage lies in the better efficacy of its drugs and greater growth potential, but its valuation is relatively high.

05 Risks of investing in weight loss drugs

Although the weight loss drug market is full of potential, investors must also recognize that there are some potential risks associated with investing in weight loss drug companies and need to carefully distinguish between speculation and investment. Currently, weight loss drug companies may face the following three main risks:

Intensified competition: In addition to Lilly and Novo Nordisk, other major pharmaceutical companies have also entered the competition for GLP-1 weight loss drugs. Morningstar analysts predict that other pharmaceutical companies will launch their weight loss drugs as early as 2026. The entry of new competitors may affect the sales of companies' products, and drug prices may further decline. In addition, in the long run, some drug patents may expire, providing opportunities for newcomers in the market.

Expensive drug prices: Reuters reported that the high cost of weight loss drugs could become a problem. For example, Wegovy costs up to $12,371 per year, which may be challenging for patients. Statistics show that only one-third of patients are still using popular weight loss drugs such as Wegovy after one year, and high costs may be one of the reasons why they give up treatment. Therefore, if there is no insurance coverage, high prices may deter some patients who hope to treat obesity problems.

High expectations: Finally, high expectations are also a potential risk for investing in weight loss drug stocks. Since the beginning of this year (as of the closing price on September 18, 2023), Lilly's stock price has risen by 56.52%, while Novo Nordisk's increase has reached 36.25%. For investors considering buying shares in these companies, the problem is that there are extremely high expectations for these drugs, which may already be reflected in the companies' stock prices, resulting in limited potential upside for these companies. Therefore, investors need to carefully assess these risks and make decisions based on their own risk preferences and investment strategies.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment