The Copper Surge: A Temporary Spike or the Start of a Steady Climb?

$Copper Futures(MAR5) (HGmain.US)$ surged to an 11-month high on Wednesday, as Chinese smelters announced their plan to tackle the drop in processing fees. They are considering production cuts, which could result in under-supply for buyers.

This news caused shares of copper mining companies to rise significantly, with $FIRST QUANTUM MINERALS (FQVLF.US)$ increasing by 12%, $Southern Copper (SCCO.US)$ by over 10%, and $Teck Resources (TECK.US)$ and $Freeport-McMoRan (FCX.US)$ by more than 7%.

What Potential Catalysts Could Drive Copper Prices in the Future?

1. Energy transition boosts demand for copper

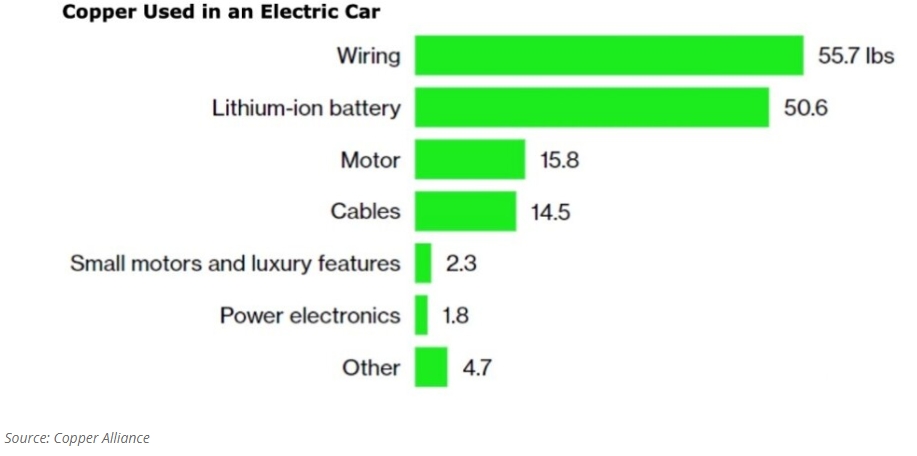

Copper is an essential metal for global decarbonization and plays a key role in facilitating the shift to green energy. Electric vehicles are a major source of rapid growth in copper demand, primarily utilized in batteries, motors, high-voltage wiring harnesses and other components. Electric vehicles require significantly more copper than traditional vehicles.

According to data from UBS Evidence Lab, the Chevrolet Bolt has 80% more copper content than a similarly-sized Volkswagen Golf. Statista predicts that global EV sales will reach 17.07 million units by 2028, an increase of 60% from 2022. This growth is expected to drive a continued rise in copper demand.

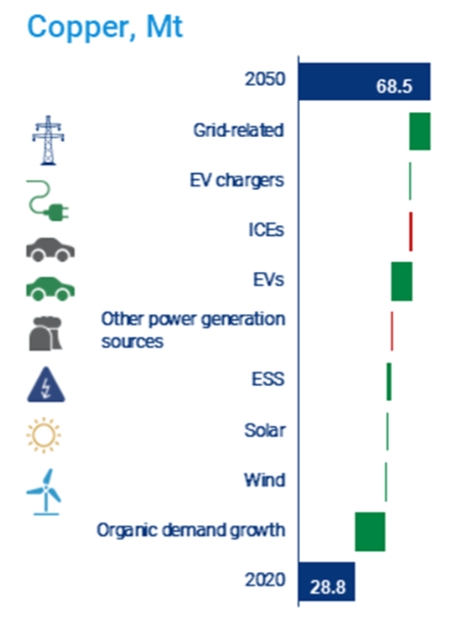

The construction of renewable energy infrastructure will also further increase the demand for copper, such as solar energy, wind energy, and grid construction. According to data from the Copper Development Association, a 3 MW onshore wind turbine requires up to 4.7 tons of copper, while offshore wind turbines require even more, about 8 tons per MW. Solar power systems require at around 5.5 tons per MW. Research and consultancy group Wood Mackenzie says,

The global energy transition presents an almost unattainable mine supply challenge, with significant investment and price incentives required.

2. From de-stocking to re-stocking

Historical data reveals a strong correlation between copper prices and manufacturing PMI. Global manufacturing is slowly stirring back to life. Benefiting from the growth in emerging markets, the global manufacturing PMI climbed back to the pivotal mark of 50 in January, ending a 16-month run of sub-50 readings, and edged up to 50.3 in February. In the US, the Markit Manufacturing PMI for February improved further to 52.2, marking the highest point since July 2022.

As an essential component in the manufacturing supply chain, copper's market demand is expected to rise alongside increased manufacturing activity. Currently, copper is in a continuous de-stocking phase, and with the expansion of manufacturing, it is anticipated to shift towards re-stocking.

3. Supply declines, uncertainty mounts

Over the past decade, there has been a marked slowdown in greenfield additions to copper reserves. According to S&P Global, new discoveries averaged nearly 50 million tonnes (Mt) annually from 1990 to 2010. However, since that period, new discoveries have plummeted by 80% to a mere 8 Mt per year. Data from Wood Mackenzie indicates that the supply-demand gap for copper is expected to widen persistently through to 2050.

Additionally, the supply side is facing growing uncertainties. Last November, Panama's Supreme Court ruled that the nation's contract for the Cobre copper mine with First Quantum Minerals violated the constitution, leading to the mine's closure.

Meanwhile, Chile, as the world's largest copper producer, has seen its copper output stagnate due to factors such as deteriorating ore quality and water resource shortages caused by prolonged drought in recent years. In addition, resource protectionism and environmentalism are expected to affect mining operations and effective supply in the medium to long term.

4. Capital expenditure slows down

Copper mining has indeed transformed into a highly capital-intensive industry. An AOTH analysis found that the current cost to build a new copper mine can reach up to US$44,000/tn of production capacity. This is a significant increase compared to the year 2000, when the average capital intensity for a new copper mine was between US$4,000 and US$5,000 to build the capacity to produce a tonne of copper.

However, currently, copper mining companies are spending less on capital expenditure compared to a decade ago, which could limit future supply.

5. Cost basis shifts upward

Due to declining average copper ore grades and other cost increases beyond mining, the global copper mining cost center may experience a long-term upward trend, which will support copper prices.

Currently, about half of the world's copper mines have been in service for more than 50 years and face the problem of aging mines, particularly in Chile. The decline in copper ore grades will constrain the growth of global copper concentrate supply, increase the difficulty of controlling mining costs, and raise the cost of ore dressing.

6. Expectation of Fed rate cut

Despite the latest CPI data for February indicating persistent inflation stickiness, market expectations for a Fed rate cut of 25 basis points in June have risen from 57.09% to 64.28% in just one week, according to the CME FedWatch Tool. Such a policy move by the Federal Reserve would not only bolster economic growth and boost demand for copper, but it could also lead to a weaker US dollar. Consequently, copper priced in the depreciating greenback is likely to become more enticing to foreign buyers, potentially stirring up the market.

Goldman Sachs analysts anticipate that potential U.S. Federal Reserve interest rate reductions could significantly benefit copper and gold prices.

Here's a list of copper mining stocks:

$Freeport-McMoRan (FCX.US)$ is a major producer of copper and publicly traded on the global market. Its most valuable asset is the Grasberg mine located in Indonesia, which is one of the world's largest sources of copper and gold.

$Southern Copper (SCCO.US)$ is a leading global copper producer with integrated operations. The company operates copper mines in Peru and Mexico, making it one of the largest producers of the metal in the world. It currently ranks fifth in copper production globally and has the biggest copper reserves, which provide ample opportunities to expand production in the future.

$Teck Resources (TECK.US)$ is a Canadian mining company that operates in various sectors. It produces copper, zinc, and metallurgical coal used in steelmaking. In 2023, the company divested its metallurgical coal business and shift its focus to energy transition metals, specifically copper and zinc.

$BHP Group Ltd (BHP.US)$ is a major global natural resource producer headquartered in Australia. The company is involved in mining a range of commodities, including copper, iron ore, nickel, metallurgical coal, and potash. BHP operates multiple copper mines in South America and one in Australia.

Source: Wood Mackenzie, S&P Global Market Intelligence, Bloomberg, Yahoo Finance

By Moomoo News Marina

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment